Lecture 14: Capital budgeting, Net present value (NPV), internal rate of return (IRR), profitability index (PI)

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

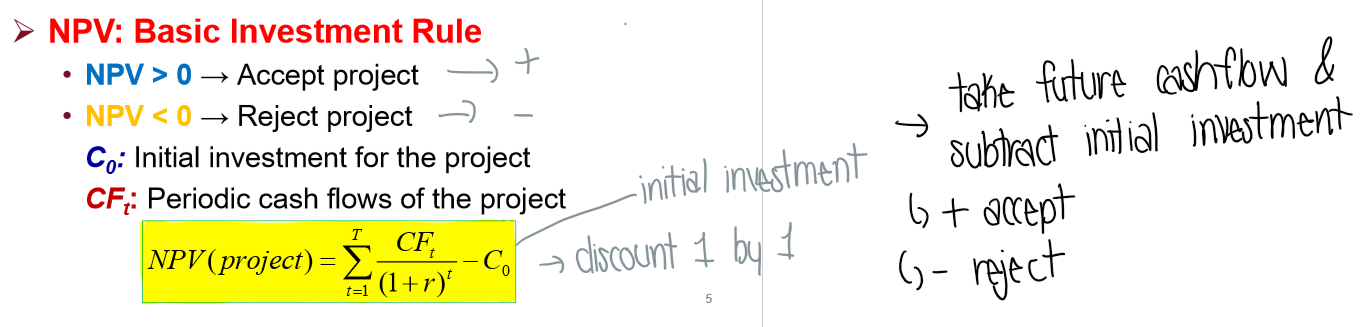

What is Net present value (NPV) formula?

The present value of all future cash inflows discounted at the WACC minus the initial investment

represents the expected change in firm value from taking the project

Rules:

NPV > 0 → accept project

NPV < 0 → reject project

What are independent vs. mutually exclusive projects?

Independent → firm has enough capital to finance both projects, accept all positive NPV projects

Mutually exclusive → can only accept one project or the other, choose the investment with the highest NPV

What are the strengths of NPV?

NPV uses cash flows

NPV uses all relevant project cash flows

NPV discounts cash flows correctly

tells you exactly how much value is added to firm

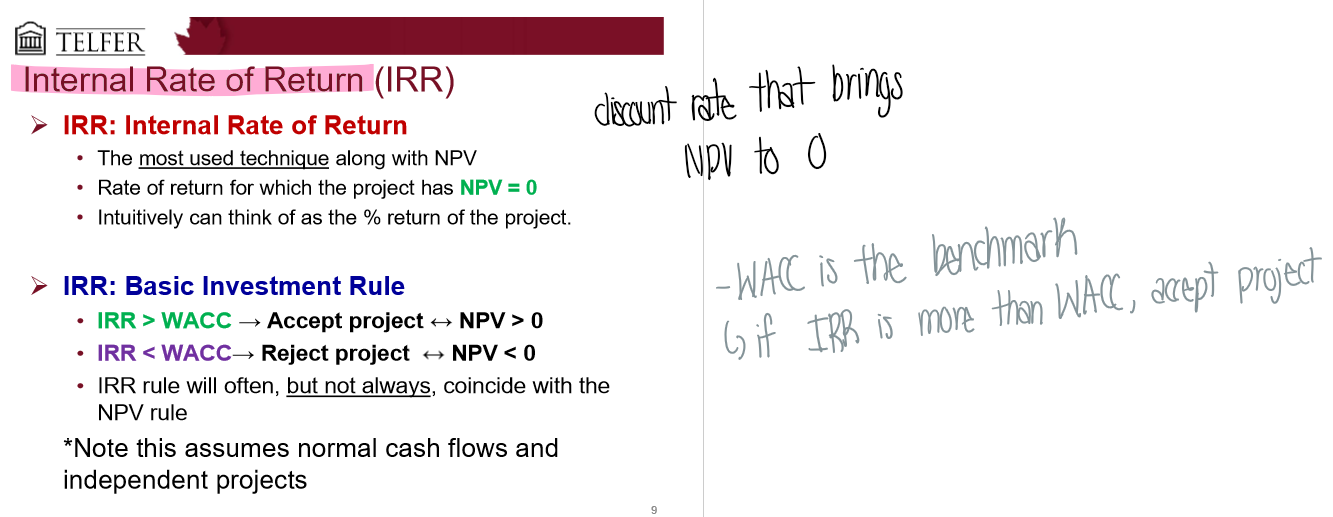

What is the internal rate of return (IRR)?

The discount rate that brings NPV to 0

the % return of the project

Rules:

WACC is the benchmark

IRR > WACC → accept project

IRR < WACC → reject project

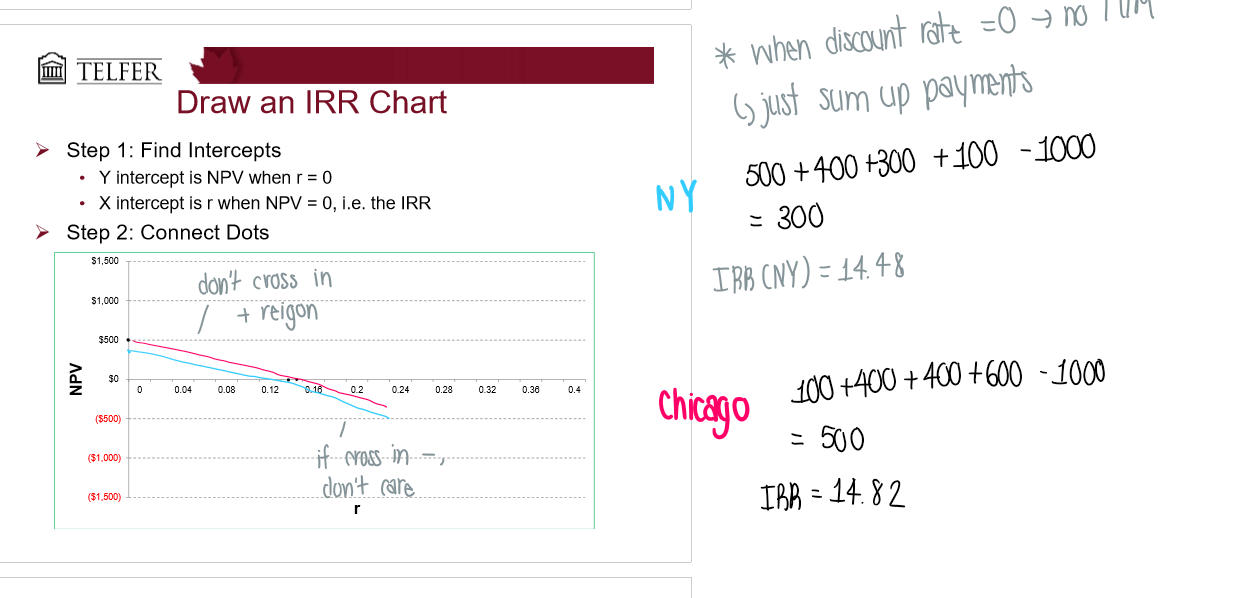

What is an internal rate of return chart?

Y is the NPV when = 0

X is the IRR

What are the 4 issues with the IRR approach?

Investing or financing?

Multiple IRRS

The scale problem

The timing problem

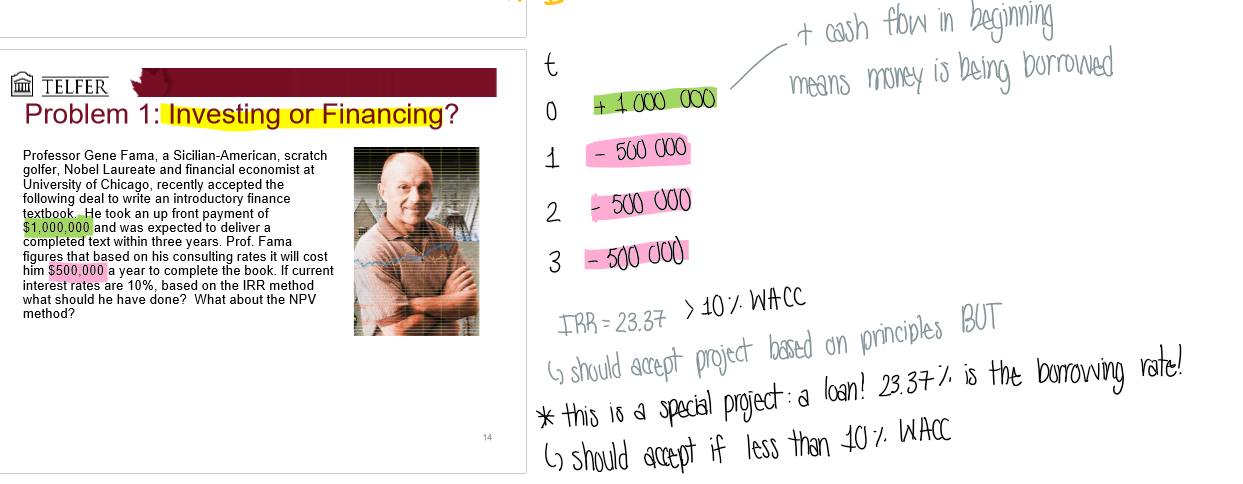

What is 1. Investing or financing?

When there is a positive cash flow in the beginning which turns negative later on → Means money is being borrowed!

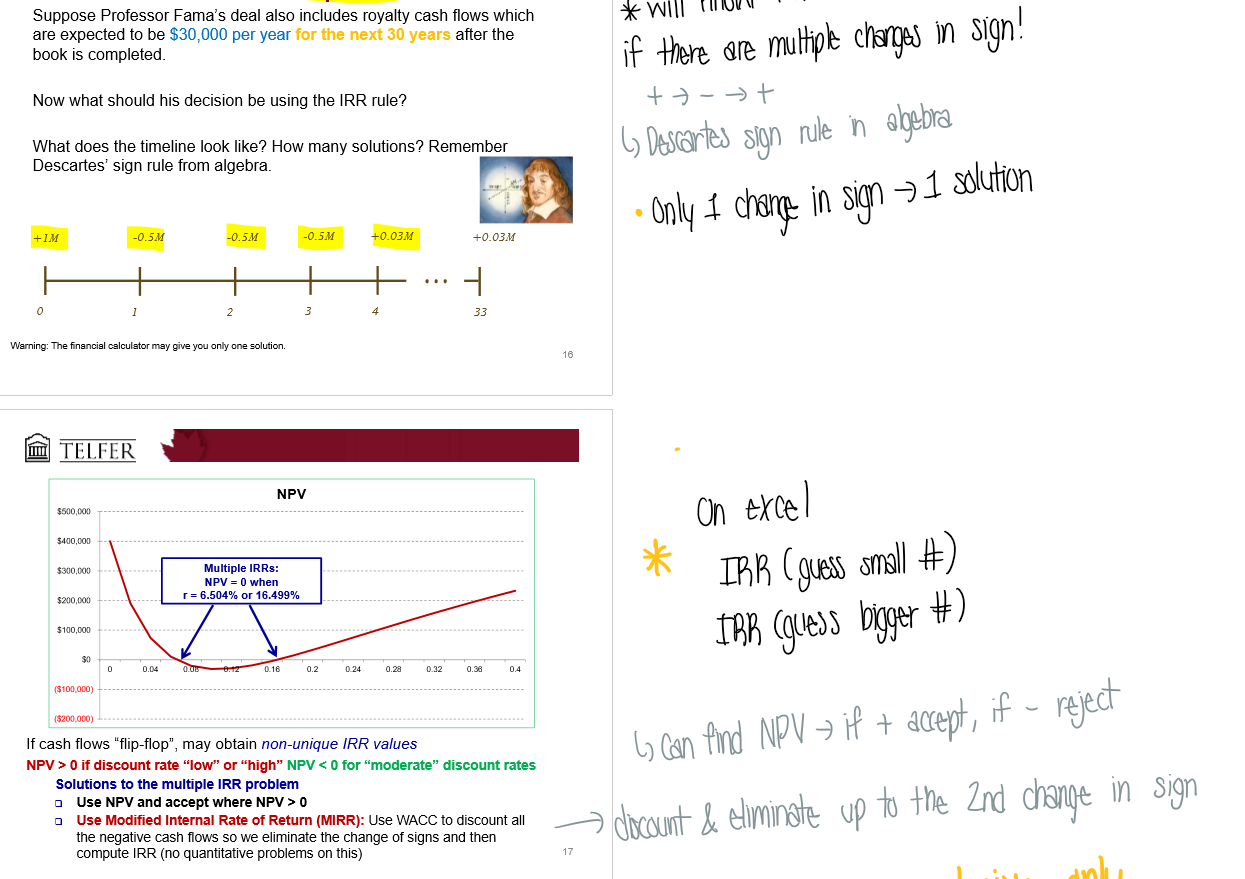

What is 2. Multiple IRRs?

Multiple IRR’s → means there are multiple changes in sign

goes from + → - → +

If there’s only 1 change in sign, there’s 1 solution

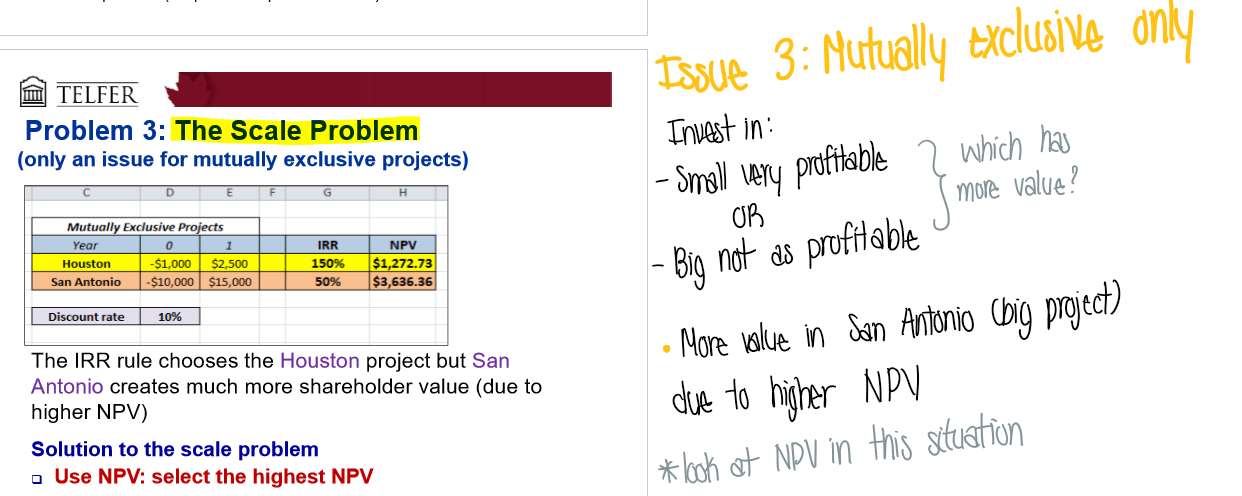

What is 3. The scale problem?

Mutually exclusive projects only

Invest in small very profitable vs. Big but not as profitable → which has more value?

more value is the big project due to higher NPV!

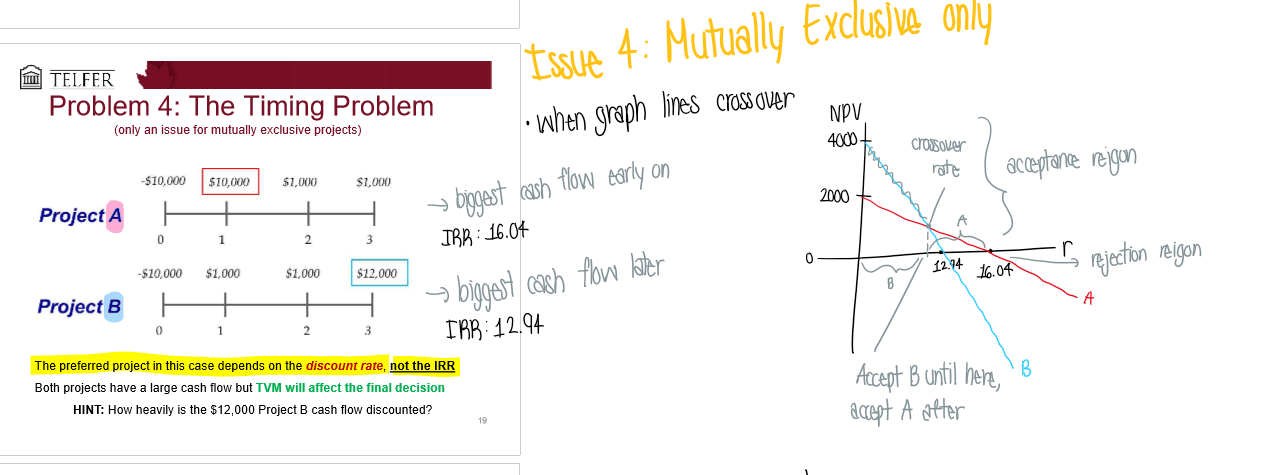

What is 4. The timing problem?

For mutually exclusive projects only

when the graph lines crossover

Project A has biggest cash flow early on vs. project B has biggest cash flow later

You accept B until the intersection rate, then accept A after → once it hits the negatives, reject

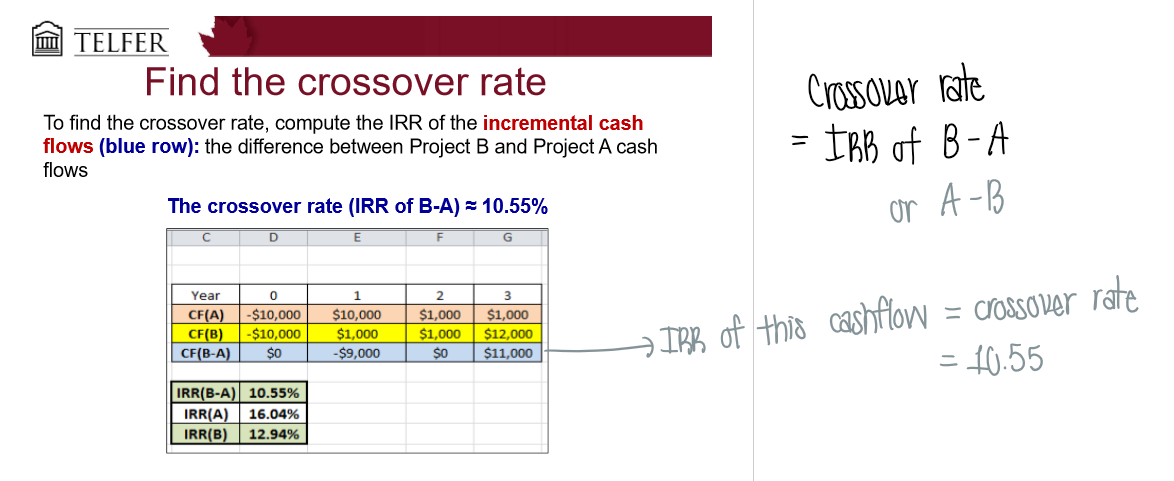

How do you find the crossover rate?

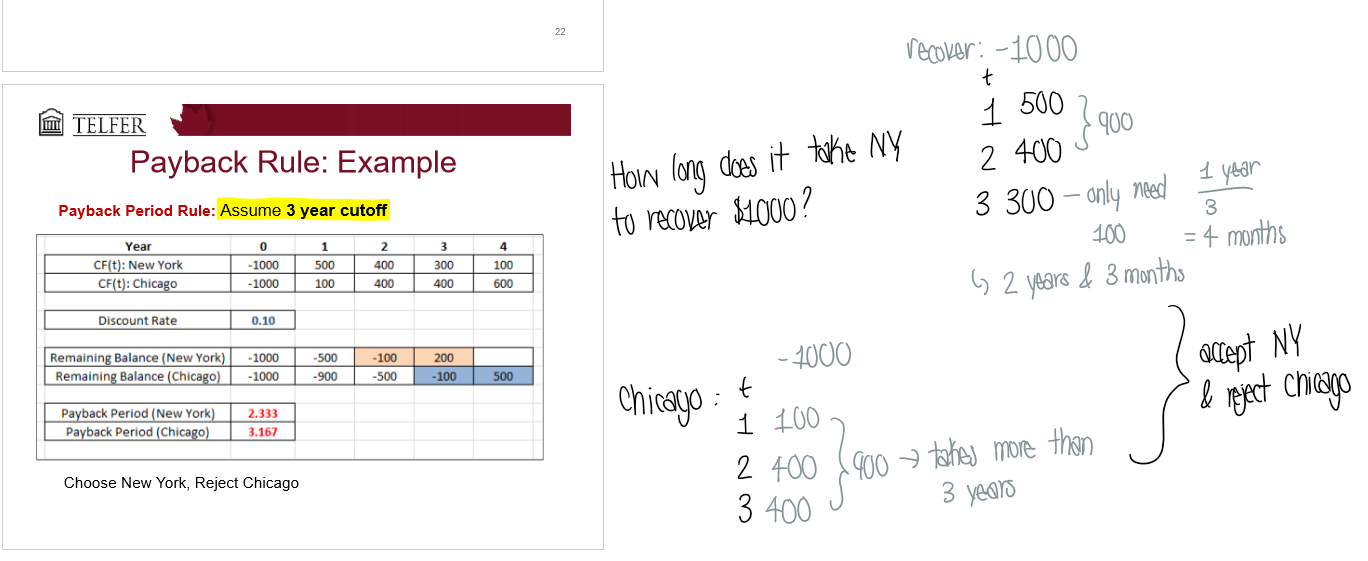

What is the payback period rule?

Payback period: amount of time required for an investment to generate cash flow to recover its initial cost

Payback period rule: a project is accepted if its payback period is less than a cutoff period

What are the strengths & weaknesses of the payback period rule?

Strengths:

simple & easy to calculate & understand

useful for firms with limited access to capital

not very limited in practice

Weaknesses:

timing of cash flows is ignored

cash flows after are ignored → may lose out on big cash flow after cutoff period

arbitrary benchmark

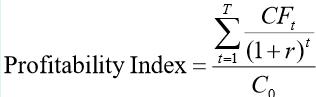

What is the profitability index formula??

Tells us how much each dollar invested in the project generates in present value

similar to NPV → divide by initial investment

how many $ you get relative to initial investment

PI > 1 → accept project

PI < 1 → reject project

What is the strength & weakness of the profitability index?

Weakness: Mutually exclusive projects

PI is a ratio & doesn’t account for $ scale of the project

more value in bigger project

Strength: Capital rationing

ratio used to rank projects → useful if a big list of projects