Finance Exam

1/187

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

188 Terms

empirical evidence for non-random financing decisions

target debt ratios, clustering based on industry and risk, motivated by similar factors, market reaction to debt ratio.

with constant interest rates, as number of periods, n, increases:

future value increases, present value decreases

with constant number of periods, as interest rate, r, increases

future value increases, present value increases

time value of money

opportunity cost, inflation, risk

ordinary annuity

equal, periodic cash flows occurring at the end of each period and lasting for n periods

annuity due

cash flows start one period earlier - ie at t=0

deferred annuity

starts t periods later, worth less than an ordinary annuity

principal of a loan

balance of the loan, PV of the annuity

debt security

a loan issued by government or private entities that can be traded in the secondary market - eg: bonds, debentures, notes and bills of exchange

short term debt securities

term less than one year (usually less than 6 months), one future cash flow, simple interest. Eg: treasury notes, bills of exchange (bank guaranteed & paid for private issuer), promissory notes (private, not guaranteed)

long term debt securities - characteristics

term longer than one year, multiple cash flows (coupon-paying), compound interest, fixed interest rate. Eg: government securities (bonds), debentures (private, secured), corporate bonds (private, unsecured usually)

when the required yield (r) of a debt security increases, price ________?

decreases

when the term (n) of a debt security decreases, price ________?

increases

why would yields decline?

decreased risk, less inflation than expected

promissory note

issued by a private company, not guaranteed

treasure note

issued by government

bill of exchange

issued by company, guaranteed by bank

when a bond is first issued, coupon rate (c) is equal to, greater than or less than the current required rate of return/yield to maturity, r?

equal to

what is a bond’s yield?

rate of return an investor will achieve, determined by risk of the bond and the current interest rates in the economy - constantly changing. Ultimately determined by changes in price caused by supply and demand for bonds.

securities with a longer term are more or less price sensitive?

more, since they react more strongly to changes in ytm

bonds with a lower coupon rate are more or less price sensitive?

more, lower coupon rate = greater price reaction to interest rates

discount bond

coupon rate is less than ytm, immediately after a coupon payment it trades at a discount

premium bond

coupon rate is greater than the yield to maturity, it trades at a premium to face value

gradient of discount bond price graph

positive

gradient of premium bond price graph

negative

return on capital vs return of capital

ON = you get a return, ie dividends

OF = you get a full return on your investment

market capitalisation

number of shares x value of shares

PE ratio

price per share/earnings per share or market cap/total earnings, reflects relative market valuations of listed firms

public companies have ______ equity, private companies have ________ equity

listed, unlisted

rights of ordinary shareholders

right to equal dividends as declared by the board of directors

right to sell their shares

right to vote for members of the board of directors

assumptions of the dividend growth model

dividends are constant and forever

dividends grow at a constant rate

problems with the dividend growth model

sensitive to inputs - ie share price changes dramatically with different growth rates

does the dividend growth model account for capital gains/losses?

Yes - this simply reflects the market’s expectations of future dividends.

what is alpha?

payout ratio

assumptions for a high PE ratio

for a given level of earnings with all else constant the market will pay higher prices for a share when:

payout ratio (alpha) is higher

risk (ke) is lower

growth is higher

but high PE ratio isn’t necessarily always good - eg: firm with high dividend payout ratio (alpha) would have low growth (g)

preference shares - definition

Hybrid securities that display characteristics of both equity and debt. Owners have priority over ordinary shareholders in return on capital. Traditional preference shares can be valued as a perpetuity.

preference shares - equity-like features

variable dividend rate

irredeemable (infinite) life

non-cumulative dividend obligation (no need to pay back missed dividends)

participating (additional dividends)

voting rights

preference shares - debt-like features

fixed dividend rate

redeemable (finite) life

cumulative dividend obligation (must pay back missed dividends)

non-participating (no extra dividends)

non-voting

characteristics of a typical preference share

fixed dividend rate

infinite

cumulative dividend obligation

non-participating

non-voting

efficient markets hypothesis

quick price reaction to any news

unbiased ‘accurate’ price reaction

weak-form market

prices incorporate all information contained in the past record of prices

semistrong-form market

prices incorporate all publicly available information

strong-form market

prices incorporate all publicly and privately available information

problem with testing the EMH

any testing of EMH assumes the model used to estimate expected return is correct - ie you cannot test it in isolation without also testing the correctness of the expected return model.

Realised return

The actual gain or loss on an investment, taking into account both capital appreciation and any income generated, such as dividends or interest. Can be for ordinary shares or bonds.

Arithmetic average

Treats each period independently, and measures the average return earned from a single, one-period investment over a specific time horizon

Geometric Average

Average return earned per period from an investment over an investors entire time horizon. Accounts for the compounding effect of returns

Which is always higher, arithmetic or geometric average returns?

Arithmetic, since the compounding effect of geometric averaging always produces a smaller percentage

When do the differences between arithmetic and geometric average returns become less pronounced?

when the volatility/variability of returns declines

what are the two components of return from a share?

return from dividends

return from price changes

nominal vs real returns

Nominal returns: The total percentage gain or loss on an investment without adjusting for inflation.

Real returns: The actual purchasing power gained or lost on an investment after adjusting for inflation.

What is a portfolio’s expected return?

The weighted average of the expected returns of its component securities

What is a portfolio’s variance?

the weighted average of the variance of its component securities and the covariance between the securities’ returns

What is the covariance of returns?

measures the level of co-movement between security returns

positive covariance

above average returns on security 1 tend to coincide with above average returns on security 2, and the same with below average returns

negative covariance

above average returns on security 1 tend to coincide with below average returns on security 2 and vice versa

covariance equal to zero

security 1’s return tends to move independently of security 2’s.

correlation of returns

standardised measure of co-movement between two securities

what are the two ways of measuring a portfolio’s risk

correlation of returns and covariance of returns

when is there no diversification benefit?

when the returns are perfectly positively correlated - risk is equal to the weighted average of the individual assets.

when can we technically achieve a zero-risk portfolio

using two securities that are perfectly negatively correlated

portfolio leveraging

strategy where an investor borrows funds at the risk-free rate of return and invests all available funds in a risky security

increases potential returns but also potential losses, so it magnifies risk

short selling

borrowing shares and selling them now with a contractual obligation to buy them back later (at an expected lower price)

increases portfolio risk - risky borrowing but gives you quick cash

what does a leveraged position involve

borrowing funds, then investing those funds plus your own funds into a risky asset

results in a higher expected return, but also higher standard deviation of returns - ie more risk

incremental diversification benefits reduce as the number of assets in the portfolio ________

increase

as a portfolio becomes more diversified, which is more important - covariance between the assets or the individual risk of the assets?

covariance between assets

unsystematic risk

risk that is unique to a specific industry or company, can be diversified away.

systematic risk

risk that is inherent in the market, so cannot be diversified away.

Capital asset pricing model (CAPM)

relates a security’s required rate of return to its non-diversifiable, systematic risk.

what is the CAPM used for

to price individual securities by estimating their required rate of return and combining this with future expected cash flows to make a price estimate. can be used to indicate relative under/overvaluation of a company

Assumptions of the CAPM

investors are risk averse

investors only make portfolio decisions based on expected returns and variance of returns

investors have the same expectations about volatilities, correlations and expected returns of stocks

capital markets are perfect - no taxes, transaction costs or government interference

unlimited borrowing and lending at the risk free rate is possible

investors only hold efficient portfolios of securities all traded in financial markets

efficient frontier

a set of optimal portfolios that offer the lowest risk for a given expected return

market portfolio

a weighted sum of every asset in the market, with weights in the proportions that they exist in the market. Should theoretically be every asset, but in practice its usually the top 100 or 200 - eg: S&P/ASX 200 index

capital market line (CML)

a theoretical concept that represents all the portfolios that optimally combine the risk-free rate of return and the market portfolio of risky assets

CML limitations

can only be used to price efficient portfolios

assumes portfolios are fully diversified and efficient with zero unsystematic risk

cannot price individual securities, since these are not efficient and always have some unsystematic risk

the contribution of systematic risk by individual securities to the market portfolio depends on?

the covariance of the asset’s risk with the market portfolio, not its own risk (standard deviation)

Security market line (SML)

a graphical representation of the CAPM, plots the expected rate of return of a single security against systematic, non-diversifiable risk.

Beta

a measure of how sensitive a security’s return is to movements in the return on the market portfolio

Beta greater than 1

security has higher systematic risk than the market portfolio

Beta less than 1

security has lower systematic risk than the market portfolio

Beta = 1

Security has the same systematic risk as the market portfolio

Beta = 0

Security has no systematic risk

negative beta

security moves in the opposite direction to the market portfolio

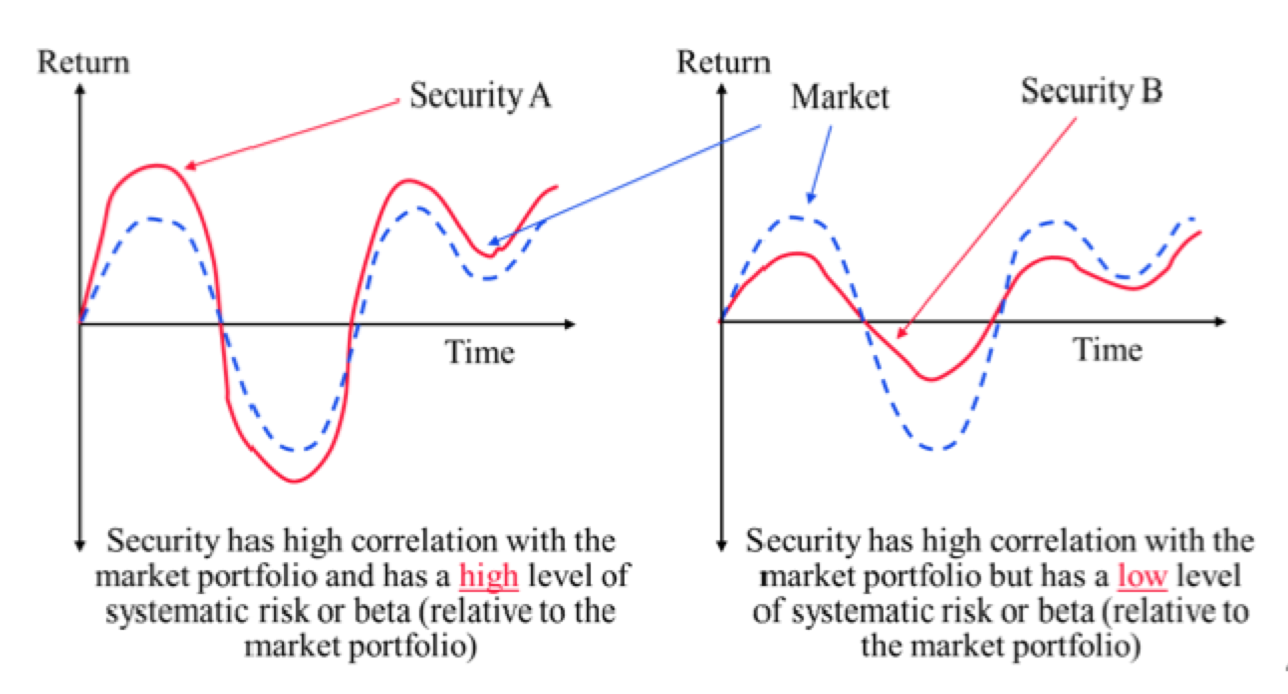

Difference between beta and return correlation

return correlation is about whether a securities returns increase/decrease when the market portfolio returns increase/decrease, but beta is about whether systematic risk of the security is higher or lower than the market portfolio systematic risk.

which type of risk does the CAPM measure?

systematic/non-diversifiable risk

market model regression

where an individual asset’s beta is estimated by regressing it’s returns against the returns from a proxy for the market portfolio. It is an empirical model, whereas CAPM is theoretical

why is the beta for a portfolio just the weighted average beta of the portfolio’s assets?

because beta measures systematic risk and when a portfolio is formed systematic risk is only averaged, not eliminated

what should you do if you think shares are overpriced

short sell them - exert selling pressure and buy them back later at a lower price

Net present value (NPV)

difference between the present value of cash inflows and the present value of cash outflows over a period of time

when the discount rate/required rate of return increases, NPV ________

decreases

what is IRR?

rate of return expected to be earned by a project over its life. it is the discount rate that produces an NPV of 0 when applied to a project’s cash flows. it is not affected by scale of cashflows unlike NPV.

IRR decision rule

accept project if IRR is greater than r, reject if IRR is less than r

IRR - delayed investments

in the case where you get a big cash inflow at the start and then successive cash outflows IRR should be interpreted as the rate you are paying, so the decision rule should be to accept the project is IRR is less than r in this case, since you want cash outflows to be decreased less.

Problems with IRR

for delayed investments, decision rule is the opposite

sometimes if NPV is always positive or negative there is no IRR

multiple IRRs are possible with multiple sign changes of cashflows - ie 2 sign changes = 2 possible IRRs

inconsistent rankings of mutually exclusive projects

problems with incremental IRR

it may not exist

there many be multiple

even if the IRR exceeds the required rate of return for both projects, this doesn’t mean both projects have a positive NPV

the individual projects may have different required rates of return - therefore discount rate to use for incremental IRR is uncertain

payback period

calculate how long it takes for the initial outlay to be repaid and accept the project with the shortest payback period. can be improved using a discounted payback period, which takes the time value of money into account.

problems with payback period

biased against projects with longer development periods

ignores the time value of money

accounting rate of return (ARR)

average earnings generated by the project after deducting depreciation and tax costs, expressed as a percentage of the initial investment outlay. We accept the project if the ARR is above a pre-specified minimum rate of return, and prefer higher IRRs

problems with ARR

time value of money is ignored

earnings are not net cash flows

tends to favour projects with shorter lives

issues with cash flow estimation

net cash flows are assumed to be at the end of the period - errors in time value of money