4.1.6 - protectionism

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

36 Terms

what is protectionism

restrictions on free trade

reasons for protectionism

infant industries

sunset industries

strategic industries

dumping

employment

current account deficit

labour/environmental regulations

(I Saw Some Drivers Eating Doner Regularly)

infant industries

new firms unlikely to succeed if they are competing globally

sunset industries

declining industries with firms on their way out (usually primary industries in first world countries)

government tries to limit the economic damage that could occur from closing abruptly

strategic industries

eg. military, energy, agriculture

u kind of have to be able to make those yourself to avoid sabotage

dumping

when foreign firms sell products at low prices in foreign markets to price out other firms

can even be below their own costs of production

employment

avoid structural unemployment caused by outsourcing production abroad

current account deficit

reduce number of imports

labour/environmental regulations

apply pressure to other countries with a lack of labour/environment regulation that makes their costs of production so cheap

4 main types of protectionism

tariff

quota

domestic subsidies

non-tariff barriers

define tariff

a tax imposed on imported g+s

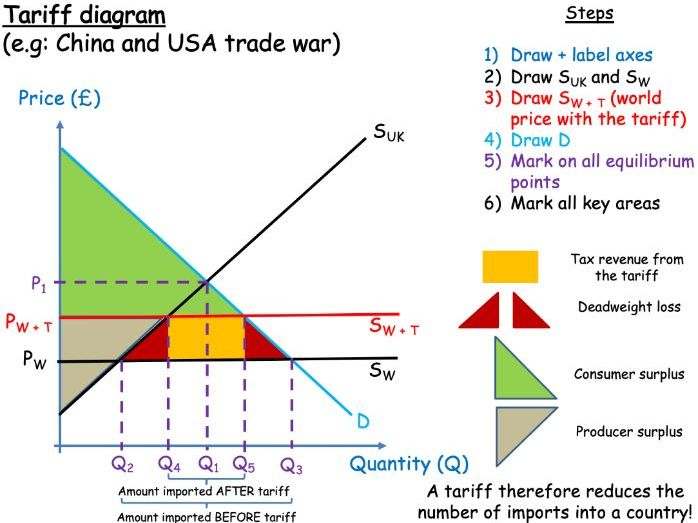

show a tariff diagram

results in an overall loss in welfare

(watch uplearn if u don’t get how this had been drawn!)

tariff impact on domestic producers

increase in producer surplus

tariff impact on domestic consumers

loss of consumer surplus

tariff impact on government

tax revenue

tariff impacts on standard of living

worse for consumers

better for employees of domestic firms

define quota

a physical limit on imports

how do quotas work

the limit is set below the free market level of imports

market price goes up

domestic firms can supply more

quota impact on domestic producers

higher revenue

quota impact on foreign producers

lower output but higher price if they do manage to export

quota impact on consumers

higher prices, less choice

quota impact on government

maybe corporation tax revenue from domestic firms, but no tariff revenue

quota impact on standards of living

lower - higher prices for everyone = lower purchasing power

how do subsidies work

lower costs of production = lower prices (for domestic firms)

more internationally competitive

subsidy impact on domestic producers

more internationally competitive

subsidy impact on foreign producers

harder to compete

subsidy impact on consumers

lower prices

subsidy impact on government

costs them the amount of the subsidy

and opportunity cost

subsidy impact on standards of living

improve - lower prices

what’s the point of non-tariff barriers

creating barriers to trade instead of taking drastic measures like tariffs, quotas and subsidies

examples of non tariff barriers

health and safety regulations (eg. banning chemicals widely used in another country)

environmental regulations (eg. banning stuff made in certain ways that are used in another country)

NTB impacts on domestic producers

limits foreign competition

NTB impact on foreign producers

disincentive to export

OR

they meet the requirements but it costs them so lower profit

NTB impact on consumers

less choice

NTB impact on government

lose WTO credibility

expensive/difficult to enforce the barriers

NTB impact on standards of living

lower - less choice, higher prices

higher - banning certain chemicals