Better Decisions PSYCH 2940 Prelim 3

1/178

Earn XP

Description and Tags

this class is not making me happy, not making me earn money, and not a good decision to take

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

179 Terms

Normative

Module 5 lec 1: Algorithms & Experts

How should people make decisions? Characteristics: rational; optimizing; forward-looking.

Descriptive

Module 5 lec 1: Algorithms & Experts

How do people make decisions? Related concepts: boundedly rational; limited cognitive capacity; heuristics; satisficing; myopic.

Prescriptive

Module 5 lec 1: Algorithms & Experts

How can we help people make better decisions? Related concepts: choice architecture, debiasing; repairs; corrective measures; preventive measures.

Behavioral Economics

Module 5 lec 1: Algorithms & Experts

A field focusing on the effects of psychological, cognitive, emotional, cultural, and social factors on the economic decisions of individuals.

Algorithms

Module 5 lec 1: Algorithms & Experts

data-based, machine-driven prediction procedures that vary in complexity. (i.e: linear regression, decision trese, deep learning NN)

Debiasing

Module 5 lec 1: Algorithms & Experts

Efforts and interventions designed to reduce biases in decision-making.

Gardner & Voice assistants

Module 5 lec 1: Algorithms & Experts

Predicted that by 2020, people will engage more with digital assistants they their spouses

Shows that voice assistant mange so many tasks and many smart speakers sold

Experiment: Shopping with Voice Assistants

Module 5 lec 1: Algorithms & Experts

Building trust has a direct correlation with overall ratings

Only 39% of consumers trust in “personalized” product selection of smart speakers

Only 44% believe/rate they offer the actual best value selection of products

Human Experts with Weather Forecasters vs ER Doctors

Module 5 lec 1: Algorithms & Experts

Weather Forecast human are very good at predicting.

but, physicians, after completing history and physical examination, estimate prob. that patient had pneumonia is very bad (at most it seems like 14-15%)

The difference is feedback. You get really fast feedback as a weather forecaster. But for doctors, it’s better to be cautious and you don’t get an answer right away or even get one anyways. As a weather forecaster, the stakes are lower.

Give the 6 reasons for why forecasting is so hard

Module 5 lec 1: Algorithms & Experts

Confirmation bias

Lack of clear feedback

Incentives

Illusion of Control

Hindsight Bias

Emotions

Heuristics

Module 5 lec 1: Algorithms & Experts

Mental shortcuts that ease the cognitive load of making a decision.

Satisficing

Module 5 lec 1: Algorithms & Experts

Choosing an option that meets a minimum standard rather than the optimal one.

Choice Architecture

Module 5 lec 1: Algorithms & Experts + Module 2 Health Decisions

The design of different ways in which choices can be presented to consumers.

Applying the techniques of the psychology of decision making and behavioral science to improve decisions without limiting choices

these choice architecture always perform some sort of nudging

Illusory Correlation

Module 5 lec 1: Algorithms & Experts

The perception of a relationship between two variables when no such relationship exists.

We tend to focus on information consistent with a desired outcome, and ignore information that is inconsistent with that outcome

example: draw a person test

Study: Draw a Person Test (DAP)

Module 5 lec 1: Algorithms & Experts

Clinical Psychologists use of the DAP. Patient draw a person and psychologist analyze the drawing. Allegedly, more paranoid => crazier facial features.

However, research indicates that the test has no validity

When told to psychologists, they kinda deny it and trust themselves and their judgement

Follow-up studies with untrained college students also report this same pattern of self-trust as clinicians

Confirmation Bias

Module 5 lec 1: Algorithms & Experts

The tendency to search for, interpret, favor, and recall information that confirms one's preexisting beliefs.

Then in this case, we tend to not look for disconfirming evidence too! And there is no feedback on options not taken

i.e: cornell doesn’t check up on ppl it doesn’t admit, so you don’t know how those people are doing → confirmation bias

John Holt: How Children Fail main takeway

Module 5 lec 1: Algorithms & Experts

Children fear negatives and nos, why they love positives and yes. Even if get the same amount of info for both positive and negative case, children cling to the idea that only good answer is a yes answer

Sir Francis Bacon quote

(you might be thinking, why do you have to memorize a quote. Well hm! I ask that to myself too BUT THE LAST TWO PRELIMS THEY ASK US QUESTIONS ABOUT WHO SAID WHAT QUOTE SO IM PUTTING IT ON URGH)

Module 5 lec 1: Algorithms & Experts

The human understanding, when any proposition

has been once laid down…forces everything else to

add fresh support and confirmation…it is the

peculiar and perpetual error of the human

understanding to be more moved and excited by

affirmatives than negatives.

John Stuart Mill on Feedback Quote

Module 5 lec 1: Algorithms & Experts

"It is evident that the instances on one side of a question are more likely to be remembered and recorded than those on the other. . . especially if there be any strong motive to preserve the memory of the first but not the latter, these last are likely to be overlooked and escape the attention of the mass of mankind."

Feedback Loops

Module 5 lec 1: Algorithms & Experts

The process where the outputs of a system are circled back and used as inputs.

Three implicit biases in hiring

Module 5 lec 1: Algorithms & Experts

Facial Symmetry

Attractiveness

Height

Blink: Gladwell on CEO and Height

Module 5 lec 1: Algorithms & Experts

Tall people get paid more and become CEO more often

Causes positive unconscious associations

CEO average height 3 inches taller than average male height

6 issues for who to hire and 6 solutions for who to hire

Module 5 lec 1: Algorithms & Experts

6 issues:

Most assessments occur in first 3-5 minutes (LT)

People have implicit biases (LM)

Individual interviewers are inconsistent (LB)

We think we’re great at interviewing but never actually check (RT)

Interview tasks do not predict on-the-job success (RM)

References and years of work experience are not predictive (RB)

6 solutions:

Use structured interviews, scored with a rubric

Don’t let managers choose their own teams

Use multiple interviews (“wisdom of crowds”)

Give interviewers feedback across their interviews

Set objective task-related standards

Work sample tests and test of general cognitive ability are predictive

Paul Meehl: Clinical vs. Stastical Prediction

Module 5 lec 1: Algorithms & Experts

humans or algs for college admissions decisions?

umm so which one did he support? Paul Meehl advocated for statistical prediction over clinical judgment, arguing that algorithms generally lead to more accurate outcomes in college admissions and other decision-making scenarios.

Model Prediction

Module 5 lec 1: Algorithms & Experts

Using statistical or machine learning models to forecast outcomes based on input data.

Implicit Bias

Module 5 lec 1: Algorithms & Experts

Unconscious attitudes or stereotypes that affect one's understanding, actions, and decisions.

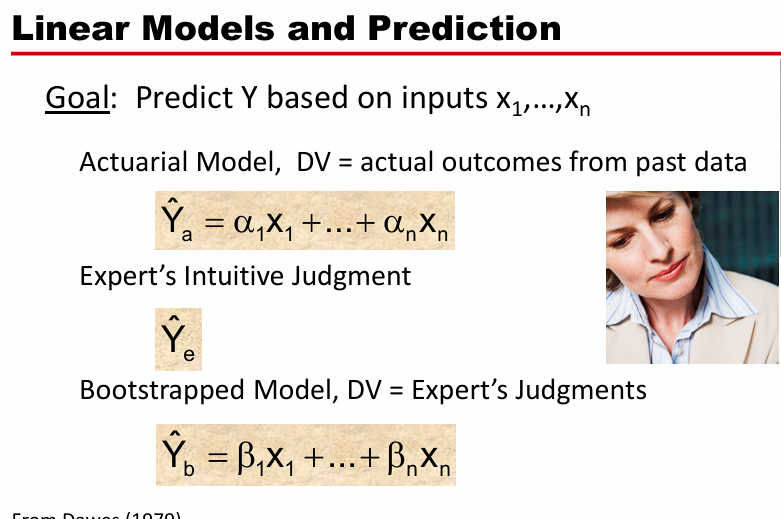

Actuarial Models, Expert’s Intuitive Judgment, and Boostrapped Model

Module 5 lec 1: Algorithms & Experts

Actuarial Models:

Statistical models used to evaluate and predict outcomes based on historical data.

DV = actual outcomes from past Data

Expert’s Intuitive Judgment:

Ye

Bootstrapped Model, DV = Expert’s Judgements

Yb = B1x1 + … Bnxn

Linear Models vs Human Experts Study

Module 5 lec 1: Algorithms & Experts

A type of model that predicts output variables using a linear combination of input variables.

Ground rules: same data, goodness of fit used as validity measure

Actuarial model > boostrap > intuitive in all fields and in total

Actuarial model outperforms expert intuition, but so does boostrapped model too so yay!

Noisy Decisions

Module 5 lec 1: Algorithms & Experts

Decisions made by humans which are often inconsistent and affected by various biases.

Oskamp 1965 on judges:

Module 5 lec 1: Algorithms & Experts

More information produces higher confidence (i.e: overconfidence), but no increase in accuracy

Goldberg (1965) on judges

Module 5 lec 1: Algorithms & Experts

judges have a hard time distinguishing between valid and invalid cues. So that means experts often do not outperform novices. And especially true when feedback is missing or sporadic.

Peter Brand and Billy Beane meaning for this class

Module 5 lec 1: Algorithms & Experts

“It's about getting things down to one number. Using stats to reread them, we'll find the value of players that nobody else

can see. People are overlooked for a variety of biased reasons and perceived flaws. Age, appearance, personality. Bill James and mathematics cuts straight through that.

Actuarial model (no humans) da best basically and Billy Jeane as Brad Pitt is another steal ig

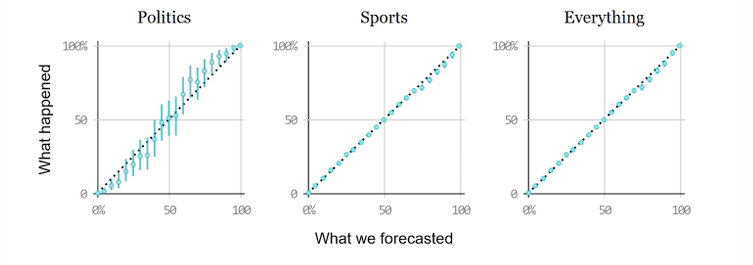

FiveThirtyEight forecasts

Module 5 lec 1: Algorithms & Experts

some good but for politics its actually very noisy!!

Algorithms, linear modals and bias

Module 5 lec 1: Algorithms & Experts

Algorithms and linear models should be less noisy and more consistent that humans but are also probably biased, because algorithms that bootstrap human decisions learn the same biases as humans!

Study: A Manager and an AI walk into a bar: Does ChatGPT make biased decisions like we do?

Module 5 lec 1: Algorithms & Experts

Use 18 common human biases relevant to decisions making categorized as (Biases in judgements regarding risk, Biases in evaluation of outcomes, heuristics in decision-making)

Judgement Regarding Risk: Chat mostly max expected payoffs, with risk aversion only demonstrated when expected payoffs are equal. Not understand ambiguity. Exhibits high overconfidence

Evaluation of Outcomes: chat is very sensitive to framing, reference points, and salience of information. Not sensitive to sunk costs or endowment effect.

Heuristics in Decision Making: more research needed. seems that confirmation bias is present

Thinking Fast and Slow: Daniel Kahneman

what is system 1, system 2?

System 1- reflexive intuitive emotional

System 2 - reflective, deliberative, thoughtful (more of this → less noise)

Procedural Decision-Making

Module 5 lec 1: Algorithms & Experts

Decisions become less noisy when people need to share their decisions rules with someone else

“High describability” rules work even in extremely y complex choice environments

Also reduce the cognitive effort needed to make decisions

Amsterdam Airport Choice Architecture & Nudging

Module 3 Lecture 2: Health Decisions

put a fake fly in urinal which decreased spillage by alot (bc people aim more) lol

subtle change in design

Sharif & Shu 2017: Exercise Persistence

Module 3 Lecture 2: Health Decisions

Reserve help/skip days with exercise schedule will more likely help you reach your end goal!

In the findings the rankings were: Reserve-Weekly > Reserve-Monthly > Easy > Hard

In the end, it’s better to set hard goals with emergency skip days. If you falter, don’t beat yourself up!

6 Exercise Hacks at the Gym

Module 3 Lecture 2: Health Decisions

Temptation Bundling (run while playing genshin impact idk)

have a gym buddy

incentives to return (i.e: money ever time you exercise, works bc ppl undervalue future benefits such as health. providing incentive now is more effective and decrease present bias)

creating habits but with flexibility (workout plan but w/ flexibility and rewards! i.e: piano stairs fun workout)

Small rewards

Giuntella, Saccardo, and Sado 2024 Sleep Study

Module 3 Lecture 2: Health Decisions

Undergraduates at uni track sleep with Fitbit. Goal to sleep at least 7 hours every weeknight

Intervention condition: bedtime cue, morning feedback, and immediate reward for meeting this goal

Results:

intervention led to more sleep, less evening screen time on streaming or scrolling, and no change in time spent studying, and higher GPAs for that semester

Riis & Ratner 2014: Diet Hacks on Labeling

Module 3 Lecture 2: Health Decisions

Went from pyramid labeling to plate labeling, which is much more intuitive and understanding to people.

Diet Hacks: Framing Effects

+Another example: people prefer 93% lean beef or 7% fat beef? (Levin & Gaeth 1988)

Module 3 Lecture 2: Health Decisions

People buy the product that says 0% fat more than the 100% fat free because of the framing of its fat content.

People prefer 93% beef and said its higher quality and tastiness too. Even after tasing the beefs still the same rankings.

Diet Hacks: Plate & Bowl Sizes

Module 3 Lecture 2: Health Decisions

Using smaller dishware can lead to reduced portion sizes and lower food intake, helping individuals manage their diet more effectively.

putting food in to-go box immediately is better so don’t eat all at once!

Diet Hacks: Food Order

Module 3 Lecture 2: Health Decisions

interventions by placing healthier foods first then unhealthy food later

can see this in school cafeterias

Diet Hacks: What are the 4 diet hacks discussed in lecture (not in the study)

Module 3 Lecture 2: Health Decisions

Labeling

Framing Effects

Plate and Bowl sizes

Food Order

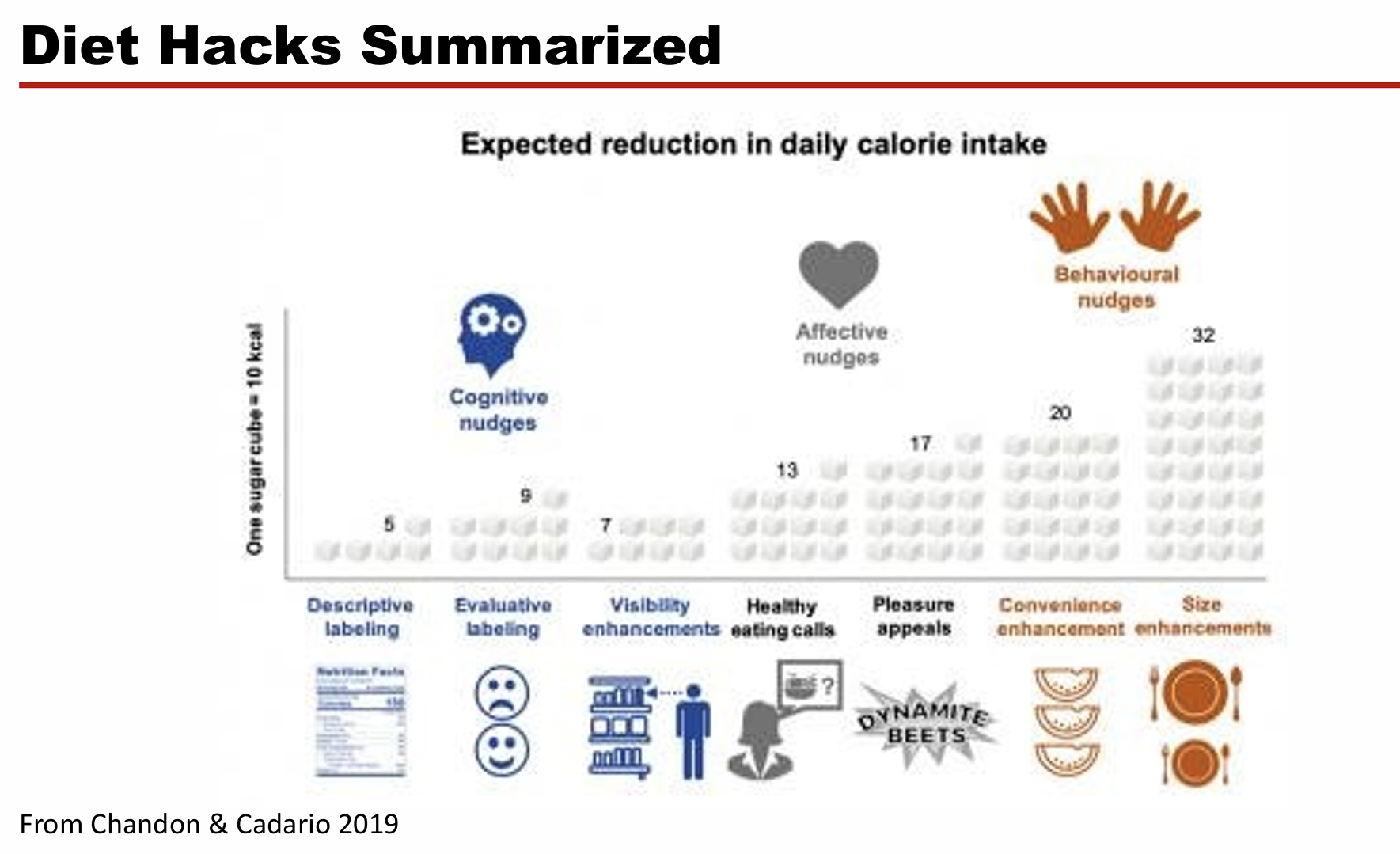

Diet Hacks: What are the 7 diet hacks in this study not lecture, its categorization as a nudge, and rankings among all of them?

Three categories to choose from: Cognitive nudges, affective nudges, and behavioural nudges

(Chandon & Cadario 2019)

Module 3 Lecture 2: Health Decisions

Behavioural Nudges: highest

Size enhancements (plate size) highest highest

Convenience enhancement

Affective nudges: middle

Pleasure appeals

Healthy eating calls

Cognitive Nudges: lowest

Visibility enhancements (i see this first!)

Evaluative labeling

Descriptive labeling

Happiness Hacks: Decisions

(Niedenthal 2007)

Module 3 Lecture 2: Health Decisions

Make happiness salient (most noticeable most important)

this just means remind yourself to be happy

track your activities!

Happiness Hacks: Design

(Wirtz et al 2021; Vanman, Baker & Tobin 2018)

Module 3 Lecture 2: Health Decisions

Nudges for sleep & good havits

avoid social mediate & upward comparisons … hmm… but tiktok

Happiness Hacks: Doing

Bonhs 2021

Module 3 Lecture 2: Health Decisions

spend time with people helping others

choose experiences over materials/things

give compliments

treat somebody if you having a bad day

What are the three happiness hacks talked in lecture? (very vague so better to actual understand each part in detail on the other flashcards)

Module 3 Lecture 2: Health Decisions

Decisions

Design

Doing

Defaults via Planning Prompts

Module 3 Lecture 2: Health Decisions

Encourage people to form plans for a certain situation and implement a certain response

this causes concrete alignment with desired behavior and future moment

makes procrastination more difficult

forgetfulness less likely!

Both experiments for planning prompts: flu shots and colonoscopy

Milkman, Beshears, Choi, Laibson, and Madrian (2011)

Module 3 Lecture 2: Health Decisions

Flu shots:

control condition is just employees informed of the dates/ times of workplace flu clinics

make a plan condition: employees allowed to choose a concrete date and time for flu vaccine

result: 37% treatment > 33% control

Colonoscopy Study:

same conditions but now for colonscopy. plans made on sticky note.

after 6 months follow-through rates: 7.2% (plan) > 6.2% (control)

Smarter Implied Defaults

Module 3 Lecture 2: Health Decisions

Some options are:

Precommit to a default date (i.e: on january 23rd I WILL jump into the gorge)

Use shorter deadlines (explicitly or implied)

Michigan ICU and Checklist Study:

Provonost and others (2006)

Module 3 Lecture 2: Health Decisions

Using checklist for ICU preparation reduced rate of infection drastically.

Even if checklist stuff seems obvious it’s still really useful. The Michigan ICU and Checklist Study demonstrated that implementing a structured checklist for ICU procedures significantly decreased infection rates. This highlights the value of standardizing practices, even for seemingly obvious protocols, in improving patient outcomes. (okay ai what a banger explanation)

Intrinsic motivation vs Extrinsic motivation

what’s better for long term change?

Module 3 Lecture 2: Health Decisions

Intrinsic: stimulation stemming from within oneself

i live for tomatoes

i.e: social comparison is an intrinsic motivation that make significant results

extrinsic motivation: encouragement from an outside force

i.e: payment for changing outcomes/behaviors

extrinsic is ok for shorter term, but intrinsic for long term

Incentives of Social Comparison

(example 1: reducing AC consumption. 2: reducing overprescribing antibiotics)

Module 3 Lecture 2: Health Decisions

Nobody wants to be the worst compared to peers, an intrinsic value that can be very important

Reducing AC consumption:

drop in AC only when ppl are told their neighbors consume less AC

Reducing overprescribing antibiotics:

defaults: no antibiotics

justifications: justify the antibiotics reduction

feedback on suage

social comparisons: compare doctors to other doctors, so doctors are competitive so social comparisons made the biggest difference

Scrarcity and ownership

Module 3 Lecture 2: Health Decisions

Scarcity refers to the perception that resources are limited, which can heighten the perceived value of ownership. Ownership gives individuals a sense of control and attachment to their possessions, often leading to increased motivation and decision-making insights regarding resource management.

I.e “You have been selected to complete colon cancer screening that could save your life!” omg i want to live

What are the 6 principles of good choice architecture

Module 3 Lecture 2: Health Decisions

Use defaults (planning prompts, precommit to defaults, smarter implied defaults)

Give feedback (i.e: ambient orb turns colors based on energy consumption; medication reminders by chaing cap color and last time bottle oppened; hospital challenge handwashing by putting up tags that glow red if not wash, patients then ask not knowing what that means )

Allow for error (need reminders, but allow mistakes bc they’re inevitable; i.e: seatbelt sings, sign on the road to remind you to look a way when its not intuitive, medication packs with a day listed for each poil so you know you haven’t missed one)

Structure complex choices (netflix or hulu separating by genre; hposital environment with checklists which was adapted by airplane pilots )

Understand mappings (# crunches instead of calories on starbucks drinks)

Think about incentives (including social ones; i.e: what doctors and patients want and care about)

Disclosures

Module 3 Lecture 3: Financial Decisions 1

Forms created to provide information useful in important (financial) decisions

mandated disclosures are required by gov. to assist consumers in specific transactions

CFPB

(Johnson & Leary 2017)

Module 3 Lecture 3: Financial Decisions 1

Consumer Financial Protection Bureau implement regulations requiring disclosures for several financial markets;

examples:

TILA-RESPA integrated disclosure: mortgages, overdraft coverage on checking accounts, prepaid cards. Provides truth in lending disclosures.

explicitly directed by Congress

Types of disclosures

Module 3 Lecture 3: Financial Decisions 1

warnings

information:

provider/gov thinks you should be totally aware of the responsibilities you have regarding payments and expectations if you take a certain loan

feature descriptions

firm trying to highlight certain features that sound very appealing, while the gov doesn’t share their enthusiasm a bout said agreements

conflict of interest

i.e: influencers are required to disclose when they are being paid to sponsor a product, or got a product for free

public disclosures

Goal of disclosures and role of constructed preferences

Module 3 Lecture 3: Financial Decisions 1

provide easily accessible info, a disinfectant to manipulations, and access to aggregated wisdom

overcome problem of asymmetric information

Role of constructed preferences: may accidentally affect preferences

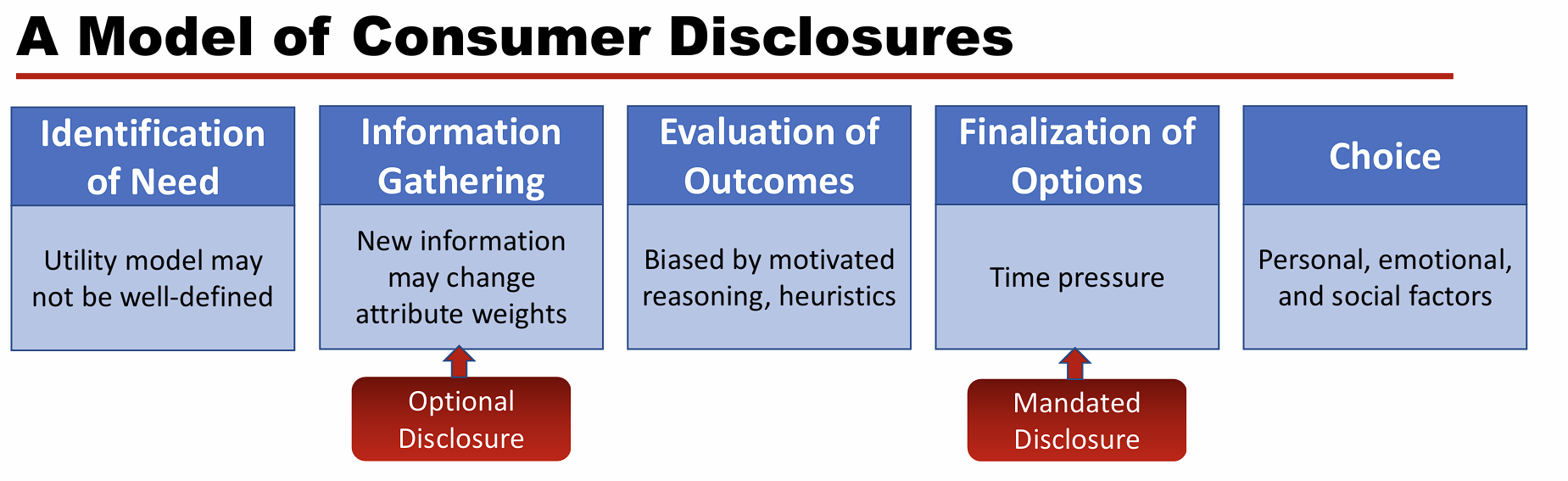

Describe the model of consumer disclosures and some negative detail/outcomes for each step

5 steps

where would an optional and mandated disclosure come into place?

Module 3 Lecture 3: Financial Decisions 1

The issue is explained in the screenshot

Identification of need: preferences assumed to be known and stable

Information Gathering (Optional Disclosure): timely’ update beliefs about options

Evaluation of Outcomes: measurable attributes

Finalization of Options (Mandated Disclosure): attention & understanding of product attributes

Choice: optimal given preferences and knowledge

The MPG Illusion:

10 mpg to 20 mpg VS 25 mpg to 50 mpg

Module 3 Lecture 3: Financial Decisions 1

is a cognitive bias leading to bad decision-making!

Low MPG is better, but people see big MPG numbers and are like omg!! But this is wrong!!!

There was also a short time where people argued window stickers should be in gallons/100 miles instead of MPG

Annual Percentage Rate (APR)

Module 3 Lecture 3: Financial Decisions

It refers to the yearly interest rate you'll pay if you carry a balance, plus any fees associated with the card and expressed as a percentage. APR helps in comparing the cost of loans or credit cards.

Minimum Interest Charge

Module 3 Lecture 3: Financial Decisions

a fee that is charged to your account when the interest fees you have due are below a certain amount

Student Loans (College) like what’s on it

What is defaulting on a loan for student loans and default rates

What are for-profit colleges and their issue

Module 3 Lecture 3: Financial Decisions

University must break down what you are paying (i.e: scholarships, work-study options, monthly fee after graduation). You should compare it to how much you expect to earn if you get the degree there.

Grade Rates and Retention Rates

Must tell your default rates:

Defaulting on a loan: Not repaying the funds you borrowed by deadlines. Never do this because the government always know!

Car and mortgages you can default on. It will leave a mark on your credit report for some years, but eventually you can move on

Problem with for-profit collges:

Maximize money and student body

So students take out loans, but don’t graduate and end up in huge amount of debt, so this is the reason schools must show grad rates

but of course getting rid of for-profit schools is not the end-be solution

What are the two implications for policy markers for improving disclosures

Module 3 Lecture 3: Financial Decisions

Policymakers need to consider how to provide education and information during earlier stages and not just at the point of disclosure in the final stage of the decision

Full understanding of disclosure not necessary. Consumers can still make an optimal choice for their situaiton. Reduces importance of measuring understanding during disclosure testing.

The Last Mile by Dilip Soman: What were his 5 takeways about ___?

Module 3 Lecture 3: Financial Decisions

His takeaways for implementing disclosures irl:

Simple: cannot be overwhelming and must be straightforward

Comprehensive: need to tell all important info

Relevant to person making decision

Stages (just in time)

Segmented: break up info so related info is together and more digestable

White House College Scorecard: The four sections and what they mean

Module 3 Lecture 3: Financial Decisions

Costs:

provides relative costs to other unis

provides H/M/L costs and borrowing amounts

Graduation Rates: entire uni not by major though

Loan default Rate

Median borrowing:

measured in absolute dollars

CFPB Shopping Sheet: Three main parts of shopping sheet

Module 3 Lecture 3: Financial Decisions

A tool developed by the Consumer Financial Protection Bureau to help students compare financial aid offers. It aims to simplify the decision-making process regarding loans and expenses.

Costs in the school year and its breakdown

Grants and scholarships to pay for college

What will you pay for colleges (net costs which is cost of attendance minus total grants and scholarships)

Very similar to White House scorecard

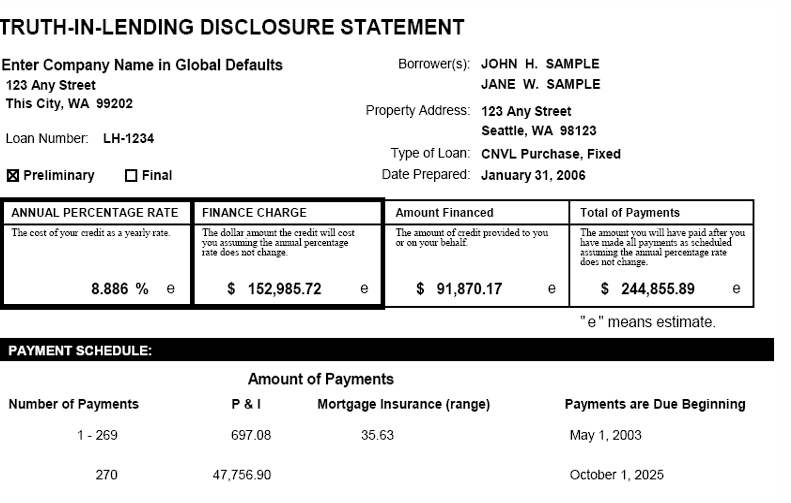

TILA RESPA Disclosure (Truth-In-Lending Disclosure Statement) and important temrs

APR

Amount Financed (Third Box)

It’s issue

Module 3 Lecture 3: Financial Decisions

A disclosure that combines information from the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA) to inform borrowers of key financial details about a mortgage loan, including interest rates, payment schedules, and estimated closing costs. Standard form for many loans.

An issue is that annual percentage rate is perceived as most important and most shocking! (The first box), but in reality what you should be focused on is monthly payments, and can these payments change so we should focus on APR instead

Adjustable rate mortgage (ARM), APR

Module 3 Lecture 3: Financial Decisions

A type of mortgage where the interest rate can change periodically based on fluctuations in a corresponding financial index. This can result in lower initial payments compared to fixed-rate mortgages, but the monthly payments may increase over time. Tells you if & how much monthly payments change

Mortgage disclosure should show that mortgage is ARM and its APR. And also do a comparison to show if its a good or bad rate.

Overdraft Coverage

Module 3 Lecture 3: Financial Decisions

allows banks to temporarily cover a transaction that withdraws more than the balance of checking account and leave it negative. So then later a customer is required to repay the expense along with associated overdraft fees (like a loan)

Comprise over 50% of net fees consumer paid on their check accounts!

Disclosure Solution for Overdraft Coverage, and then how it lowkey doesn’t work sometimes

Module 3 Lecture 3: Financial Decisions

Federal regulations now require that financial institutions gain consumers’ affirmative consent (“opt in”) for overdraft fees on non-recurring debt card transactions and ATM withdrawals.

But now firms try to advertise overdraft fees as exciting and omg you don’t want to miss it guys!!! fo sure!

Testing Overdraft Disclosure Forms + Version 2 with Salience and Mapping

Module 3 Lecture 3: Financial Decisions

Testing three different forms on overdraft fees (Model Form A-9 the standard, Comparison form (two column format), Example form)

Measures: coverage decisions, decision time, and comprehension

The results showed no significant difference between forms on overall comprehension. But redesign formed did improve knowledge about default choice. (so they actively chose to opt-in or out, instead of just being like eh whatever ill just choose the default choice)

so while people to appear relatively knowledgeable, in aggregate, about how attributes should be weighted, so personal factors sometimes weight much more than product features!!

Version 2 did salience (personal decisions in this) and mapping (show how personal factors could affect preferences). But instead no difference in decision time or overall comprehension, although higher decision confidence.

Behavioral Finance and the Stock Market

Module 3 Lecture 4: Financial Decisions 2

Security prices are highly correlated with intrinsic value, but sometimes diverge to a significant degree

It is possible to predict stock prices just not very precise

Taxes: what it is, what is taxes witheld, what to people tend to do

Module 3 Lecture 4: Financial Decisions 2

Taxes are witheld from paycheck. You choose how much get withheld. When tax days come along (April every year), if you withheld too much, you get money back. If you withheld too little, you write a check to the gov.

What people do? 80% of taxpayers overwithhold because we hate the idea of owning money. Loss aversion: writing the check feels a lot worse than getting money back.

Sales Tax Holiday (what is it, what is the trick)

Module 3 Lecture 4: Financial Decisions 2

A weekend where you don’t pay sales tax. Stores pay the taxes out of their own profits. However, stores usually just increase the normal price to adjust for this.

Effect from Signing things

Module 3 Lecture 4: Financial Decisions 2

you’re more likely to be honest

Credit Cards what is the best repayment strategy

Say you have balances on multiple credit cards, what do you do with…

an emotional perspective?

a financial perspective?

Module 3 Lecture 4: Financial Decisions 2

Paying the full balance each month to avoid interest and build good credit.

Emotional perspective: pay off faster with a debt snowball. You pay the smallest balance first and gain momentum

Financial Perspective: Pay off the credit card with the highest interest rate

New York Cabbies and Credit Cards

Module 3 Lecture 4: Financial Decisions 2

At first cabby drivers preferred cash because it was harder to track than credit cards. there was more cash under the table.

but later on, credit card readers have tip screens pop up, which caused cabbies to get better tips. The reason why more people tip is because they are influenced by the default (the default is to tip)

Disposition Effect:

Module 3 Lecture 4: Financial Decisions 2

Home owners reluctant to sell at a loss

Anchoring

Module 3 Lecture 4: Financial Decisions 2

buyers anchor on the housing prices o the city they are moving from

so that’s why when you first move to a new place, make sure you stay there for a while to get used to the new housing prices!

Study on Savings: Temporal Reframing

Module 3 Lecture 4: Financial Decisions 2

Had three saving options for 401(k):

save $5 per day

save $35 per week

save $150 per month

All groups (high and low income) prefer $5 per day. Taking big amounts of money and chunking into more affordable amounts is good.

Study on Reframing Metrics of Savings

Module 3 Lecture 4: Financial Decisions 2

Between % savings and “pennies on the dollar” savings

PPL w/ higher incomes save a little bit more when asked about % (but basically equal)

PPL w/ lower incomes save much more when asked about pennies

of course in absolute terms, higher income will accept higher savings rates

Study on Savings Nudge: Automatic Enrollement

Module 3 Lecture 4: Financial Decisions 2

Firms changed default. Participants are enrolled into the 401(k) plan unless they explicitly opt out (framing effect). Enrollment increased dramatically.

If you precommit, more likely to do it in the future. If you just say you will save, most likely you end up not doing it.

Illusion of wealth for retirement savings

Module 3 Lecture 4: Financial Decisions 2

If you use lump sums, those numbers seem larger and more appropiate for lower wealth amounts, which can confuse alot of people on how much to save in retirement funds.

Breaking down the lump sums into monly income gives ppl a better idea of if they have enough money.

Investing: Confirmation bias when online

Barber & Odean 2001

Module 3 Lecture 4: Financial Decisions 2

401k plans with web-based interfaces, turnover increases by 50%

but these online forums and discussions lead to confirmation bias regarding investing. Ppl convince each other online to do stuff leading to an echo chamber. More overconfident and trade more actively and speculatively, earning lower returns.

Warren Buffet Quote

Module 3 Lecture 4: Financial Decisions 2

If you have a hypothesis, you need to write down the contrary to that hypothesis. Running list of procs and cons. Otherwise, your brain will focus on your appealing side and you have confirmation bias.

What are the psychological challenges in decumulation (spending wisely in retirement)

Module 3 Lecture 4: Financial Decisions 2

Every individual’s situation is different

Large Stakes (often million of dollars)

Limited Opportunities to Learn (only get one shot)

Multiple Sources of uncertainty (i.e: life expectancy)

Effects of decisions last for long time periods

Difficult emotional tradeoffs

What are the psychological influences on decumulation

Module 3 Lecture 4: Financial Decisions 2

self-control: enjoy now or save for later?

impatience: discounting of future outcomes

psychological ownership/endowment effect: overvalue the things you own

loss aversion, especially for annuities

annuity: contract between you and insurance company that requires insurer to make payments to you

biases in prediction: uncertainty in longevity, health, etc

fairness and trust: do i trust company that’s holding onto my money during retirement and gov?

Subjective Life Expectations Task: Live-to or Die-by

Module 3 Lecture 4: Financial Decisions 2

% Chance you live to 75? (higher)

Die by 75? (lower)

10 year age gap between median expect age of death. So want ppl to make good retirement decisions, ask about living to 75 bc ppl tend to be more optimistic about how long they’ll live and they will realize that they should save more

What are the two retirement income options?

Module 3 Lecture 4: Financial Decisions 2

Single Life Annuities and Social Security

Life Annuities: What Economists think, what really happens?

Module 3 Lecture 4: Financial Decisions 2

LIfe annuity: take chunk of your savings, insurance company will give you guaranteed income for the rest of your life. so you would prefer to live longer than shorter to reap benefits of this insurance

Economics think life annuities should be an attack solution for more retirees, but only 1-6% of retirees buy them.

Why do people not buy them?

Social norms: nobody else is doing it

Feeling like there’s a loss: its unfair, especially if u die early and having very high savings

Life Annuities Expected Utility/Cumulative Dipslay Experiment

Module 3 Lecture 4: Financial Decisions 2

Giving people three options of life annuities, and one option of not choosing any. With a basic description of the annuity (monthly payment, its annual increase, and the time period). Other view is enriched, showing the cumulative earnings by age.

Enriched view significantly increased the chance for people to take annuity. However, despite showing expected values, many people were still not rationalize and rejected the annuity plan (basic 36% rejection to enriched 24% rejection)

Cumulative displays can debias valuations and increase overall demand.

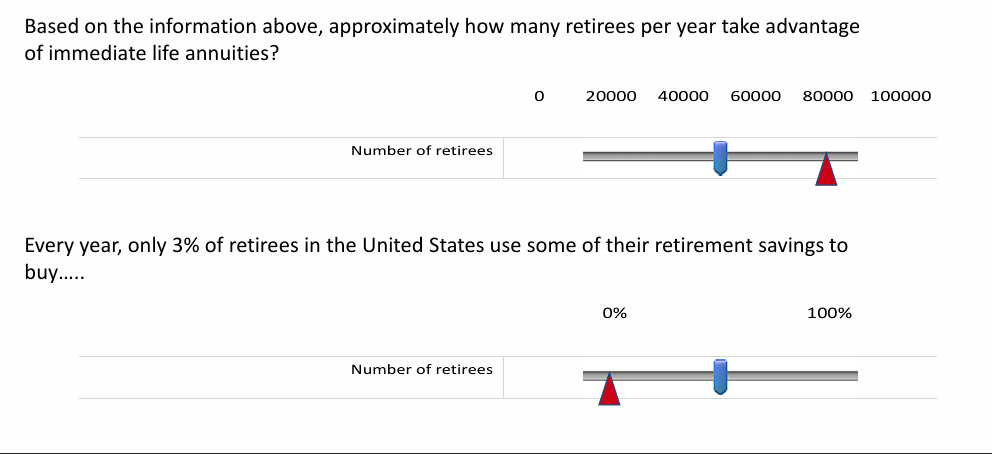

Life Annuities Social Norms Experiment

Module 3 Lecture 4: Financial Decisions 2

Increase life annuities by reframing the information.

If you say: 3% of retirees in US buy some sort of life annuities, many do not choose to buy annuities. in the graphic, 3$% is in the bottom slider.

If you say: 80,000 retirees in US buy some sort of life annuities, then a lot more people agree to buy annuities. in the graphic, 80,000 is near the top slider.

Social Security, why do people usually do instead of what they should do, and why?

Module 3 Lecture 4: Financial Decisions 2

A government program that provides financial assistance to retirees, disabled individuals, and survivors of deceased workers, primarily funded through payroll taxes.

Can claim when aged 62-70. The later you claim the social security benefits, the more you get, but people tend to claim the benefits as soon as they are eligible at age 62.

This is because

People perceive shorter life expectancy

Feel loss averse if they don’t take the benefits early on (bc think of death and losing it all)

Stronger feelings of ownership (the money the gov pays feels like their own money)

Social Security Expected Utility/Cumulative Display Experiment

Module 3 Lecture 4: Financial Decisions 2

Showed an enhanced display of payouts for social security. (so start at age 62 you earn 1339/month vs start at age 70 you earn 2395/month)

saw opposite effects compared to life annuities

people still want to claim even earlier! could be due to endowment effect and the feeling that you want the money right away.