Net present value/ Discount cash flow

1/3

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

4 Terms

Net present value method

Calculates the total return on an investment taking into account the time value of money

is the value of future money if you had it

now (considering inflation and the potential

for earning interest on investment capital or

cost of finance on raising investment capital)

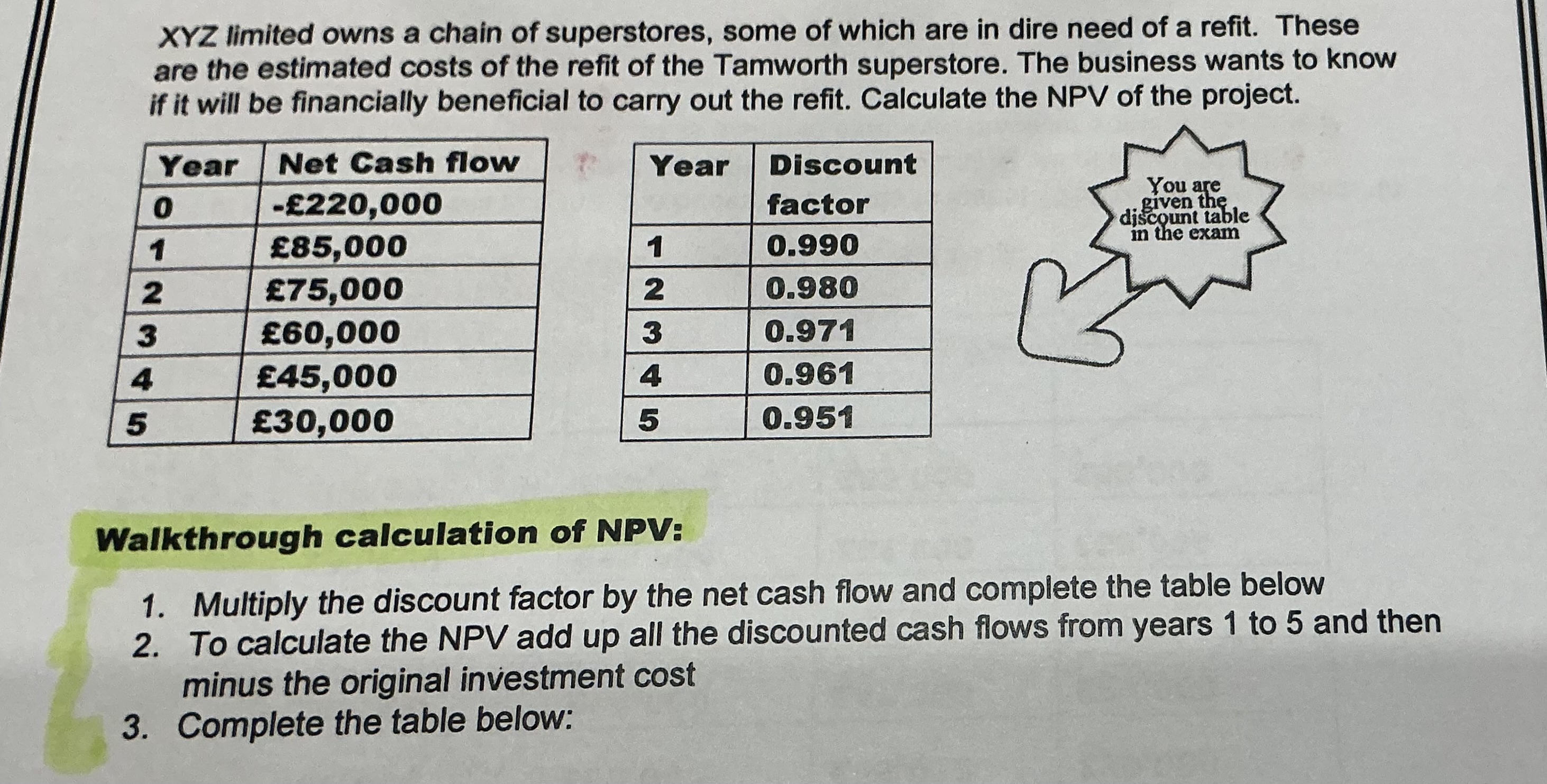

How to calculate NPV

Advantages of NPV

• Take into account changes in the

economic and financial climate e.g.

inflation

• Allows for future earnings to be

adjusted to present values and future

cashflows

• Easy to compare different projects

• Allows for effect of risk on estimated

future cash flows

Disadvantages of NPV

It is difficult to calculate

Discount factors could be incorrect

which makes the NPV inaccurate

Difficult to set discount factors far

into the future, the longer into the

future we go, the less reliable the

discount factor