Money and Banking Chapters 5,7,11 and 12

0.0(0)

0.0(0)

Card Sorting

1/91

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

92 Terms

1

New cards

Risk

A measure of uncertainty about the future payoff to an investment, assessed over some time horizon and relative to a benchmark.

2

New cards

How do we use risk to measure

We can compare two investments, see which one is riskier and by how much

3

New cards

How does risk arise?

Uncertainty about the future

4

New cards

real interest rate

nominal interest rate minus expected inflation

5

New cards

Probability theory

considering any uncertainty, we must list all the possible outcomes and then figure out the chance of each one occurring

6

New cards

How do we express a probability?

A number between 0-1. 1 being certain and 0 being definitely will not happen. All probable outcomes must add up to 1.

7

New cards

Expected Value

Expected Value = Sum of (Probability x Payoff)

8

New cards

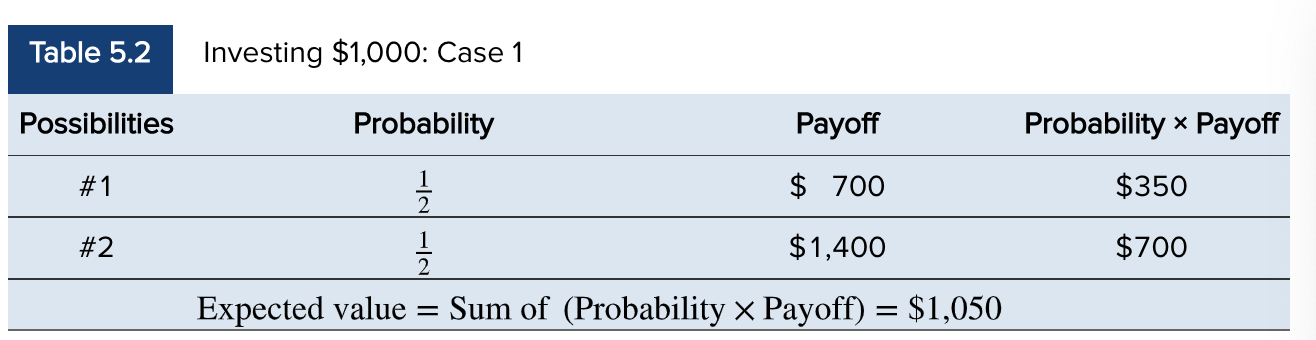

You purchase a stock for $1000. It is equally likely to fall to $700 as it is to increase to $1400, so what is the expected value?

700 x 0.5 = 350

1400 x 0.5 = 700

Expected value = $1050

1400 x 0.5 = 700

Expected value = $1050

9

New cards

What is the flaw in that case?

The payoff will not be 1050. Since it is only being done once, it will be wither 700 or 1400.

10

New cards

What is average payoff?

When an investment is made multiple times so the expected value payoff is actualized.

11

New cards

What is the expected return?

The expected value - investment value.

$1050-$1000 = $50

Written as a percent, so 5%

$1050-$1000 = $50

Written as a percent, so 5%

12

New cards

Risk-free asset

An investment whose future value is known with certainty and whose return is the risk free rate of return.

13

New cards

Examples of measuring risk by quantifying the spread among an investment's possible outcomes.

Standard deviation- Measure of spread

Value at risk - a measure of the riskiness of the worst case

Value at risk - a measure of the riskiness of the worst case

14

New cards

risk premium

the expected return minus the risk-free rate of return; the payment to the buyer of an asset for taking on risk

15

New cards

idiosyncratic risks

risks unique to a select few

16

New cards

systematic risks

economywide risks that affect everyone

17

New cards

Two kinds of idiosyncratic risk

Ones that only affect certain people,

One that affect certain industries, like oil on cars

One that affect certain industries, like oil on cars

18

New cards

Two methods of diversification

Spread assets along many investments

Hedging

Hedging

19

New cards

Hedging

Reducing idiosyncratic risk by making two investments with opposing risks.

20

New cards

Interest rate spreads

The simultaneous increase in some interest rates and decline in others.

The difference between the interest rate a bank receives on its assets and the interest rate it pays to obtain liabilities.

The difference between the interest rate a bank receives on its assets and the interest rate it pays to obtain liabilities.

21

New cards

Two bond rating firms

Moodys

Standard and Poors

Standard and Poors

22

New cards

What are the label of bonds with an investment grade rating?

AAA, AA, A, BBB (BAA for Moodys) Examples are J&J, JPM Chase, Google

23

New cards

What are the label of noninvestment, speculative grade bonds?

BB, B

Ex. Brazil, Greece, Kenya

Many firms may not be allowed to invest in these

Ex. Brazil, Greece, Kenya

Many firms may not be allowed to invest in these

24

New cards

What are the label of highly speculative grade bonds?

CCC, CC, C, D

Ex. Venezuela

Ex. Venezuela

25

New cards

What percent of bonds have a ratings upgrade or downgrade yearly?

2-3% upgrade

2-3% downgrade

2-3% downgrade

26

New cards

Commercial paper

Short-term, privately issued zero-coupon debt that is low risk and very liquid and usually has a maturity of less than 270 days.

27

New cards

Who holds one third of all commerical paper?

Money-market mutual funds.

28

New cards

prime grade commercial paper

commercial paper with a low risk of default

29

New cards

benchmark bond

A low-risk bond, usually a U.S. Treasury bond, to which the yield on a risky bond is compared to assess its risk.

30

New cards

Spread over treasuries (risk spread)

The difference between the yield on a bond and that on a U.S. Treasury with the same time to maturity; a measure of the riskiness of the bond.

31

New cards

risk spread

The yield over and above that on a low-risk bond such as a U.S. Treasury with the same time to maturity, it is a measure of the compensation investors require for the risk they are bearing. Also called a default risk premium

32

New cards

Bond yield =

Bond yield = U.S Treasury yield +default-risk premium

33

New cards

When treasury yields move...

All yields move with them

34

New cards

The yield on a U.S treasury bond will be lower or higher than that of a Moodys AAA yield?

Lower, Treasury bonds are consistently the lowest

35

New cards

Are the yields higher on a Moodys AAA bond or a BAA bond?

BAA, risk requires compensation

36

New cards

Default risk is one factor that affects the return on a bond, what is another imporant one?

Taxes. Bondholders must pay income tax on the interest income they receive.

37

New cards

Taxable bond

A bond whose coupon payments are not exempt from income tax.

38

New cards

Municipal bonds

Also called tax-exempt bonds.

Bonds issued by state and local governments to finance public projects; the coupon payments are exempt from federal and state income taxes.

Bonds issued by state and local governments to finance public projects; the coupon payments are exempt from federal and state income taxes.

39

New cards

How do you calculate after tax yield?

Add the coupon yield, to face value, and subtract taxes.

The yield will reflect the difference in the final payment and how much you were taxed.

(100 face value, plus 6 dollar coupon)

30% taxation

6/.3 =1.8

106-1.8=4.2

4.2% yield

6% coupon rate

The yield will reflect the difference in the final payment and how much you were taxed.

(100 face value, plus 6 dollar coupon)

30% taxation

6/.3 =1.8

106-1.8=4.2

4.2% yield

6% coupon rate

40

New cards

Tax-exempt bond yield =

Tax-exempt bond yield = (taxable bond yield) x 1(-tax rate)

41

New cards

term structure of interest rates

The relationship among bonds with the same risk characteristics but different maturities.

(Same tax status and default risk)

(Same tax status and default risk)

42

New cards

Yields on short term bonds are more or less volatile than yields on long term bonds?

More

43

New cards

Long term yields in comparison to short term yields are higher or lower

long term yields are higher than short term yields

44

New cards

expectations hypothesis of term structure

The proposition that long-term interest rates are the average of expected future short-term interest rates. (short+short+short=long)

45

New cards

what is the logic behind the expectations hypothesis?

when interest rates are expected to rise in the future, long-term interest rates will be high than short-term interest rates.

46

New cards

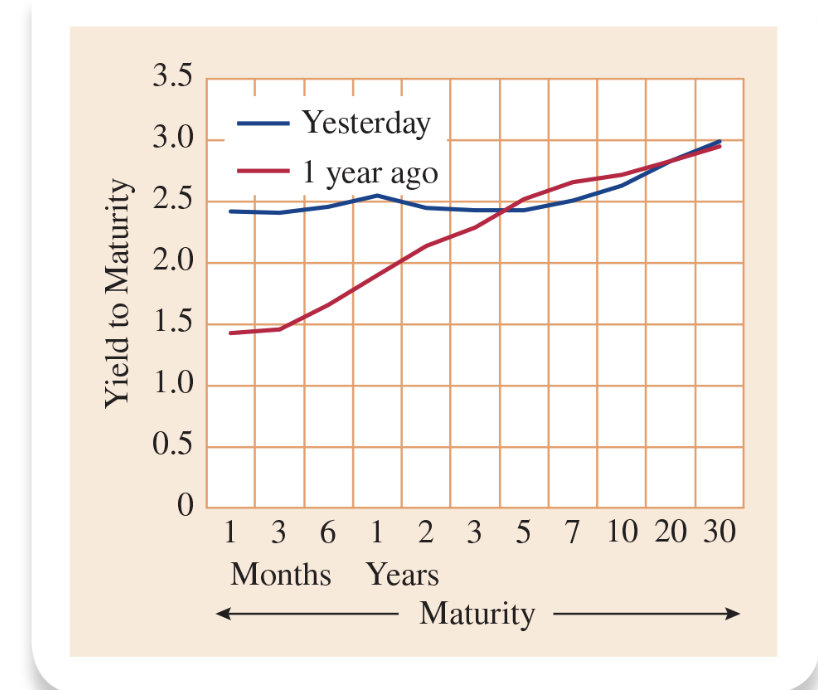

yield curve

A plot showing the yields to maturity of different bonds of the same riskiness against the time to maturity.

47

New cards

If interest rates are expected to rise in the future yield to maturity is expected to...

Is expected to slope up and rise

48

New cards

If interest rates are expected to remain unchanged in the future yield to maturity is expected to...

stay flat

49

New cards

If interest rates are expected to fall in the future yield to maturity is expected to...

slope down, ytm falls

50

New cards

How do you calculate the yield of a one year interest bond today

i(1t)

i=interest

t=time (today)

i=interest

t=time (today)

51

New cards

How do you calculate the yield of a one year interest bond one year from now?

ie (1t+1)

ie=EXPECTED interest

1t+1 is one year from now

ie=EXPECTED interest

1t+1 is one year from now

52

New cards

How do you calculate the yield of a one year interest bond two years from now?

ie (1t+2)

ie=EXPECTED interest

1t+2 is two years from now

ie=EXPECTED interest

1t+2 is two years from now

53

New cards

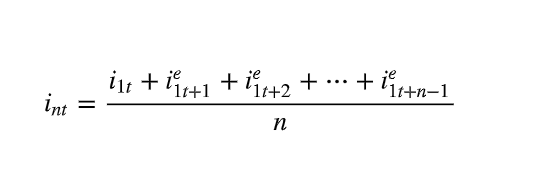

How can we calculate the value of three one year bonds in consecutive years? (expectations hypothesis)

i3t = i(1t) + ie(1t+1) + i (1t+2)/3

This essentially finds the average interest rate between the three,

This essentially finds the average interest rate between the three,

54

New cards

Expectations hypothesis format

the interest rate on a bond with n years to maturity is the average of n expected future one year interest rates.

55

New cards

What can the expectations hypotheis explain and what can it not explain?

It can explain that interest rates of different maturities will move together

It can explain that yields on short term bonds are more volatile than yields on long term bonds

It cannot explain why long-term yields are higher than short term yields.

It can explain that yields on short term bonds are more volatile than yields on long term bonds

It cannot explain why long-term yields are higher than short term yields.

56

New cards

How does expectations hypothesis show that interest rates of different maturities will move together

If a current one year interest rate changes, both short term and long term bonds will move.

57

New cards

How does expectations theory explain that yields on short term bonds are more volatile than yields on long term bonds

Because long-term bonds are averages of a sequence of expected short-term rates.

58

New cards

Why cant expectations theory explain why long-term yields are higher than short-term yields.

Because the yield curve slopes up only when interest rates are expected to rise

59

New cards

Why are default free bonds risky

inflation and future interest rates

60

New cards

Why are long term bond interest rates higher than short term interest rates?

Because the risk is higher with inflation rates and future interest rates.

61

New cards

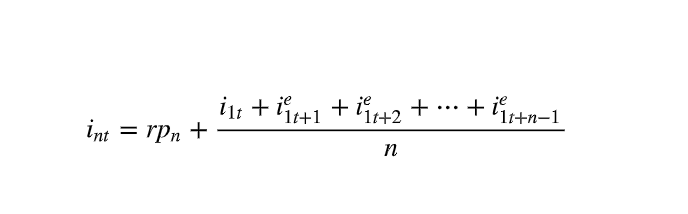

Liquidity premium theory of the term structure

The proposition that long-term interest rates equal the average of expected short-term interest rates plus a risk premium that rises with the time to maturity.

62

New cards

Liquidity premium theory long term bond yield equation

i(nt) = rp(n) + expectation hypothesis

rp=risk premium

n=amount of years

rp=risk premium

n=amount of years

63

New cards

inverted yield curve

The rare occasion when short-term interest rates exceed long-term yields.

In this case the yield curve slopes downward as opposed to upwards.

In this case the yield curve slopes downward as opposed to upwards.

64

New cards

What does an inverted yield curve predict

a rise in interest rates and an economic downturn

65

New cards

term spread

The gap between yields to maturity on a long- and a short-term bond (usually free of default risk);

66

New cards

What is the relationship between term spread and GDP growth

When the term spread falls, GDP growth tends to fall somewhat later

67

New cards

When they do their job well, financial intermediaries

increase investment and economic growth at the same time that they reduce investment risk and economic volatility

68

New cards

two costs of lending and borrowing

transaction costs and information costs

financial institutions exist to reduce these costs

financial institutions exist to reduce these costs

69

New cards

Five functions of financial institutions as financial intermediaries

1- Pooling savings

2- Safekeeping and accounting

3-Providing liquidity

4- Diversifying risk

5- Collecting and processing information services

2- Safekeeping and accounting

3-Providing liquidity

4- Diversifying risk

5- Collecting and processing information services

70

New cards

comparative advantage leads to

specialization so that each of us ends up doing one job and being paid in some form of money

71

New cards

What do financial intermediaries take advantage of to reduce costs

economies of scale, where the price of a good or service falls as the quantity produced increases

(writing individual legal contracts would be costly)

(writing individual legal contracts would be costly)

72

New cards

information asymmetry

borrowers have information that lenders dont

73

New cards

Adverse Selection

The problem of distinguishing a good risk from a bad one before making a loan or providing insurance; it is caused by asymmetric information. (Seeing if they have good credit)

74

New cards

Moral hazard

The risk that a borrower or someone who is insured will behave in a way that is not in the interest of the lender or insurer; also caused by information asymmetry.

\

(Taking greater risk for greater reward)

\

(Taking greater risk for greater reward)

75

New cards

What is Akerlofs "Lemon" Theory

Two 2017 Honda Accords

One in bad shape for 8k, one in good shape for 20k

buyer doesnt know which is which

buyer will only pay average of 15k

This causes the expensive car to be taken off the market

Only the 8k "lemon" remains

outdated in the present

One in bad shape for 8k, one in good shape for 20k

buyer doesnt know which is which

buyer will only pay average of 15k

This causes the expensive car to be taken off the market

Only the 8k "lemon" remains

outdated in the present

76

New cards

How do you solve the hidden attributes problem

disclosure of information

77

New cards

Depository institution

A financial institution that accepts deposits and makes loans.

78

New cards

nondepository institution

A financial intermediary that does not issue deposit liabilities. (insurance is the biggest one)

79

New cards

what differentiates depository and nondepository institutions?

their primary source of funds, liability side of the balance sheet

80

New cards

A banks balance sheet says

Total bank assets = Total bank liabilities + Bank capital

81

New cards

3 types of cash assets

Reserves (Vault cas)

Cash items in process of collection

Cash items in process of collection

82

New cards

They hold it, they want liquidity

83

New cards

Four broad categories of assets

Cash, securities, loans, and all other assets

84

New cards

What percent of a banks holdings are securities

around 20%

85

New cards

What is the primary asset of banks?

Loans

86

New cards

Why did banks invest more in real estate before 2007-2009?

Mortgage Backed securities

87

New cards

Commercial banks make loans to

buisnesses

88

New cards

credit unions specialize in

consumer loans

89

New cards

Two types of deposit accounts

Transaction, and nontransaction

90

New cards

Nontransaction deposits

savings and time deposits.

Also knows as passbook savings accoiunts and Certificates of deposit.

Also knows as passbook savings accoiunts and Certificates of deposit.

91

New cards

liquidity risk

The risk that a financial institution’s liability holders will suddenly seek to cash in their claims; for a bank this is the risk that depositors will unexpectedly withdraw deposit balances.

92

New cards

interest rate risk

1. The risk that the interest rate will change, causing the price of a bond to change with it. (6) 2. The risk that changes in interest rates will affect a financial intermediary’s net worth. It arises from a mismatch in the maturity of assets and liabilities.