Exchange rates

1/11

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

12 Terms

exchange rate

price of one currency in terms of another

Central Bank controls the exchange rate system to determine the value of a nations currency

3 main types:

floating

fixed

managed

floating exchange rate system

different currencies can be bought and sold

floating exchange rate - market forces determine the rate at which one currency exchanges for another

if excess demand for currency on forex market, price rises (currency appreciates)

demand comes from foreigners wishing to buy goods from/travel to/save or invest in this country

if excess supply for currency on forex market, price falls (currency depreciates)

citizens of that country wishing buy goods from/travel to/save or invest in foreign countries

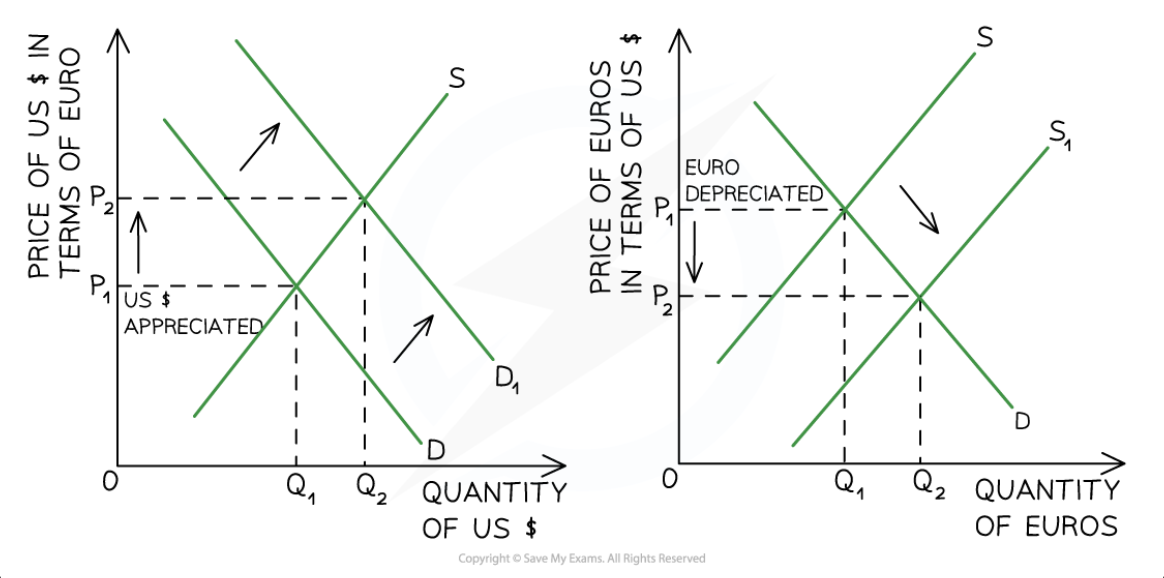

floating exchange rate diagram

initial exchange rate equilibrium at P1Q1 in both markets

Europeans visit USA, demand US dollars and supply euros

increased demand for dollars shifts demand curve to right

dollar appreciates from P1 to P2 in USD market, creating new equilibrium at P2Q2

increased supply of the Euro shifts supply curve to right, value of euro depreciates from P1 to P2

calculation:

fixed exchange rate

involves a commitment by the gov to fix their exchange rate to the value of another currency

central bank intervenes in currency market to fix the exchange rate in relation to another currency

when they want their currency to appreciate, they buy it on forex markets using their reserves, increasing its demand

when they want their currency to depreciate, they sell it on forex markets, increasing its supply

value of currency is “pegged” to the value of another currency

revaluation: gov allows value of currency to rise

devaluation: gov decides to lower value of currency

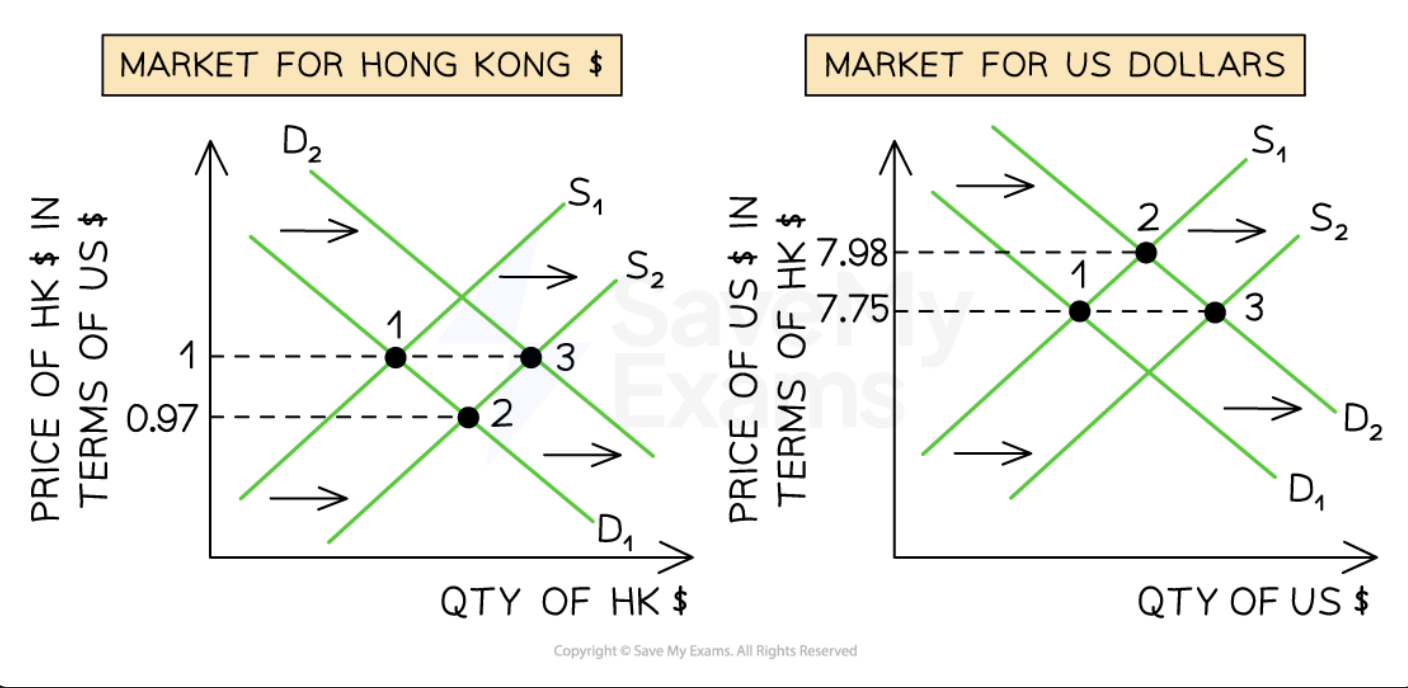

fixed exchange rate diagram

diagram 1: increased supply of HK dollar shifts the supply curve right, depreciating the currency

Central Bank intervenes by buying excess supply of the HK dollar, shifting demand curve to the right

HK dollar now moved back to its target value (fixed rate) of K$ 7.75 = US$ 1

managed exchange rate system

periodic government intervention to influence value of currency

wants to keep rate in a specific range, intervenes if valuation goes beyond it

when they want currency to appreciate: they buy it on forex market increasing demand

when they want it to depreciate: they sell it on forex market, increasing supply

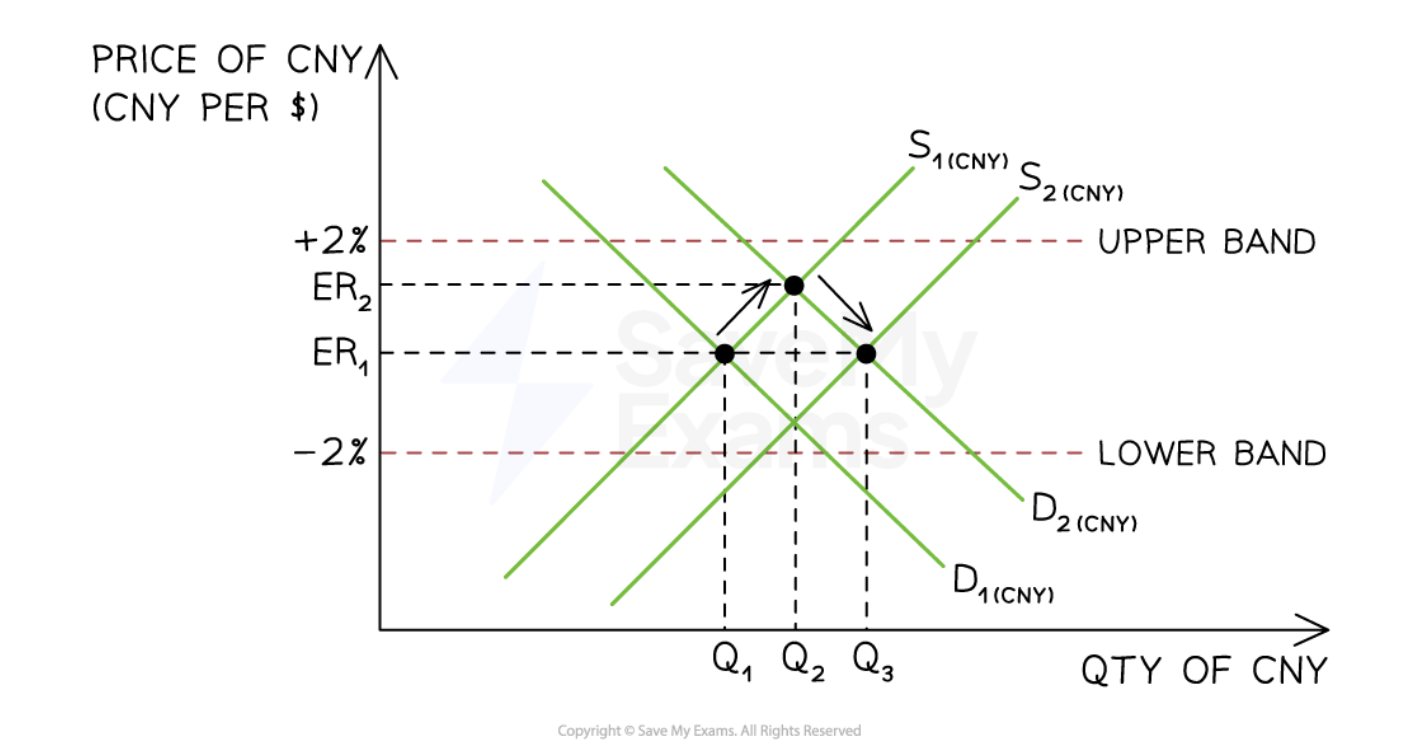

manage exchanged rate diagram

increased demand for chinese yuan leads to right shift in demand curve, causing appreciation

currency is approaching upper band of the margin, so china intervenes and sells its own currency, increasing it’s supply on the forex market

supply curve shifts right, new equilibrium established within the range

overvalued/undervalued currencies

overvalued

when its value is above its equilibrium value in the long run

maintained by the Central Bank (in a managed/fixed system) consistently to keep its value above equilibrium

undervalued

when its value is below its equilibrium value in the long run

maintained by Central Bank (in managed/fixed system) to consistently keep its value below equilibrium value

causes of exchange rate fluctuations

relative interest rates

increase in interest rates = more incentive to save in that country, demand for currency increases, currency appreciates

relative inflation rates

increase in inflation = more expensive exports, less demand for products from foreigners, less demand, currency depreciates

net foreign direct investment

foreigners investing into a country increases demand for currency, currency appreciates

changes in tastes/preferences

global demand for product increases when it becomes trendy, if country specialises in that product their exports increase, demand increases, currency appreciates

current account

increased net exports= appreciation of currency, falling net exports = depreciation

speculation

when traders buy currency in expectation it will be worth more, then sell it to realise a profit

net portfolio investment

portfolio investment into a country increases demand for currency, currency appreciates

remittances

some countries receive high levels of remittances (payments) to keep their currency strong

relative growth rates

countries with strong economic growth rates attract higher rates of foreign investment, currency appreciates

central bank intervention

any form of monetary policy influences exchange rates e.g interest rate fluctuations

consequences of foreign exchange rate fluctuations

current account

depreciation of currency causes exports to be cheaper for foreigners and imports into country to be more expensive

extent to which currency depreciation improves current account balance depends on PED for exports/imports

if PED elastic, depreciation of currency will result in larger than proportional increase in demand for UK exports, improving any current account deficit

economic growth

net exports component of AD

depreciation results in increase in exports leading to economic growth

inflation

cost push inflation can be caused by depreciation of currency, as this increases price of raw imported materials

unemployment

if depreciation leads to increase in exports, unemployment likely to fall as more workers required to produce to keep up w demand

appreciation of currency has opposite effect

living standards

depreciation of currency causes limited impact on living standards

imports become more expensive, households face higher prices and less choice

rising exports can decrease unemployment and increase wages

appreciation isn’t much better

exports decrease, increasing unemployment

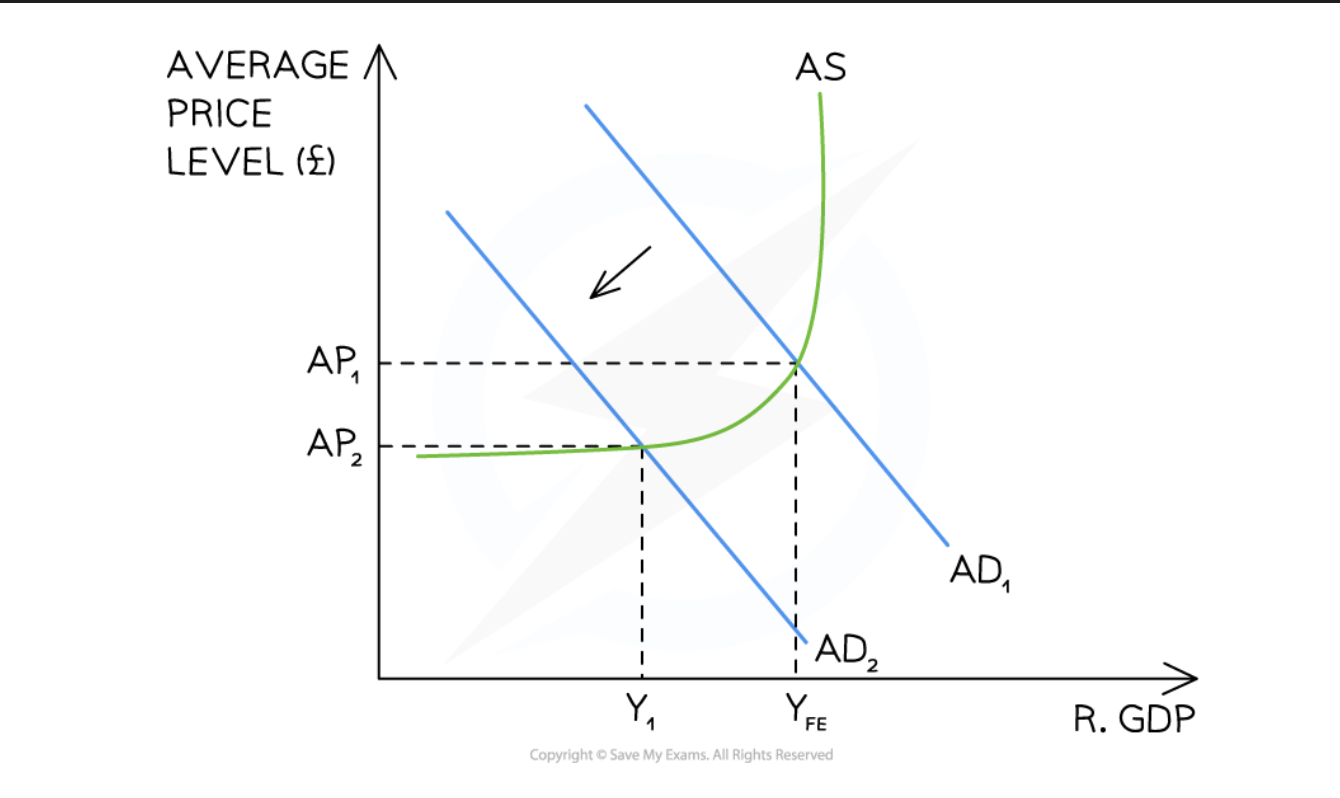

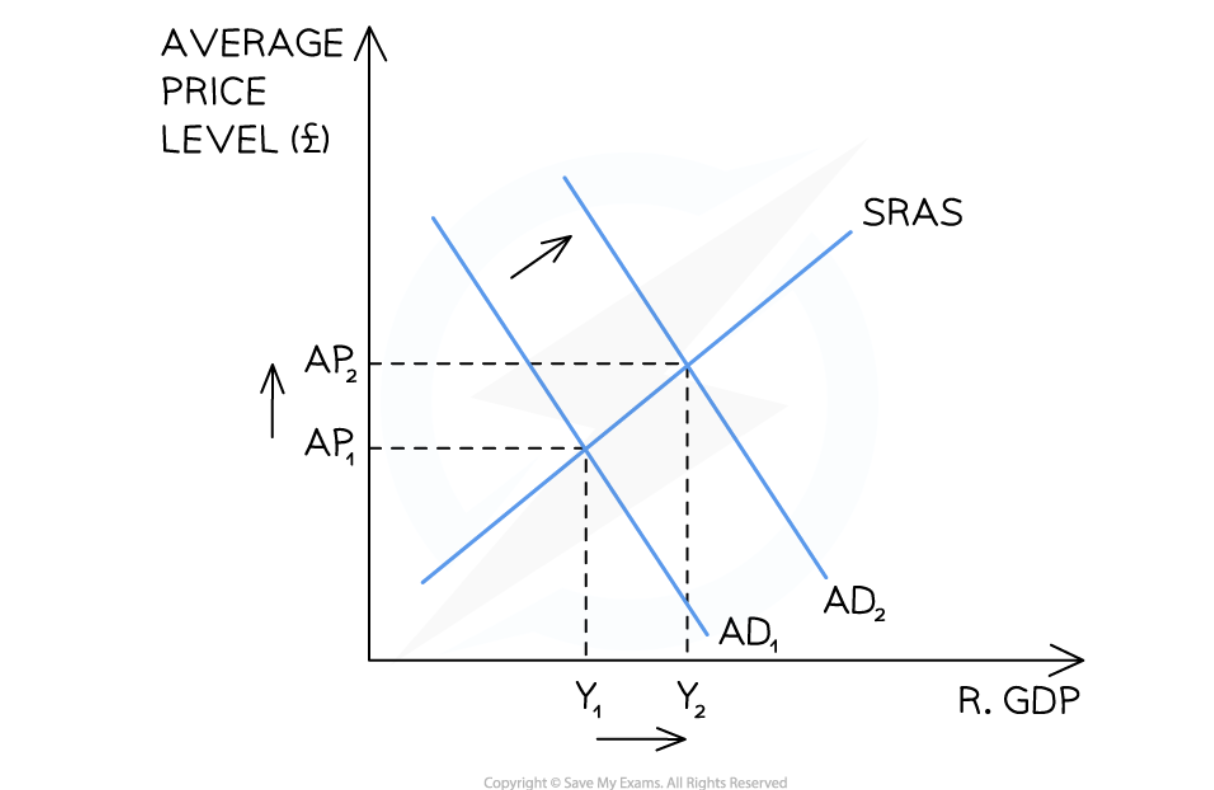

macroeconomic effect of currency depreciation

macroeconomic effect of currency appreciation