Consumer behaviour - Chapter 9: Individual decision making

1/101

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

102 Terms

Why do we make decisions as consumers?

We make decisions to solve problems

Purchase momentum

When the likelihood of buying more increases after an initial purchase

When we get "revved up" and plunge into a spending spree

Consumer hyperchoice

An overabundance of choices for the consumer, which results in the need to make repeated choices that can result in a drain a psychological energy

Consumer hyperchoice (con’t)

Too many choices may lead to dis-satisfaction with the purchase decision and reduce the likelihood to purchase in that product category again

Rational perspective

A viewpoint which sees consumers as careful analytical decision makers that try to maximize utility in purchases

The economics approach of the search process

The assumption that people collect as much data as needed to make a decision

Utility

The rewards of searching for info and the value of additional info

What should be looked at in the decision-making process?

Marketers should carefully study steps in decision making to understand how information is obtained, how beliefs are formed, and what choice criteria are specified by consumers

What can marketers do after they understand decision making process

They can develop marketing strategies which can cater to deliver types of info likely to be desired in effective formats as well as emphasize key attributes

Rational system of cognition

When people processes information analytically and sequentially using rules of logic

Experiential system of cognition

When people process information more holistically and in parallel.

Constructive processing

When consumers tailor their degree of cognitive “effort” to the task at hand

i.e when consumers devote more brain power to tasks which need more thought-out rational approaches

What do consumers do when constructive processing isn’t needed?

They’ll look for shortcuts

e.g. “just do what I usually do,” or use “gut” decisions that “automate” these choices

Behavioural influence perspective

When one’s decision is a learned response to environmental cues

e.g. An impulse buy on an item promoted as a surprise special

Extended problem solving

Initiated by a motive that is central to self-concept and comes with a high-perceived risk, and thus one tries to collect as much info as possible and weighs alternatives carefully

Limited problem solving

Buyers use simple decision rules to choose as they aren’t motivated to search for info rigorously nor evaluate alternatives

Habitual decision making

Decisions made with little to no effort, almost as if they’re routines

Experiential perspective

Consumers buy based on the sum of a product’s appeal

Compensatory rule

When we let a product make up for a flaw when it excells in another area

Simple additive rule

A type of compensatory rule where the consumer picks the option with the most positive attributes

*albeit some of attributes may not be relevant to the consumer

Weighted additive rule

The consumer takes into account the important positive attributes

Non-compensatory rule

When we reject a product based on the fact that we don’t like one or more of its traits

The lexiographic rule

The brand that is the best on the most important attribute (or the 2nd most important attribute) is chosen

Elimination-by-aspects rule

Cut-offs are imposed on the most important attributes

e.g. Someone looking for an HD TV may want at least three HDMI ports

The conjunctive rule

When one processes positive attributes by brand by cut-offs which are established by brand, and a brand is chosen if it meets all the cut-offs

The disjunctive rule

When the consumer develops acceptable standards for each attribute; these standards are usually higher than the shopper’s minimum cut-offs for attributes

The disjunctive rule (con’t)

The consumer will select something that’s exceptional in some unique way

e.g Someone shopping for a shirt may be impressed by great new colour, style, or type of fabric that exceeds their standards; if they come across 2 shirts that meet their standards, they must resort to a different rule

Decision huerstics

Mental shortcuts/rules of thumb taken during a decision-making process, which lead to quick decisions,

e.g. I buy Dempster’s Bread, the brand my dad always ate

Market beliefs

Consumer assumptions about companies, products, and stores that become shortcuts for decisions

Market beliefs (con’t)

Beliefs which send information about the association between stand-alone market concepts and are used as decision rules, and also incorporate cues as indicators of complex info

Signal

The communication of underlying qualities or traits (e.g. Values or status) via aspects which are visible to others

e.g Someone selling a used car will clean it extensively to make it look presentable to buyers

Covariation

Association among events when information is incomplete

e.g. One may form an association between quality and the length of time a manufacturer has been in business

Price-quality relationship

The assumption that higher prices mean better quality

Country of origin as a heuristic

People tend to rate their own country’s products more favourably than do people who live elsewhere

Country of origin as a heuristic (con’t)

We like to buy Italian shoes, German cars, and French luxury goods (country of origin!), as product address matters

Stereotype

A thought structure based on beliefs as opposed to evidence

How may country of origin impact consumer’s thought processes?

It can stimulate the consumer’s interest in the object to a greater degree and thus makes them think more extensively and evaluates it more carefully.

How may country of origin impact consumer’s thought processes? (con’t)

It may become a product attribute which combines with other attributes to influence evaluations

Ethnocentrism

The tendency to prefer products or people of one’s own culture over those from other countries

Choosing familiar brand names

A power heuristic where people form preferences for favourite brands and stick with them

Inertia

When a brand is purchased out of habit merely because less effort is required (low-involvement)

If another brand comes along that’s easier to purchase, the consumer won’t hesitate to switch over

Brand loyatly

Consciously choosing a preferred brand to buy regardless of all other factors

Mental accounting

When decisions are influenced in terms of how a problem is posed

Someone who paid an arm and a leg for a hockey ticket would go out in a storm to view it compared to if they got the ticket for free.

Sunk-cost fallacy

Paying for something makes one hesitant to waste it.

Hyperopia

People who are so obsessed with the future to the point they can’t enjoy the present

Loss aversion

When losing money feels worse than gaining money

Prospect theory

A model of how people make choices which finds that risk is different when one faces options involving gains vs. those involving losses

The 4 key parts of prospect theory

Reference point

Loss averse

Risk averse concerning gains, & risk seeking concerning losses

Overweight small probabilities

Reference point example

Two people wait 20 minutes to get help from a hotline. Person A will think they wasted time if they were told they’ll wait 10 mins, while person B will think they saved 10 mins if they were told they’d be waiting 30 mins

Loss averse example

Person B may be happy for a little bit about saving time, while person A may feel angry for a while about wasting time

Risk averse concerning gains & Risk seeking concerning losses

There’s a disaster, and 600 people are at risk of dying. You’re considering two rescue strategies. Strategy A: Save 200 people for sure. Or Strategy B: A one-third chance of saving 600 people and a two-thirds chance that no one will be saved

People are risk averse and prefer Strategy A, but because 400 people die, it’ll be viewed as a loss, unlike option B where there’s a chance everyone's lives will be saved. Thus option B will be preferred

Overweight small probabilities example

Lotteries, where the chance of winning is small, but people still think they’ll win

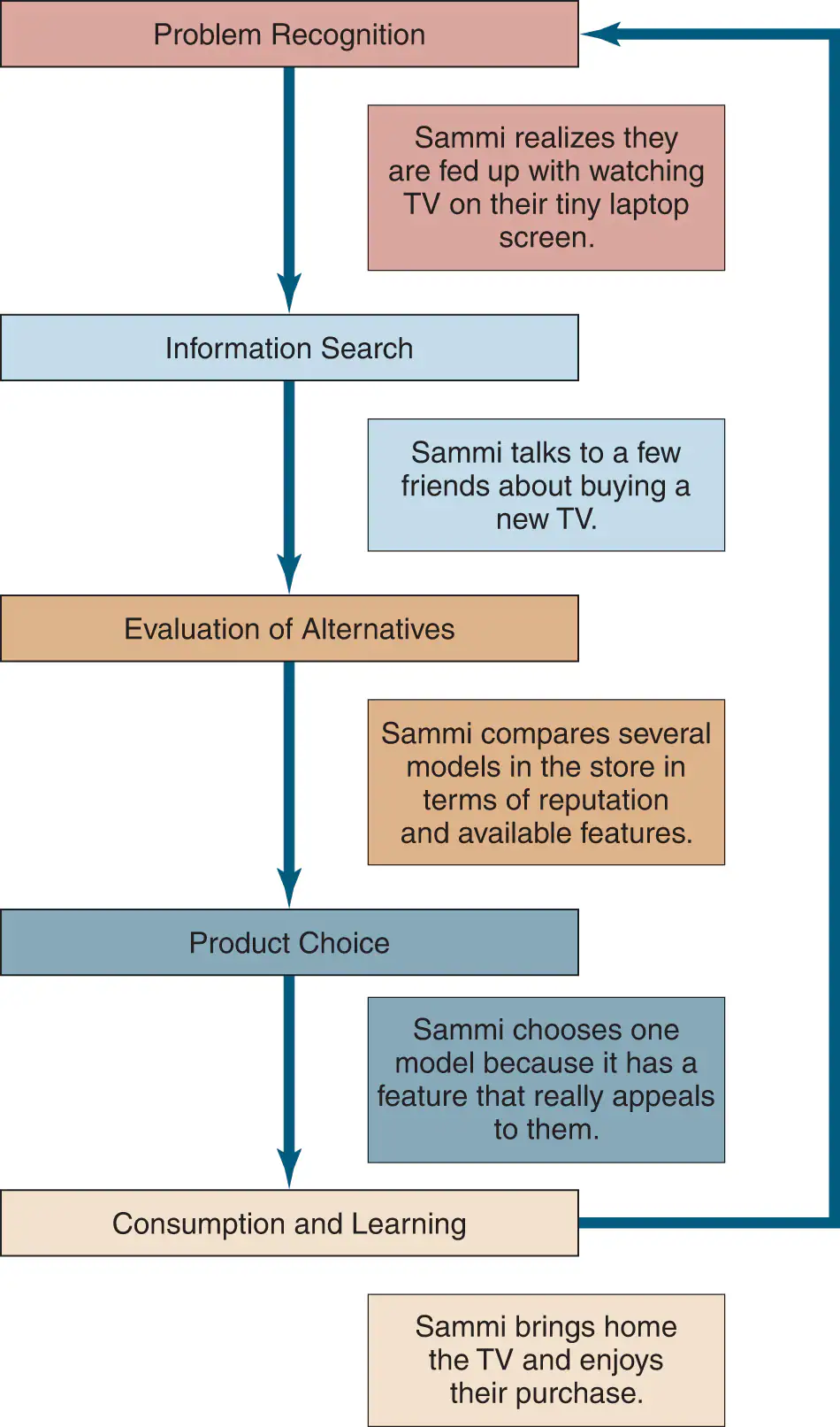

Stages in consumer decision making

Problem recognition

Information search

Evaluation of alternatives

Product choice

Consumption and learning

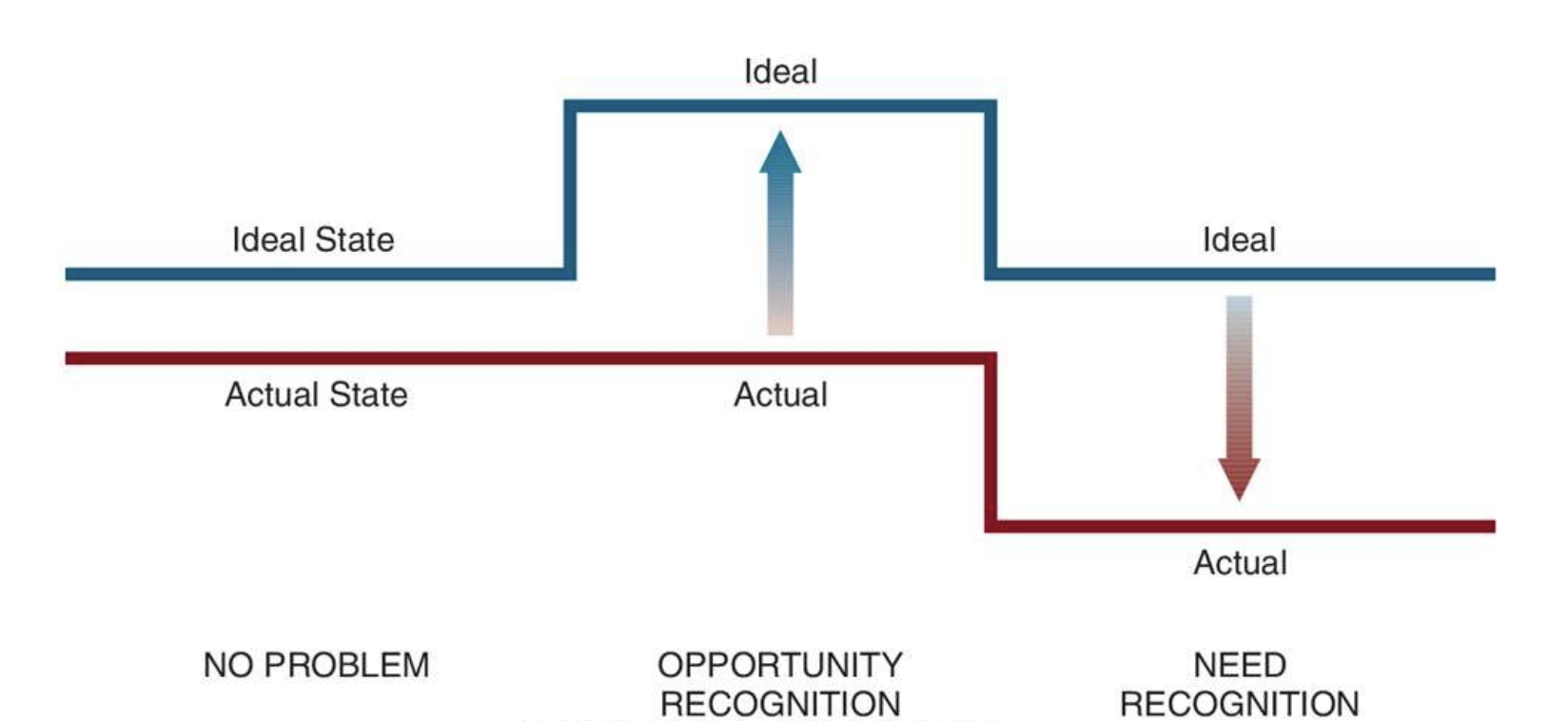

Problem recognition

When we recognize we have a problem and decide to solve it

The 2 ways problems can arise

Actual state - need recognition

e.g. Someone runs out of gas for their car

Ideal state - opportunity recognition

e.g. One is no longer content with how their car conveys their self-concept

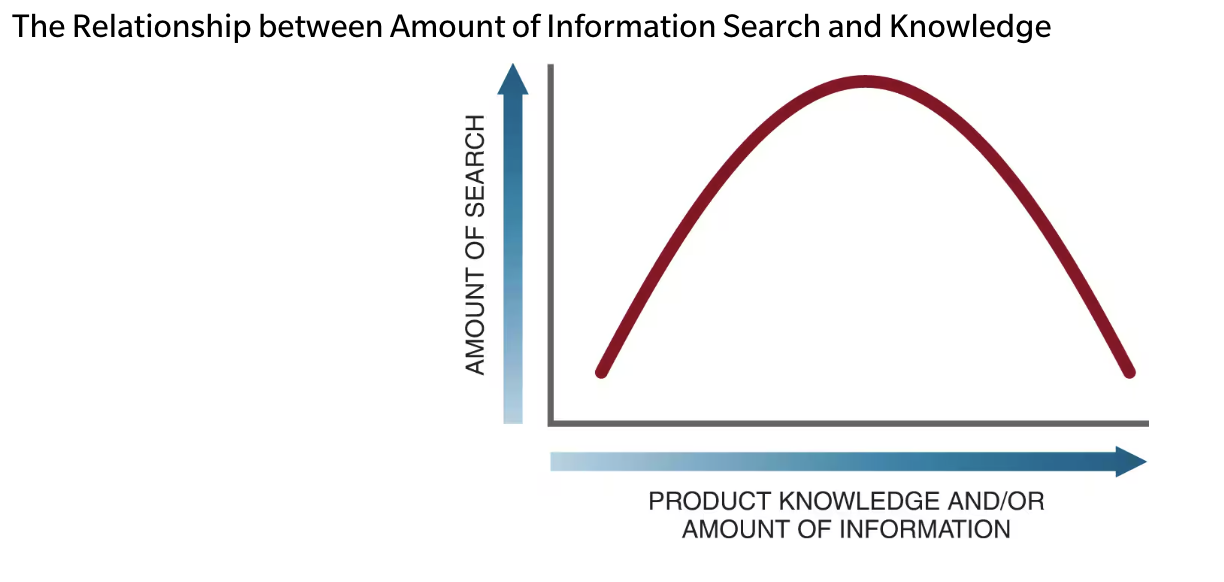

Information search

When a consumer surveys the environment for appropriate data/information to make a reasonable decision

Pre-purchase search

When a consumer searches the marketplace for specific information after recognizing a need

Selective search

Efforts are more focused and efficient

What sort of searching do ‘newbies’ engage in?

“Top-down”, searches which focus less on details than the big picture

e.g. One be more impressed by the sheer amount of technical information presented on a webpage than by the actual significance of the claims made

Internal search for info

Consumers call upon background info they already know in their memory in order to gather info about product alternatives

External search for info

Obtaining information from outside sources

e.g. Ads, retailers, catalogs, friends, family, people-watching, Consumer Reports, etc.

Directed learning

When someone, on a prior occasion, has already searched for info or experienced alternatives for a product

e.g. A parent who bought a cookie for their kid may have a good idea of what cookie to buy for another kid

Incidental learning

Exposure to conditioned stimuli and observations of others results in learning material that may very well not be needed

Cybermidiary

A website or app that helps filter and organize online market information so that customers can more efficiently identify and evaluate alternatives

Maximizing

A decision-making strategy which aims to yield the best possible result

Satisficing

A decision-making strategy where the consumer settles for good enough

Satisficing (con’t)

Most consumers engage in this thought process due to a lack of time for larger items (e.g. cars or appliances), but less so for symbolic items such as clothes

Bounded rationality

A decision-making strategy where the consumer settles for good enough due to a lack of time to weigh all other options

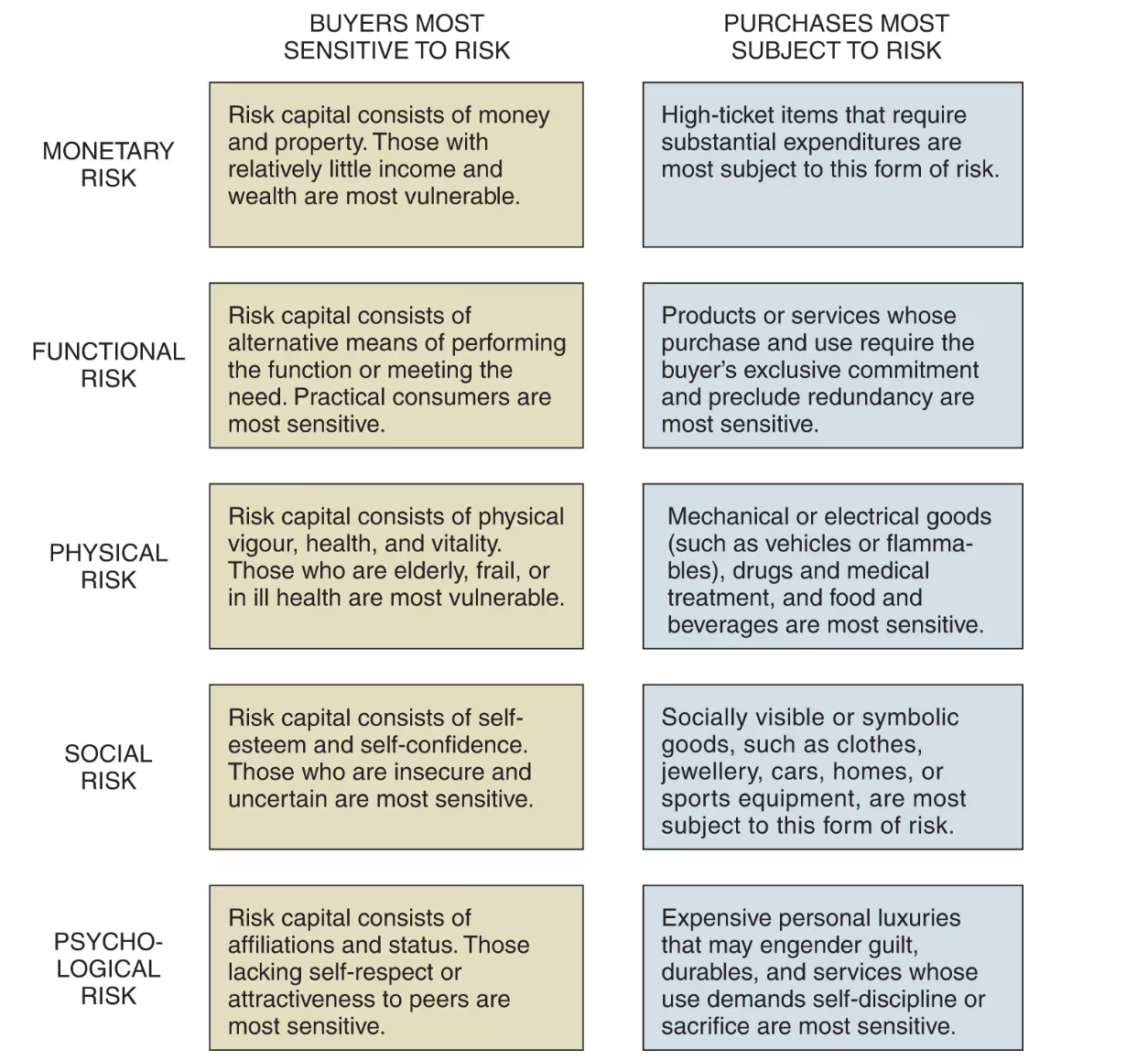

Perceived risk

The belief that using a product may bring negative physical or social consequences

Perceived risk (con’t)

It may also be present if the decision is expensive or tricky to understand

The 5 types of perceived risks

These can be objective (physical danger) and subjective (social embarrassment)

Monetary risk

Functional risk

Physical risk

Social risk

Psychological risk

Evaluation of alternatives

Picking from the often very many available alternatives

Evoked set

Products/alternatives already in the consumer’s memory as well as prominent brands in the retail setting

Consideration set

Products/alternatives seriously considered by the consumer

Inept set

Options the consumer has decided against or don’t fit their needs

Inert set

Options which don’t come to the consumers mind at all

Why must marketers focus on getting their brands in consumers’ evoked set

Rejected brands don’t get second chances very often

How do consumer put alternatives into categories?

They evaluate attributes in terms of what they already know about the item or other similar objects (they’ll refer back to their evoked set)

Example of how consumers put alternatives into categories

One who’s evaluating a Garmin fitness watch will most likely compare it to other fitness watches rather than to a watch that simply tells the time; the category in which a consumer places the object determines the other objects they will compare it to

Why is schema (conginitive structures) important to understand

Marketers want to ensure that their offerings are correctly grouped

E.g. Tide Pods, where kids mistook them for candy instead of laundry detergent

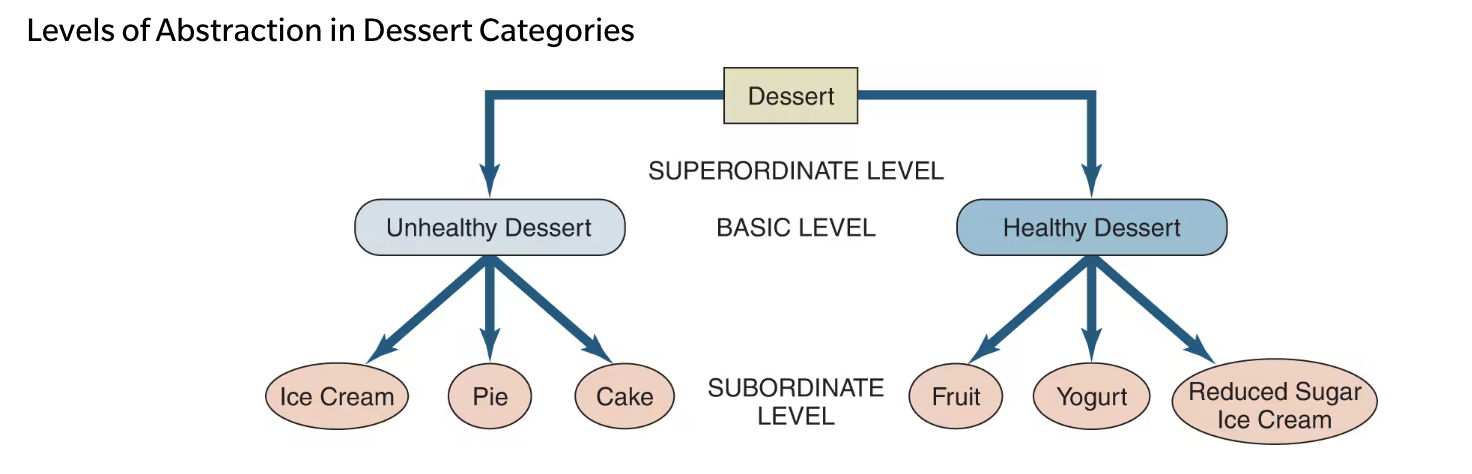

Levels of categorization

The superordinate category - more abstract

Basic-level - the most useful in classifying products as grouped items here have lots in common yet still have alternatives

Subordinate category - often consists of individual brands

Strategic implementations of product categorization (Production Positioning)

Positioning

Identifying competitors

Exemplar products

Locating products

Positioning

When a marketer convinces consumers that a product should be considered within a given category

e.g. Orange juice being touted as a breakfast beverage

Identifying competitors

Products/services that are different on the surface but can actually compete on a super-ordinate level

e.g. Yoga and working out can both be classified as subcategories of fitness, but may not be necessarily considered substitutes of each other

Exemplar products

Brands strongly associated with a category/a brand, or a product that’s a really good example of a category, will be more familiar to consumers and will thus be recalled easier

e.g. The Kleenex brand of tissues

Exemplar products (con’t)

Moderately unusual products may stimulate more information processing and positive evaluation, as they’re neither so familiar to the point they will be taken for granted nor so discrepant that they’ll face dismissal

Location

If objects do not fit into categories, consumers’ ability to find them or make sense of them may be affected

e.g., Is a rug furniture? Where might I find frozen dog food?

Location (con’t)

The alignment between consumers’ internal product categorization and retail shelf layout dimensions heightens purchase intentions

Evaluative criteria

Dimensions used to judge merits of competing options

Spiral of complexity feature creep

Products with more options than one can realistically manage

Determinant attributes

Features which are essential to the consumer’s final choice

Post-purchase evaluation

When the consumer experiences the offering selected; is the final stage of the consumer decision process

Consumer satisfaction/dissatisfaction (Cs/d)

Determined by the general feelings/attitude a person has about an offering following its purchase; firms that have high satisfaction have bigger advantages

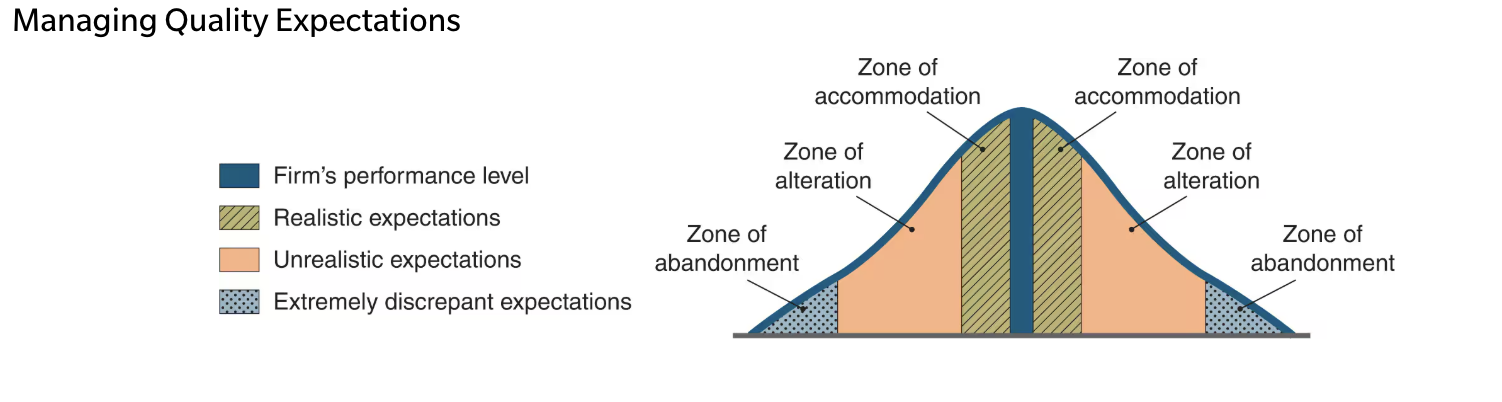

Expectancy disconfirmation model

When one forms beliefs about performance based on prior experience with the object or on communications about the object that imply a certain level of quality; the response can be influenced by how it aligns with expectations

Expectancy disconfirmation model (con’t)

When something performs the way we thought it would, we may not think much about it. If something fails to live up to expectations, a negative affect may result.

Expectancy disconfirmation model example

People who eat at fine dining restaurants may expect crystal clear glasses, and may be unhappy if they receive grimy glasses; though if they eat at a fast food place, they may not mind grimy glasses

Managing expectations

How may dissatisfaction be handled?

Voice response

Private response

Third-party response

Voice response

The consumer can appeal directly to the firm for compensation or do it publicly on social media

Private response

The consumer can express dissatisfaction to friends or boycott the store; is also becoming more public, with an increase in social media use and online forums for consumer expression, private responses can be quickly communicated to a more significant number of people.