Chapter 7: Deductions and Losses: Certain Business Expenses and Losses

1/29

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

30 Terms

if a taxpaper is cash based get deduction for bad debt

no

how is business bad debt treated

like ordinary business deduction

what is the most common types of nonbusiness bad debt

loans to relatives or friends

Which of the following is a characteristic of a non-business bad debt?

a. A deduction is allowed for both partially or wholly worthless debt.

b. It is classified as a short-term capital loss.

c. It is deducted as an ordinary loss.

d. It is related to a taxpayer’s trade or business

B

when are worthless securities deductible

in the year they are completely worthless

what is the limit on capital loss

3,000 net

Sale or worthlessness of § 1244 stock results in ordinary loss rather than capital loss for individuals

what is ordinary loss limit?

50,000 single 100,000 MFJ

who does 1244 loss treatment apply to?

original buyer of stock

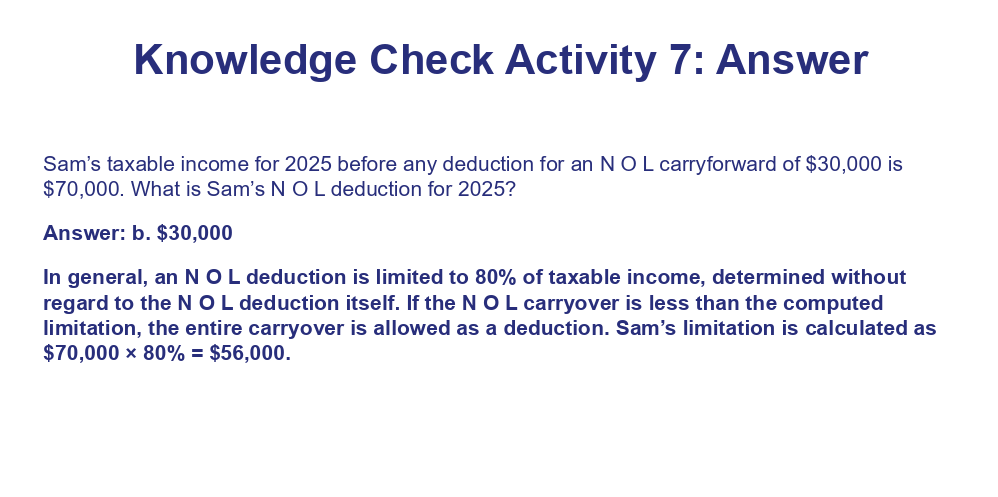

Petit files a return as a single taxpayer. In 2025, Petit had the following items:

• Salary of $60,000.

• Loss of $65,000 on the sale of § 1244 stock acquired two years ago.

• Interest income of $8,000.

Petit’s A G I for 2025 is?

is net loss from a trade or business deductible

yes

is loss incurred in a transaction entered into for profit deductible

yes

are losses caused by fire, storm, shipwreck or theft deductible

yes

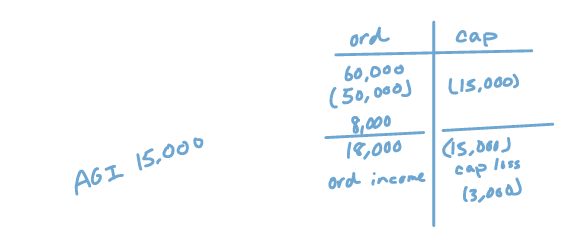

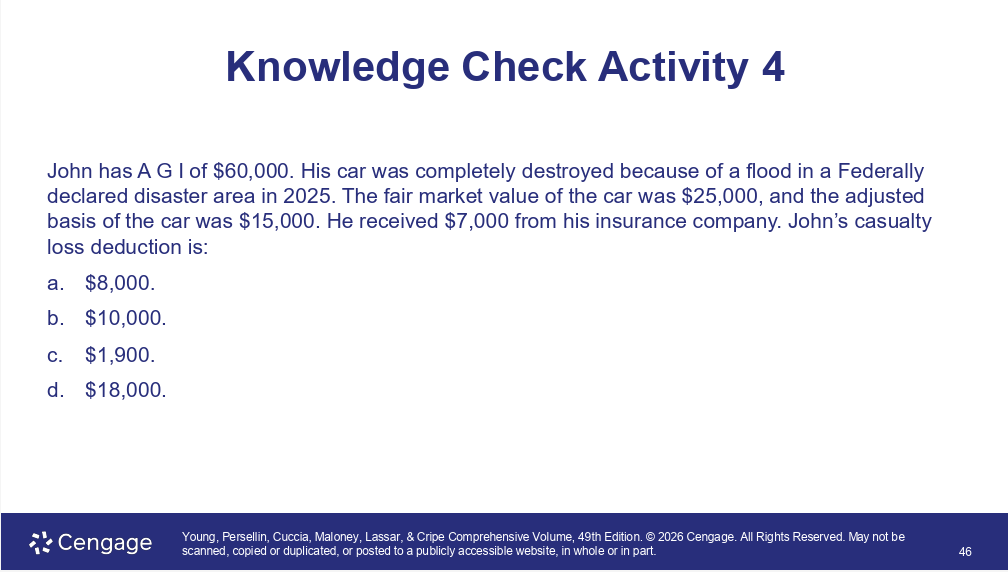

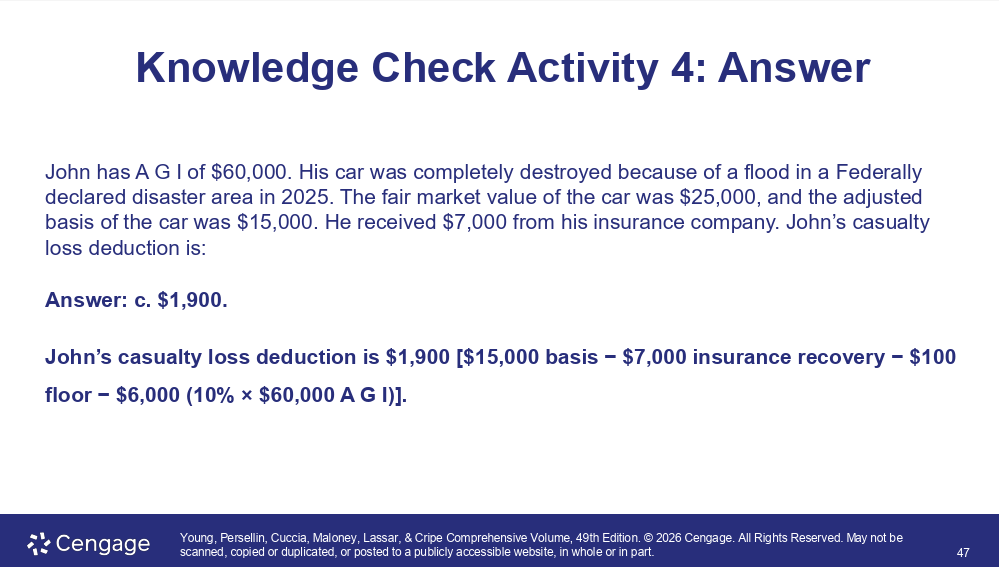

personal casualty or theft can only be deductible if what?

federally decalred disaster area

casualty loss need to be ______

sudden, unexpected, and unusual

Which of the following is not a deductible loss for an individual taxpayer?

a. Losses incurred in a trade or business

b. Losses incurred in a transaction entered into for profit

c. Losses caused by fire, storm, shipwreck, or other casualty or by theft

d. Losses on personal use property

D

theft loss doesn’t include what?

misplaced items

when are theft loss deducted

year of discovery

casualty loss is deducted in the year the loss occurs UNLESS

designated disaster areas by prez

delete

delete

how do you measure loss if it a business is completely destroyed

basis

if partially destroyed business or non business how do you measure loss

lesser of adjusted bassi or decline in value

Rules for personal use loss reduction

-100

-10% of AG

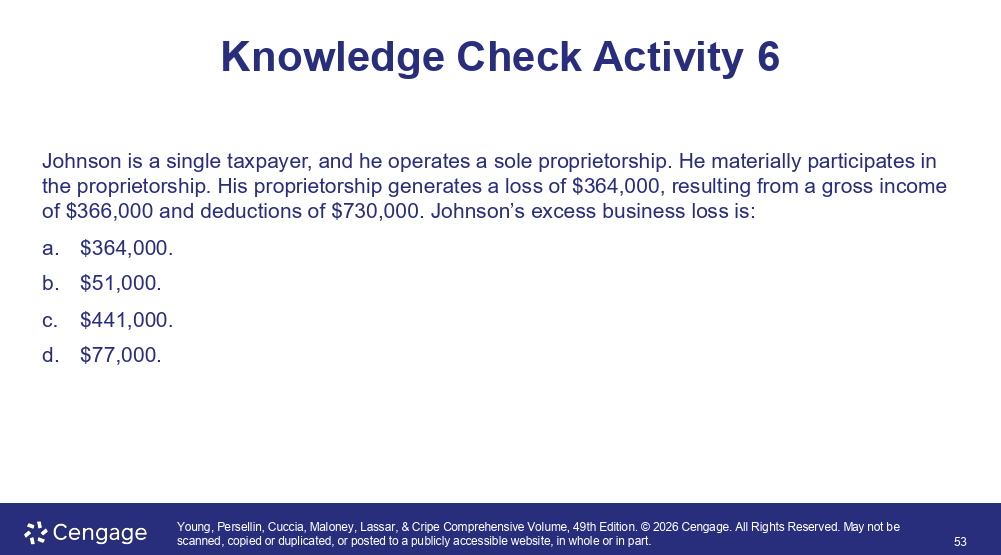

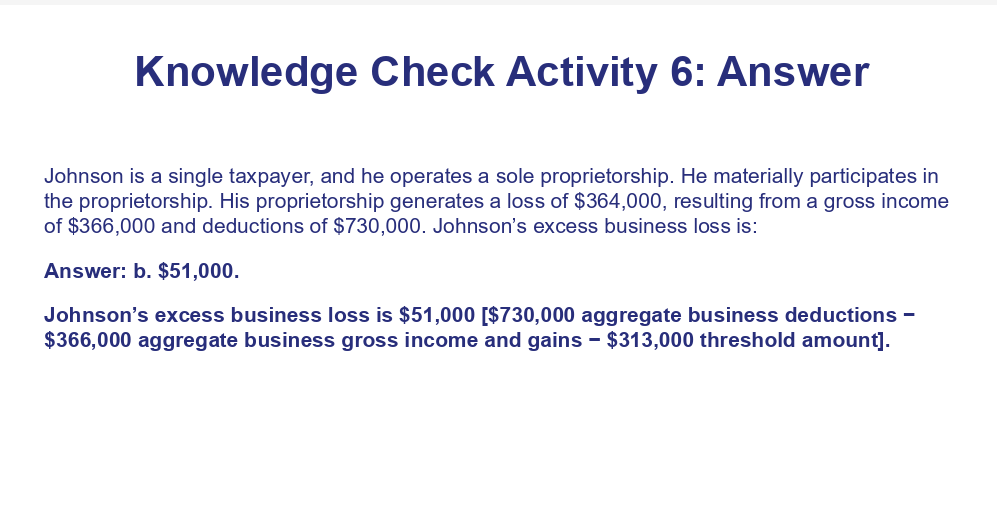

excess business loss limit

262,000 MFJ

313,000 other

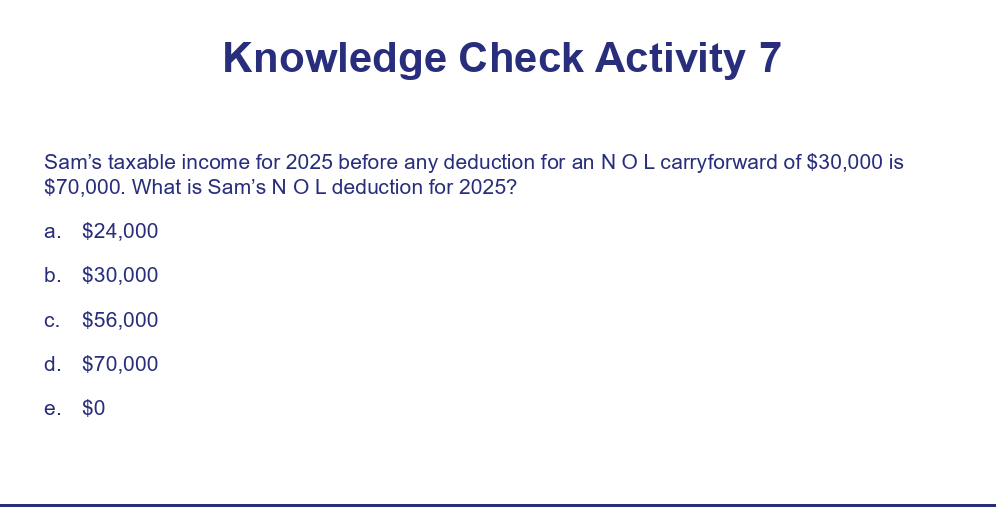

can NOL be carried back

no

how many times can NOL be carried forward

indefinitely

how much of NOL be offset

80% of income