Econ 102 - Chapter 6: Taxes, Prices Controls, and Quantity Regulations

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

Government Intervention

The government can affect market outcomes with laws, taxes, and regulations.

Goal: shape costs and benefits, not stop supply & demand.

Taxes

Result: buyers pay more, sellers receive less → both share burden.

Tax on Sellers

shifts supply curve up (higher cost of production).

Tax on Buyers

shifts demand curve down (lower willingness to pay).

Statutory Burden

who (pays) legally sends tax to the government.

Economic Burden

who actually bears the cost after price changes.

(determined by elasticity)

Tax Incidence

how the economic burden is divided between buyers & sellers.

Depends on elasticity, not statutory burden.

More Inelastic (steeper) = More Burden

If demand is inelastic → buyers pay more.

If supply is inelastic → sellers pay more.

Four-Step Recipe for Analyzing Taxes

Identify which curve shifts (supply or demand).

Determine shift direction (up/down).

Compare pre- and post-tax equilibrium.

Determine which side is more inelastic (demand/supply)

Subsidies

government payment for making a specific choice.

Acts like a negative tax → increases quantity, lowers price for buyers, raises price for sellers.

Example: Pell Grants (college students).

More inelastic side captures more benefit.

Inelastic

pays more tax / gains more subsidy.

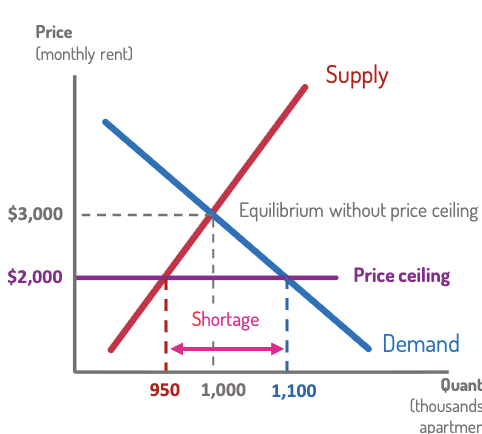

Price Ceiling

maximum legal price.

Binding if set below equilibrium → causes shortage.

Example: Rent control.

Lowers rent → fewer apartments available.

Leads to black markets, bribes, poor maintenance.

Ceilings go below equilibrium.

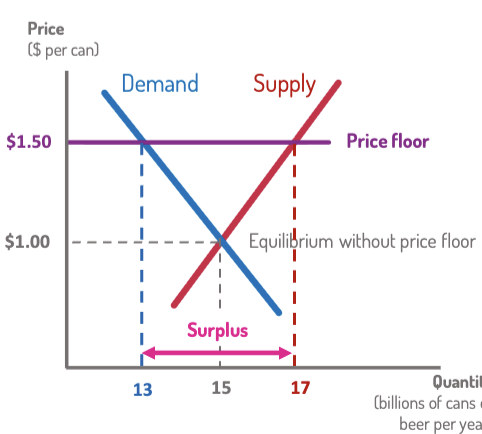

Price Floor

minimum legal price.

Binding if set above equilibrium → causes surplus.

Examples:

Minimum Wage: raises worker pay, may reduce jobs.

Minimum Alcohol Price (Scotland): reduces consumption.

Floors go above equilibrium.

Quantity Regulation

government sets a minimum or maximum quantity.

ex: Mandate or Quota

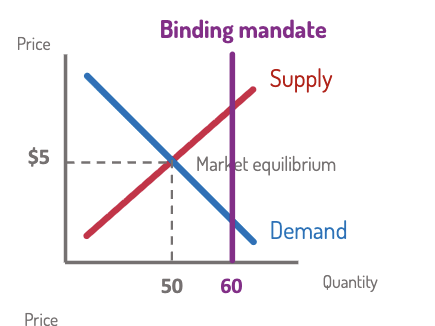

Mandate

minimum quantity that must be bought/sold.

Binding if above equilibrium quantity → increases quantity.

Increases the quantity bought or sold.

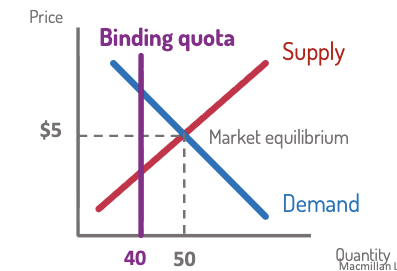

Quota

maximum quantity allowed

Binding if below equilibrium quantity → decreases quantity.

Decreases the quantity bought or sold