2.4 national income and 2.5 economic growth

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

26 Terms

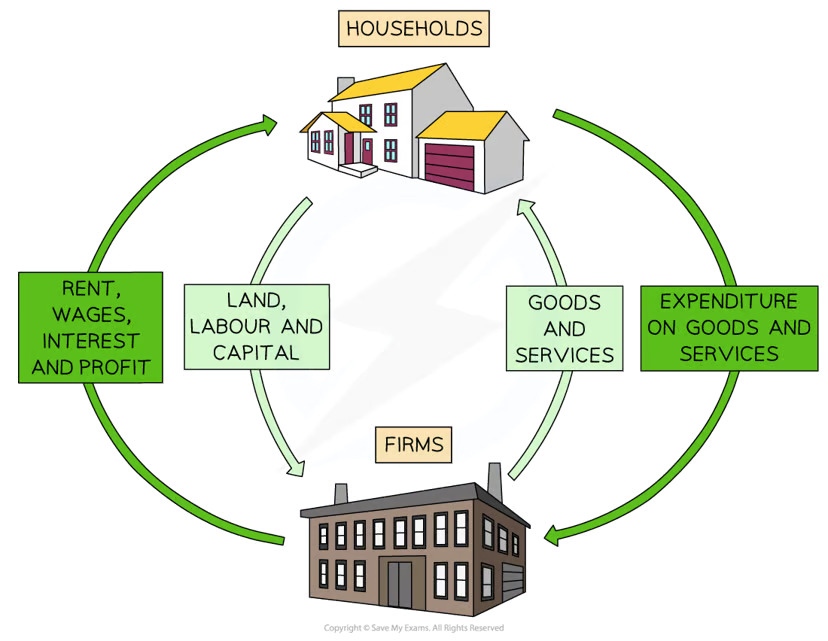

Circular flow of income

an economic model that illustrates how money flows in an economy

Diagram analysis of the circular flow

Households own the wealth in the economy

These are the factors of production

Households supply their factors of production to firms and receive income as a reward

They receive rent for land, wages for labour, interest for capital, and profit for enterprise

With this income, they purchase goods/services from firms

Firms purchase factors of production from households

They use these resources to produce goods/services

They sell the goods/services to households and receive sales revenue

National income is the value of the output of an economy over a period of time

It can be calculated using the income approach or expenditure approach

Expenditure = income

Income is a flow in the economy, whereas wealth is a stock of assets that can be used to generate income

Injections

add money into the circular flow of income and increase its size

Increased government spending (G)

Increased investment (I)

Increased exports (X)

withdrawals

remove money from the circular flow of income and reduce its size

Increased savings by households (S)

Increased taxation by the government (T)

Increased import purchases (M)

Injections > withdrawals

economic growth

vise versus is a fall in real GDP

the multiplier effect

Occurs when an injection into the circular flow causes the real national income to increase by a greater amount

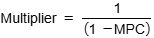

size of the multiplier is dependent on the (MPC), (MPS), the marginal propensity to import (MPM) and the marginal propensity to be taxed (MPT). If the marginal propensity to withdraw is smaller, then the multiplier will be higher, and vice versa

multiplier ratio

the ratio of change in real income to the injection that created the change

Marginal propensity to consume

The proportion of additional income that is spent

marginal propensity to save

The proportion of additional income that is saved

marginal propensity to tax

The proportion of additional income that is paid in tax

marginal propensity to import

The proportion of additional income that is spent on imports

calculating the MPC

calculating withdrawals

Significance of the Multiplier in Shifting AD

if taxes increase, the value of the multiplier reduces

If interest rates increase, savings increase and consumption decreases, and the multiplier reduces

If exchange rates appreciate, the level of imports will increase and the multiplier decreases

If confidence in the economy increases consumption increases and the multiplier increases

short run economic growth

Changes to any of the components of aggregate demand (AD)

An increase in real GDP = economic growth

Long run economic growth

Caused by improvements to the quality or quantity of the factors of production

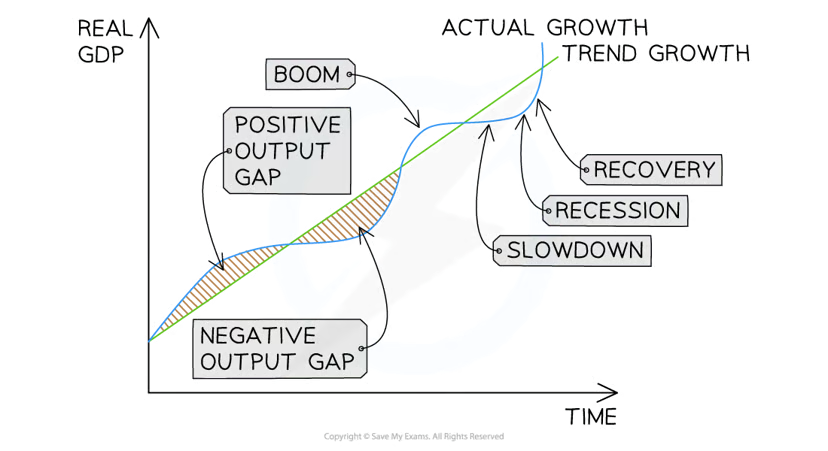

Actual growth

the increase in the productive potential of an economy as demonstrated by a shift outward of the production possibilities frontier (PPF) or the long-run aggregate supply (LRAS) curve

potential growth

when there is an increase in the real value of goods and services produced in an economy over a given period of time

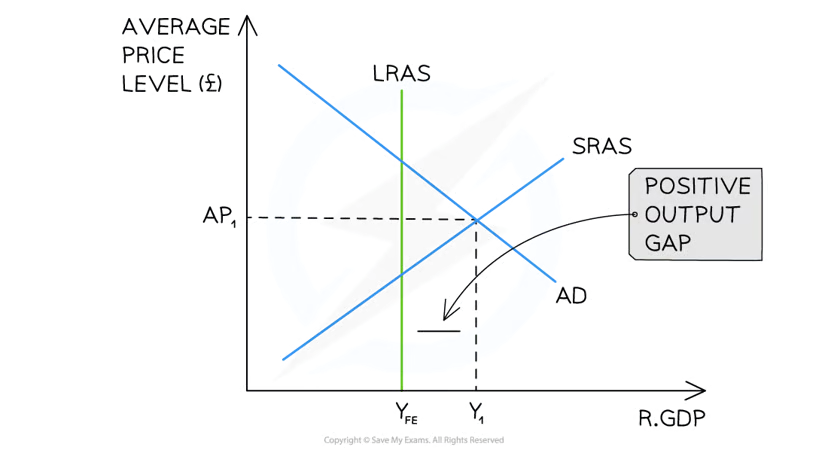

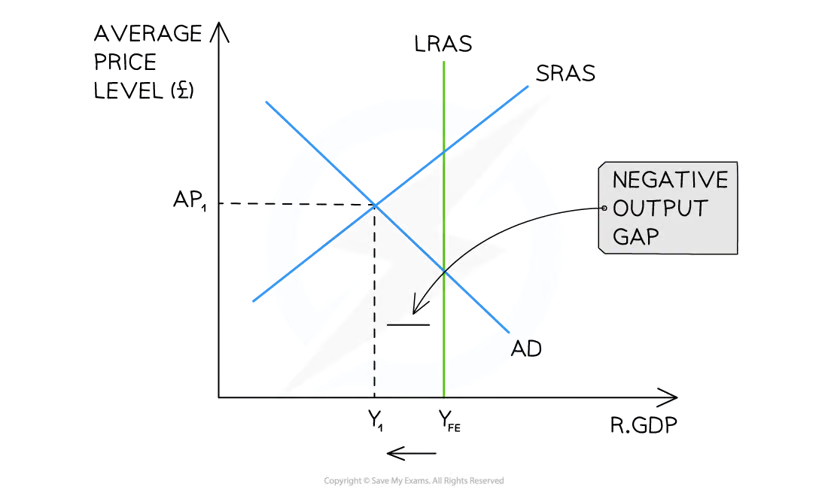

output gap

the difference between the actual level of output (real GDP) and the maximum potential level of output

positive output gap

when real GDP is greater than the potential real GDP

negative output gap

when the real GDP is less than the potential real GDP

there is spare capacity

Business cycle

refers to the changes in real GDP that occur in an economy over time

characteristics of a recession

two consecutive quaters of negative growth

high unemployment

spare production capacity

low confidence for firms/households

characterstics of a boom

high economic growth

decreasing unemployment

demand pull inflation

Benefits of economic growth

increased incomes

decreased levels of poverty

improvement in quality and quantity

higher sales revenue

higher gov tax revenue

costs of economic growth

demand pull inflation

lack of equity

negative externalities

increased inflation can harm export sale