ERE week 2 - Market instruments & dynamic efficiency

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

41 Terms

The problem with pollution

Its a negative externality

Coase theorem not applicable to most enviro problems

Govt has to intervene

Direct / command & control regulation

Control firms output of negative externalities via laws and regulations - Govt in control

Tell firms by how much (and how) to reduce pollution

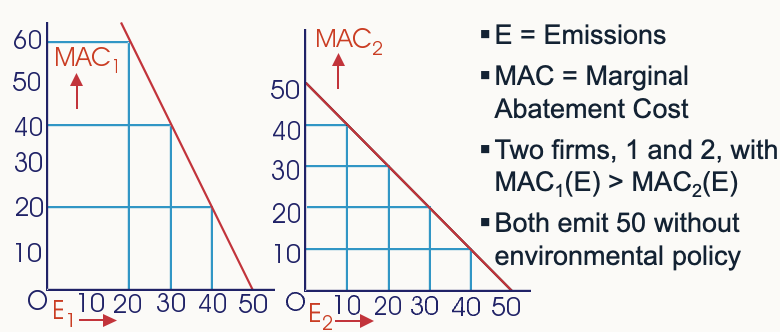

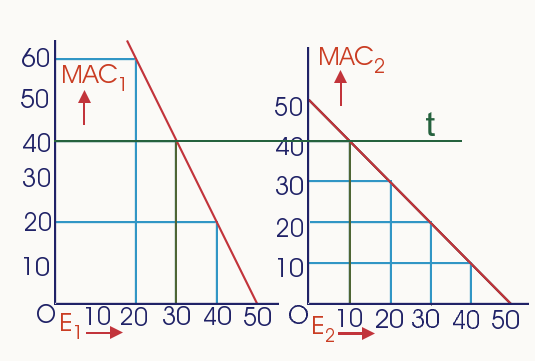

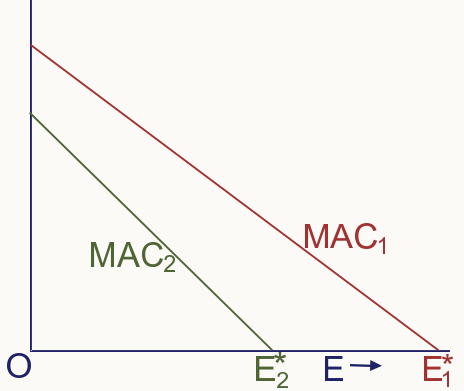

2 firm pollution diagram

Reducing emissions costs firms → Cheapest emission reduction methods used first but get increasingly more expensive

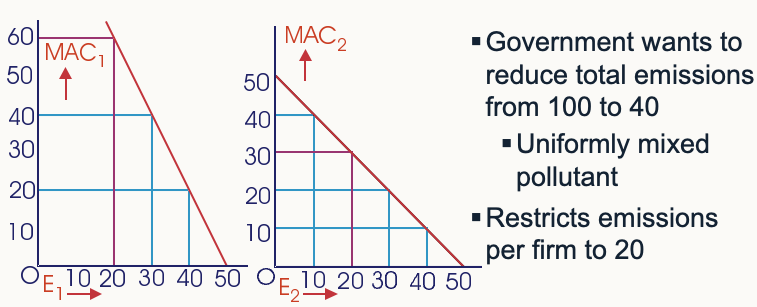

2 firm pollution diagram - Govt caps firm emissions

Uniformly mixed pollutant

Damage from pollutant doesn’t depend on where the emissions are

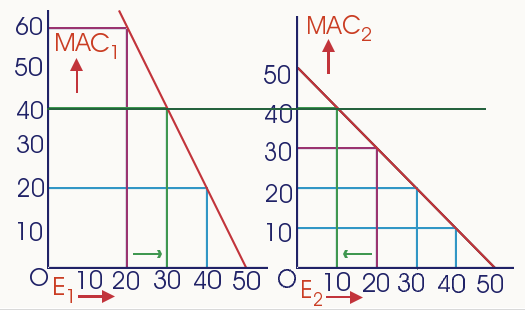

2 firm pollution diagram - Optimal pollution

Lower MAC for firm 2 - optimal for it to pollute less

Optimal pollution level

Where MACs are equal

minimises overall costs

Problems with optimal / efficient pollution for Govt

Need to know firms individual MAC

Firms don’t have incentive to find out and disclose

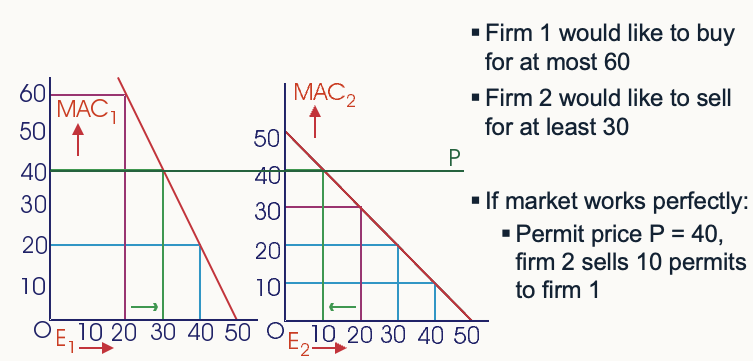

Tradable emission permit system

The govt allocates permits for both firms to emit a certain level of E but the firms can trade them

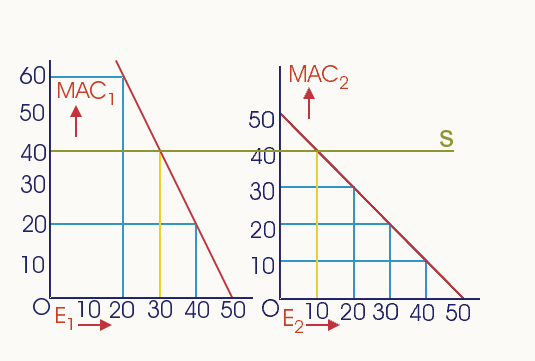

2 firm pollution diagram - Tradable permits

Govt allocates permits for both to emit 20 (wants E = 40)

Cheaper for 2 to cut E so they sell permits

2 sells permits until MAC1 = MAC2 = permit price

How to introduce tradable permits

Grandfathering - Distribute permits for free among incumbent firms

Auction - permits sold to highest bidder

Trading results in the efficient permit allocation, whatever the initial distribution

2 firm pollution diagram - Emissions taxation

Firms choose between paying tax and abatement (reduces T paid)

Set MAC = T

Each firm has different E & T

2 firm pollution diagram - Abatement subsidy

Firm paid to reduce emissions below a baseline

Firms reduce emissions till subsidy rate (s) = MAC

past s its more expensive to reduce emissions than you gain from the subsidy

Costly to Govt

Market instruments vs Direct regulation

Market:

Govt only needs to know aggregate MACs

Tradable - Emission target always met if cap enforced

Costs not known in advance

Tax - Emissions may be above or below target

MAC known in advance

Direct

less cost effective

Are permit trading outcomes independent of allocation?

Theory - Permit trading leads to efficient allocation whatever initial allocation

Can use initial distribution for political means – most permits to firms that lobby

Strong correlation between initial allocation and ultimate emissions - TC and regulatory uncertainty? CORRELATION ≠ CAUSATION

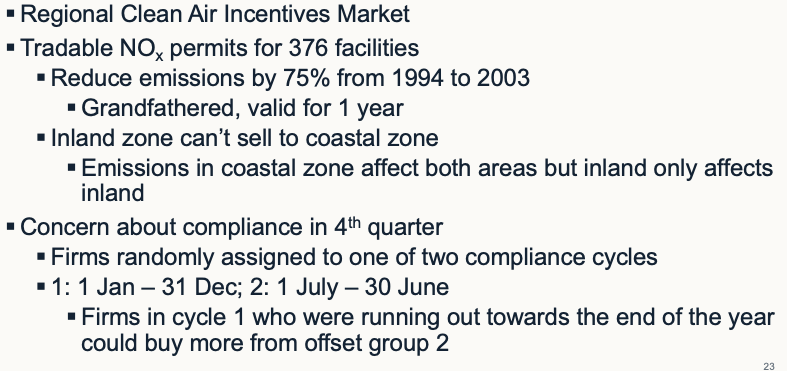

RECLAIM programme example - overview

RECLAIM programme example - TC & regulatory uncertainty

Firms had to learn about programme, abatement costs and how it works

Broker fees to buy through a broker (1-3%)

Questionable broker practices as well – brokers never sourced the permits

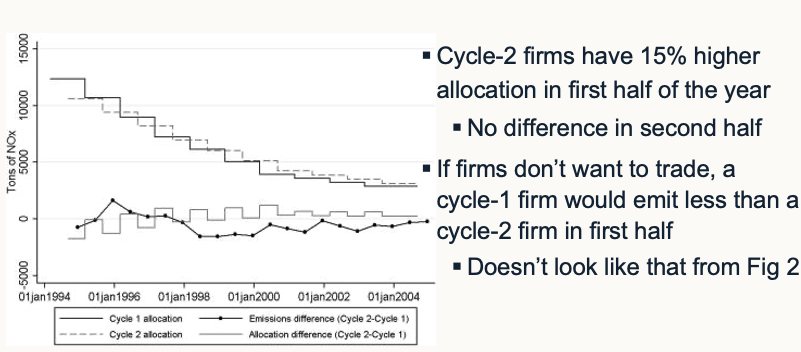

RECLAIM programme example - Allocation & E overtime

RECLAIM programme example - Empirical test (does allocation affect E)

Dependent variable - Log E (per firm + per 6 months)

Explanatory variable - Initial permit allocation

Results - Only explan var (0.79***) OR Include final allocation (0.65***) OR include wage and PPI (0.65***)

Initial permit allocation affects E

RECLAIM programme example - Instrumental variables

Maybe firms exploit the existence of 2 cycles - If random assignment then cycle 2 firms no higher E

Regress allocation on Time & Fixed effects + cycle dummy

allocation no longer significant

Empirical findings are consistent with, but not proof of, independence property

Uncertainty about abatement costs

Tradable permits

Certainty about reaching emissions target – emissions are valuable and firms want to maximise production

Uncertainty about costs - More / less permits should be issued if cost higher / lower than expected

Taxation

Uncertainty of reaching emissions target - If abatement costs higher than expected, then emissions higher than expected – higher tax rate needed

Certainty of what MAC - Firms set MAC = t

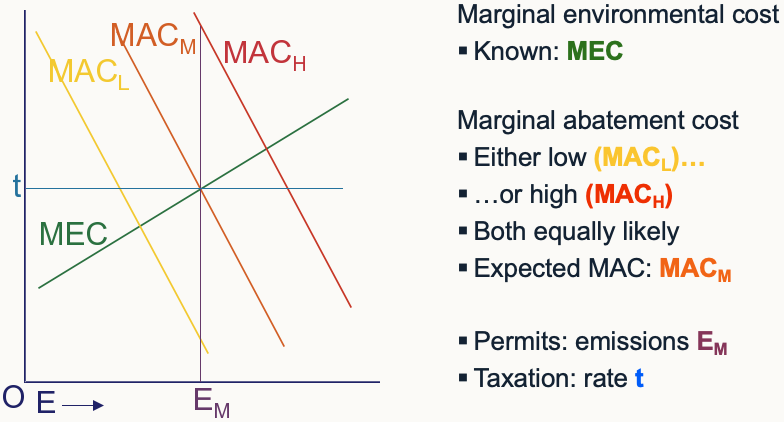

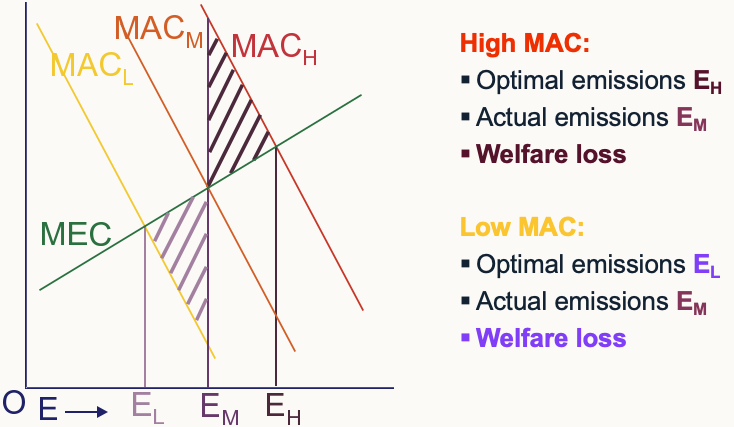

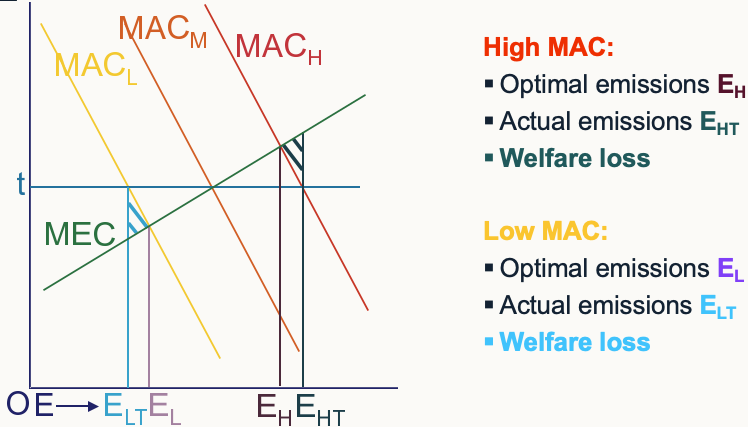

Taxes vs permit diagram - initial diagram

Taxes vs permit diagram - permits

Too many or too few permits issued

Total welfare loss = ½ of high welfare loss + ½ low welfare loss

Taxes vs permit diagram - tax

Optimal emissions is different to where firms optimally choose

Firms choose where t = MAC

Social optimal is where MEC = MAC

Taxes vs permit diagram - comparison

Optimal depends on slope of MAC and MEC

When MAC steeper than MEC – taxes better

MEC uncertain for both methods unlike MAC

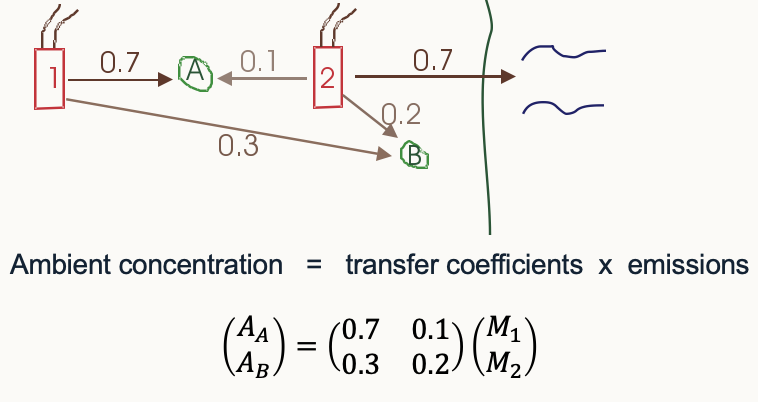

Spatial dimension theory - overview

Assumptions

1 & 2 have same MAC

Environmental damage function same in A & B

Spatial dimension theory - tax

Same tax rate for both firms

BUT 1 does more damage so should have higher tax rate optimally

All E from 1 ends up in A or B

If worked out then you might as well impose direct regulation and so all benefits lost of market

Spatial dimension theory - permits

1-to-1 trade

Both firms emit same amount

Too much pollution from 1 in A & B

Ambient permits

Permits used in term of conc at receptor point A or B

Firm 1 wants to increase emissions by 10: Needs 7 permits for A, 3 for B

Lower administrative cost than taxation - set E cap and let firms trade

Higher TC

Not yet tried in real life

US air pollution example - overview

Pollutants captured from 10k point sources (country aggregated ground sources)

Source-receptor matrices give county-level concentrations

Exposures = concentration x populations (people, crops etc.)

Damages - Market price, Human health, valuation studies

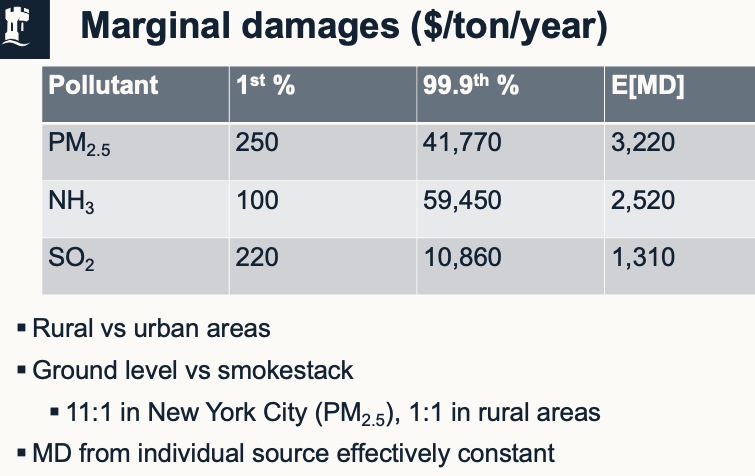

US air pollution example - Marginal damages

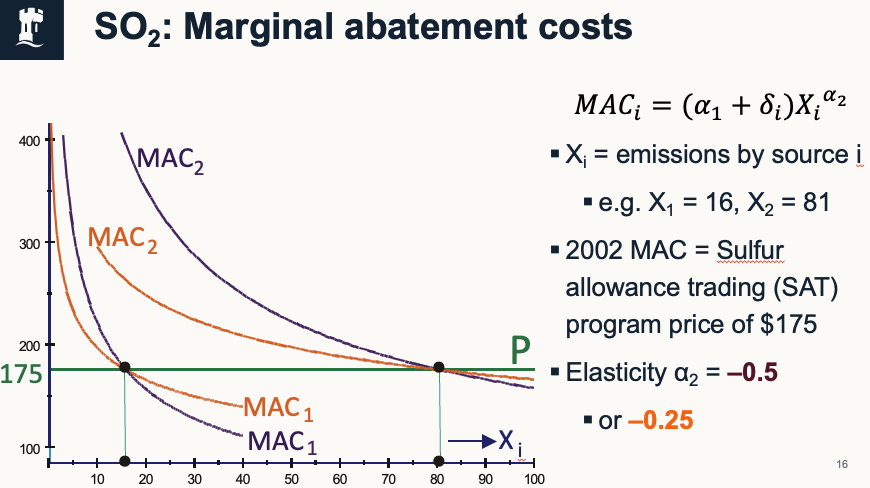

US air pollution example - SO2 marginal abatement costs

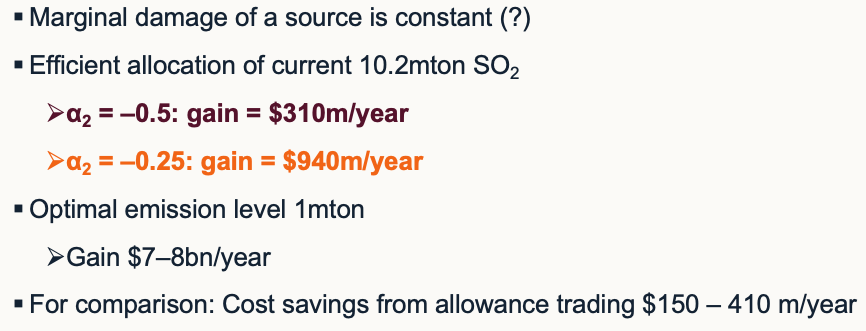

US air pollution example - Welfare gains

Dynamic efficiency

Incentive to do R&D into and adopt new technologies

→ New tech lowers E

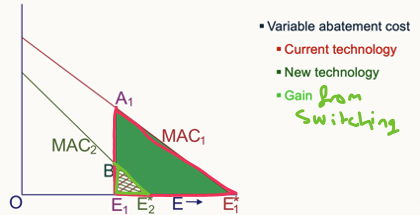

Dynamic efficiency graph - initial

Dynamic efficiency graph - Direct regulation (E1)

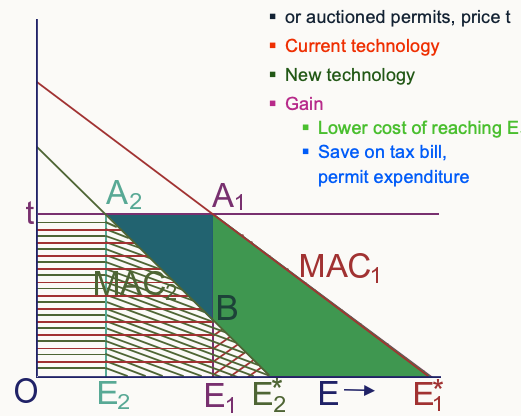

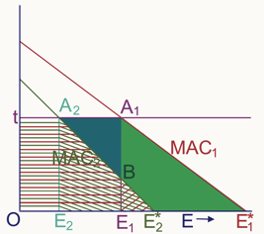

Dynamic efficiency graph - Tax / auctioned permits

Dynamic efficiency graph - Tax / auctioned permits

Dynamic efficiency graph - Direct vs market

Market instruments have additional gain of net saving on tax bill / permit expenditure

• Reducing emissions to E2 gives higher abatement cost (area below MAC2)

• More than compensated by saving in tax bill

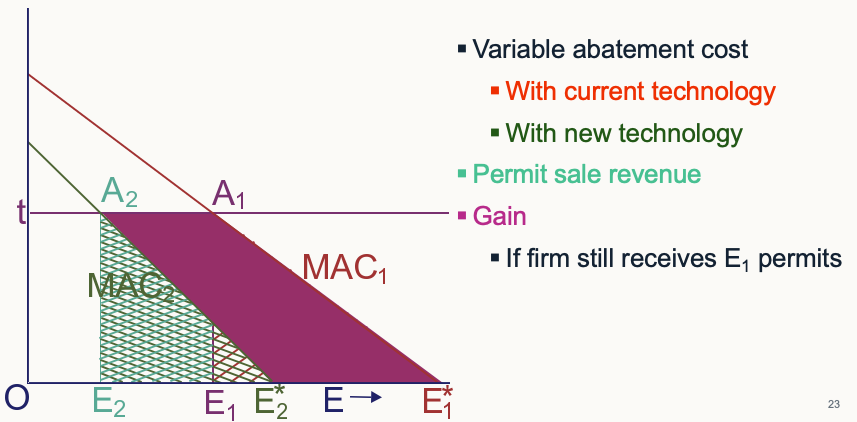

Dynamic efficiency graph - Grandfathered permits

With new tech still get E1 permits → Can sell excess at price t

Regulator may see the switch to new tech and give firm E2 permits in the future → Reduces incentive to switch

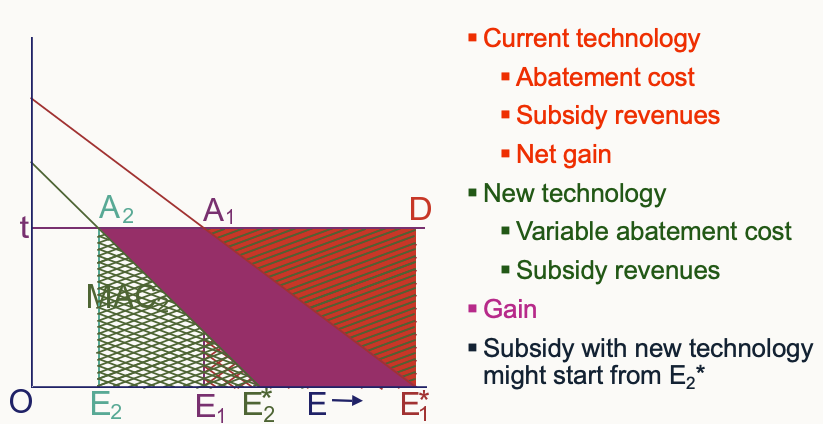

Dynamic efficiency graph - Abatement subsidy

Firm paid D → Paid more by reducing E

Dynamic efficiency summary

E tax + Auctioned permits give highest incentives for new technology adoption

Abatement subsidies + grandfathered permits also give these incentives (if baseline remains the same)

These high incentives for adoption are optimal

New technologies make it worthwhile to reduce emissions further - Firms should be rewarded for this gain