HL MICRO CONTENT 2.11-2.12 | Quizlet

1/49

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

50 Terms

Rational producer behavior

Firms wanting to maximize profits (cost, revenue, profits)

Market power

Ability of firm to raise market price of a good or service above MC, influencing market outcomes by restricting output to increase price without loosing their share

Perfect competition

- Many firms

- Firms are small relative to industry size (price takers)

- No product differentiation

- No barriers to entry

- Invisible hand has power

- Only short-run abnormal profits/losses

- Long-run normal profits

- No market failure

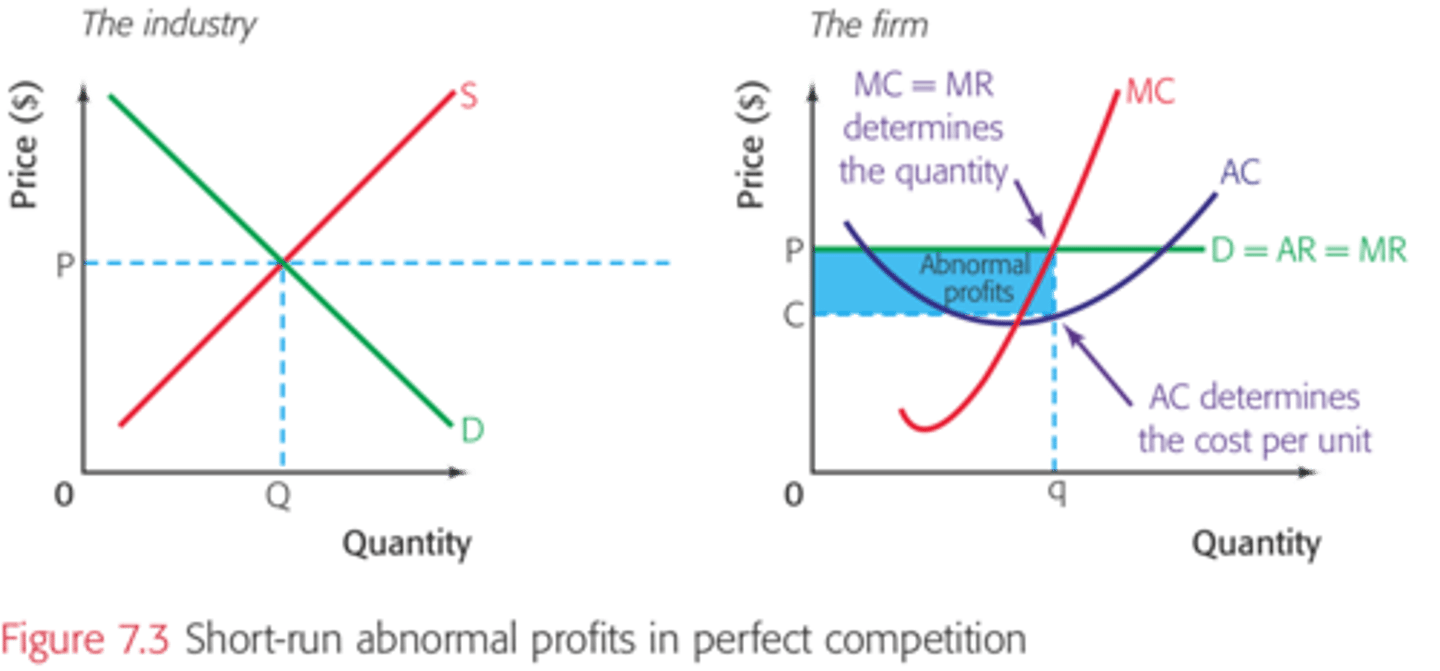

Perfect competition making abnormal profits

Short-run only

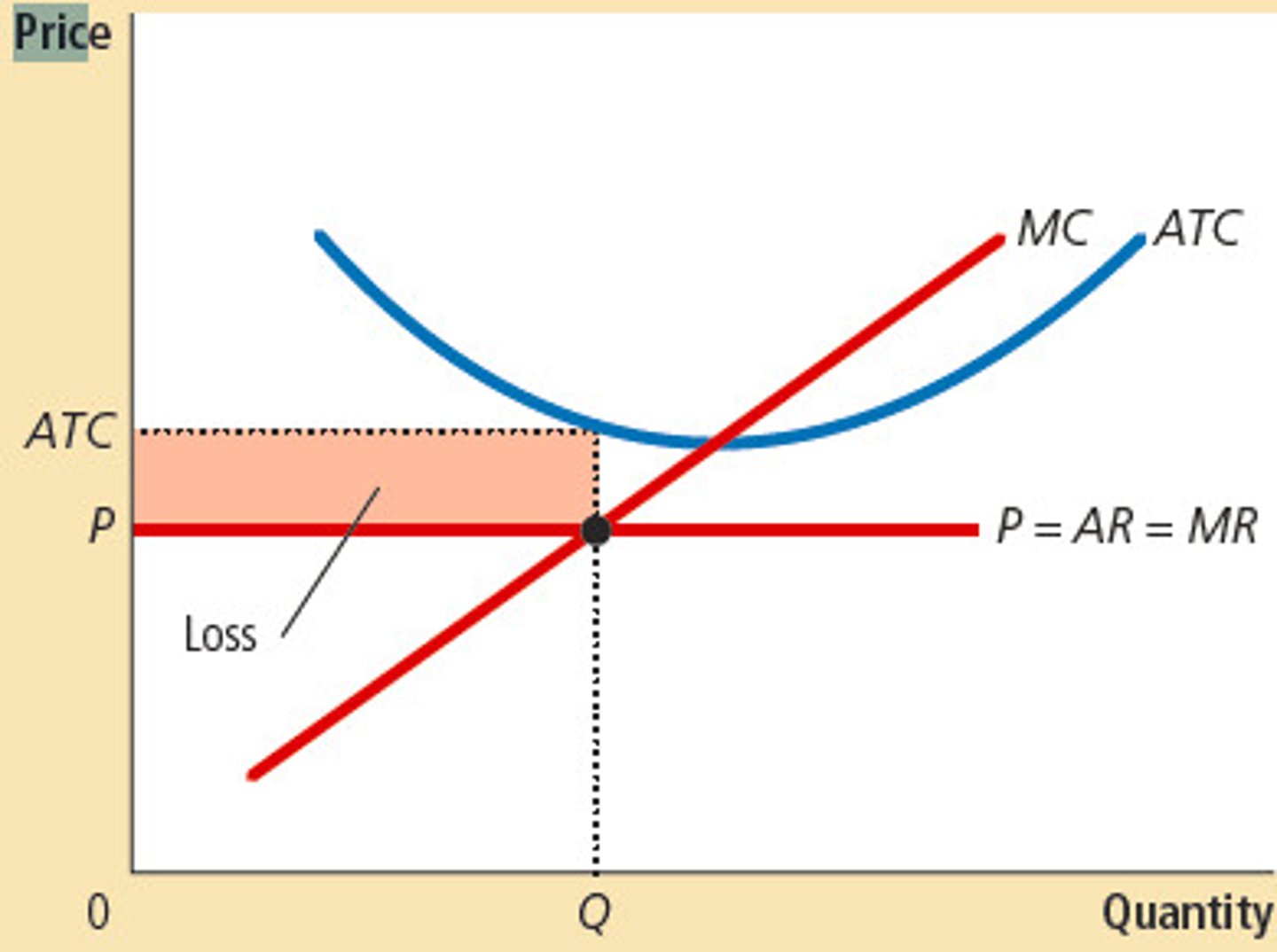

Perfect competition making losses

Short-run only

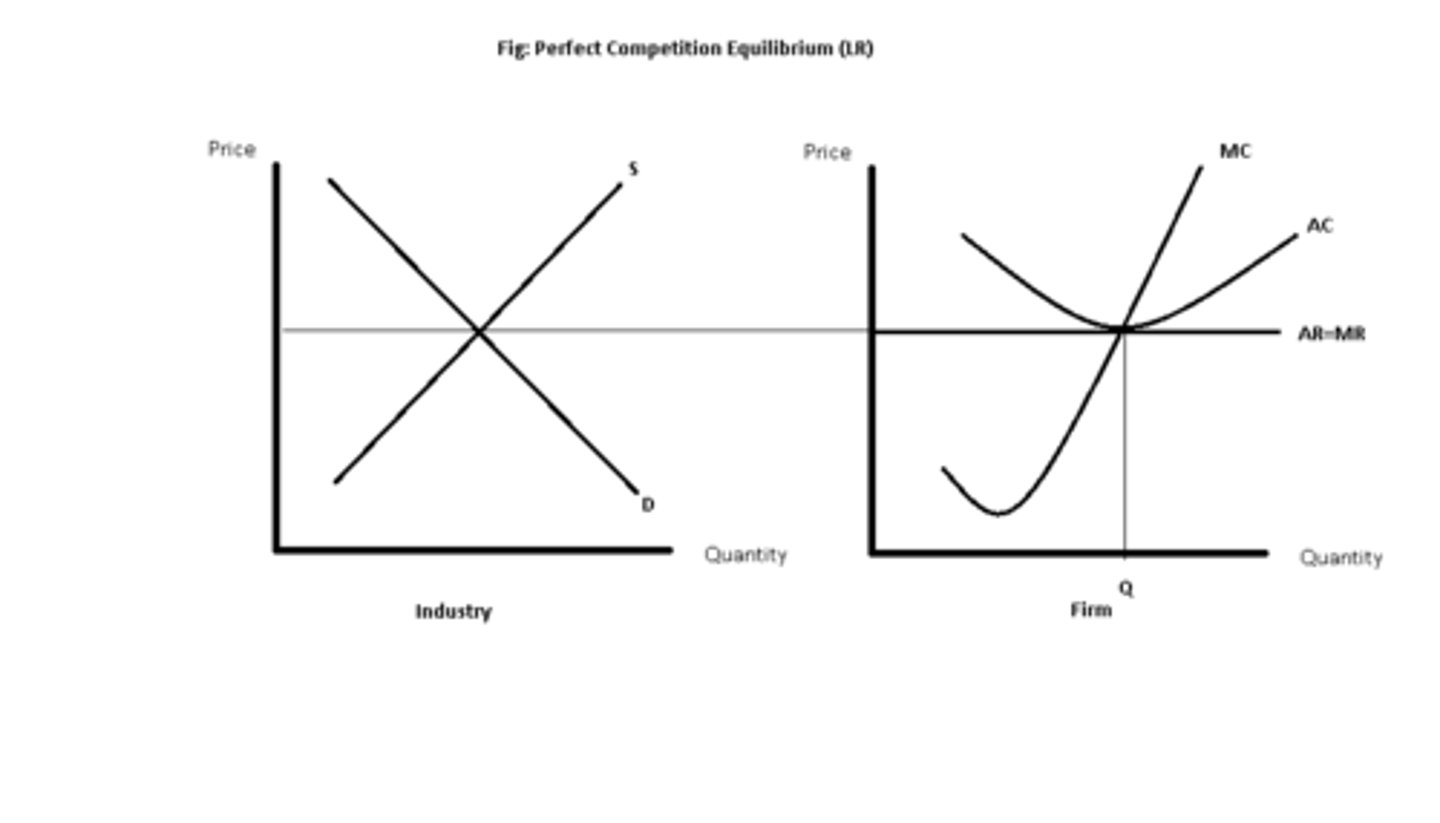

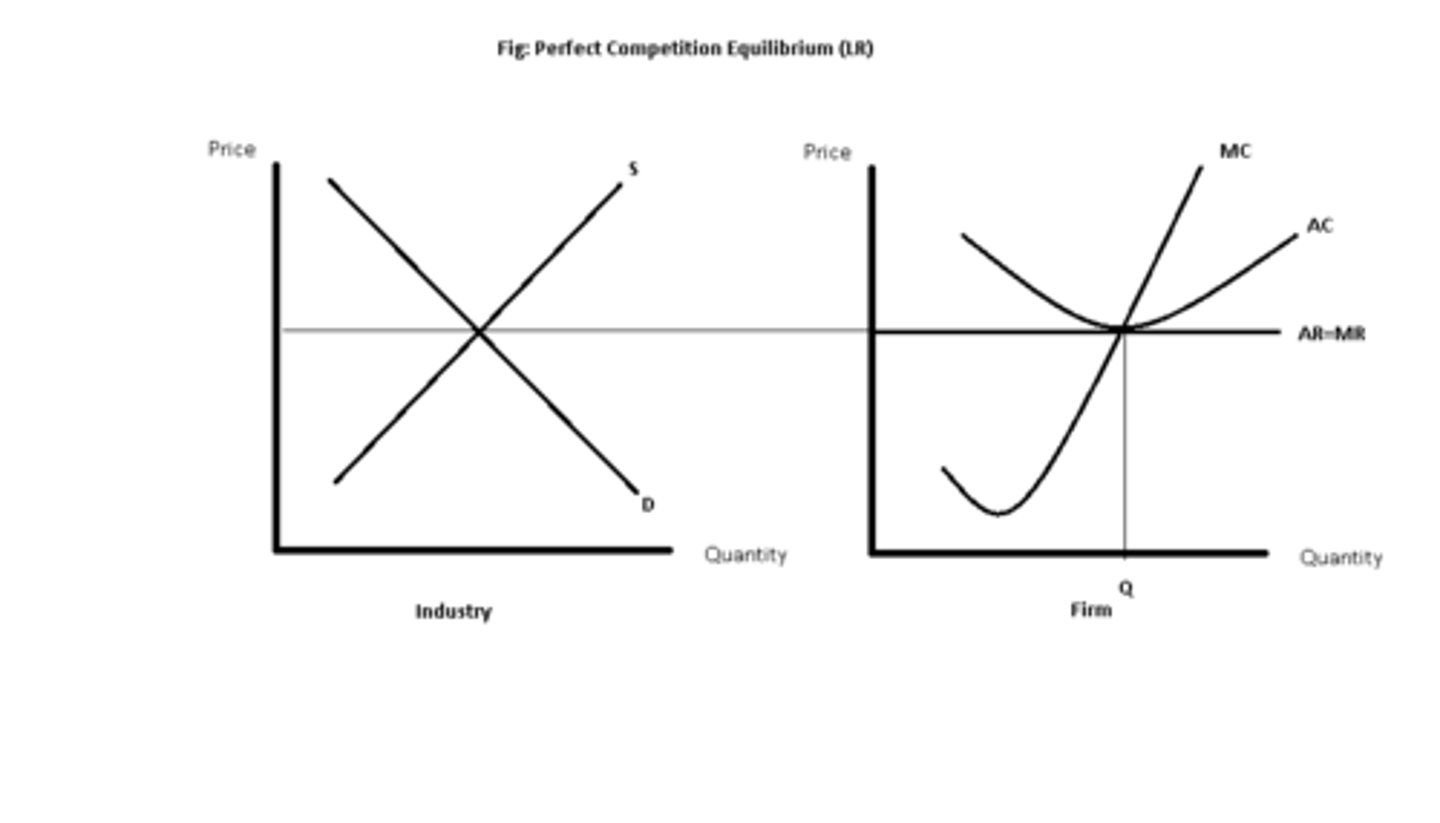

Perfect competition making normal profits

Long-run

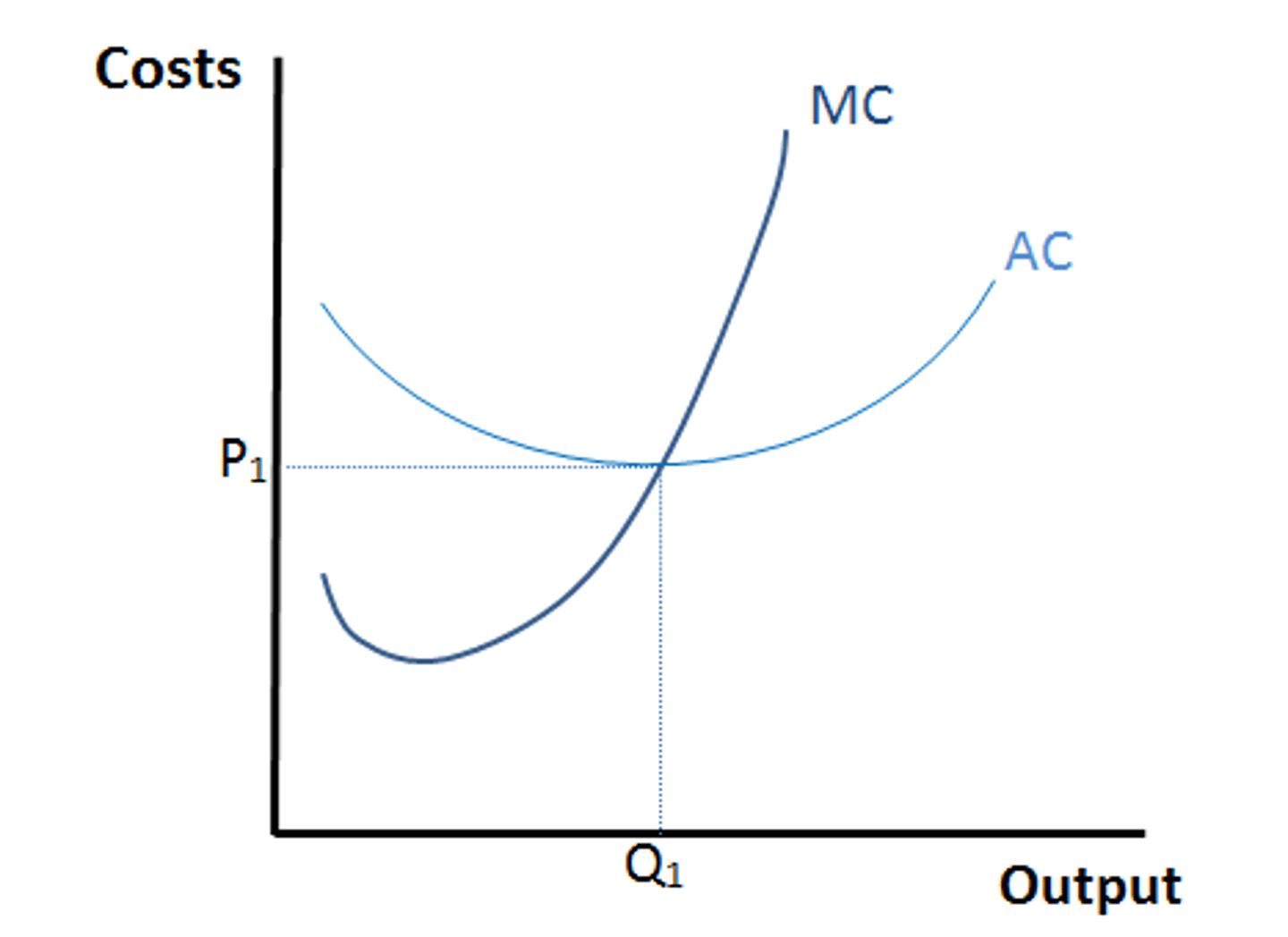

Productive efficiency in perfect competition

Firm produces at lowest possible unit average cost (MC=AC)

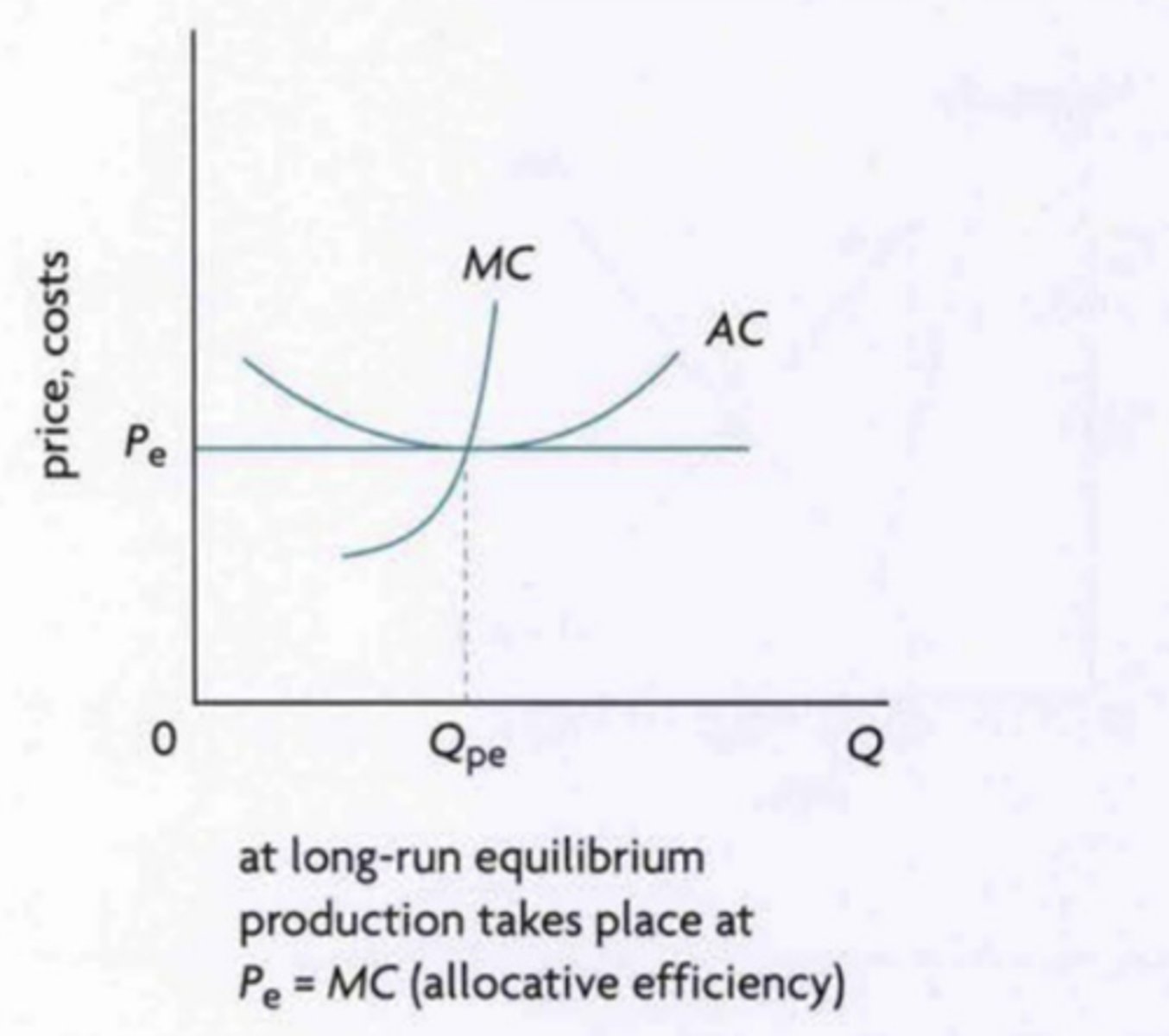

Allocative efficiency in perfect competition

Socially optimum level of output where suppliers produce optimal mix of goods/services required by consumers

Monopolistic competition

- Many firms

- Few firms have little market power

- Product differentiation

- No barriers to entry/exit

- Perfect information

- Only short-run abnormal profits/losses

- Long-run normal profits

- Market failure

Monopolistic competition making abnormal profits

Short-run only

Monopolistic competition making losses

Short-run only

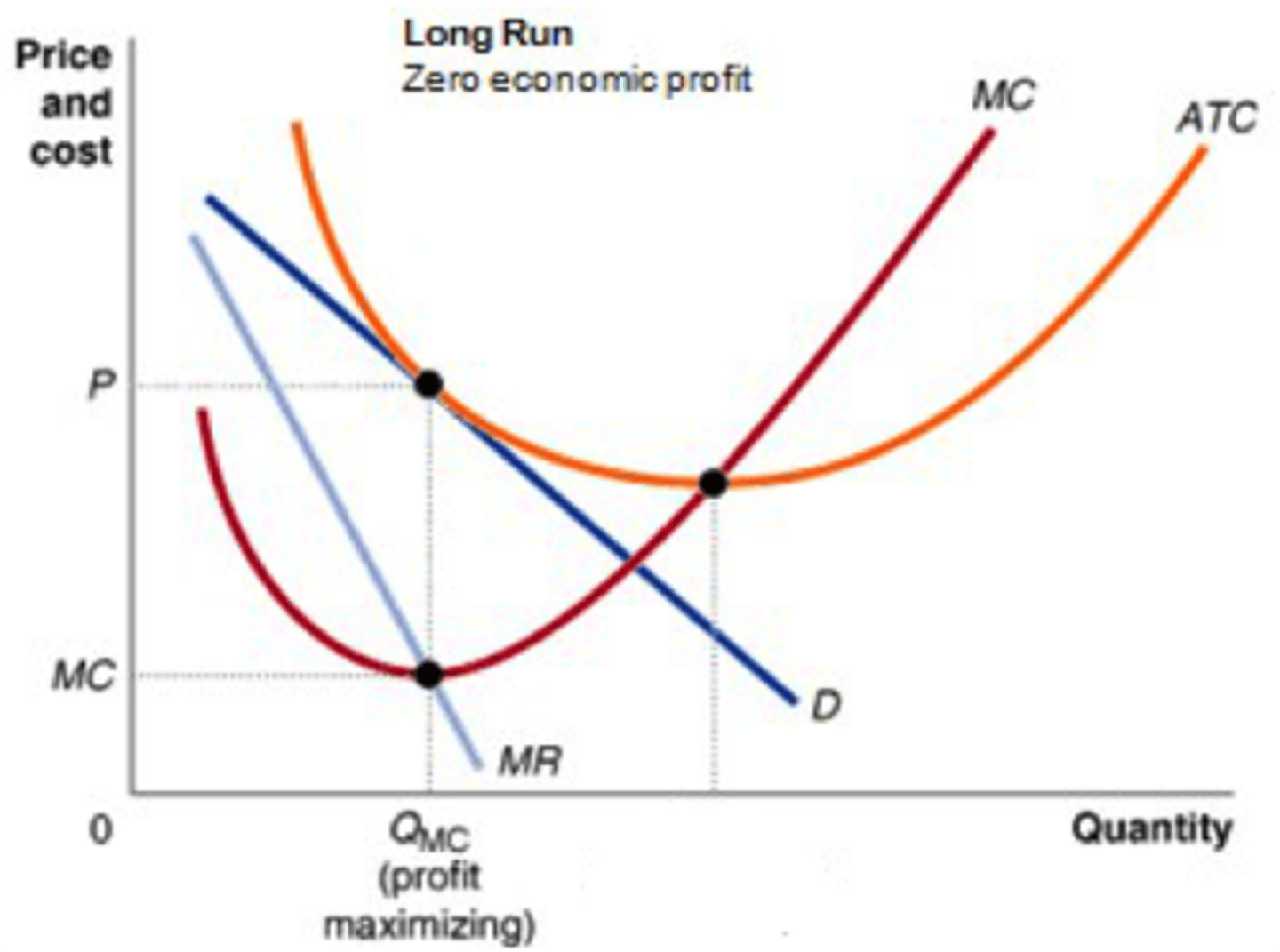

Monopolistic competition making normal profits

Long-run

Productive efficiency in monopolistic competition

MC=AC

Allocative efficiency in monopolistic competition

MC=AR

Monopolies

- One firm with power (firm=industry)

- Barriers to entry

- Abnormal/normal profits, losses (long/short-run)

Factors of how monopolies maintain position/market power efficiently

Economies of scale, natural monopolies, legal barriers, brand loyalty, anti-competitive behavior

Economies of scale

Factors that cause a firm's average cost per unit to fall as output rises (specialization, division of labour, bulk buying, financial economies, transport economies, large machines, promotional economies)

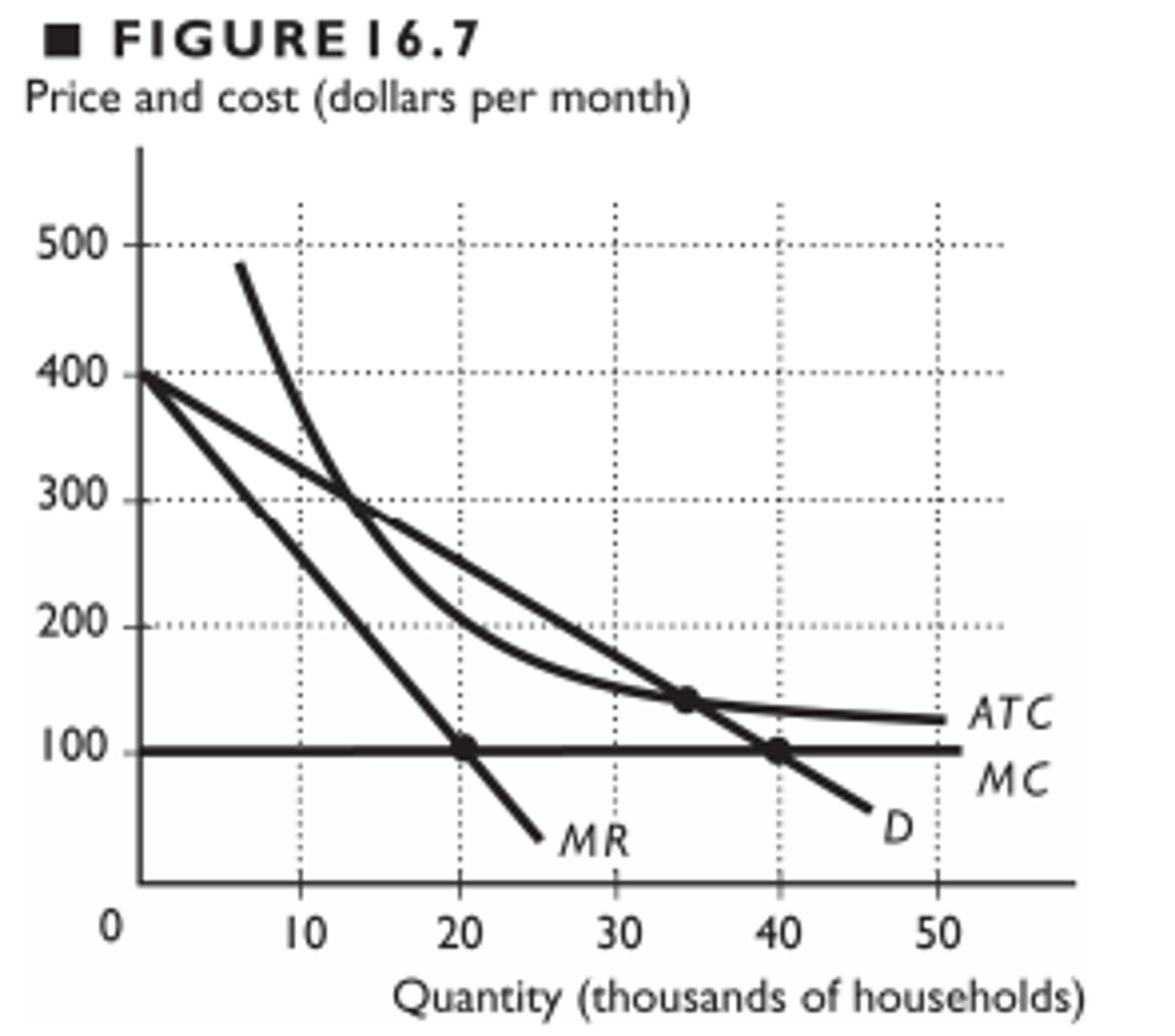

Natural monopoly

A market that runs most efficiently when one large firm supplies all of the output

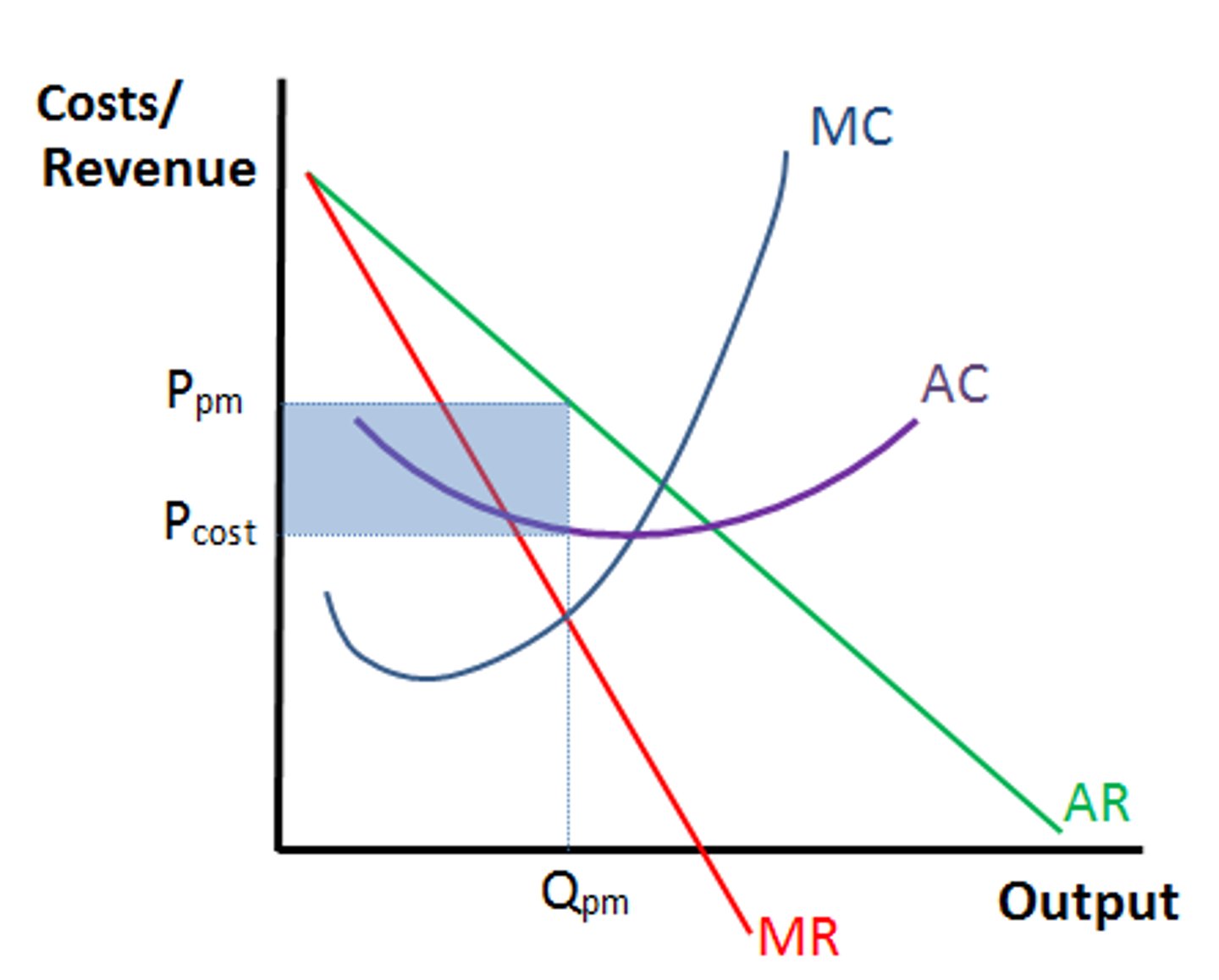

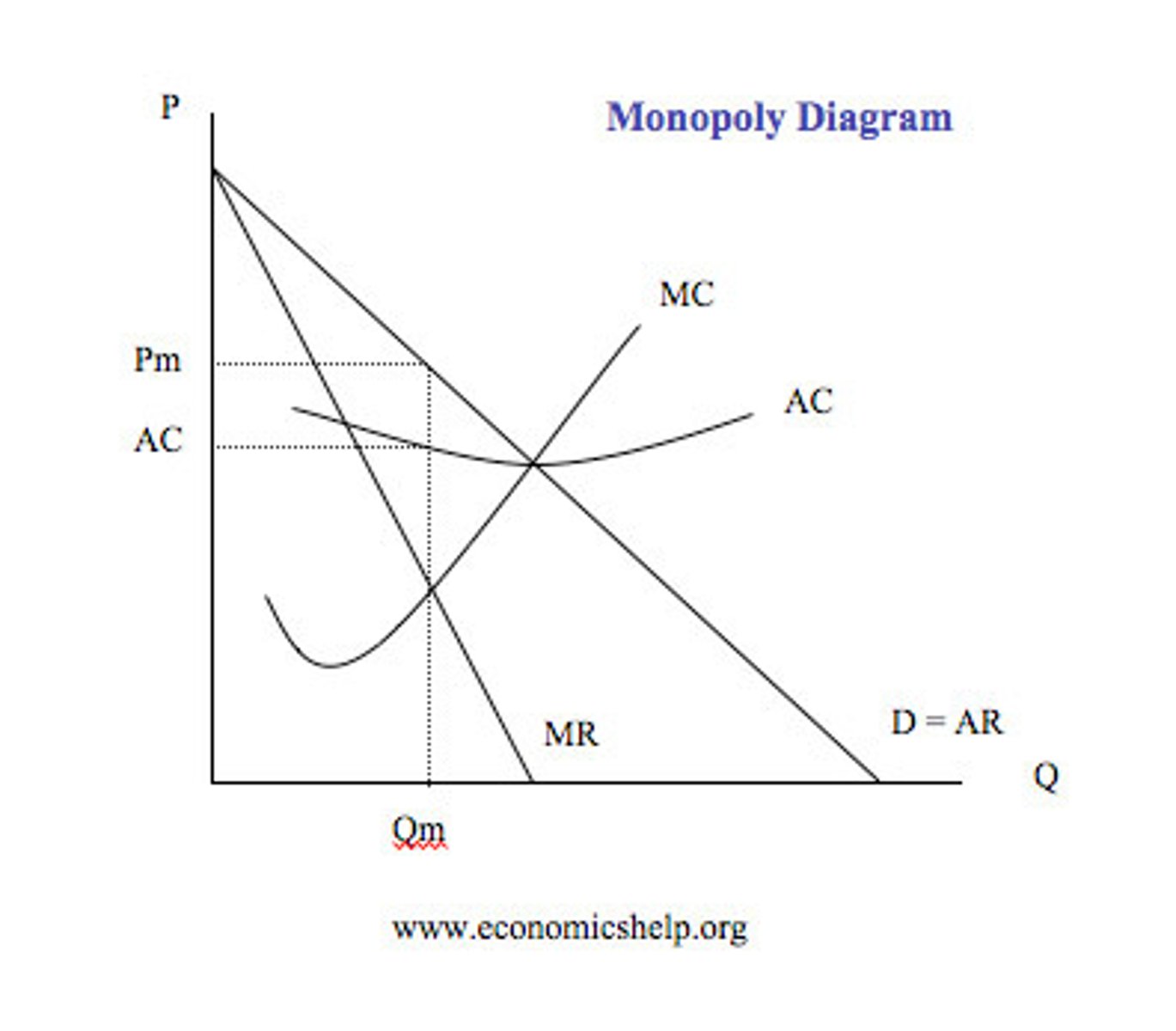

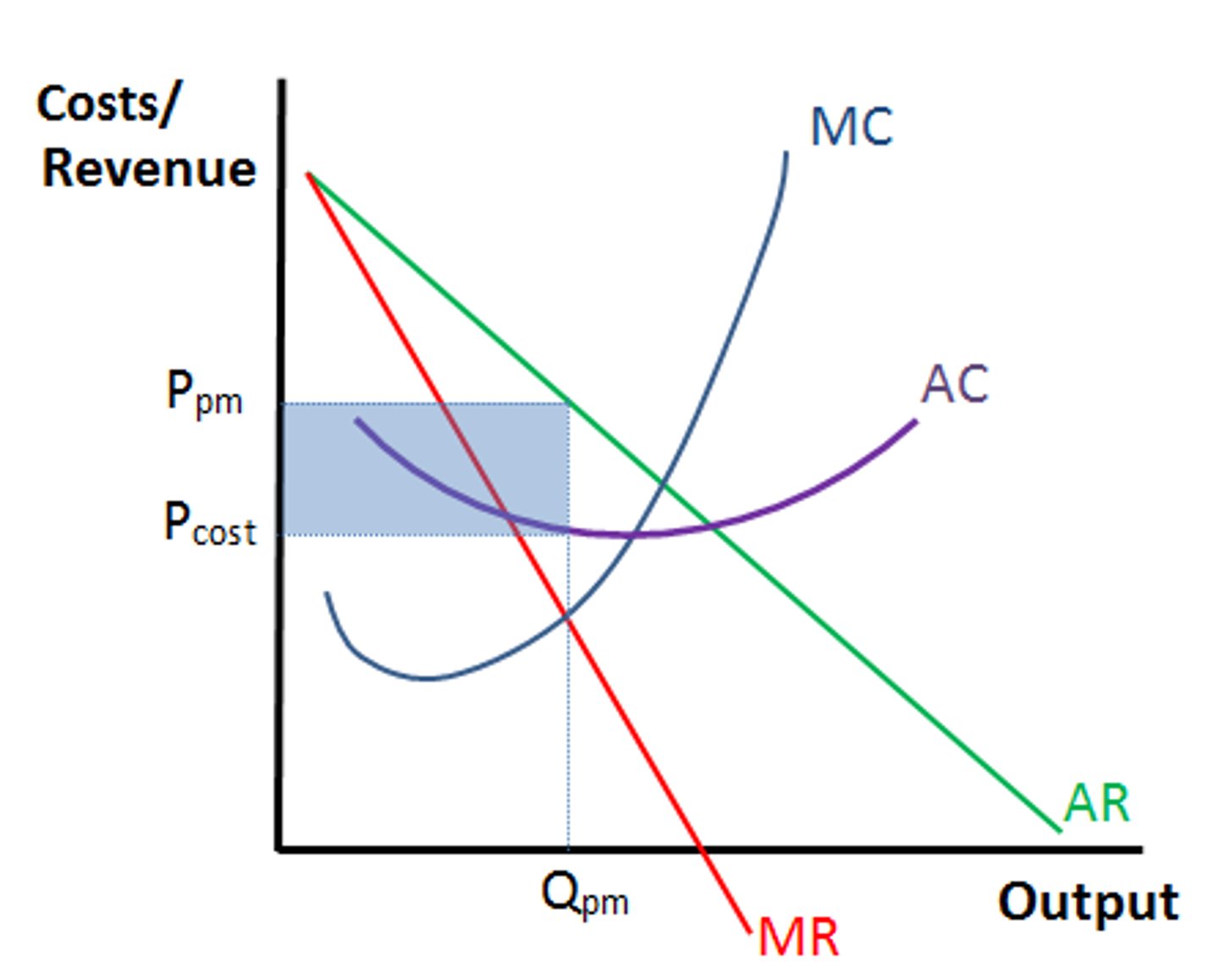

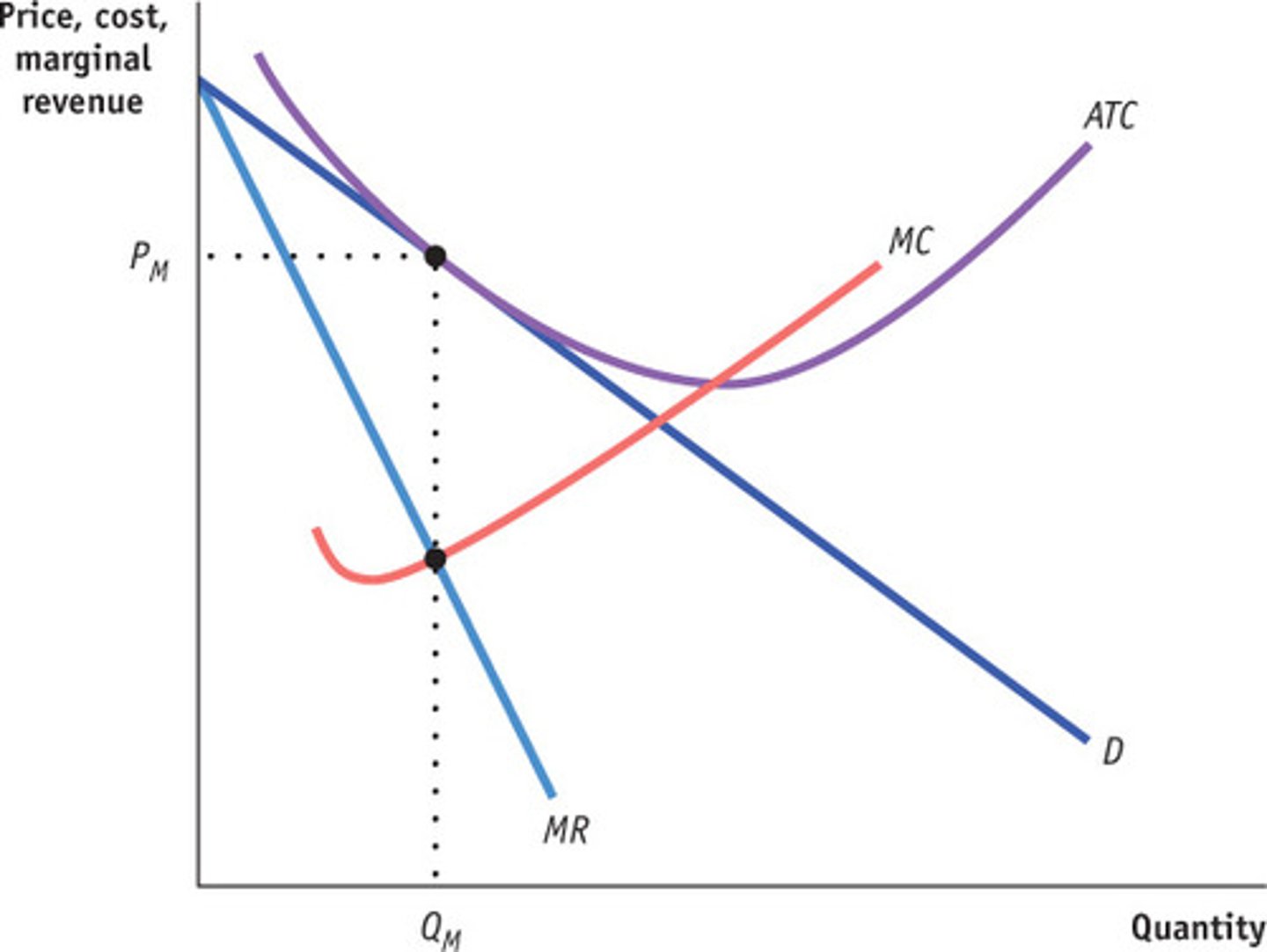

Monopolies making abnormal profits

AC below profit-maximizing quantity (MC=MR)

- MC crosses the lowest point at AC

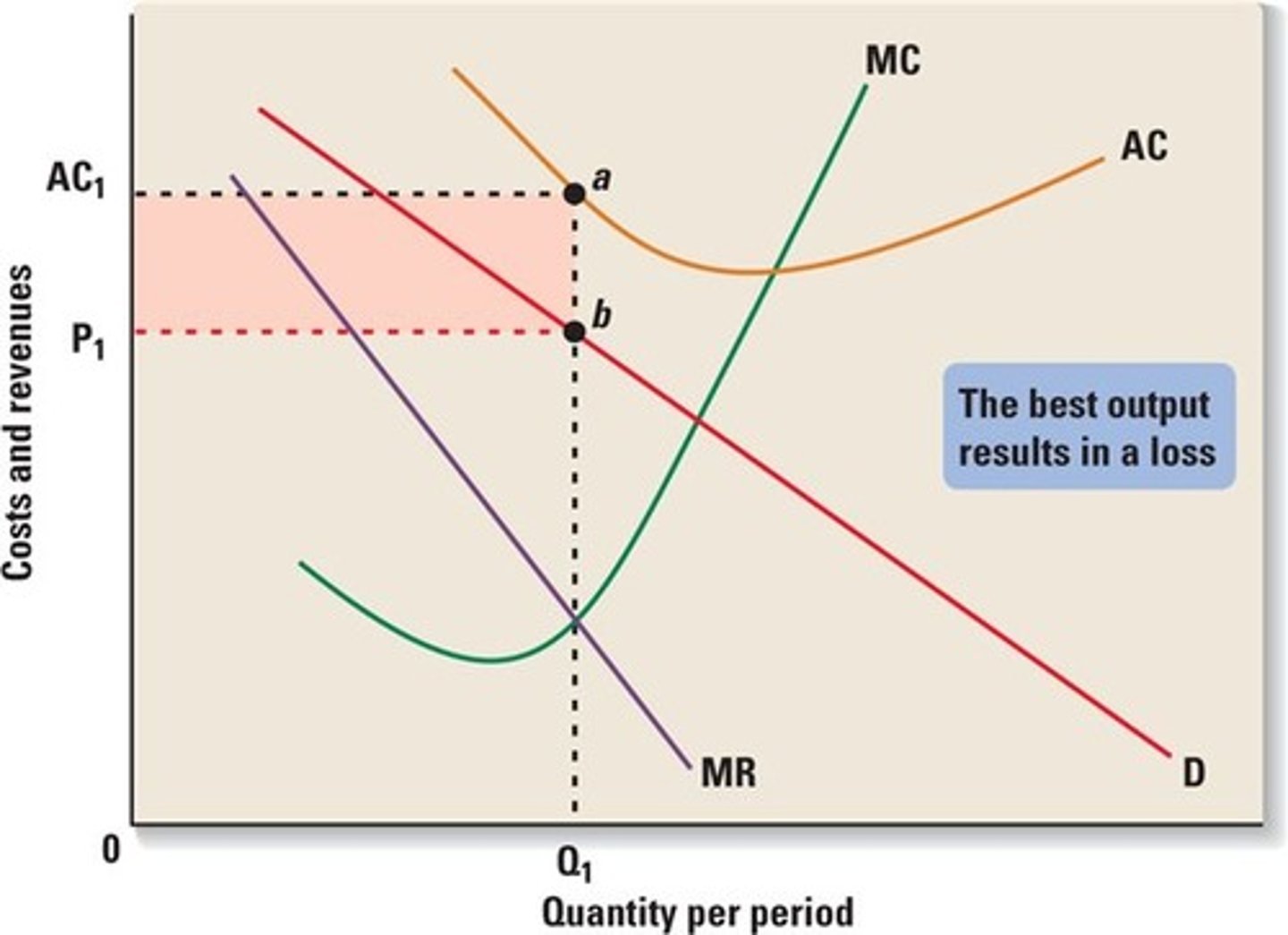

Monopolies making losses

AC above profit-maximizing quantity (MC=MR)

Monopolies making normal profits

Productive/allocative efficiency in monopolies

MC=D=AR=P

Advantages of monopolies

- Substantial economies of scale: More possible to change price (lower) than in perfect competition

- High levels of investment: Abnormal profits used for R&D, benefitting quality of products and consumers in long-run

Disadvantages of monopolies

- May restrict output

- Charge high price w/ less economies of scale (brings lower output)

- Unfair high profits for low-income firms

- Anti-competitive

- No productive/allocative efficiency

- Can act against public interest

Oligopolies

- Few firms dominate the industry

- Concentration ratio (CRx) --> higher percentage = more concentrated market power of the firms

- Barriers to entry

- Product differentiation

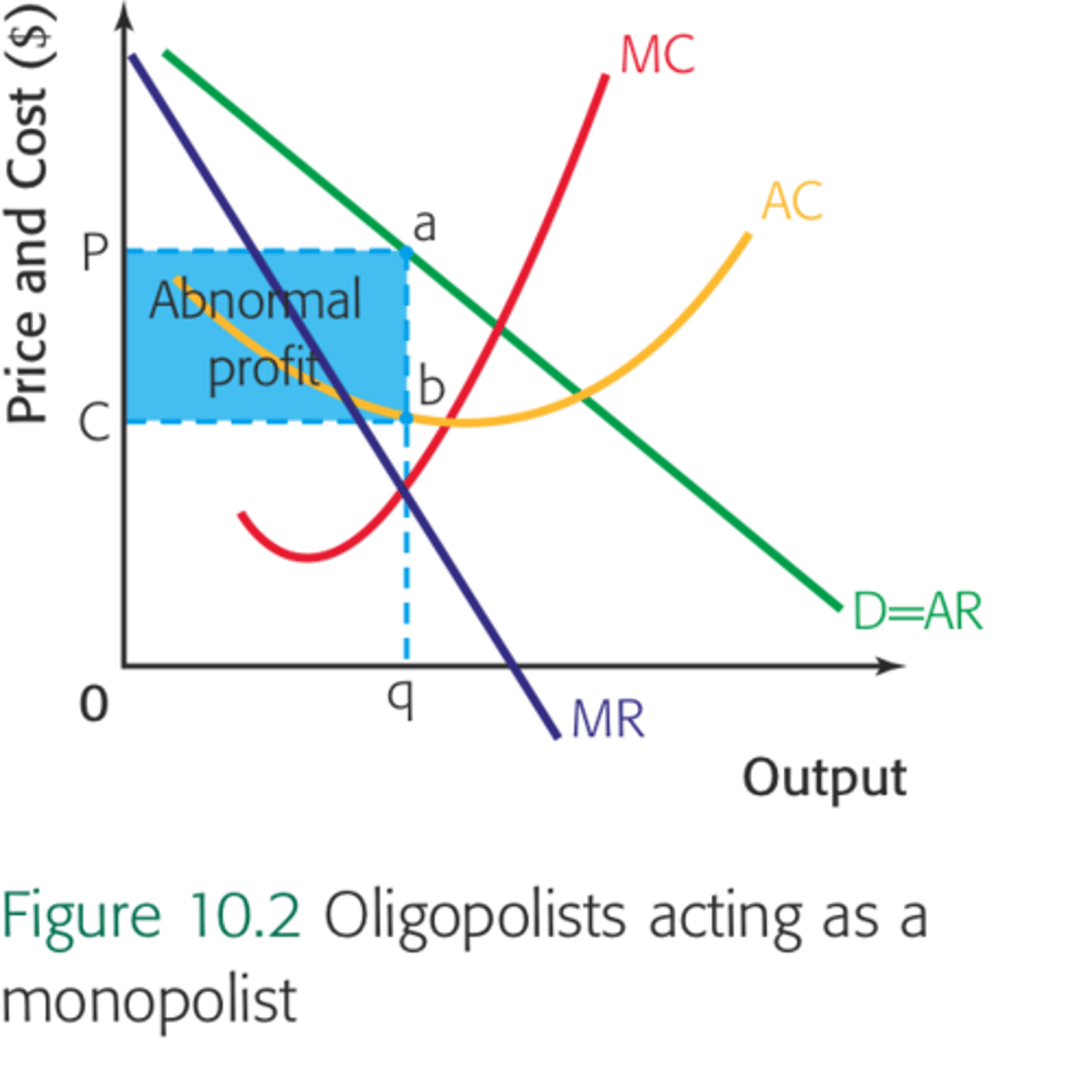

Collusive oligopolies

When firms in market collude to charge the same prices for their products in effect of monopolies (dividing profits), offering price ridgity--> ex. cartel

Non-collusive oligopolies

When firms don't collude so they are aware of firms' actions and reactions when deciding on pricing (game theory applied)

Competition in oligopolies

- Non-price competition (brand names, packagings, special features, adverts, etc.)

- Used to make demand less-elastic

Reasons why governments intervene

- Output/price/distorted resource allocation

- Less consumer choice

- Productive inefficiency

- Allocative inefficiency

- Abnormal profits exploiting firms/consumers

How governments intervene

- Regulation (taxes, incentives, etc.)

- Legislation (laws/rules to follow)

Economic costs

Explicit costs + implicit costs

Explicit costs

Costs that are direct, out-of-pocket monetary payments made for business expenses (salary, rent, etc.)

Implicit costs

Indirect, non-purchased, or opportunity costs of resources provided by the entrepreneur (Potential investment, time, etc.)

Fixed costs

Costs that remain constant as output changes

Variable costs

Costs that vary with the quantity of output produced

Total costs

Fixed costs + variable costs

Marginal costs

Cost of producing one more unit of a good

Average costs

Total costs / output

Law of diminishing marginal returns

As more of a variable resource is added to a given amount of a fixed resource, marginal product eventually declines and could become negative

TR (Total Revenue)

TR = P x Q (price times quantity)

AR ( Average revenue)

AR = TR / q --> AR = (pxq) /q (total revenue over quantity(

MR (Marginal Revenue)

∆TR / ∆Q (change in total revenue over change in quantity)

TC (Total Cost)

Total fixed costs + Total variable costs

or

Average Cost * Quantity

AFC (Average Fixed Cost)

TFC/Q (total fixed cost/quantity)

AVC (Average Variable Cost)

TVC / Q (total variable cost/quantity)

ATC or AC (Average Total Cost)

TC / q (total cost over quantity)

MC (Marginal Cost)

change in TC / change in q (change in total cost over change in quantity)

TFC (Total Fixed Costs)

Total Costs - Total Variable Costs

TVC (Total Variable Costs)

Total Costs - Total Fixed Costs

Profit

TR - TC (total revenue - total costs)