PE01 - AREI - My Past Exam - Currently only Multiple-Choice Questions

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

10 Terms

Which of the following statements regarding the property cycle is incorrect? (2 credits)

a) In Recovery period, property prices begin to increase.

b) In Expansion period, yields fall.

c) In Hyper Supply period, rent growth stagnates or rents fall.

d) In Recession period, the completion of building stock decreases.

The incorrect statement regarding the property cycle is d) In Recession period, the completion of building stock decreases.

During the Recession phase of the real estate cycle, completion increases, rather than decreases.

Here's why the other statements are correct:

• In the Recovery period, property prices begin to increase.

• In the Expansion period, yields fall.

• In the Hyper Supply period, rent growth stagnates or rents fall.

Question 2

Real Estate Cycle: What accompanies the transition from decreasing expected yields / increasing rents / decreasing vacancy rates to high LTV ratios / high property prices / high volume of transaction with respect to financial conditions? (2 credits)

a) Tightening financial conditions.

b) Falling leverage effect.

c) Easing financial conditions.

d) Rising leverage effect.

c) easing financial conditions

The correct statement regarding the property cycle for the described transition is c) Easing financial conditions.

Here's why:

The question describes a transition characterized by:

• Decreasing expected yields.

• Increasing rents.

• Decreasing vacancy rates (an implied characteristic of strong demand during market upturns).

• Moving towards high Loan-to-Value (LTV) ratios, high property prices, and a high volume of transactions.

These characteristics align with the Expansion (Boom) phase of the real estate cycle.

During the Expansion (Boom) phase, the sources state that:

• Rents rise and property prices rise.

• Yields fall.

• The price movement is strengthened by a positive feedback loop featuring abundant credit.

• Competition drives banks to lower their credit standards.

These descriptions of "abundant credit" and "lower credit standards" are direct indicators of easing financial conditions. The mentioned "high LTV ratios" are a direct consequence and manifestation of a rising leverage effect, which itself is enabled by easing financial conditions. While "leverage begins to rise" during the Recovery phase, it continues to be high or increase during the Expansion phase due to abundant credit, leading to high LTV ratios.

Therefore, the transition into and within the Expansion phase is accompanied by easing financial conditions.

Question 3

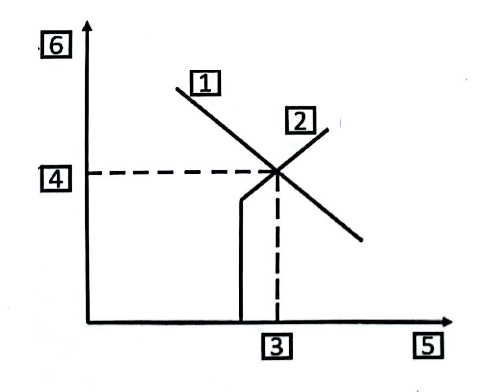

4-Quadrant Model by DiPasquale and Wheaton

Which of the following statements is correct? (2 credits)

a) Quadrant I explains how rents are determined in the asset market.

b) Quadrant II explains how properties are valued in the asset market.

c) Quadrant III explains how new construction is related to the existing space of stock.

d) Quadrant IV explains what determines the amount of new construction.

e) None of the above statements is correct.

b) Quadrant II explains how properties are valued in the asset market.

doble checked - correct

Question 4

Which of the following statements is correct? (2 credits)

a) REITS are Equity Assets that are traded on Private Markets.

b) Real Properties are Equity Assets that are traded on Public Markets.

c) Mortgages are Debt Assets that are traded on Public Markets.

d) None of the above statements is correct.

e) Mortgage Backed Securities (MBS) are Debt Assets that are traded on Public Markets.

e) Mortgage Backed Securities (MBS) are Debt Assets that are traded on Public Markets.

Question 5

Which is the correct assignment for the graphic below? (2 credits)

a) 1 = Demand Curve; 2 = Supply Curve; 3 = Equilibrium Price; 4 = Equilibrium Stock of Space; 5 = Price/Rent; 6 = Quantity of Space

b) 1 = Supply Curve; 2 = Demand Curve; 3 = Equilibrium Price; 4 = Equilibrium Stock of Space; 5 = Price/Rent; 6 = Quantity of Space

c) 1 = Supply Curve; 2 = Demand Curve; 3 = Equilibrium Stock of Space; 4 = Equilibrium Price; 5 = Quantity of Space; 6 = Price/Rent

d) 1 = Supply Curve; 2 = Demand Curve; 3 = Equilibrium Price; 4 = Equilibrium Stock of Space; 5 = Quantity of Space; 6 = Price/Rent

e) 1 = Demand Curve; 2 = Supply Curve; 3 = Equilibrium Stock of Space; 4 = Equilibrium Price; 5 = Quantity of Space; 6 = Price/Rent

Correct answer: e)

1 = Demand Curve

2 = Supply Curve

3 = Equilibrium Stock of Space

4 = Equilibrium Price

5 = Quantity of Space

6 = Price/Rent

Question 6

Which of the following statements is correct? (2 credits)

a) The interest and principal payment from the borrower pass through to the security holder.

b) Different tranches of the securities have different return profiles but the same risk profile.

c) A mortgage-backed security is secured by the reputation of the borrower.

d) Commercial mortgage-backed securities are backed by a pool of commercial mortgages and residential mortgages.

e) The first lost is associated with the lowest risk and the highest expected yield.

a) The interest and principal payment from the borrower pass through to the security holder.

This describes a pass-through security, which is exactly how many mortgage-backed securities (MBS) work:

Borrowers pay principal + interest →

Payments flow through (after fees) →

To security holders (investors).

This is a defining characteristic of pass-through MBS

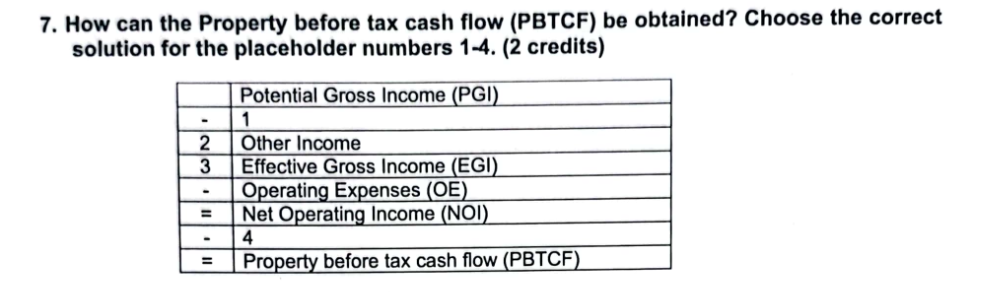

Question 7

How can the Property before tax cash flow (PBTCF) be obtained? Choose the correct solution for the placeholder numbers 1–4. (2 credits)

a) 1: Operating costs (OC), 2: +, 3: -, 4: Late rent payments (LRP)

b) 1: Vacancy Allowance (VA), 2: +, 3: =, 4: Capital improvement expenses (Capex)

c) 1: Operating Expenses for damage (OED), 2: +, 3: =, 4: Tax payments (TP)

d) 1: Mortgage payments (MP), 2: -, 3: +, 4: Hereditary lease expenses (HLE)

b) 1: Vacancy Allowance (VA), 2: +, 3: =, 4: Capital improvement expenses (Capex)

Question 8

Which of the following statements is correct? (2 credits)

a) The coefficient of determination is the proportion of the variance explained by the regression model with respect to the total variance of the observations.

b) The value of the adjusted coefficient of determination is always bigger than the value of the coefficient of determination.

c) If the coefficient of determination is 1, all residuals are also 1.

d) If the coefficient of determination is 0, all regression coefficients have a value different from 0.

e) None of the above statements is correct.

a) Correct

“The coefficient of determination is the proportion of the variance explained by the regression model with respect to the total variance of the observations.”

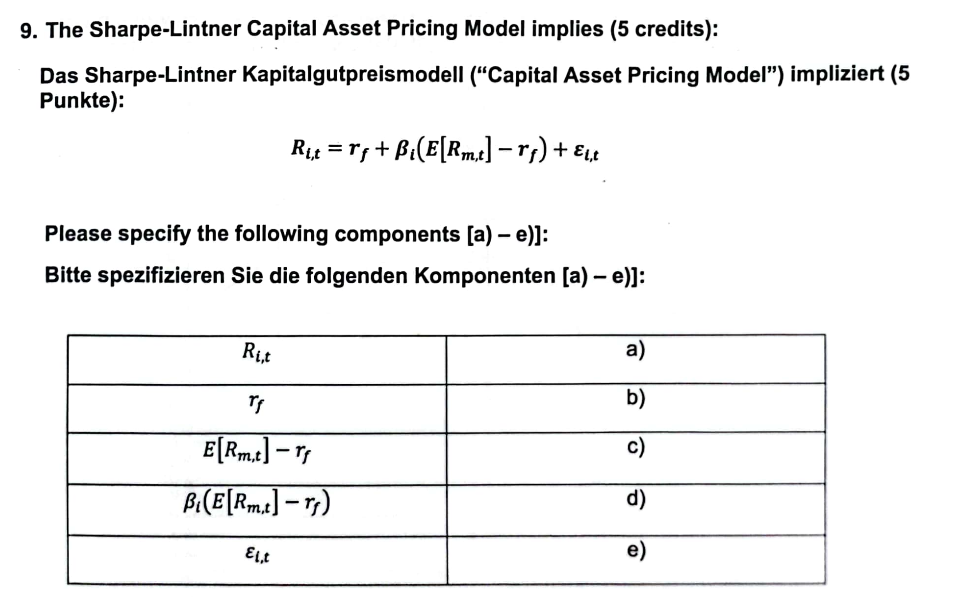

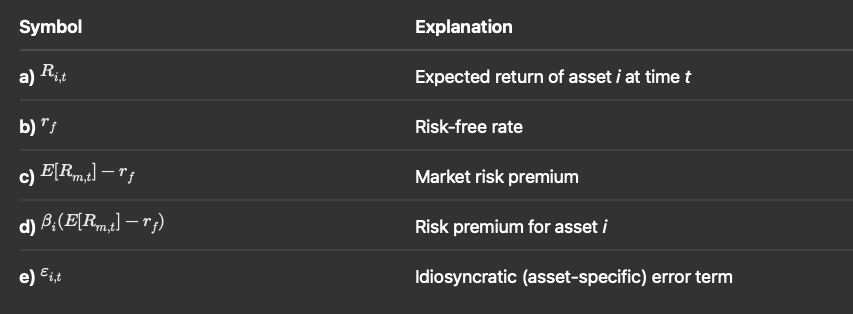

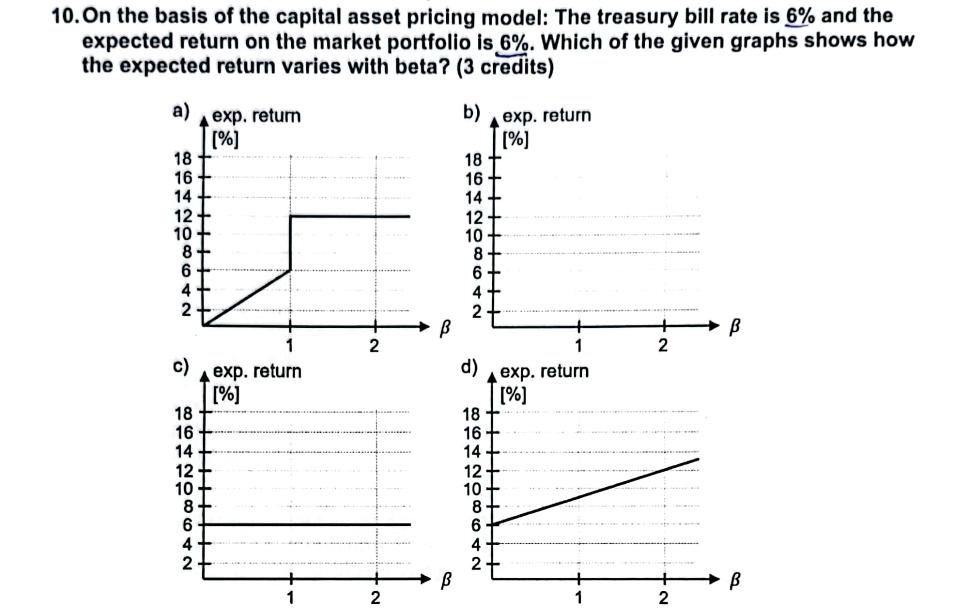

Correct answer: c)

Because:

It shows a horizontal line at 6% for all β

Which is exactly what the CAPM predicts when the market premium is zero

Common trap:

If the market premium were positive (e.g. market return = 10%, risk-free = 6%), then you’d see a positive linear relationship between β and expected return — that would match option d).