Chapters 5 and 6 ECON

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

33 Terms

Elasticity

Consumers are sensitive/responsive to price changes

Measure of responsiveness of quantity demanded/supplied to a change in one of its determinants

Inelasticity

Consumers not very responsive / sensitive to price changes

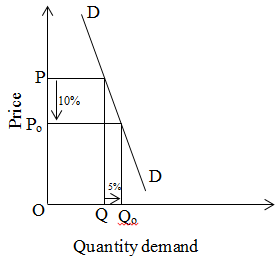

Price elasticity of demand (PED)

Measure of how much quantity demanded of a good responds to a change in its price

How is PED measured

Percent change in quantity demanded and in price change

Factors influencing PED

1) Consumers more sensitive to price change when products have many substitutes

2) Goods and services taking large portions of their budget

3) More time consumers have to adjust (inelastic in short run, elastic in long run)

Perfectly inelastic (PED)

PED = 0

Relatively inelastic (PED)

PED < 1

Unit elastic (PED)

PED = 1

Relatively elastic (PED)

Perfectly elastic (PED)

Total revenue test

TR = PQ, knowing whether a good is inelastic or elastic lets producers know how a change in price will affect their total revenue

What happens to total revenue when a good is inelastic

Price up, total revenue up

Price down, total revenue down

What happens to total revenue when a good is elastic

Price up, total revenue down

Price down, total revenue up

Price Elasticity of Supply (PES)

Measure of responsiveness of quantity supplied to the change in price

How is PES measured

%change in Qsupplied / %change in price

What factors influence PES

-Change in per-unit costs with increased production (Can production increase without increasing production of a unit of a product? yes - elastic, no - inelastic)

-Time Horizon (short-run → inelastic, long-run → elastic)

Perfectly inelastic (PES)

PES = 0

Relatively inelastic (PES)

PES < 1

Unit elastic (PES)

PES = 1

Relatively elastic (PES)

PES > 1

Perfectly elastic (PES)

PES = infinite

Price controls (how are they implemented and why)

Implemented through government interfering with economic market, policies aimed to help certain population groups

Price ceiling

Max price at which a good or service can be sold

-Price ceilings above equilibrium price not matter

-Price ceilings below equilibrium price altering market

Binding price ceiling

-Above equilibirum price, altering market

-Causing shortage (below market price)

Nonbinding price ceiling

Above equilibirum price, not mattering

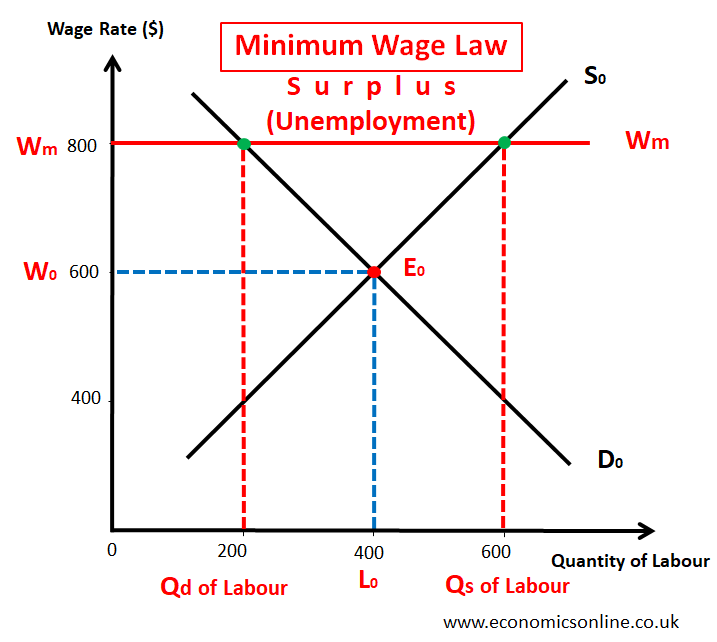

Price floor

Minimum price set by government, price cannot go below a certain amount

Binding price floor

-Above equlibirum price, altering market

-Causing surplus

Non-binding price floor

-Below equilibrium price, not mattering/affecting

Example of a price ceiling

Rent control

Example of a price floor

Minimum wage laws

Tax incidence

Analysis of how burden of a tax is between buyers (consumers) and sellers (producers), depending on price elasticity of demand and supply

Who has the greater tax burden when supply is elastic and demand is inelastic?

Resources producing taxed good easily moved to other industries

ESCAPE tax

Who has the greater tax burden when supply is inelastic and demand is elastic?

Resources fixed, only used to produce taxed good

Producers stuck with bigger burden