Quantity Theory, Inflation, and Money Demand

1/64

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

65 Terms

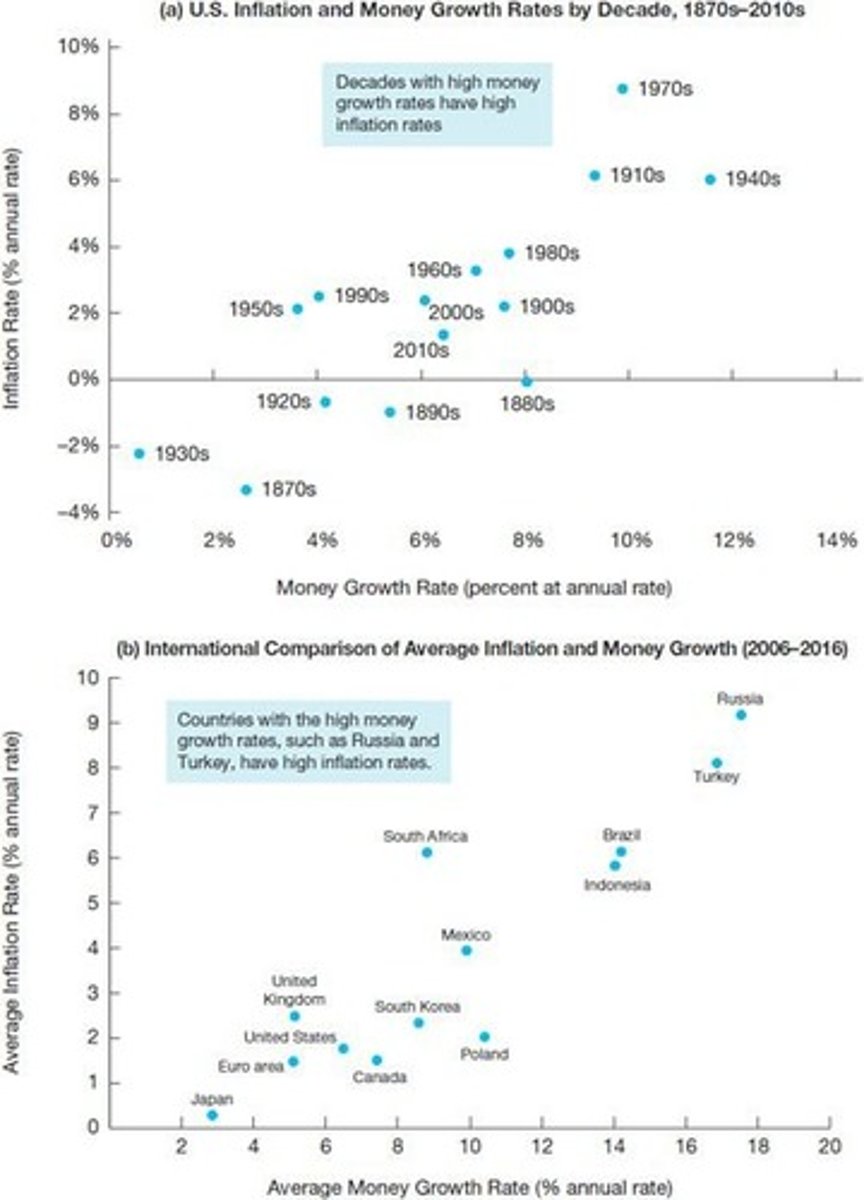

Quantity Theory of Money

Relationship between money supply and price level.

Velocity of Money

Frequency a dollar is spent annually.

Equation of Exchange

M × V = P × Y, money dynamics.

Money Supply (M)

Total amount of money in circulation.

Price Level (P)

Average level of prices in an economy.

Aggregate Output (Y)

Total production in an economy, or GDP.

Nominal GDP (PY)

Total income measured at current prices.

Liquidity Preference Theory

Demand for money based on transaction needs.

Portfolio Choice Theory

Factors influencing how wealth is allocated.

Fisher's Quantity Theory

Nominal income determined by money supply changes.

Short Run Velocity

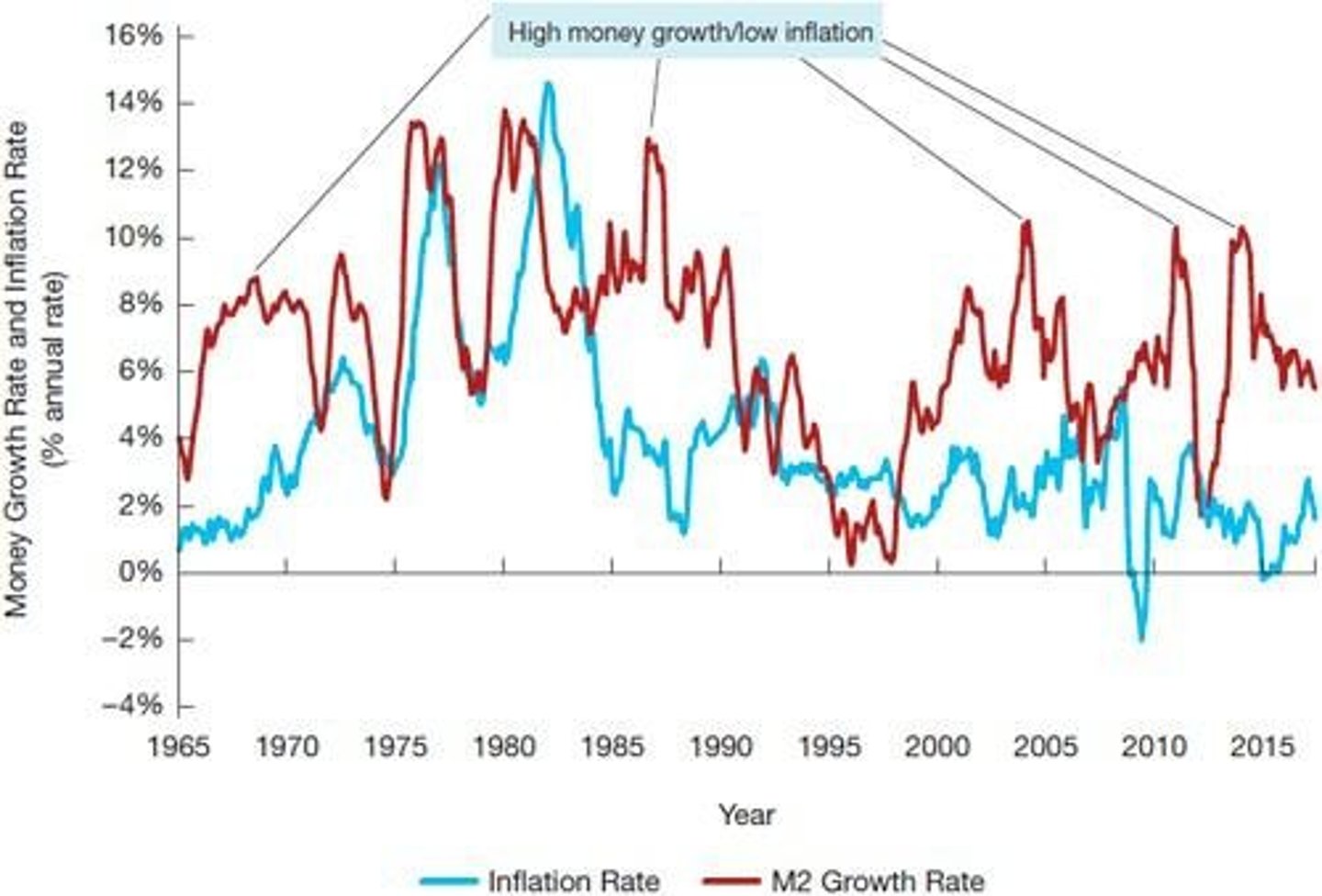

Velocity remains stable in the short term.

Long Run Inflation

Inflation linked to money supply growth.

Equilibrium in Money Market

M equals demand for money (Md).

Demand for Money (Md)

Determined by transactions at fixed income level.

Interest Rates and Money Demand

Demand for money unaffected by interest rates.

Classical Economists' View

Wages and prices are flexible in economy.

Full-Employment Level

Output level when all resources are utilized.

Inflationary Monetary Policy

Budget deficits can lead to increased money supply.

Liquidity Preference

Desire to hold cash over other assets.

Portfolio Factors

Risk, return, and liquidity influence money demand.

Empirical Evidence

Data supporting liquidity and portfolio theories.

Percentage Change

Sum of percentage changes in variables.

Equation of Exchange

Relationship between money supply, velocity, price, and output.

Inflation Rate

Growth rate of the price level.

Constant Velocity

Assumption that money velocity does not change.

Quantity Theory of Money

Theory linking money supply growth to inflation.

Money Growth Rate

Rate at which money supply increases.

Budget Deficit

Government spending exceeding its revenue.

Government Bonds

Debt securities issued to finance spending.

Monetary Base

Total amount of money in circulation.

Hyperinflation

Inflation exceeding 50% per month.

Liquidity Preference Theory

Theory explaining why individuals hold money.

Transactions Motive

Need for money for everyday transactions.

Precautionary Motive

Holding money for unexpected expenses.

Speculative Motive

Holding money as a store of wealth.

Real Money

Value of money adjusted for inflation.

Nominal Money

Face value of money without inflation adjustment.

Payment Technology

Methods that affect money demand.

Income Effect

Change in money demand based on income.

Public Bond Holdings

Public ownership of government-issued bonds.

Zimbabwe Hyperinflation

Extreme inflation case in early 2000s.

FRED Database

Source for economic data from Federal Reserve.

Keynesian Economics

Economic theory focusing on total spending.

Real Money Balances

Demand for money adjusted for price level.

Interest Rate (i)

Cost of borrowing money, inversely affects demand.

Real Income (Y)

Income adjusted for inflation, positively affects demand.

Velocity of Money

Rate at which money circulates in the economy.

Procyclical Movement

Economic indicators moving in the same direction.

Portfolio Theory

Investment strategy balancing risk and return.

Liquidity Preference

Desire to hold cash versus other assets.

Opportunity Cost

Potential return lost when choosing one option over another.

Precautionary Demand

Holding money for unexpected expenses or emergencies.

Nominal Interest Rate

Stated interest rate without inflation adjustment.

Wealth Effect

Increased wealth leads to higher money demand.

Riskiness of Assets

Perceived danger of investment affecting money demand.

Inflation Risk

Potential decrease in money's purchasing power over time.

Liquidity of Assets

Ease of converting assets into cash.

Demand Response to Interest Rates

Higher rates decrease money demand due to opportunity cost.

Demand Response to Income

Higher income increases demand for money.

Payment Technology

Advancements reducing need for physical cash.

Federal Reserve Policy

Central bank's approach to managing money supply.

Stability of Money Demand

Consistency in money demand affects economic predictions.

Aggregate Spending

Total expenditure in an economy over a period.

Quantity Theory of Money

Money supply directly influences price levels.

Unpredictable Velocity

Fluctuations in money circulation complicate economic forecasting.