1.4 government intervention

1/49

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

50 Terms

merit goods

demerit goods

positive externality

negative externality

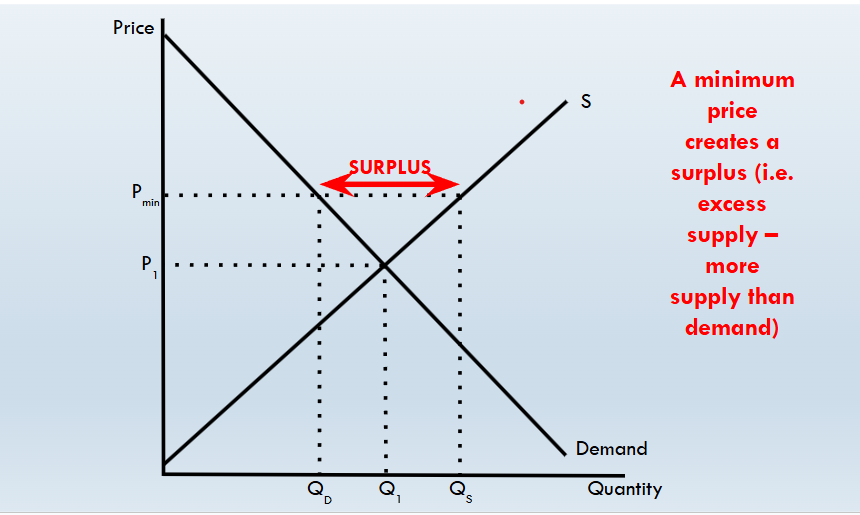

define minimum price and why it may be introduced in a market

A minimum price is a price set by government, below which the price is not allowed to fall

To be effective the minimum price needs to be set above the free market equilibrium price

Examples include minimum wage laws or price floors for agricultural products.

outline the details of minimum price on alcohol which is in place in the uk

minimum price - 50p per unit of alcohol

this policy aims to reduce alcohol related harm such as crime,liver failure,NHS waiting lists it targets cheap and accessible alcohol

Supply and demand impact of a minimum price

minimum price purpose

Generally used to raise the price of a good that creates a negative externality

The increase in price should push it nearer to reflecting the social costs – i.e. the total costs to society

protecting producers (farmers) and minimum wage

minimum price problems

4

A minimum price creates a surplus and disequilibrium will need to be maintained

Some producers would be happy to sell below the minimum price

Potential for a black market

Poorer households are likely to be disproportionately affected

Government may set price too low (e.g. alcohol minimum price in England and Wales) so that it has little or no impact

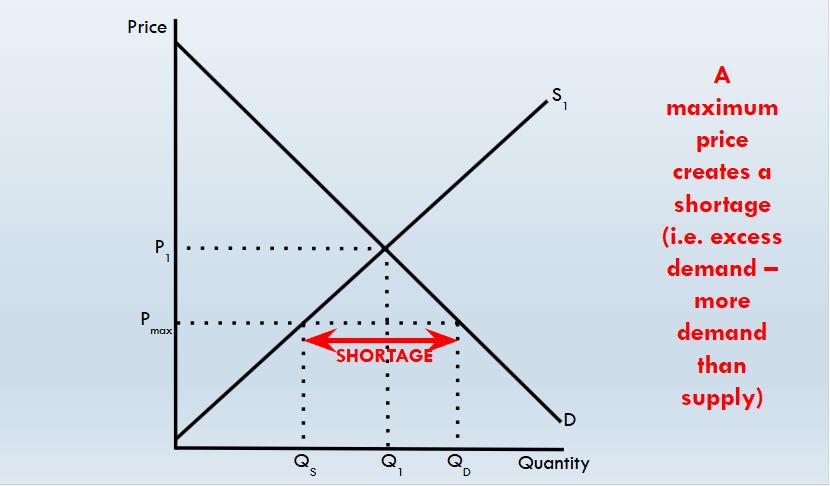

maximum price

A maximum price is a price set by government, above which the price is not allowed to rise

To be effective the maximum price needs to be set below the free market equilibrium price

why may maximum prices be introduced

Could be used to lower the price of a good that creates a positive externality

The reduction in price should price consumers in to the market and increase the consumption

A price cap could also be used to make necessities affordable (food, housing) or to prevent exploitation of consumers by powerful businesses

maximum prices examples

Maximum price: car £54.85; motorbike £29.65

Many garages offer MOTs significantly below the maximum price

Train tickets

Some fare types are regulated by government

Train companies prevented from raising price too high

Both have a positive externality element to them:

MOTs check a car is road-safe

Train use reduces congestion and emissions compared to car use

maximum prices diagram

problems by maximum price

3

A maximum price will create a shortage and disequilibrium will need to be maintained

Some consumers may be prepared to pay above the maximum price to get the goods that they want

Potential for a black market

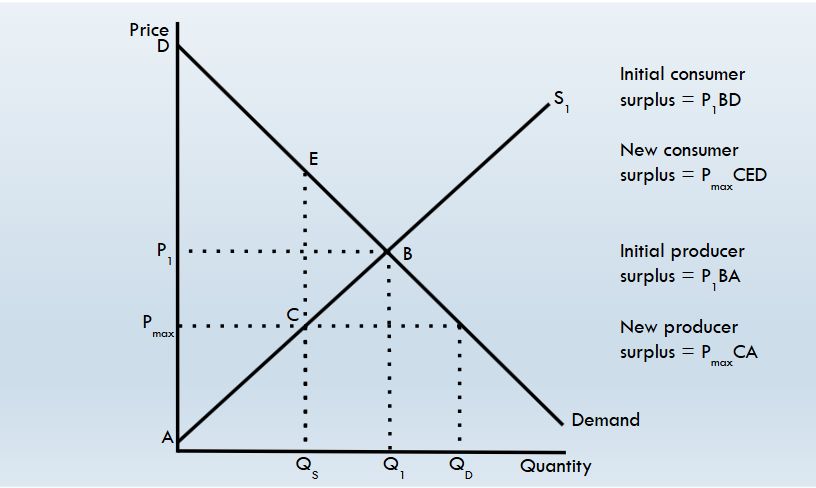

maximum prices impact on producer surplus

maximum prices consumer surplus

Consumer surplus

Consumer surplus increases as the price falls

However

As there is a shortage some consumers will not be able to consume the good and so will miss out (i.e. Q1 falls to QS)

taxation of carbon emissions

Taxation of carbon emissions is a viable alternative

Each unit of production that creates pollution is taxed, or each actual ton of carbon emitted is taxed

It raises the price of the polluting activity

Ideally the tax should be equal to the external cost - this would increase the MPC to the value of the MSC

“Internalising the externality”

pollution permits VS taxation

Permits create a stronger financial incentive to cut pollution than taxes

There is a clearer limit on pollution with pollution permits than with taxation

The total number of permits is the limit

Harder to predict the impact on emissions when imposing a tax

public good

avaliable to everyone and one persons use does not reduce its avaliability to others

-clean air

non-rival

one persons use does not reduce its avaliability to others

non excludable

no one can be prevented from using the good ,everyone can access

why are public goods provided by the state

as private companies typically do not have enough incentive to provide them they are non rival. businesses are unable to profit from them so the state steps in to ensure these goods are available for everyone to use ensuring society’s well-being

advantages and disadvantages of the state providing

unviersal access

equity

high tax

misallocation of resources

unintended consequences

Policy interventions may lead to effects that are unanticipated

Individuals in society can be unpredictable and may respond to policies in a way that is unexpected

These unintended consequences could be either positive or negative

Examples:

Smoking ban – increased use of outdoor patio heaters, leading to greater electricity consumption

5p plastic bag charge – increased theft of baskets

carbon tax evaluation

regressive impact: It can disproportionately affect low-income households, who spend more of their income on energy.

Industry resistance: Some industries may oppose it, especially if they rely heavily on fossil fuels.

Competitiveness: It might make domestic products more expensive than imports from countries without a carbon tax—unless border adjustments are applied.

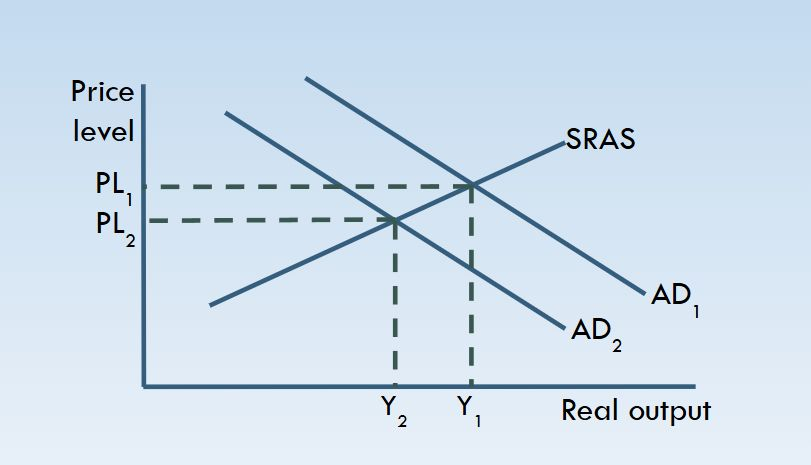

contractionary fiscal policy

distortion of price signals leading to government failure

Some government policies distort the prices that would otherwise be created by the market (e.g. taxes, subsidies, min/max pricing)

Example:

Minimum wage – raises income levels but may mean businesses lay off the lowest paid which were the people the government had wanted to protect

government failure administrative costs

Sometimes the bureaucracy involved in administering a policy may become very ‘bloated’ and costly

If the costs of administering a policy are greater than the benefits to society of that policy then there is likely to be a misallocation of resources

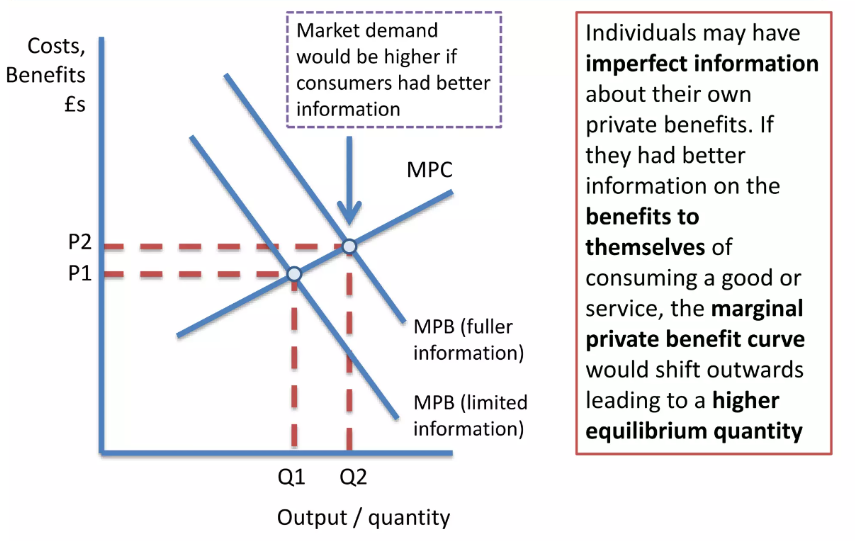

information gaps market failure

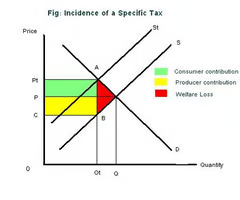

indirect taxes

Used to reduce production/consumption of negative externalities.

Examples: Cigarettes (tobacco duty), petrol, alcohol, sugar tax.

Diagram: Supply shifts left (or upward if specific tax).

Evaluation:

Tax revenue generation (used for hypothecation?)

Unintended consequences (e.g., black markets)

Elasticity impacts effectiveness

Equity: regressive impact on lower-income households

subsidies

Used to increase production/consumption to internalise positive externalities.

Examples: Public transport subsidies, renewable energy support.

Diagram: Supply shifts right (or downward).

Evaluation:

Opportunity cost to government

Risk of government failure (misallocation)

Dependency of firms

Elasticity and effectiveness

state provision of merit goods

Example: NHS, education

Address under-consumption due to information failure

Evaluation:

Government failure risk

Overuse or inefficiency

Equity vs. efficiency again

Tradable Pollution Permits (Link with Theme 4 for synoptic depth)

Market-based approach to internalising external costs.

Firms buy/sell pollution rights.

Evaluation:

Hard to set correct cap

Admin costs

Risk of monopolisation of permits

real world examples

7

Sugar Tax (UK) – indirect tax on soft drinks (2018)

Plastic Bag Charge – reduction in plastic bag usage

Minimum Alcohol Pricing – Scotland (2018)

Congestion Charge (London) – externalities and road pricing

Subsidies for Electric Cars/Green Energy

COVID vaccine funding – state provision, public good

Ofgem / Ofcom – regulators enforcing rules on utilities

evaluations for indirect taxation

4

Time lags – effects take time to work,it might take time for consumers to change their behavior (due to addiction, habit, or lack of substitutes).

- Higher prices for consumers;

- May force firms out of business leading to negative costs for the whole economy;

- Inelastic goods will not see consumption fall;

- Development of illegal markets;

- Regressive taxation

indirect taxes

An indirect tax is a tax imposed on goods or services, which is paid by producers to the government but is often passed on to consumers through higher prices.

why may government intervene in markerts

To correct market failure (e.g. externalities, missing markets)

To promote equity or redistribute income

To regulate monopolies

how can information provision correct market failure

Market failure can occur due to information gaps. The government can provide accurate information (e.g. health warnings on cigarettes), allowing consumers to make more informed choices, thus improving allocative efficiency.

subsidies effectiveness

Benefits:

Reduces price, increases consumption of merit goods

Internalises positive externalities

Supports producers and innovation (e.g. renewables)

Drawbacks:

Cost to government (opportunity cost)

May cause overproduction or dependency

Difficult to set correct amount

cost to taxpayer

advantages on maximum price in housing market

Advantages:

Increases affordability for low-income households

Prevents exploitation during housing crises

May reduce homelessness

Disadvantages:

Creates excess demand (shortages)

Disincentivises landlords from maintaining or supplying housing

May lead to black markets or waiting lists

why would there be underconsumption of education in the free market

People would be unable to afford it and may think that it is not worth it due to the opportunity cost of getting a job

what is government intervention

Government intervention is where the government steps in to correct market failure and improve the allocation of resources

why is supply of public good inelastic

because supply does not vary depending on price and profit

why are taxes ineffective when trying to counter inelastic demand

Because the consumers will continue to consume the goods even if the consumer burden is as large as it can be.

indirect taxes diagram

why are indirect taxes seen as regressive

because even when people have a high income they pay the same tax as those who have a low income

why are merit goods underprovided

they have a higher private cost than social cost so these externalities are ignored and the good is underproduced

internalise the externality

an attempt to deal with an externality by bringing an external cost or benefit into the price system through tax

what would cause the demand for houses to increase

Limited supply, would be difficult to increase the supply of houses due to time lags

- buying of second homes by the wealthy

- migrants buying homes

what are tradeable pollution permits

Companies are offered permits as rewards for not polluting and they can trade this permit to other firms for money.

what are bad about pollution permits

A lot of companies have found legal loopholes around this and can exploit the system for more profit whilst still polluting

- It is not global so they can easily relocate to bypass the permits entirely

- Big firms / monopolies with deep pockets can afford the permits and continue to pollute

what is bad about pollution permits

- The firms can use the money from these permits to reinvest and further grow their business and shift output outwards

- government may take a % or tax the permits and can then increase rev and spending

- Firms can maintain their competitiveness and profitability

information gaps - government

government may not have all the right information and this may lead to a further misallocation of resources

(this explains why some subsidies may be exacted incorrectly or the government intervenes poorly)