ECON 3330 Exam 1

1/105

Earn XP

Description and Tags

ECON 333 (Money & Banking), Prof. Scott Burns, Spring 2026, Southeastern Louisiana University

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

106 Terms

What are the three “MICRO-foundations” of macroeconomics lessons that we discussed in class?

1. People respond to price signals (RECALL: “a price is a signal wrapped in an incentive”)

2. These price signals are almost always quoted in terms of money

3. If something is wrong with the money supply, it will distort price signals in the entire economy

What is money?

Money: commonly accepted medium of exchange (CAMOE)

C.A.M.O.E.

Commonly Accepted Medium Of Exchange

“Commonly Accepted” (CAMOE Def.)

Money is routinely offered and taken in trade for other goods. It is the most liquid, or “saleable”, good in the entire economy

“Medium of Exchange” (CAMOE Def.)

Money is a vehicle of indirect exchange.

Indirect exchange def.

It’s a good that people acquire through trade with the intention of trading away later rather than consuming it (or using to produce other goods)

Direct exchange def.

Exchanging one directly good for another.

Why do economists say that money is the most critical and “pervasive” good in an economy?

Money is one side of every non-barter transaction

Money has no market of its own

Money has no price of its own

Implication of “Money is one side of every non-barter transaction”

Money is ½ of virtually every exchange, so money “touches” ALL goods

Implication of “Money has no market of its own”

Since ALL markets are markets for money, money mischief affects all goods

Implication of “Money has no price of its own”

Since ALL goods are priced in money, ALL prices must adjust to clear MD

What are the three main characteristics of money that are often described in textbooks?

Commonly Accepted Medium of Exchange (CAMOE)

Unit of Account

Store of Value

Commonly Accepted Medium of Exchange (CAMOE) def.

Defining role – this is both “necessary & sufficient” for something to be considered money

What is the defining trait of money?

Commonly Accepted Medium of Exchange (CAMOE)

Unit of Account def.

“Measuring stick of value”; We price ALL goods in money, so money lets us compare their value

Store of Value def.

Ideally, money should maintain its value over time

Which characteristics is/are truly unique to money?

Commonly Accepted Medium of Exchange (CAMOE) and Unit of Account

What is not required for something to be money but only an ideal characteristic of a good (i.e. well-managed) money?

Store of Value

Would Gold bullion (i.e. bricks of gold) be considered money today in the US?

NOT money. Why? Not a commonly accepted medium of exchange.

Would Bitcoin be considered money today in the US?

NOT money. Why? Not a commonly accepted medium of exchange

Would Euros be considered money today in the US?

NOT money. Why? Not a commonly accepted medium of exchange

Would Euros be considered money today in Europe?

Yes

Based on our discussion of the 19th century economist Carl Menger’s famous treatise on the “Origins of Money,” why does money emerge?

Money emerges to help reduce the high transaction costs associated with barter (namely, the “double coincidence of wants problem” we discussed in the context of a barter economy).

What are the main economic reasons why individuals would voluntarily move from direct exchange (barter) to indirect exchange (a monetary economy) without being directed to by any king or ruler?

Starting from a position of barter, individuals begin to realize that they can enhance their ability to engage in mutually beneficial trades and to receive a “good price” in their trades if they use more marketable, or “salable,” goods as a medium of (indirect) exchange. Over time, these more marketable goods gain momentum as medium of exchanges, until finally people converge on using one particular good as money. Having one good serve as money is in each individual’s self-interest because it makes it easier for them to finding willing trading partners. It is also socially desirable (i.e. for the entire economy) because it creates a common “measuring stick of value” – all items can be priced in money, and everyone can be certain that others will accept money in trade. All this serves to reduce transaction costs in the economy and facilitate trade.

Why was money so integral to the development of international trade?

Direct exchange (i.e. barter) is so costly that it would be almost impossible for international trade to take place if both nations relied on barter. For Menger, the scope of specialized production is limited by the scope of indirect exchange. In other words, agreeing on a common medium of exchange is critical for international trade to occur. The more trading partners you have who are willing to accept your money, the more potential trades you can complete and the more a nation can afford to specialize and trade.

What four intrinsic traits should an ideal money have?

Portability

Uniformity

Durability

Divisibility

P.U.D.D.

Portability Uniformity Durability Divisibility

Portability def.

Money should be easy to carry and transport to the marketplace

Uniformity def.

Money should be easy to carry and transport to the marketplace

Durability def.

Money should be able to maintain its structural integrity over time without melting, etc.

Divisibility def.

Money should allow us to conduct both small- and large-scale transactions and make change

Which came first: government mints or private mints?

Private mints

Why might individuals wish to bring their raw gold and silver to a mint in order to be coined?

Individuals brought raw gold and silver nuggets to be coined in order to certify their value so that they could more easily attract a good (or what Menger called, “economic”) price. Sellers are more willing to accept coined metals because their value is easier to certify. In short, coinage emerged as a way to reduce transaction costs by certifying the quality/integrity of precious metals.

What historically were the two steps towards bank-issued money?

Money Warehouses and Banks

Money Warehouses def.

Storage facilities that accept deposits but do NOT make loans or pay interest

Banks def.

Perform two key roles: (a) accept deposits, and (b) make loans* (pay interest to depositors

Banks vs. Money Warehouses

What fundamentally distinguishes banks from money warehouses is that banks make loans using a fraction of their deposited funds. Money warehouses, in contrast, only store people’s money for them, charging them a storage fee for that service. Banks, in order to recompense their depositors for accepted some level of risk by allowing the bank to lend out a fraction of their deposits, also pay depositors interest on their deposits. This is unlike money warehouses, which must charge their depositors storage fees in order to earn revenue to stay in business.

Inside Money def.

Bank-issued forms of money. (e.g. Bank Notes, Deposits)

Bank Notes def.

Paper currency issued by banks – in effect a paper IOU issued by banks to their customers

Deposit def.

Just like the checkable deposits most of us use today whenever we want a debit card

Outside money def.

Ultimate reserve form of money, issued outside of banking system (i.e. banks cannot create it themselves)

Historically, ____ served as the most common type of “outside money”.

gold

Prior to central banks and the development of fiat money, gold served as bank reserves; all bank liabilities (notes and deposits) were IOUs for gold. T/F?

True

Today, US Dollars/Federal Reserve Notes (paper currency issued by the Federal Reserve, the central bank of the United States) serve as ______ ____ in our economy.

outside money

Gold and silver no longer have the status of “money” because, although they are still a popular investment and hedge against inflation, neither they nor bank liabilities denominated in them serve as _______________________________.

“commonly accepted mediums of exchange.”

Historically, why might individuals voluntarily decide to hold their wealth in the form of inside money rather than outside money?

Inside money (i.e. private bank notes & deposits), much like the advent of coins, served to reduce transaction costs. In particular, it provided a safer, more portable (and salable) way for individuals to hold their wealth.

What could bank-issued forms of money offer their customers that would make them more attractive to hold and use as money than simply using gold or silver coins?

Bank deposits were especially attractive because (a) they provided a safer, more convenient way to store one’s wealth and (b) they offered to pay depositors interest, which was more attractive than paying a storage fee to a money warehouse.

Why might rival banks voluntarily agree to accept each other’s liabilities (i.e. bank notes and deposits) at par (i.e. without refusing to accept their rival’s money or charging a high fee)/what economic incentive did banks have to engage in regular par acceptance?

Accepting a rival bank’s notes at par is in the rational, profit-maximizing self-interest of banks because: (1) it expands the circulation of its own liabilities (i.e. notes and deposits) – thus making that bank’s liabilities more marketable and popular amongst the general public – and (2) banks are able to replace their rival’s notes and deposits with their own notes and deposits, which they could then make interest-earning loans against.

Why would private banks voluntarily join clearinghouse associations with rival banks?

It was in each bank’s profit-maximizing interest to join a clearinghouse association (CHA) to swap liabilities of other banks at par. Bi-lateral clearing is very costly for banks. Establishing multi-lateral clearings at one location significantly reduced the transaction costs associated with swapping each other’s notes and checks.

What were the three main functions that private clearinghouse associations adopted to help oversee their respective members?

Bankers’ Bank

Bank Regulator

Lender of Last Resort

Bankers’ Bank def.

Banks kept a large share of their reserves at the CHAs to settle claims with rivals

Bank Regulator def.

CHAs regulated their members to ensure they were soundly managed and reduce the risk of financial contagion, i.e. bank panics, by ensuring the integrity and stability of all members

Lender of Last Resort def.

CHAs reserved the right to lend to solvent but illiquid members if doing so reduced the risk of financial contagion, i.e. bank panics, by ensuring the integrity and stability of all members

What was the 1st typical steps that governments took that eventually led to the formation of central banks?

Government bestows a legal monopoly on note issue on one particular bank (often one who lends to it)

What was the 2nd typical steps that governments took that eventually led to the formation of central banks?

That specially privileged bank’s notes become widely accepted and treated by banks as “proxy reserves”

Results of “Specially privileged bank’s notes become widely accepted and treated by banks as “proxy reserves””

Monopoly issuer essentially nationalizes CHA’s role as “banker’s bank,” regulator, and LOLR

Monopoly issuer in effect becomes a “central bank” because this monopoly over producing currency gives it a systemic influence over the economy’s entire money and banking system

What was the 3rd typical steps that governments took that eventually led to the formation of central banks?

Central Bank (monopoly bank of issue) is allowed by its sponsor government to suspend redeemability into gold/silver with legal immunity.

What happens as a result of the Central Bank (monopoly bank of issue) being allowed by its sponsor government to suspend redeemability into gold/silver with legal immunity?

Since the ultimately form of money is now only notes (i.e. currency) issued by the central bank that are not redeemable in gold, we are left with “fiat” money.

The reason why so many smart people (like Nobel laureate economists Paul Krugman and Ben Bernanke) struggle with money and macroeconomics is because they often lose sight of micro-economic foundation of macro-economics. In particular, they lose sight of how money impacts prices can massively distort micro-level decisions. T/F

True

Coinage was invented by:

privately-owned mints

Why did mints emerge?

to certify the value of coins

Money is best defined as a:

commonly accepted medium of exchange

Monetary exchange (trading money in exchange for goods or services) is an example of what economists call _________.

indirect exchange

What are the three main (and ideal) characteristics of money that are often described in textbooks?

Commonly Accepted Medium of Exchange

Unit of Account

Store of Value

Based on the definition of money, Bitcoin is money in today's economy. T/F

False

Which of the following reasons, if any, explains why bitcoin might NOT be considered "money" in today's economy?

NOT commonly accepted

Who (or what) invented money?

No one

According to 19th century economist Carl Menger's theory on the origins of money, money is a prime example of what economists call a(n) _____________ - something that is "the result of human action, but not human design"

spontaneous order

To adopt a phase from Adam Smith's Wealth of Nations, Menger's theory is an example of the ____________ theory about how money supplanted barter exchange.

invisible hand

Based on our discussion of the 19th century economist Carl Menger's famous treatise on the "Origins of Money," some goods are more likely than others to emerge as money because they are more _______________.

salable

Historically, why might most individuals decide to hold their wealth in the form of bank-issued money?

It tended to be safer and more portable than carrying commodity money (i.e. gold or silver) and banks paid their customers interest on their deposits, so they could earn money on their savings

What point about the relationship between money and international trade is the author trying to convey in this passage?

Money makes international trade much easier than barter, so specialization and trade were facilitated by (and developed simultaneously with) the creation of money

__________ money refers to money banks don't create themselves, but accepts as the ultimate (i.e. reserve) form of money.

Outside

The practice of the one bank accepting a rival's notes at face value (i.e. without charging a fee or applying a discount) is called:

Par Acceptance

Accepting a rival bank's notes at par is in the rational self-interest of private banks because it increases the circulation of that bank's liabilities (i.e. notes and deposits). T/F

True

____________ refer to centralized locations where rival banks could exchange each other's notes and settle any outstanding balances they have with one another in reserves.

Clearinghouses

What is "fiat" money?

Paper money that isn't redeemable in any underlying commodity like gold or silver

Why do we use fiat money today instead of a commodity-backed money like gold?

Over time, governments intervened to establish a monopoly over the ability to create new money eventually leading to the fiat standard of today.

Accepting a rival bank's notes at par is in the rational self-interest of private banks because banks are able to replace their rival's notes and deposits with their own notes and deposits, which they could then make interest-earning loans against. T/F

True

What represents the "MICROfoundactions" of MACROeconomics?

Market prices are almost always quoted in terms of money

If something is "wrong" with the money supply, it will distort relative price signals, causing economy-wide problems

People respond to price signals

The extreme inflation in Venezuela in recent years, which at times has exceeded 1,000 percent per year, is an example of what economists call ________________.

hyperinflation

Which is primarily responsible for Venezuela's extreme inflation in recent years under the Chavez and Maduro regimes?

increases in its money supply

Barter (trading one good in exchange for another) is an example of what economists call _______________.

direct exchange

Monetary exchange (trading money in exchange for goods or services) is an example of what economists call ___________.

indirect exchange

Money makes all exchanges more difficult, since agreeing on a money price is harder than engaging in barter exchange. T/F

False

________ money refers to bank-issued forms of money

Inside

A bank's _____ is the percentage of its total assets that it holds as equity capital

equity ratio

A bank's ______ is the ratio of its debt (i.e. liabilities) to equity (i.e. capital)

leverage ratio

A bank has $25 million of in deposits. It also has $25 million in equity capital. What is its leverage ratio?

2 to 1

A bank's leverage ratio is sometimes referred to as its:

debt to equity ratio

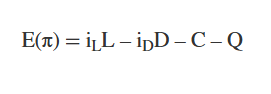

A bank's income statement is given by the equation where iL represents interest earned on bank loans and iD represents interest paid to bank depositors: T/F

True

A bank has $15 million in reserves and $85 million in deposits. What is the reserve ratio?

18%

A bank has $20 million in equity and $80 million in total assets. Its equity ratio is:

25%

Generally speaking, a bank's income statement (like the income statement for any other business) depicts its:

Revenue - Expenses

Generally speaking, what are the two main categories of cost that banks incur (besides paying interest (to their depositors)?

Operating costs and liquidity costs

What are the two essential functions of banks as described in class last week?

Accept deposits and make loans

What distinguishes banks from the money warehouses that arose centuries ago?

Banks make loans using depositor's savings. Money warehouses safeguard deposits but do not make loans

__________ refers to the process of channeling savings from depositors into investments by borrowers.

Financial intermediation

Key services provided by the banks and the financial system that benefit both you and the entire economy?

Banks help savers diversify their portfolio by investing in a wider range of loans and assets than we could do ourselves

Banks reduce transaction cost by allowing you to purchase goods and services with debit and credit cards, cheques, etc., rather than having to rely on only using cash

Banks specialize in acquiring information about the most promising opportunities in the economy

A free banking system is:

a minimally regulated banking system where banks are treated no different that any other industry