CapMar Lec4

1/23

Earn XP

Description and Tags

IM Lesson 4 Credit Ratings affecting Bond Market

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

24 Terms

Credit Ratings

assessments of creditworthiness of issuers of debt (corporations, municipalities, governments) & debt instruments they issue

provides a measure of credit risk associated with various debt instruments

these ratings help investors make informed decisions & play a crucial role in determining borrowing costs for issuers

these ratings indicate the likelihood that the issuer will be able to meet its debt obligations (interest payments & principal repayment)

According to Corporate Finance Institute (CFI), a credit rating is?

an opinion of a particular credit agency regarding the ability & willingness an entity (government, business, individual) to fulfill its financial obligations in completeness & within the established due dates

Type of Credit Ratings

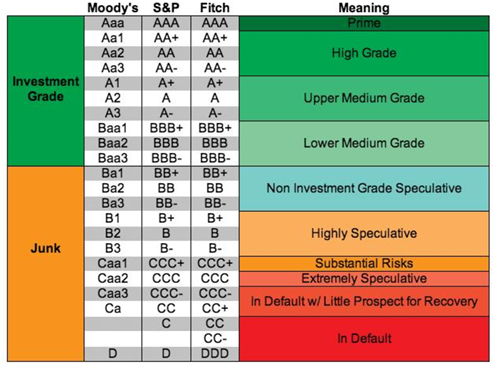

Investment Grade

Speculative-Grade or Junk

Investment Grade Ratings

low to moderate risk of default

ratings are typically categorized as

AAA: Highest credit quality

AA, A, BBB: Lower grades within investment-grade categories

Speculative-Grade or Junk Ratings

higher risk of default

ratings are typically categorized as

BB, B, CCC, CC, C, D: increasingly speculative & higher risk

Major Credit Rating Agencies

responsible for assigning credit ratings to issuers & their debt instruments

each uses its own methodologies & criteria to assess credit risk, but all consider similar factors including financial stability, economic environment, & issuer-specific conditions

Standard & Poor’s (S&P)

Moody’s Investors Services

Fitch Ratings

Standard & Poor’s (S&P)

one of the most prominent credit rating agencies, known for its broad range of ratings & indices

Moody’s Investors Service

provides credit ratings & research on debt instruments & issuers

Fitch Ratings

offers ratings & analysis across a wide array of financial instruments

Significance of Credit Ratings

Impact on Issuers

Impact on Investors

Impact on Issuers

Cost of Borrowing

higher credit ratings generally lead to lower borrowing costs for issuers

lower-rated issuers typically face higher interest rates to compensate for increased risk

Access to Capital

investment-grade ratings allow issuers to access a broader range of investors, including those restricted to investment-grade assets

Impact on Investors

Risk Assessment

ratings provide a standardized measure of credit risk, helping investors assess the risk associated with specific debt instruments

Portfolio Management

investors use credit ratings to diversify portfolios & align investments with their risk tolerance

How Credit Ratings are Determined

Financial Analysis

Economic & Industry Analysis

Qualitative Factors

Financial Analysis

Financial Statements - agencies analyze financial statements (balance sheets, income statements, cash flow statements)

Financial Ratios - key ratios are evaluated (debt-to-equity, interest coverage, liquidity ratios)

Economic & Industry Analysis

Economic Conditions - broader economic conditions & trends are considered

Industry Conditions - health & prospects of the industry in which the issuer operates are assessed

Qualitative Factors

Management Quality - track record & expertise of the issuer’s management team are considered

Operational Risks - operational challenges & business risks are evaluated

Limitations & Criticisms

credit ratings play crucial role by providing a standardized measure of credit risk

they offer valuable insights for investors & issuers, but need to understand their limitation & factors influencing ratings for informed decision-making

Potential Conflicts of Interest

Lagging Indicators

Impact of Rating Changes

Potential Conflicts of Interest

Issuer Pays Model: agencies are paid by issuers for ratings, which may lead to conflicts of interest & potential biases

Lagging Indicators

Historical Data: ratings may be based on historical data & may not be always reflect current conditions or future risks

Impact of Rating Changes

Market Reactions: changes in ratings can lead to significant market reactions, affecting bond prices & investor sentiments

Enron Scandal of 2001 & its Credit Ratings

Enron Corporation

american energy, commodities, & services company

based in Houston, Texas

infamous for one of the largest corporate frauds

founded in 1985 by Kenneth Lay

rapidly grew to become a major player in the energy sector & was renowned for its innovative trading strategies & aggressive business expansion

one of the largest companies in US with reported revenues of over $100 billion in 2000

Enron Scandal

their spectacular rise was fueled by fraudulent accounting practices designed to hide the company’s true financial condition

used complex financial structures, including special purpose entities (SPEs) to keep large amounts of debt off its balance sheet & inflate its earnings

executives (CEO Jeffrey Skilling & CFO Andrew Fastow) manipulated financial statements to present a misleadingly strong performance, which misled investors, regulators, & the public

scandal began to unravel in October 2001 when Enron announced a massive third-quarter loss & a significant reduction in shareholder equity due to hidden debts

disclosure led to a loss of investor confidence & rapid decline in the company’s stock price

filed for bankruptcy on December 2, 2001 which was the largest bankruptcy in US history at the time, resulting in the loss of thousands of jobs & billions of dollars investments

Credit Ratings of Enron After the Scandal Emerged

credit rating agencies responded by downgrading Enron’s multiple times in a short period

November 28, 2001: S&P, Moody’s, & Fitch downgraded Enron’s credit rating to junk status (non-investment grade)

S&P: downgraded Enron to BB+, below the investment-grade threshold, considered speculative & indicates a higher risk of default

Moody’s: downgraded Enron to Ba1, a non-investment grade, indicating substantial credit risk

Fitch: downgraded Enron to BB+

November 29, 2001: S&P downgraded Enron again to B-

December 2001: before Enron’s bankruptcy filing, ratings had fallen to D by S&P (default status)

rapid downgrade from investment-grade to junk status within days of the company’s bankruptcy filing was a key element of the Enron scandal, exposing the failure of credit rating agencies to detect the financial instability & fraud earlier

Impact of the Scandal & Failure of Credit Ratings Agencies

highlighted major flaws in the credit rating system

raised concerns about conflicts of interest, as rating agencies were paid by the companies they rated, potentially compromising their objectivity

delayed downgrade significantly contributed to the scale of the financial losses suffered by investors & creditors

scandal led to regulatory changes (Sarbanes-Oxley Act of 2002) which aimed to enhance corporate governance, financial disclosures, & accountability of credit rating agencies & auditors