Ch 12 - Statement of Cash Flows

1/22

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

23 Terms

12-LO1 Discuss the usefulness and format of the statement of cash flows.

The statement of cash flows provides information about the cash receipts, cash payments, and net change in cash resulting from the operating, investing, and financing activities of a company during the period. Operating activities include the cash effects of transactions that enter into the determination of net income. Investing activities involve cash flows resulting from changes in investments and long-term asset items. Financing activities involve cash flows resulting from changes in long-term liability and stockholders’ equity items.

12-LO2 Prepare a statement of cash flows using the indirect method.

(1) Determine net cash provided/used by operating activities by converting net income from an accrual basis to a cash basis. (2) Analyze changes in noncurrent asset, liability, and stockholders’ equity accounts and report as investing and financing activities, or disclose as noncash transactions. (3) Compare the net change in cash on the statement of cash flows with the change in the Cash account reported on the balance sheet to make sure the amounts agree.

12-LO3 Analyze the statement of cash flows.

During the introductory stage, net cash provided by operating activities and net cash provided by investing activities are negative, and net cash provided by financing activities is positive. During the growth stage, net cash provided by operating activities becomes positive but is still not sufficient to meet investing needs. During the maturity stage, net cash provided by operating activities exceeds investing needs, so the company begins to retire debt. During the decline stage, net cash provided by operating activities is reduced, net cash provided by investing activities becomes positive (from selling off assets), and net cash provided by financing activities becomes more negative.

Free cash flow indicates the amount of cash a company generated during the current year that is available for the payment of additional dividends or for expansion.

What are the three cash flow activities?

Operating, Investing, Financing

Operating activities can be found in the _____ statement.

income

List 7 operating activities.

Sale of goods/services

Interest and dividends received

inventory costs

wages

taxes

interest to lenders

other expenses

investing activities include changes in _____ and _____.

investments, long-term assets

List 4 investing activities

Purchase/sale of PPE

Purchase/sale of investments in debt or equity securities of other entities

loans to other entities

collection of principal on loans to other entities

Financing activities include changes in _____ and _____.

long-term liabilities, stockholders’ equity

List 5 financing activities

sale of common/preferred stock

issuance of debt (bonds/notes)

dividend payments

purchase treasury stock

redeem long-term debt

List 4 significant noncash activities.

Direct issuance of common stock to purchase assets.

Conversion of bonds into common stock.

Direct issuance of debt to purchase assets.

Exchanges of plant assets.

In what order are the activities present in the statement of cash flows?

operating, investing, financing

The _____ method shows operating cash receipts and payments.

direct

The majority of companies use the _____ method because it is easier to prepare.

indirect

The direct and indirect methods arrive at [the same, different] amount(s) for “Net cash provided by operating activities.”

the same

Bread Co reports net income of $60,200, and depreciation expense of $1300, and a gain on disposal of plant assets of $150. Prepare the operating activities section of the statement of cash flows.

Cash flows from operating activities

(a)______________________ $(b)________

Adjustments to reconcile net income to net cash provided by operating activities:

(c)______________________ $(d)________

(e)______________________ $(f)________

——————

Net cash (g)[provided, used] by operating activities $(h)________

a. Net income

b. $60,200

c. Depreciation expense

d. $1300

e. Gain on disposal of plant assets

f. -$150

g. provided

h. $61,350

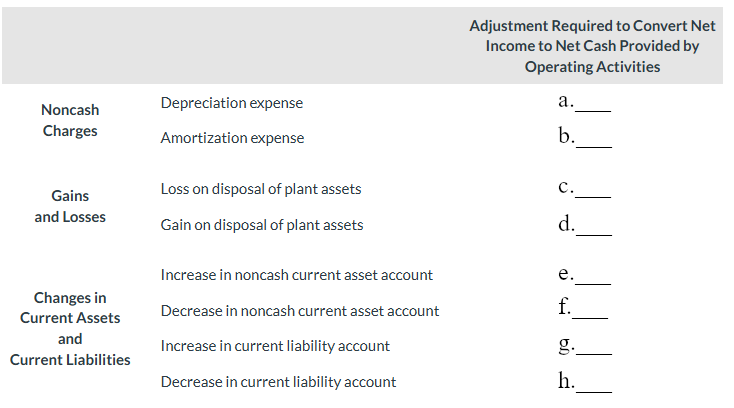

Refer to the image and fill in the blanks.

a. add

b. add

c. add

d. deduct

e. deduct

f. add

g. add

h. deduct

Cat Graphics Inc. reported net income of $100,000 for 2025. The company had a depreciation expense of $8,000, patent amortization expense of $3,000 and a gain on disposal of plant assets of $2,000. Cat Graphics Inc.’s Dec. 31, 2025 balance sheet shows Accounts receivable $20,000 and Accounts payable $6,000. Its Dec. 31, 2024 balance sheet shows Accounts receivable $21,000 and Accounts payable $4,000.

What is the net cash provided by operating activities?

$112,000

During the year, Mark Company’s equipment account increased from $50,000 to $76,000 as a result of selling old equipment for $3,000 that had cost $7,000 and a book value of $2,000 and from purchasing new equipment for cash. What are the totals for Sale of equipment, Purchase of equipment, and Net cash produced/used by investing activities? (Use negative numbers where appropriate.)

Sale of equipment = $3,000

Purchase of equipment = -$33,000

Net cash used by investing activities = -$30,000

For the year, Blades Inc. issued common stock at par for $7,500, declared and paid $14,500 in dividends, acquired $2,500 in treasury stock, and reported a net income of $40,000. What is the net cash used by financing activities?

-$9,500

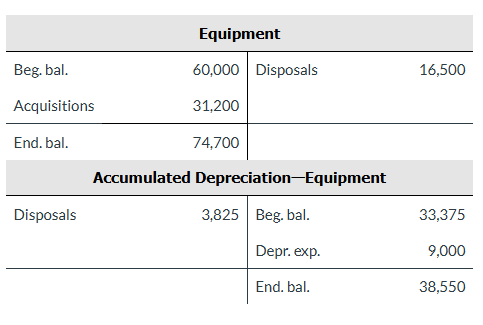

Use the T-accounts provided to determine cash flow from sale of equipment. Also reported was a loss on the disposal of plant assets of $2,625.

$10,050

(Tip: 16,500 - 3,825 - 2,625 = 10,050)

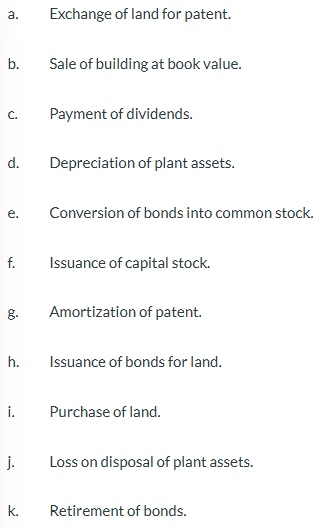

Identify the classification under which the following activities should be reported. The classifications are (1) Operating Activities, (2) Investing Activities, (3) Financing Activities, (4) Noncash Investing and Financing Activities.

a. 4

b. 2

c. 3

d. 1

e. 4

f. 3

g. 1

h. 4

i. 2

j. 1

k. 3

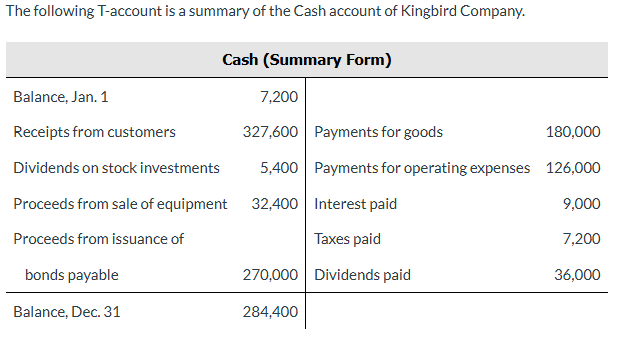

What amount of net cash provided/used by financing activities should be reported in the statement of cash flows?

$234,000 provided