4.2 poverty and inequality

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

22 Terms

absolute poverty

When a household does not have sufficient income to sustain even a basic acceptable standard of living / meet basic needs

Measured by the world bank $3.00 (PPP)

Relative poverty

A level of household income that is considerably lower than the median level of income within a country

The official UK relative poverty line is household disposable income (adjusted for household size) of less than 60% of median income

causes of changes in absolute poverty

Economic Growth: Increases in a country's overall income and GDP can reduce absolute poverty by providing more resources to meet basic needs.

Population Growth: Rapid population growth can strain resources and lead to an increase in absolute poverty.

Globalization: Economic globalization can impact poverty levels through changes in trade, investment, and labor markets.

Foreign Aid: International aid and development programs can contribute to poverty reduction in developing countries.

P - political instability/corruption

O - out of work / high unemployment

V - violence / civil war

R - remote location

T - trade

Y - yield failure

Changes in relative poverty

Income Inequality: Rising income inequality can lead to an increase in relative poverty, even in economically prosperous societies.

Taxation and Redistribution: Progressive tax systems and income redistribution policies can help mitigate income inequality and reduce relative poverty.

Education & Skills Gaps: Unequal access to quality education limits opportunities, creating an attainment gap and trapping individuals in low-paying jobs

Government Policy: Changes to welfare benefits, minimum wages, and tax policies directly alter household incomes and the poverty line, as seen during the pandemic when benefit uplifts lowered poverty rates temporarily

Sudden drop in income, Tax , youth , assets (houses,property,shares)

The poverty line

If general incomes rise, the relative poverty line moves up, meaning households need more money to not be considered poor.

If incomes fall (like during a recession), the poverty line drops, potentially reducing measured relative poverty even if living standards worsen.

Explain the distinction between wealth and income inequality

Income inequality refers to the unequal distribution of income earned over a period of time (usually per year).

Wealth inequality refers to the unequal distribution of accumulated assets held by individuals or households at a point in time.

Wealth includes property, savings, shares, pensions, and inheritances.

Explain why wealth inequality is likely to be greater than income inequality

Those who already own assets benefit from capital gains and compounding returns, while poorer households often lack the income to save or invest. In contrast, income is a flow earned over time and can change more easily through employment or taxation, making it more evenly distributed than wealth. but also more insecure due to volatilty/changes

explain why greater wealth inequality can lead to greater income inequality

wealth generates income. Individuals with large asset holdings, such as property and shares, earn unearned income through rent, dividends, and interest. These returns can compound over time, increasing their income without additional work. In contrast, those with little or no wealth rely mainly on wages, which grow more slowly.

wealth inequality

how could educational disparities cause inequality

A poorer quality education leads to worsened career opportunities

Lower value skills

Lower value to employers, so lower paid work

More likely to be out of work during times of recession

Private schools vs. state schools may compound the issue

Affordability of higher education

can cause income inequality

evaluate education causing income disparities

Depends on the types of industry that are in a particular economy – the more high value industry there is, the more the types of job that will be shut off from the poorest

Depends on the structure of the education system – more inclusive systems may have fewer disparities

If greater education levels achieved, depends on there being suitable employment for a reduction in inequality

how could differences in assets/wealth lead to inequality

Individuals own different levels of assets, such as property, shares, savings, and pensions

→ those with more assets earn income from these assets (rent, dividends, interest)

→ they can also reinvest this income, allowing wealth to grow through capital gains and compounding returns

→ those with few or no assets earn almost all their income from wages, which generally grow more slowly

→ over time, this leads to greater differences in both wealth and income

→ resulting in inequality across society.

evaluate assets leading to inequality

Depends on tax system – high levels of inheritance tax can redistribute wealth and make more equal

progressive tax can be implemented

Higher-income earners pay a larger % of their income → redistributes money via government revenue.

Revenue funds public services or welfare → low-income households get cash or free services.

Disposable income of low earners rises relative to high earners → reduces income/wealth inequality.

levels of benefits causing inequality

Lower level of unemployment benefits means those out of work have lower disposable incomes

Benefits tracked to price rises instead of wage rises means they fall behind earners

Low state pensions means elderly may be trapped on a low income with little prospect of raising it

why may low levels of benefits not cause inequality

Low unemployment benefits may provide an incentive to take work, reducing inequality in the long run

Raising benefits would have to be paid for – low benefits may allow funds to be used to reduce inequality in other ways

global wealth inequality

globally, the richest 10 % own about 75 % of the world’s wealth, while the bottom 50 % own just 2 %.

inequality in britain

In Great Britain, the wealthiest 10 % of households held about 43 % of all wealth, while the bottom 50 % held just 9 %

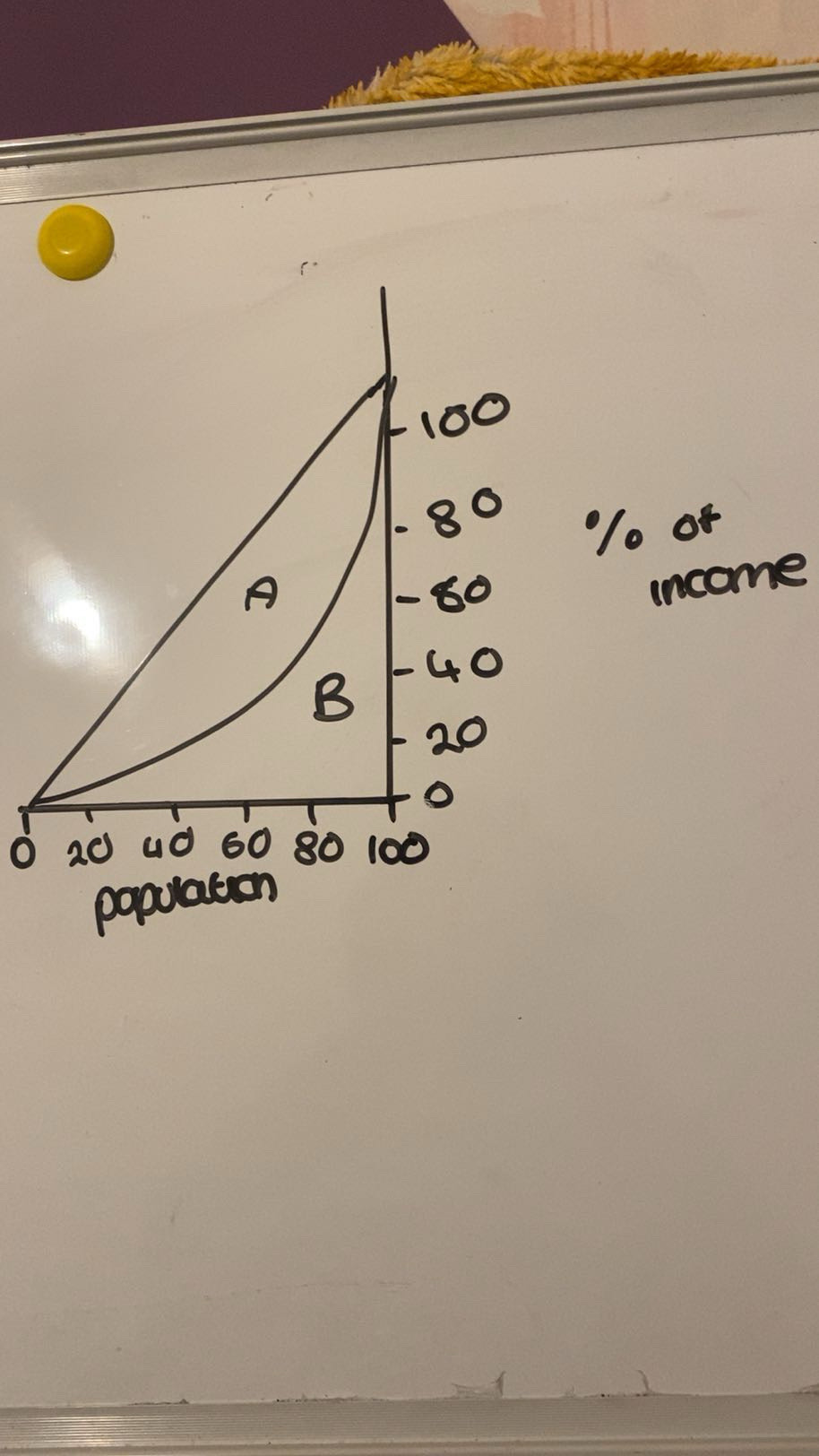

How can income inequality be measured through the lorenz curve and gini coefficient

Lorenz curve - shows the distribution of income in an economy (closer to the straight line the more equal the income distribution)

Gini coefficient - a numerical measure of income inequality based on the lorenz curve

Gini - A (A+B)

what is the gini coffecient in the UK

0.33

how can governnment intervention step in to reduce inequality caused by educational disparities

Government provides subsidies → lowers financial barriers → more low-income students access quality education → human capital improves → higher future earnings → inequality falls.

demand for skilled labour increases alongside their wages

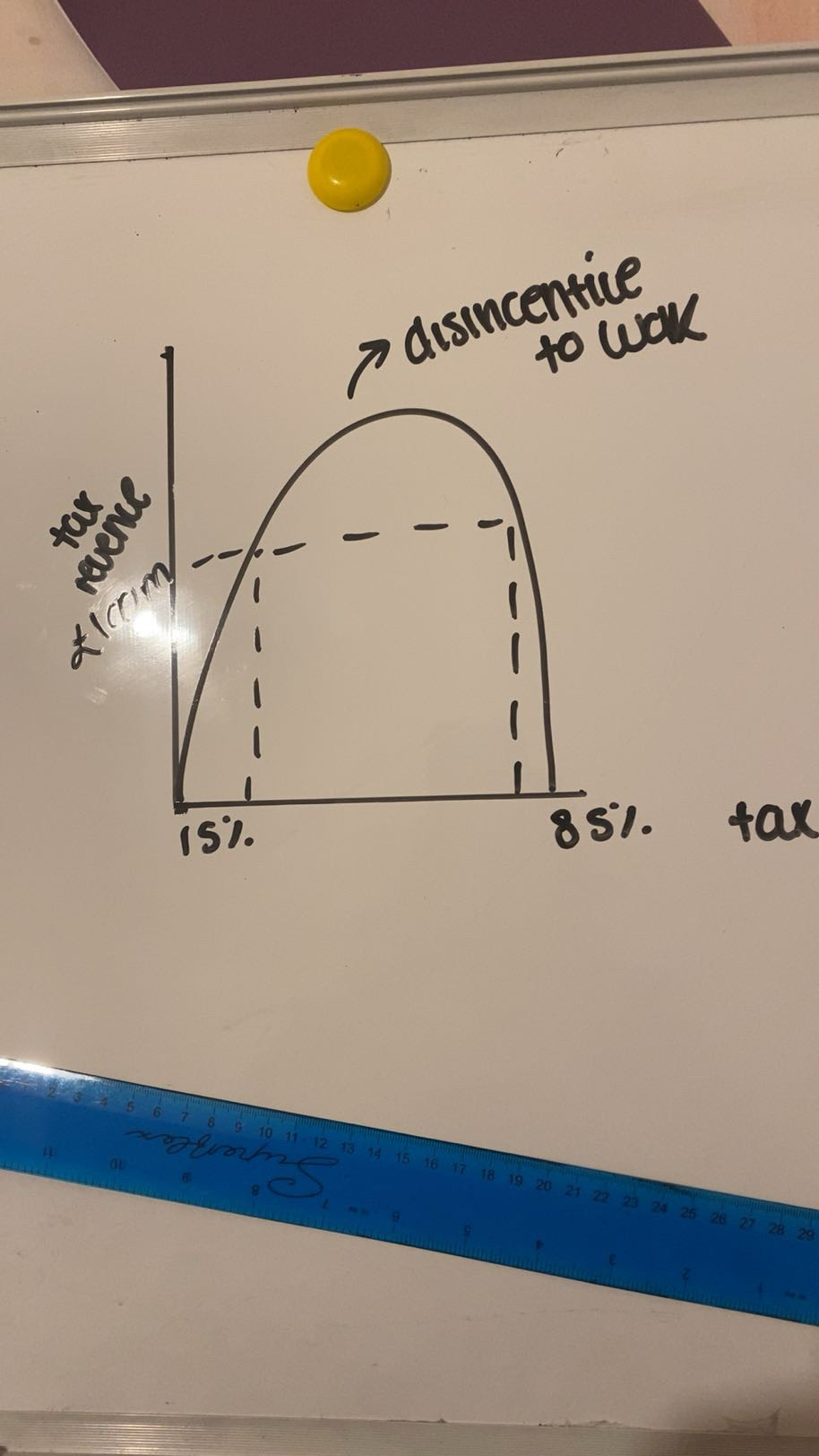

progressive tax evaluation

May disincentivise work, investment, or entrepreneurship if rates are very high → slower economic growth.

Tax avoidance or evasion can reduce effectiveness.

Redistribution depends on how government spends the revenue; poorly targeted spending may not reduce inequality.

Only addresses income inequality, not wealth inequality directly.

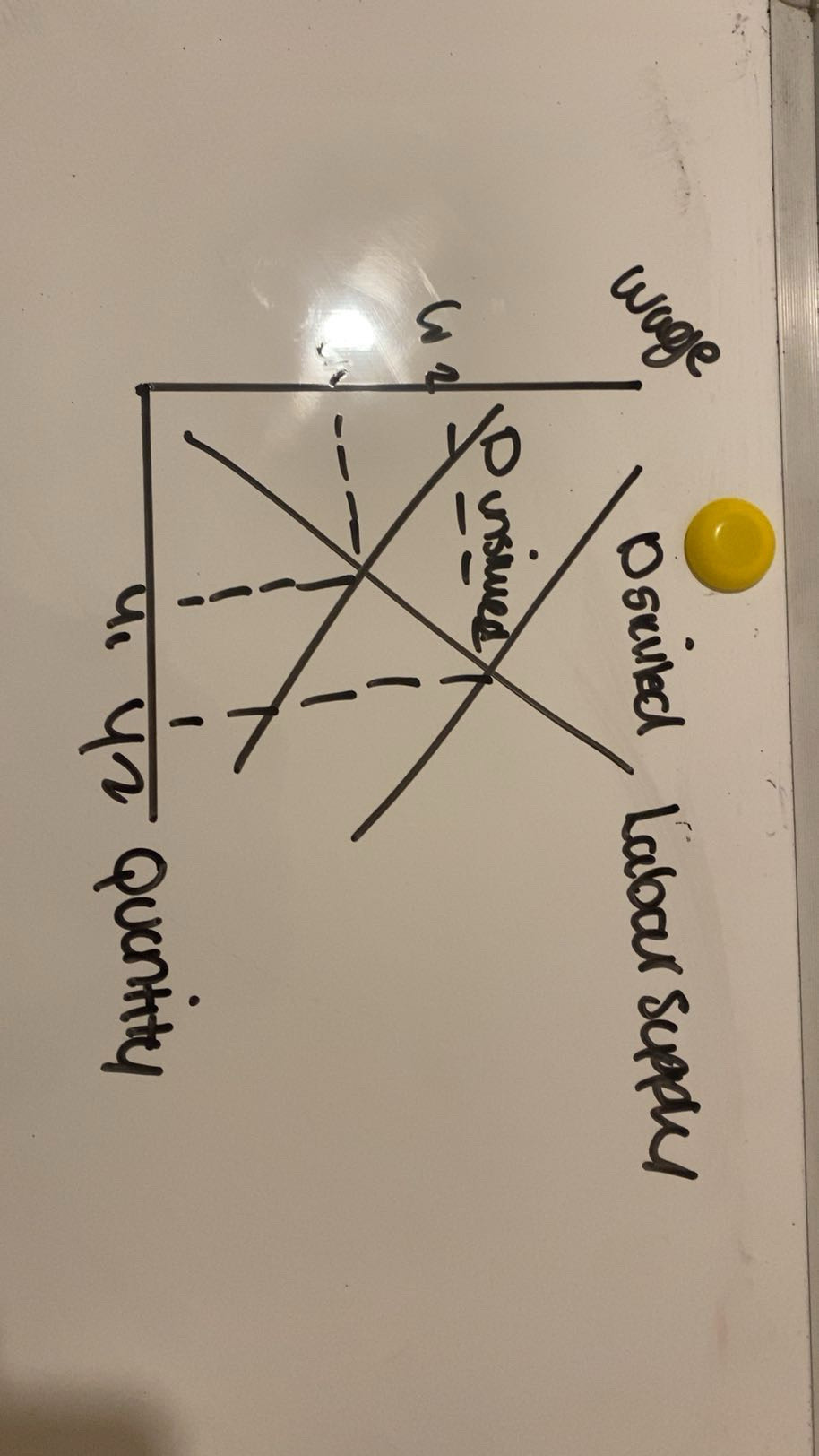

how could raising minimum wage reduce inequality

Government or policy raises the minimum wage → low-income workers earn more per hour.

Higher wages increase disposable income for the poorest → reduces the income gap with higher earners.

Increased spending power can improve living standards, reducing relative poverty → inequality falls.

Evaluate - will increase costs for businesses , laying people off halting hiring (refer to diagram)

how could a government tackle cyclical unemployment to reduce inequality

During a recession, demand falls → firms lay off workers → low-income households lose jobs → inequality rises.

Government uses expansionary fiscal policy (higher spending, lower taxes) or monetary policy (lower interest rates) → boosts aggregate demand.

Firms hire more workers → unemployment falls → low-income households regain income → reduces income inequality.

EVAL - huge opp cost , time lag