Principles of Economics

1/165

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

166 Terms

Economics

the study of choice in a world of scarcity

On one hand people have practically unlimited needs and wants, while on the other hand resources are too scarce to meet all of those needs and wants

Economics investigates constrained decision making

Balancing the tradeoffs of economics:

At its core, this is the question economics attempts to answer

Basically, the answer is that individual choices attempt to achieve a perceived optimal outcome

Self-interest

people make decisions based on their preferences

Economics determines that people are self-interested, not that people are selfish

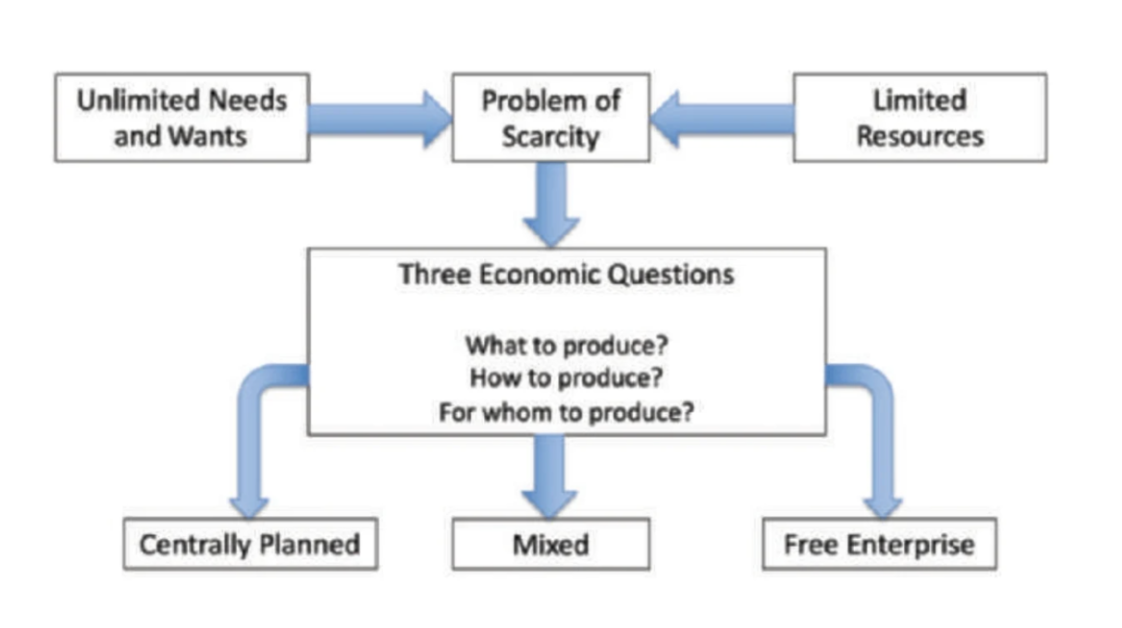

Three big questions society often focuses on are:

What to produce?

How to produce?

For whom do we produce?

Central planning

at its extreme attempts to completely replace market systems

In essence, central plan-ning attempts to mimic the role of markets and improve upon their out-comes

Evidence shows that moving too far toward central planning results in poor performance when it comes to a wide variety of measures of standards of living

Completely free markets

unfettered markets with no governance can lead to great instability and poor outcomes for citizens as well

Markets come into being naturally as people find ways to interact to satisfy their needs and wants

Policies to protect property rights and ensure fair, competitive markets are fundamental building blocks of a thriving society

Figure 1

Figure 1 that looks at how unlimited wants and needs combined with limited resources leads to scarcity and how the three questions of economics lead to the development of systems to combat scarcity.

Market failure

a situation in which a market left on its own fails to allocate resources efficiently

Often, there are negative externalities that result from economic activity

Externality

occurs when there is an uncompensated impact of one person’s actions on the well-being of a bystander

A negative externality is a situation when that impact affects the well-being of a bystander negatively

Competition:

For markets to allocate resources efficiently, there must be an adequate level of competition

Economists like competition because it lowers prices, increases quantities produced, and leads to more efficient markets

In a way, competition is redistributive in that it allows more consumers and producers to participate in and benefit from markets

Monopoly

a market with a sole seller of a product with no close substitutes

Policy makers and economists are wary of monopolies because they result in prices that are higher and quantities that are lower than is often considered optimal or efficient

This leaves a potential role for government to encourage competition through antitrust laws and regulation

Microeconomics

a study of individual choices by households and firms

As the name portends, microeconomics focuses on smaller levels of decision making

Households

the consumers in goods markets and workers in labor markets

Households represent people broken up into units making common decisions

Utility

represents the satisfaction level of the household

Firms

the producers of our goods and services, from Big Pharma to the roadside fruit market

Firms include sole-proprietorships, partnerships, limited liability companies, corporations, and any other way to organize a business

The goal of a firm is to maximize profits

Physical capital

includes the tools, factories, equipment, and machines that firms use to produce

Physical capital and labor complement each other, and each increases the other’s efficiency

Marginal analysis

to achieve a perceived optimal outcome, firms and households must per-form an incremental and constantly evolving cost–benefit analysis called marginal analysis

At every step of the marginal analysis, the individual compares the marginal benefit to the marginal cost

You can think of the marginal costs and benefits as the “next” costs and benefits; “If I take this ‘next’ step, this is my ‘next’ cost and this is my ‘next’ benefit”

You do not go forward with an activity if the cost is greater than the benefit

Rational people

systematically and purposefully do the best they can to achieve their objectives

Example:

John Jacob Jingleheimer Schmidt has already invested $100 million on a business venture he thought would make him $150 million in revenue. John has a really bad day and finds out that he needs to invest more money to finish the project and the actual revenue he is going to earn is only going to be $110 million. Which of the following is true?

He should scrap the project no matter what and cut his losses

He should invest only up to $10 million more

He should invest only up to $150 million more

He should invest only up to $110 million more

He should invest more money no matter what it costs

The answer here when only considering the marginal benefit and marginal cost would be “d.”

When conducting a marginal analysis, sunk costs cannot be taken into consideration. We call the point where the marginal cost is equal to the marginal benefit the indifference point. In a marginal analysis, we always include the indifference point for mathematical consistency.

Opportunity costs

the things that are given up

There are two types of opportunity costs: explicit opportunity costs and implicit opportunity costs

Explicit opportunity costs

involve the transaction of money

Anything that requires you to exchange money to obtain a good or service is considered an explicit opportunity cost

Implicit opportunity costs

anything else you need to give up obtaining something outside of explicit costs

They can be monetary costs or costs of lost utility

Diminishing marginal utility of consumption

the more we have of a certain good, the less satisfaction we receive from another unit of that good

Marginal utility

the utility from the next unit consumed

Marginal cost

the cost of the next unit consumed

Diminishing marginal productivity (DMP)

the property whereby the marginal production of an input declines as the quantity of the input increases, holding all other inputs constant

Changes in production are still positive as the input increases, but the size of the increases in production becomes smaller

Said another way, production increases at a decreasing rate

Here we are talking about the produc-tion process with increases in labor as I hold the physical capital constant

DMP of labor is due to the logistical and physical constraints of sharing the fixed capital

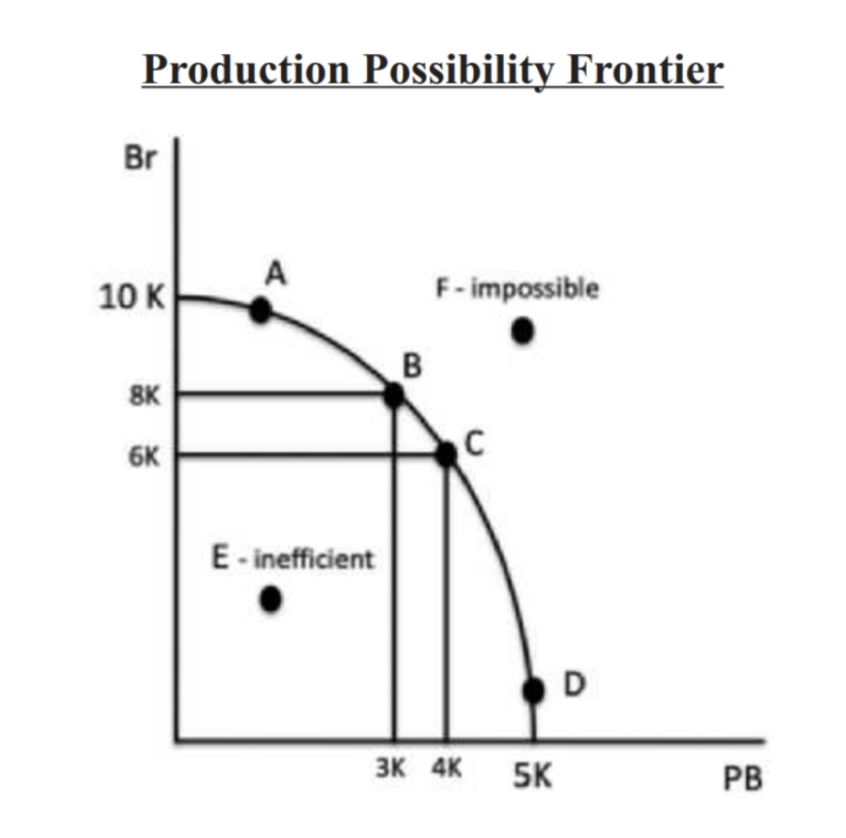

Production possibility frontier (PPF) model

shows the combinations of output an economy can produce given the available factors of production and the available technology

The PPF illustrates a nation’s tradeoffs in production and the costs involved in those tradeoffs

Figure 2 shows PPF. With the PPF, note that if we draw a line tangent to the PPF at any point, that line is downward sloping. The slope dictates that there must be a tradeoff between the two goods when it comes to production. We face tradeoffs and have opportunity costs associated with those tradeoffs. Anywhere along the curve at point A, B, C, or D (or anywhere else) is possible. That is the frontier of our production capabilities. The eventual point chosen depends on a country’s preferences.

Bowed shape on a PPF graph

represents the assumption of specialized factors of production

Specialized factors of production

inputs to production that are more suitable to producing one specific good versus another

Specialized factors of produc-tion result in opportunity costs changing as we move to one extreme or the other

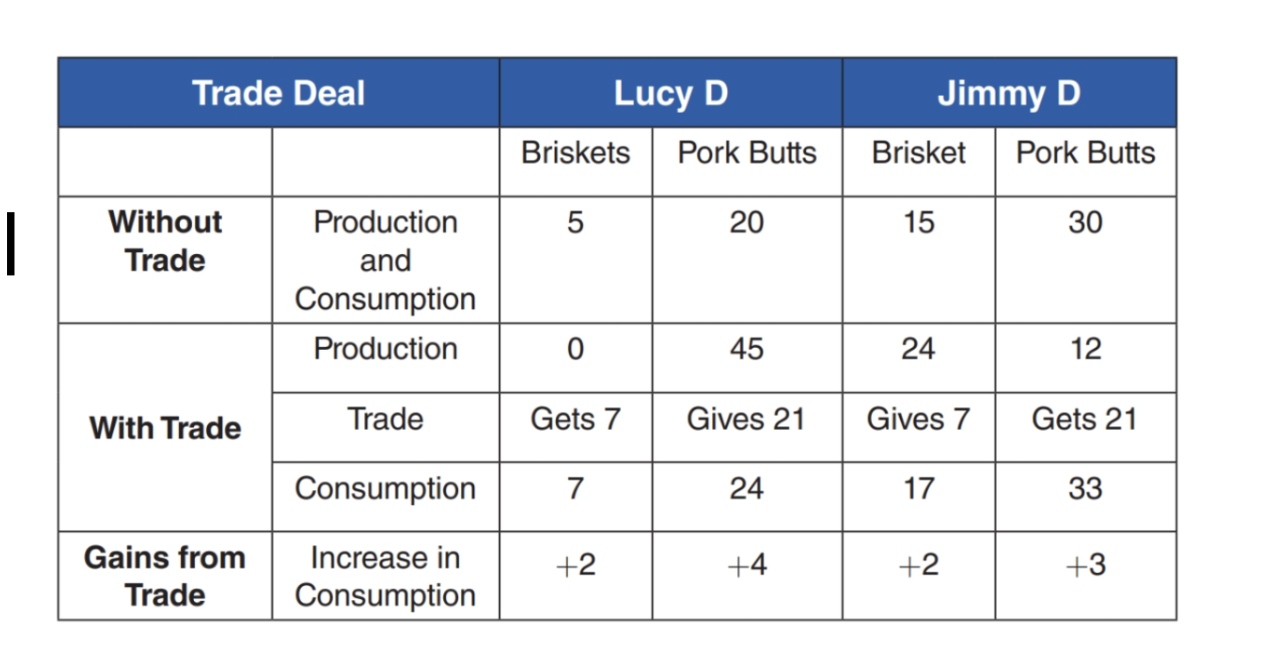

Absolute advantage

one type of efficiency, which is the ability to produce a good using fewer inputs

Trade is not dependent on absolute advantage

Comparative advantage

the ability to produce a good at a lower opportunity cost than another producer

If two countries have different comparative advantages, trade can be beneficial to both if the price of trade is between the two countries’ opportunity costs

Figure 3 shows the difference between not trading and trading and how countries that have different comparative advantages can both benefit from trading with one another

Macroeconomics

the study of economy-wide phe-nomena, including inflation, unemployment, and economic growth

Macroeconomics takes all the individual decisions by households and firms, and aggregates them to estimate the economic performance of a nation

Macroeconomics attempts to add up all the little pictures into the big picture

Gross domestic product (GDP)

measures three things simultaneously: production, income, and expenditures

Inflation

which is an increase in the overall level of prices in the economy

Low and stable rates of inflation are considered healthy for an economy because they show increased demand, and they give confidence to firms to increase production and hire new workers

When inflation is too high, the costs outweigh the benefits

The main cost associated with infla-tion is the diminishment of the purchasing power of money

Hyperinflation

a term to describe rapid, excessive, and out-of-control general price increases in an economy

Unemployment rates

attempt to capture the percentage of people who want to work but cannot find work

Participation rates

attempt to capture the percentage of people who want to work out of those eligible to work

The two rates should always be looked at together to understand the big picture

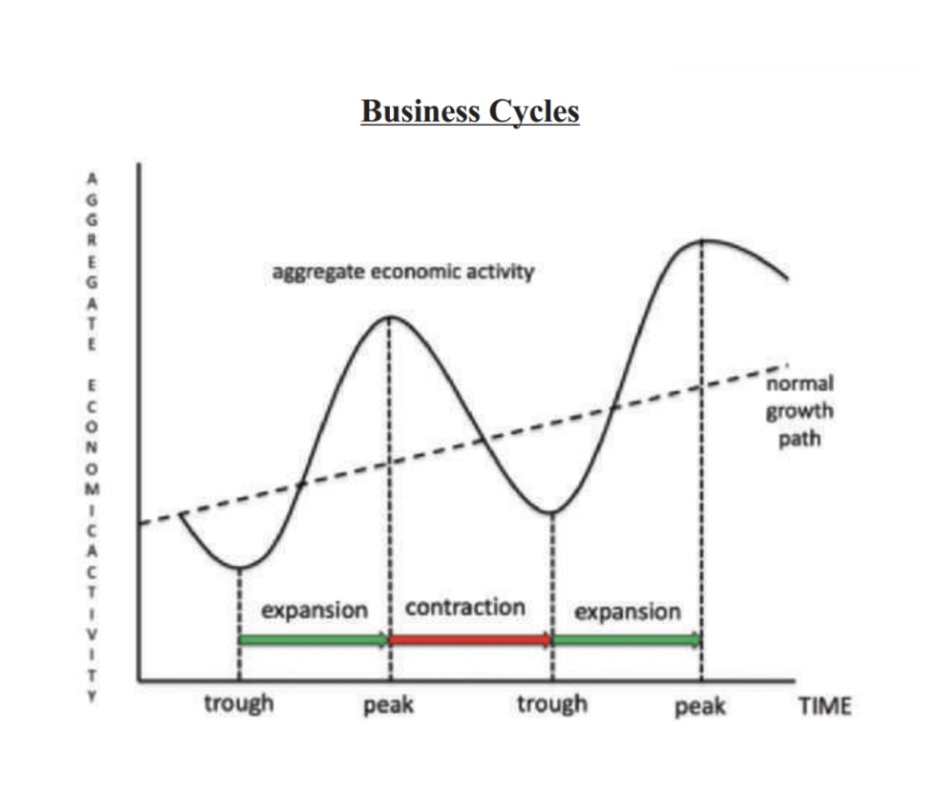

Business cycles

types of fluctuations in aggregate economic activity of nations that organize their work mainly in business enterprises

The cycle consists of expansions occurring about the same time in many economic activities, followed by similar general contractions and revivals, which merge into the expansion phase of the next cycle

This sequence is recurrent but not periodic, varying in dura-tion from about 1 to 12 years

Trough

the bottom of the business cycle

Peak

the top of the business cycle

Expansion

from the trough to the peak is an expansion of aggregate economic activity

Contraction

from the peak to the trough is a contraction of aggregate economic activity

Economic growth

a long-run phenomenon referring to an increase in aggregate production and the mar-ket value of goods and services in an economy over time

The long run is derived from all the short-run business cycles over time

Sticky wage theory

a short-run theory asserting that wages are “stickier” than prices, or that wages adjust slowly to changes in price levels

Results in the Phillips curve

Phillips curve

asserts there is a tradeoff in the short run between inflation and unemployment

This idea is central to the policies employed by many central banks in their attempts to achieve full employment in the economy

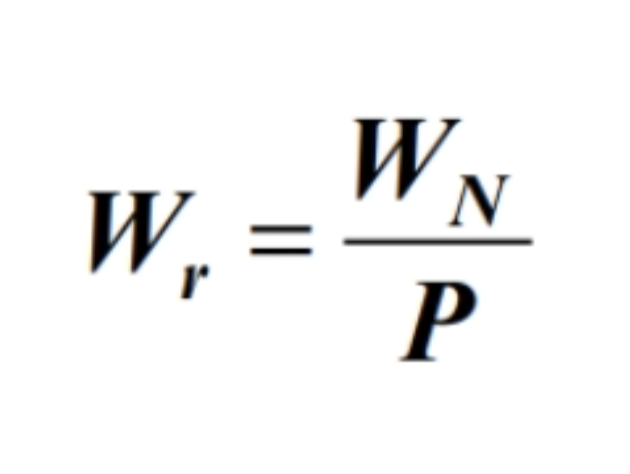

Nominal wage

the average wage workers earn in dollars

The price level is the average cost of goods and services and would be represented by some sort of price index like the CPI

On the firm side, the nominal wage is the average cost of labor in dollars

Real wage

the average amount of stuff (goods and services) workers can buy with the wages they earn

The real wage is the real cost of labor in terms of lost production

Real wages are of course more important than nominal wages to a standard of living

Productivity

the quantity of goods and services produced from each unit of labor

Empirical evidence shows there are some important factors that lay the condi-tions for economic growth by increasing a country’s productivity:

Physical capital, or the tools, equipment, machines, and factories used in production

Human capital, or the health, knowledge, and skill of our workforce

Natural resources, including air, land, sea, and energy and mineral sources

Entrepreneurship, or people’s willingness to take financial risks for the financial rewards that come along with innovation

Social and legal framework, which considers whether a country has a system of rules and laws that encourages productivity

*Technology, which is starred because innovation is the most impor-tant factor for long-run, sustained economic growth

Technology affects all our other factors

Ways to control economy:

Price ceilings

Price floors

Rent regulations

Minimum wages

Market economy

an economy that allocates resources through the decentralized decisions of many firms and households as they interact in markets for goods and services…The Invisible Hand

This is as opposed to central economic planning like that which occurred in the Soviet Union–does not work out so well

Roles of government:

in order to facilitate The Invisible Hand, the government must enforce rules and maintain institutions that are key to the market economy

Property rights - the ability of an individual to own and exercise control over scarce resources

Property rights are limited

Critics of property rights argue that it leads to inequality (accumulation of wealth from property rights)

In order to facilitate efficiency, the government can help improve markets

Market failure - a situation in which a market left on its own fails to allocate resources efficiently

Externality - which is the uncompensated impact of one person’s actions on the well-being of a bystander

Tragedy of the Commons

Market power - which refers to the ability of a single person or small group to unduly influence market prices

Monopolies

Government can also intervene in the market to facilitate equality

An economic question but also a question of fairness or social justice

Your thoughts on addressing equality are often based on your politics

Property rights

the ability of an individual to own and exercise control over scarce resources

Property rights are limited

Critics of property rights argue that it leads to inequality (accumulation of wealth from property rights)

Market failure

a situation in which a market left on its own fails to allocate resources efficiently

Externality

which is the uncompensated impact of one person’s actions on the well-being of a bystander

Tragedy of the Commons

Market power

which refers to the ability of a single person or small group to unduly influence market prices

Monopolies

Microeconomics

the study of how households and firms make decisions and how they interact in markets

Smaller decision making units

Households: consumers

Households are trying to maximize utility (satisfaction)

Firms: businesses

Firms are trying to maximize profits

Two big inputs to production → labor (workers) and capital (tools/ machinery)

Labor is variable and capital is fixed initially, but then labor and capital both end up variable in the long-run

Rational people

people who systematically and purposefully do the best they can to achieve their objectives

Marginal analysis

incremental and constantly evolving cost benefit analysis

When making decisions, people compare the marginal costs to the marginal benefits

Forward looking

Example:

John Jacob Jingleheimer Schmidt has already invested $100 million on a business venture he thought would make him $150 million in revenue. John has a really bad day and finds out that he needs to invest more money to finish the project and the actual revenue he is going to earn is only going to be $110 million. Which of the following is true?

He should scrap the project no matter what and cut his losses

He should invest only up to $10 million more

He should invest only up to $150 million more

He should invest only up to $110 million more

He should invest more money no matter what it costs

Goal is to minimize losses ($100,000 is sunk, so now the focus is on the marginal cost equalling the marginal benefit to minimize losses)

Opportunity costs

whatever must be given up to obtain something (phone explicit and implicit)

Explicit: putting money down

Implicit: not putting money down

Example:

What are the opportunity costs of going to school?

Explicit:

Tuition

Room & board

Textbooks

Implicit:

Lost leisure time

Lost salary

Marginal analysis: a consumer’s choice

A person’s willingness to pay for a good is based on the marginal benefit that an extra unit of the good would yield. That marginal benefit depends on how many units the person already has. Diminishing marginal utility of consumption, states the more we have of a certain good, the less satisfaction we receive from another unit of that good

Marginal analysis: a producer’s choice

Labor

Physical capital

Factories

Tools

Machinery

Diminishing marginal productivity (DMP)

states that production increases at a decreasing rate as we add more of an input while holding other inputs constant

Tradeoffs in national production:

Assumption: one country that produces two different goods, specialized factors of production (some are better at producing one good than the other)

The production possibility frontier

shows the combination of output that the economy can possibly produce given the available factors of production and the available production technology

Downward slowing: we face trade offs and have opportunity costs associated with those trade offs

Trade offs

can’t produce more of one good without giving up more of the other

Opportunity costs

how many of one good we have to give up to get another unit of a different good

From B to C, the opportunity cost of producing 100 more IPAs is 200 wings

Bowed shape

the opportunity costs increase as we move to one extreme or the other

At point D, the resources best suited to wing production are being used for IPA production, which is inefficient (big losses for small gains)

International trade:

Trade allows countries to specialize and enjoy a great variety of goods and services

You can make what you have an advantage in making and buy the rest from someone else

Comparative advantage drives trade

Ex: in the U.S., our comparative advantage is technology, but we do not have an advantage in manual labor production

Loss of industry can lead to negative social effects: drug use, suicide, depression, etc.

Therefore, a push towards industries where we have a comparative advantage is necessary

Trade allows us to break the possibility frontier curve

Absolute advantage

the ability to produce a good using fewer inputs than another producer

Comparative advantage

the ability to produce a good at a lower opportunity cost than another producer

The price of trade

for both parties to gain from trade, the price at which they trade must lie between the two opportunity costs

Market

exists every time there are buyers and sellers for a particular good or service

Good

products that are tangible like apples or shoes

Services

intangibles or products that cannot be stored and are consumed at the place and time of their purchase

Ex: going to a concert to listen to music

Perfectly competitive market

a market with many buyers and sellers, identical products, free entry and exit into the market, and homogenous firms facing the same costs of production

In a perfectly competitive market, buyers and sellers have no power to set prices

They are price takers

Markets are made up of individuals:

There-fore, buyers and sellers really should have at least a tiny bit of power over the price

However, we are saying they have such little power that it is negligible

Market forces dictate prices to buyers and sellers

Quantity demand

the amount of a good buyers are willing and able to purchase

Individual demand

the relationship between the price of a good and an individual buyer’s quantity demanded

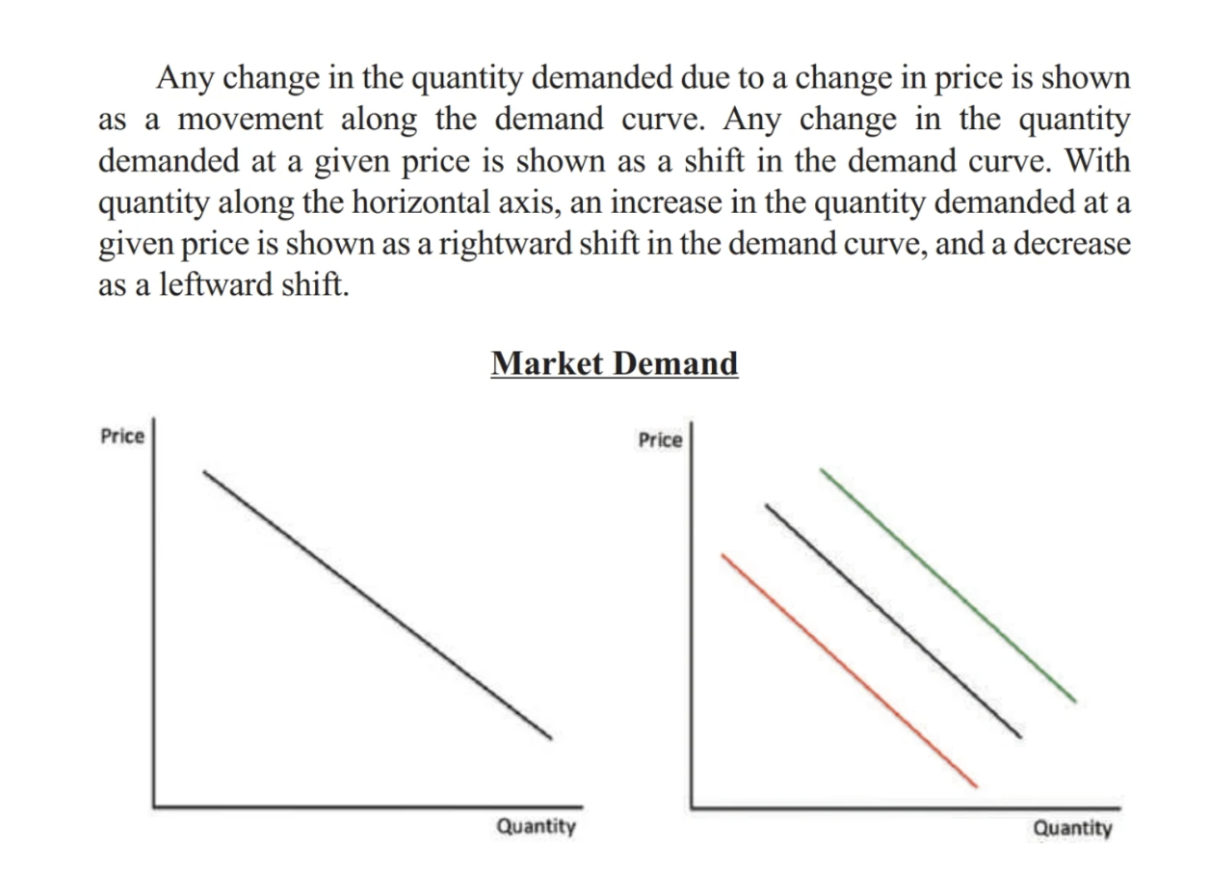

Market demand

the relationship between the price of a good and the quantity demanded by all the buyers in the market

Market demand adds up all the individual buyer’s demand

The demand curve is downward sloping

Law of demand

all other things being held equal, the quantity demanded of a good will increase when the price of the good decreases

Increases in a market can happen intensively or extensively:

By intensively, I mean that as prices go down, consumers already in the market are willing and able to purchase more of the good

By extensively, I mean that as prices go down, more consumers are enticed to enter the market

Different buyers value products differently and will not enter the market until the price comes down to the value they place on the product

Factors that affect a buyer’s demand beyond changes in prices include:

Income

Normal goods - goods that we purchase more of as our income increases

Inferior goods - goods that we purchase less of as our income increases

Price of related goods

Complements - goods that go together and for which an increase in the price of one leads to a decrease in the demand for the other

Substitutes - goods that can replace each other and for which an increase in the price of one leads to an increase in the demand for the other

Preferences

Expectations

The number of buyers

Normal goods

goods that we purchase more of as our income increases

Inferior goods

goods that we purchase less of as our income increases

Complements

goods that go together and for which an increase in the price of one leads to a decrease in the demand for the other

Substitutes

goods that can replace each other and for which an increase in the price of one leads to an increase in the demand for the other

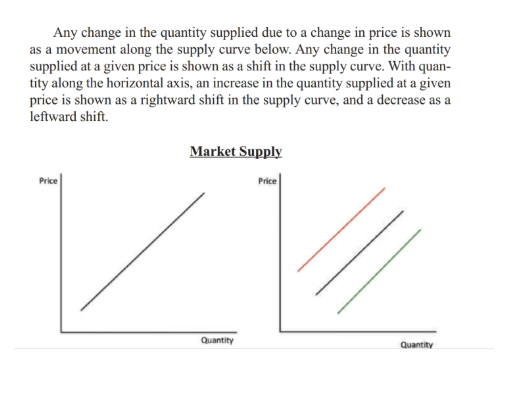

Quantity supplied

the amount of a good sellers are willing and able to sell

Individual supply

the relationship between the price of a good and an individual seller’s quantity supplied

Market supply

the relationship between the price of a good and the quantity supplied by all the sellers in the market

Market supply adds up all the individual seller’s supply

The supply curve is upward sloping

Law of supply

all other things being held equal, the quantity supplied of a good will increase when the price of the good increases

Increases in a market can happen intensively or extensively:

By intensively, I mean that as prices go up, sellers already in the market are willing and able to sell more of the good

As margins increase and selling becomes more profit-able, firms take advantage of that by increasing production

By extensively, I mean that as prices go up, more producers are enticed to enter the market

Different firms have different costs of production and will not enter the market until the price of a good is high enough to justify incur-ring the costs of production

Factors that affect a seller’s supply beyond changes in prices include:

Input prices

Technology

Expectations

Number of sellers

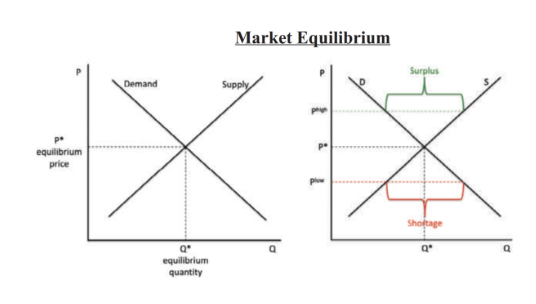

Market equilibrium

a situation where the price is such that the quantity supplied equals the quantity demanded

With perfect infor-mation, markets should be at equilibrium unless there is a policy in place that prevents it

Surplus

if markets sell at a price that is too high, supply is greater than demand

In that case, firms have excess inven-tory sitting on their shelves unsold

To sell that excess production, firms must lower their prices toward equilibrium

Shortage

if markets sell at a price that is too low, demand is greater than supply

Firms start to realize that buyers are willing to pay more for their goods, so they start raising their prices toward equilibrium

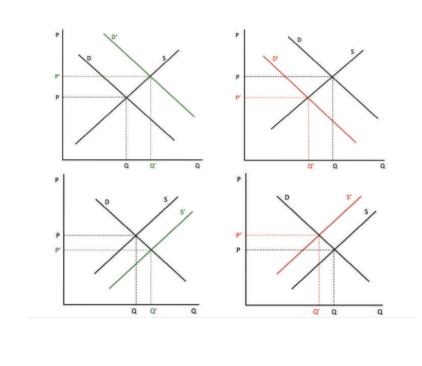

Shifts in Market Demand and Market Supply:

Starting in the upper left-hand corner below, a rightward shift in the demand curve drives up the equilibrium price, causing an increase along the supply curve to our new equilibrium quantity

In the top right corner, a leftward shift in the demand curve drives down the equilibrium price, causing a decrease along the supply curve to our new equilibrium quantity

In the bottom left corner, a rightward shift in the supply curve drives down the equilibrium price, causing an increase along the demand curve to our new equilibrium quantity

In the bottom right corner, a leftward shift in the supply curve drives up the equilibrium price, causing a decrease along the demand curve to our new equilibrium quantity

Shifts in Both Market Demand and Market Supply:

In the graphs below, we have two examples of a decrease in supply and an increase in demand occurring at the same time

In both instances, we know that equilibrium prices increase because a leftward shift in supply and a rightward shift in demand both put upward pressure on prices

However, the graph on the left has an increase in the equilibrium quantity while the one on the right has a decrease

These results are due to the magnitude of the shifts in supply versus demand

If the shift in demand is of a larger magnitude than the shift in supply, the equilibrium quantity increases

In the graph on the right, we see the opposite take place with a larger magnitude shift in supply

The size of the shift matters in this instance for the direction of the equilibrium quantity

Market

a market is a group of buyers and sellers of a particular good or service

The buyers as a group determine the demand for the product, and the sellers as a group determine the supply of the product

Three assumptions for markets:

Perfectly competitive

Many buyers, many sellers, identical products, free entry and exit into the market, and all of the firms will be homogeneous (same marginal cost of production)

Buyers and sellers are price takers

At the market price, buyers can buy all they want and sellers can sell all they want