3.4 Profit and Loss Statements + Balance sheets

0.0(0)

0.0(0)

Card Sorting

1/11

Earn XP

Description and Tags

Last updated 3:14 PM on 5/31/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

12 Terms

1

New cards

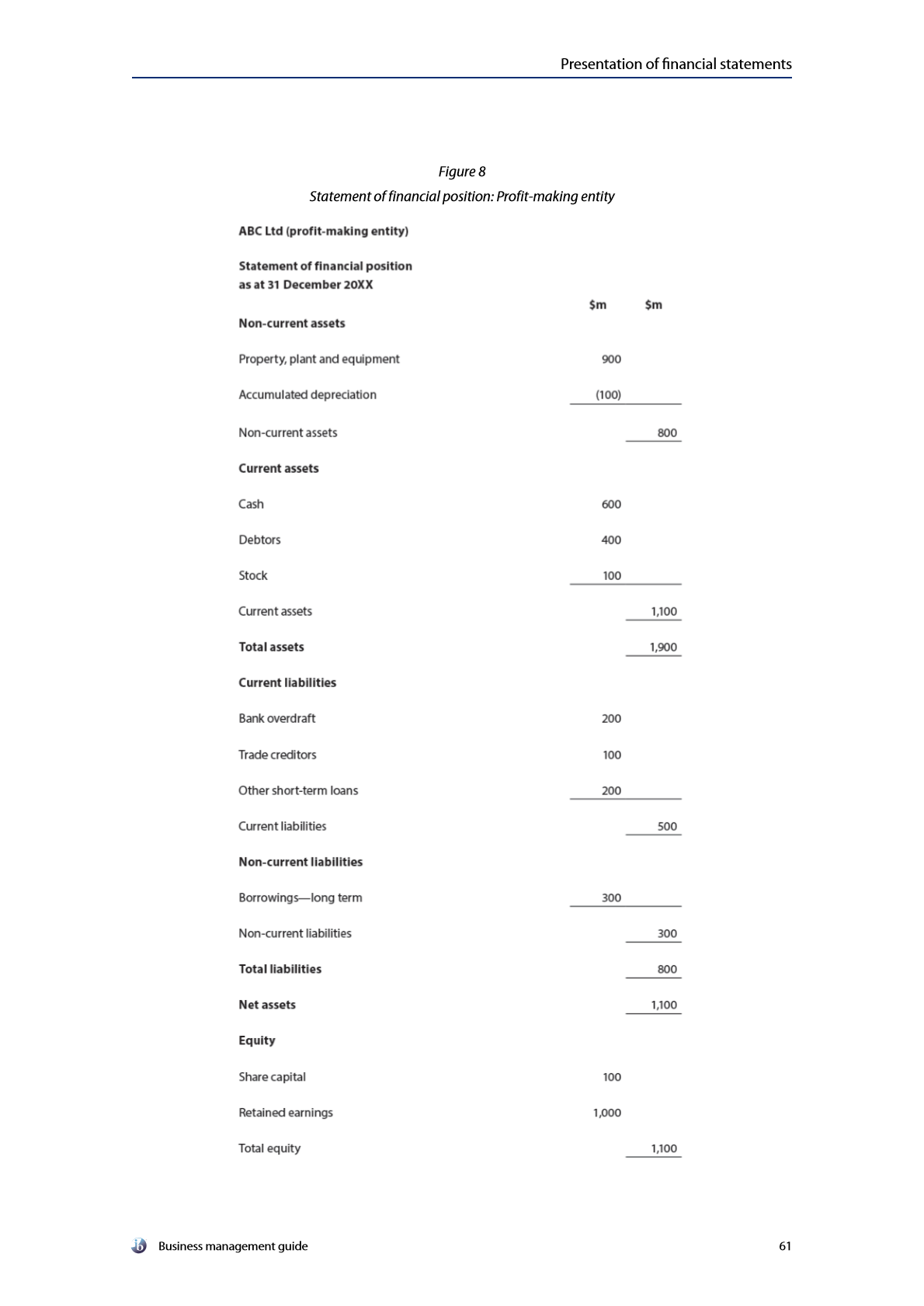

profit and loss statement definition

It shows the profit or loss generated by a business from its trading activites. The accounts are constructed differently depending on whether the business is a for-profit enterprise or non-profit enterprise.

2

New cards

profit and loss statement: step 1

* **calculate the gross profit (gross profit)**

* Average price x quantity = sales revenue

* Sales revenue - cost of sales = gross profit

* Gross profit margian = gross profit/ sales revenue x100%.

* A good gross profit margian means a company is more efficient as buying off its suppliers, it also allows you to compare businesses over time and it allows you to compare two different size companies because it is about efficiency

* Cost of sales includes the direct costs associated with producing the product that has been sold

3

New cards

profit and loss statement: step 2

* **calculate the profit or loss (profit before interest and tax)**

* Profit before interest and tax = gross profit - expenses

* Costs not directly involved in the production if the good or service, e.g. CEO salary, rent, advertising, toner for printer ect...

4

New cards

profit and loss statement: step 3

* **take off interest (profit before tax)**

* Interest from loans (could be positive if the comapny has cash in bank accounts and no debts)

5

New cards

profit and loss statement: step 4

* **take off tax (profit for period)**

* Payed to government in each jurisdiction

* The left over is profit/loss for period which could be for the next quarter or for the whole year

6

New cards

profit and loss statement: step 5

* **list how the profits are distributed (profit for the period)**

* Dividends: money payed in cash to shareholders from the profit after interest and tax

* Retained profit: the portion of the profit that the business keeps for its use after paying dividends

* Profit margin = profit for the period/revenue x100%

7

New cards

photo of profit and loss statement

8

New cards

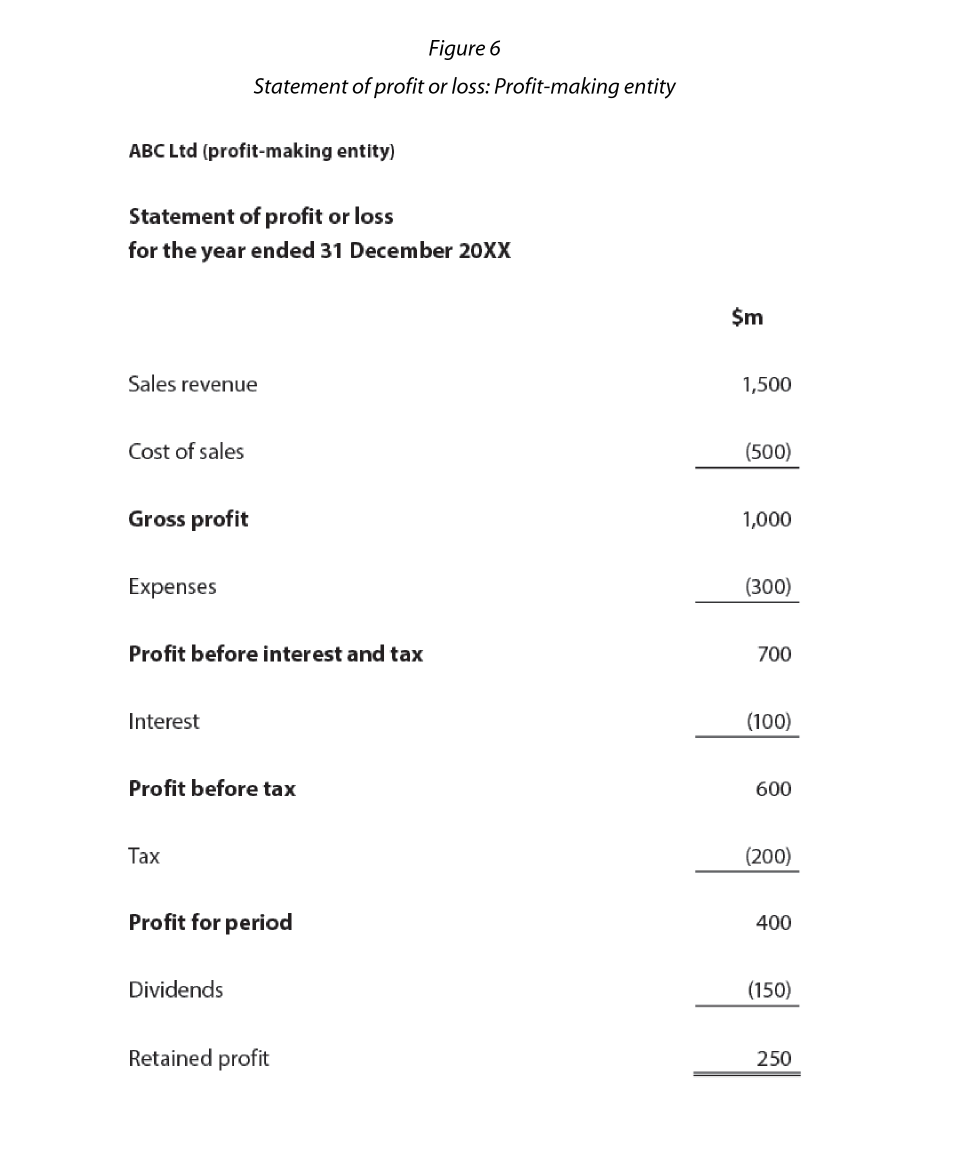

balance sheet/statement of financial position

* They show what a company owns (assets) and what to owes (liabilities)

* A balance sheet always balances

* They are a 'snapshot' of a company's financial position at a specific point in time, such as the end of the financial year. It states the company's assets and liabilities and shareholders' investment or equity in the business

* Assets = liabilities + equity

9

New cards

balance sheet: step 1

* assets: current and non-current

* Non current assets are fixed assets. Something that is a long term asset that a company would not turn to cash

* Tangible - something you can touch

* Plant, property and equipment - vehicles, desks, chairs, land ect..

* Non-tangible - something that you can't touch

* plant, patent and copyright

* Current assets are something that is cash or could be cash in the next 12 months. They are:

* Cash: in hand or in business's bank accounts

* Accounts receivable / debtors/creditor: invoices given to customers that they must pay in cash in the next 30 or 60 days. If something goes bankrupt then they will not recieve the money

* Stock (inventory): unsold goods, raw materials or work-in progress that the company has in hand at the end of the trading period

10

New cards

balance sheet: step 2

* current and non-current (debt)

* Liabilities are all funds owed by the company to financial or other institutions

* Current liabilities (things that will require cash in the next 12 months):

* Bank overdrafts: These relate to situations whereby a business takes out more money from its bank account than it had in deposit, you have to pay it back in the next 12 months

* Short-term loans: These refer to money that the business has borrowed from a bank, which will be paid back over a relatively short period of time, within 12 months

* Trade creditors/ trade payable: These relate to cash that a business owes another business or individual when it has bought goods or services on credit. Something that cash is needed for in the next 12 months

* Non current liabilities: are funds that a business owes individuals and/or institutions that are paid back over a longer period, typically more than 12 months

* borrowing/long term

11

New cards

balance sheet: step 3

* net assets and equity (owed to the shareholders)

* Net assets: they the total assets minus the total liabilities, the value of the net assets should be equal to the value of equity in the business.

* Share capital: the money raised through the sale of shares, owed to share holders

* Retained earnings/profit: the amount of net profit after interest, tax and dividends have been paid, owed to share holders

12

New cards

picture of balance sheet