Managerial Accounting Ch. 2

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

How do manufacturing companies use job order and process costing systems: Cost accounting system

Used to accumulate product cost info, management would rely on how much it costs us to produce each unit of product.

How do manufacturing companies use job order and process costing systems: Job order costing system

Companies like accounting firm, health care providers, building contractors, and custom furniture manufactures←Unique products or specialized services

How do manufacturing companies use job order and process costing systems: Which produces unit through a series of production steps or processes— Process costing system

Soft drink companies, surfboard manufacturing company and food processing company.

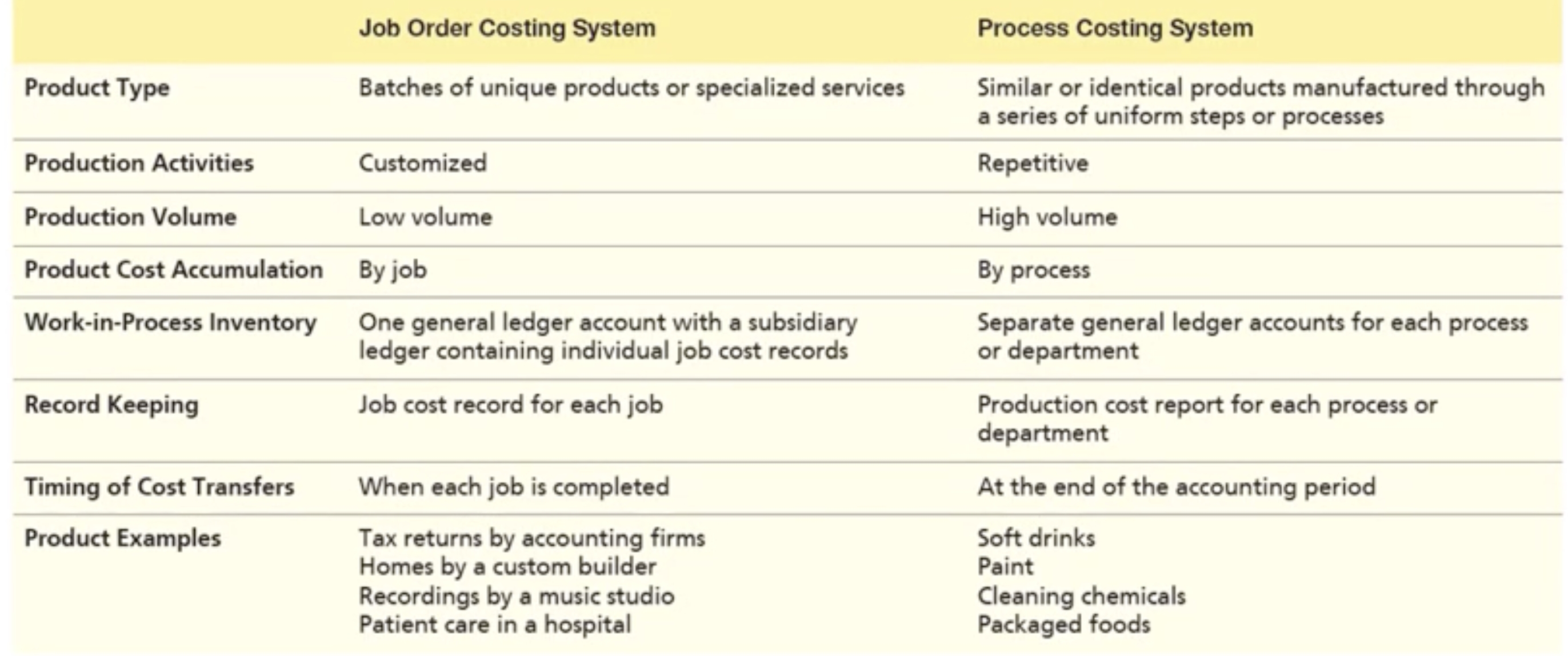

How do manufacturing companies use job order and process costing systems: Diff between job order system and processing costing system

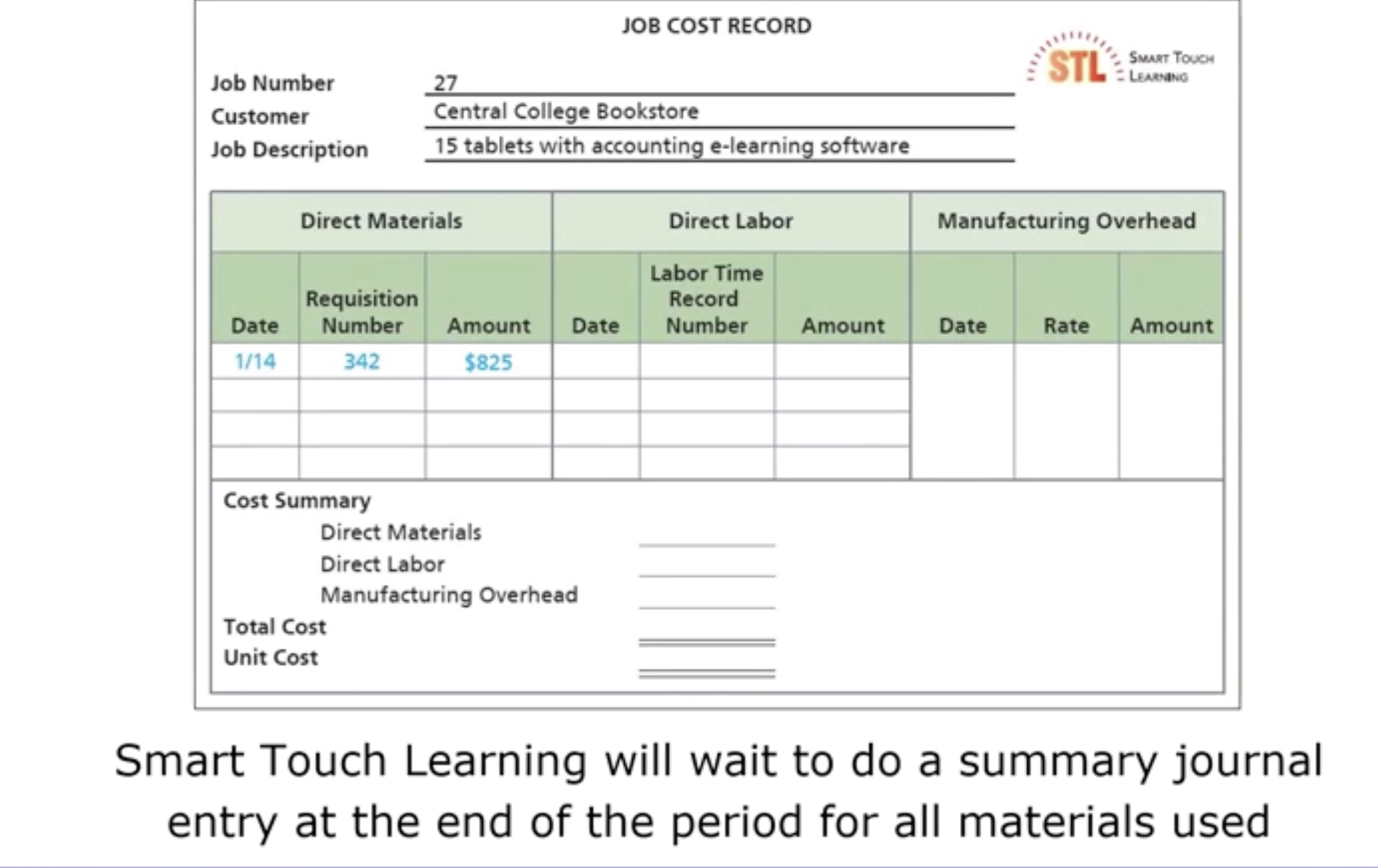

How do materials and labor costs flow through the job order costing system: Job Cost Record

A document that shows the direct materials, direct labor and manufacturing overhead costs for ana individual job

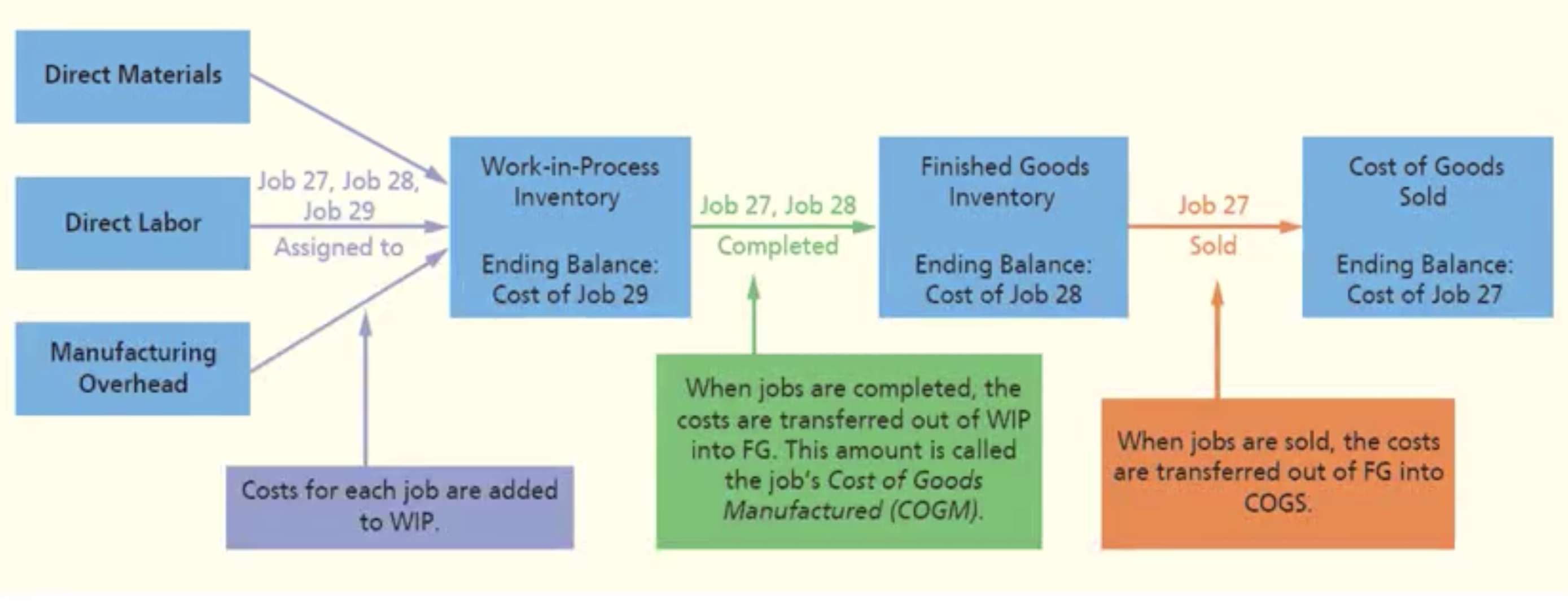

How do materials and labor costs flow through the job order costing system: Flow of product costs in Job order costing

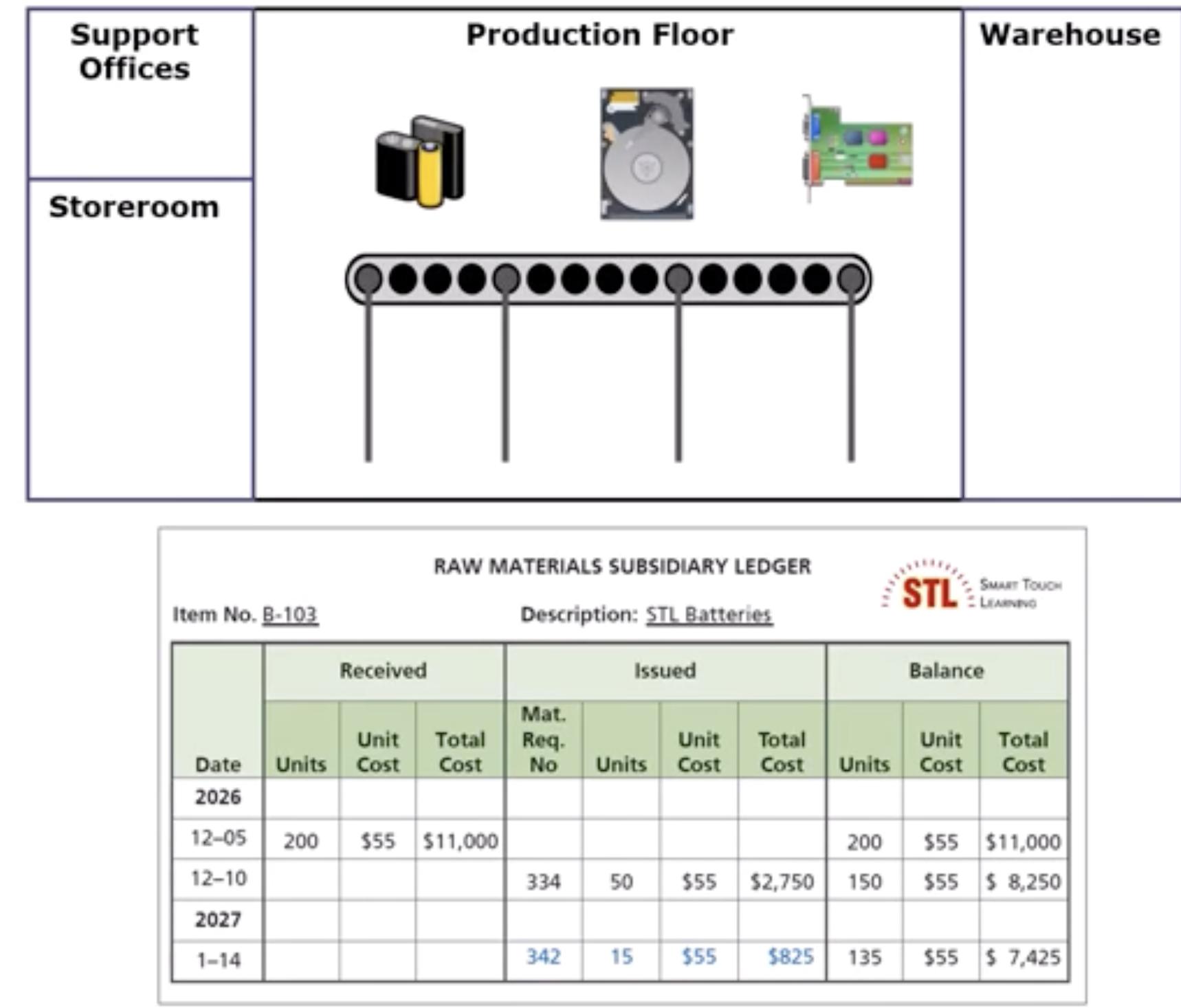

How do materials and labor costs flow through the job order costing system: Raw materials Subsidiary ledger

A separate record for each type of material

(Allows for better control of inventory)

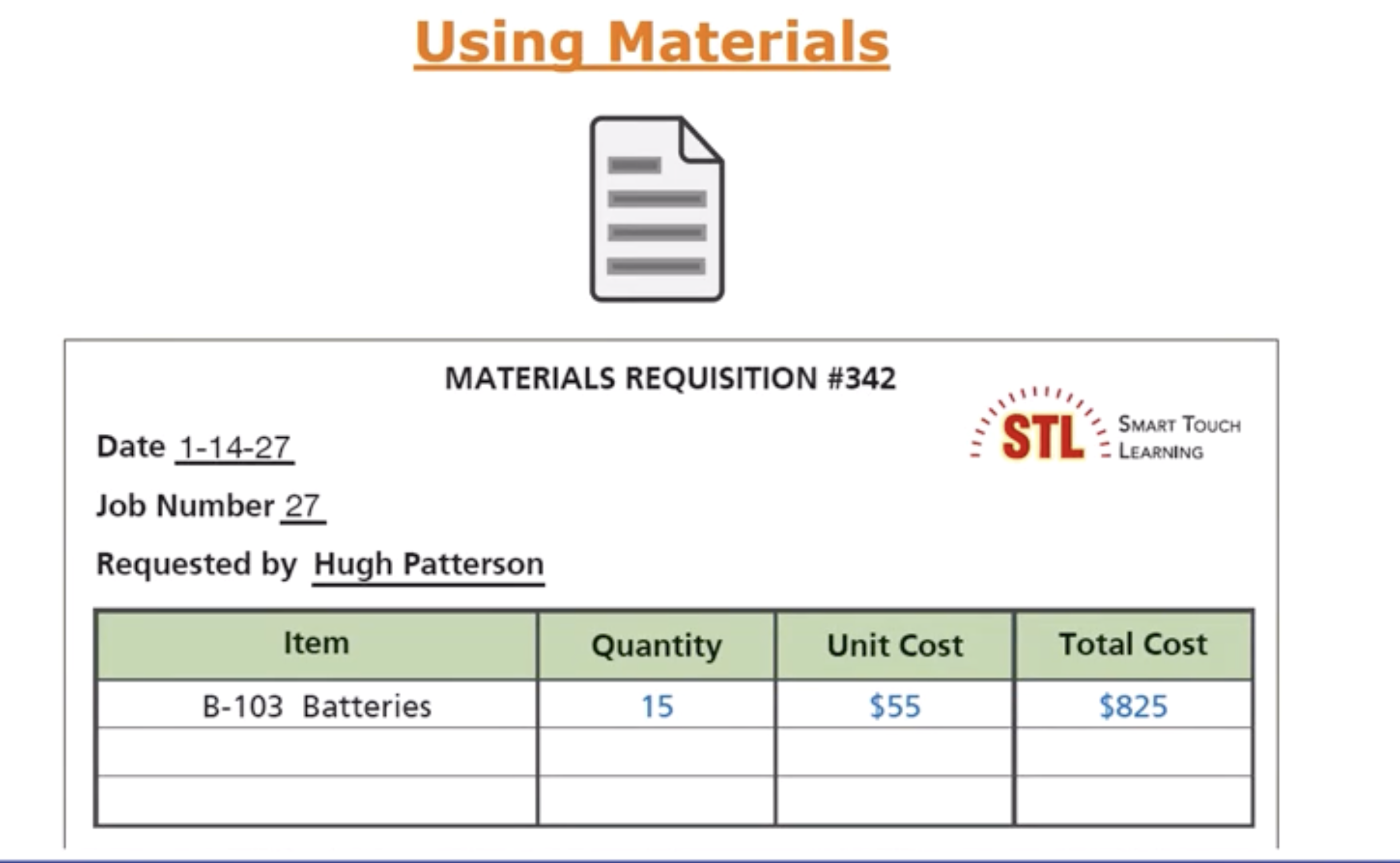

How do materials and labor costs flow through the job order costing system: Materials requisition

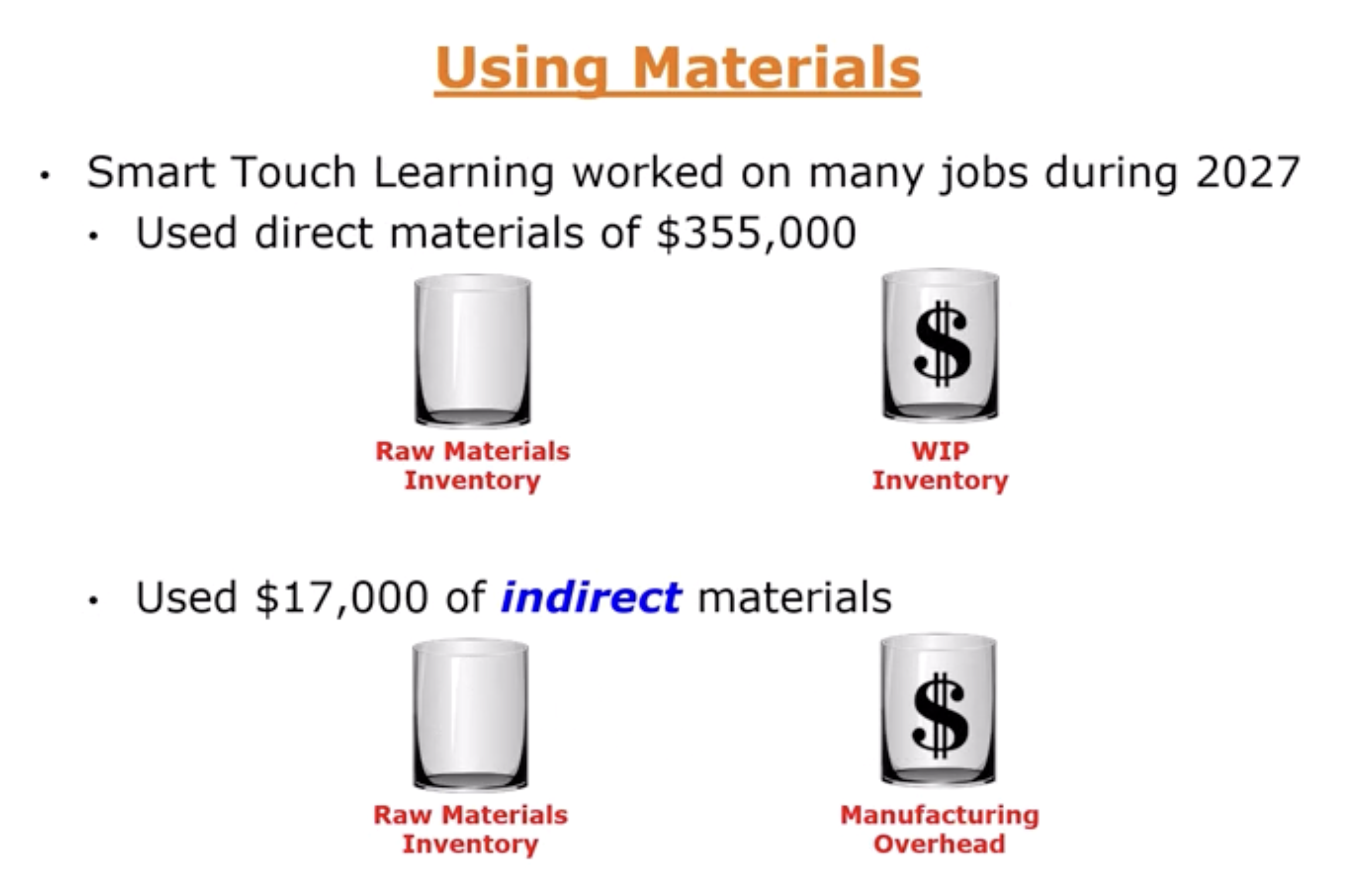

How do materials and labor costs flow through the job order costing system: Smart TL will wait?

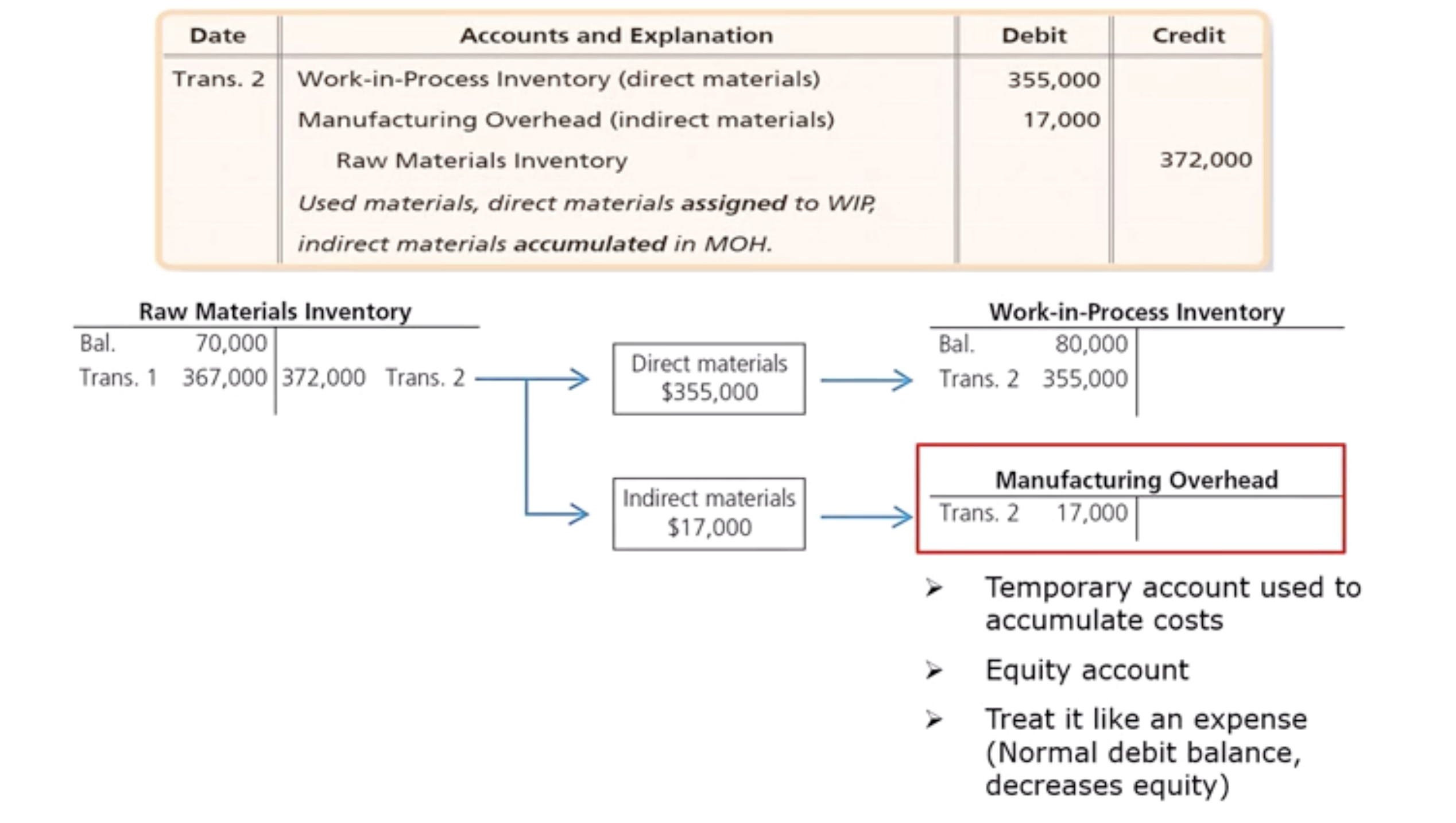

How do materials and labor costs flow through the job order costing system:

Find the summary journal for this problem?

How do materials and labor costs flow through the job order costing system: Labor time record

A record used in a manual system to assign direct labor costs to specific jobs

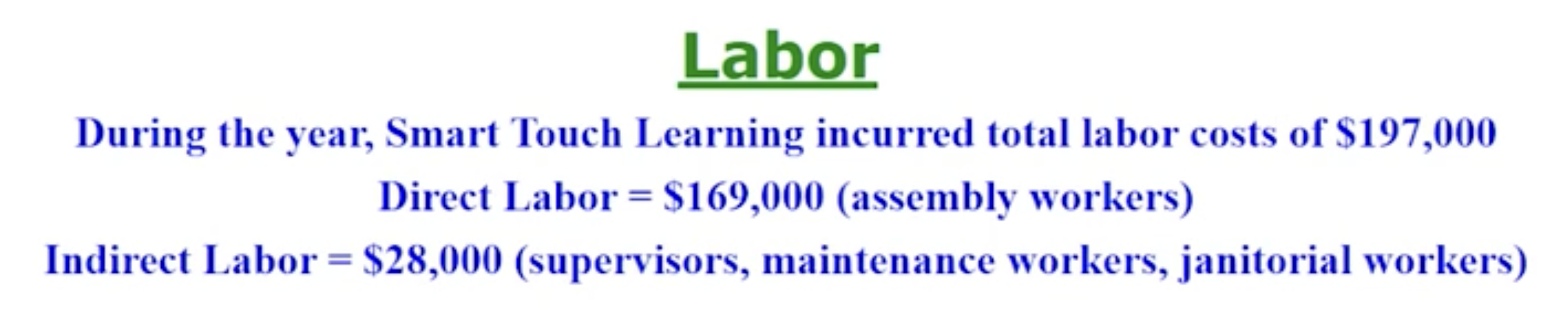

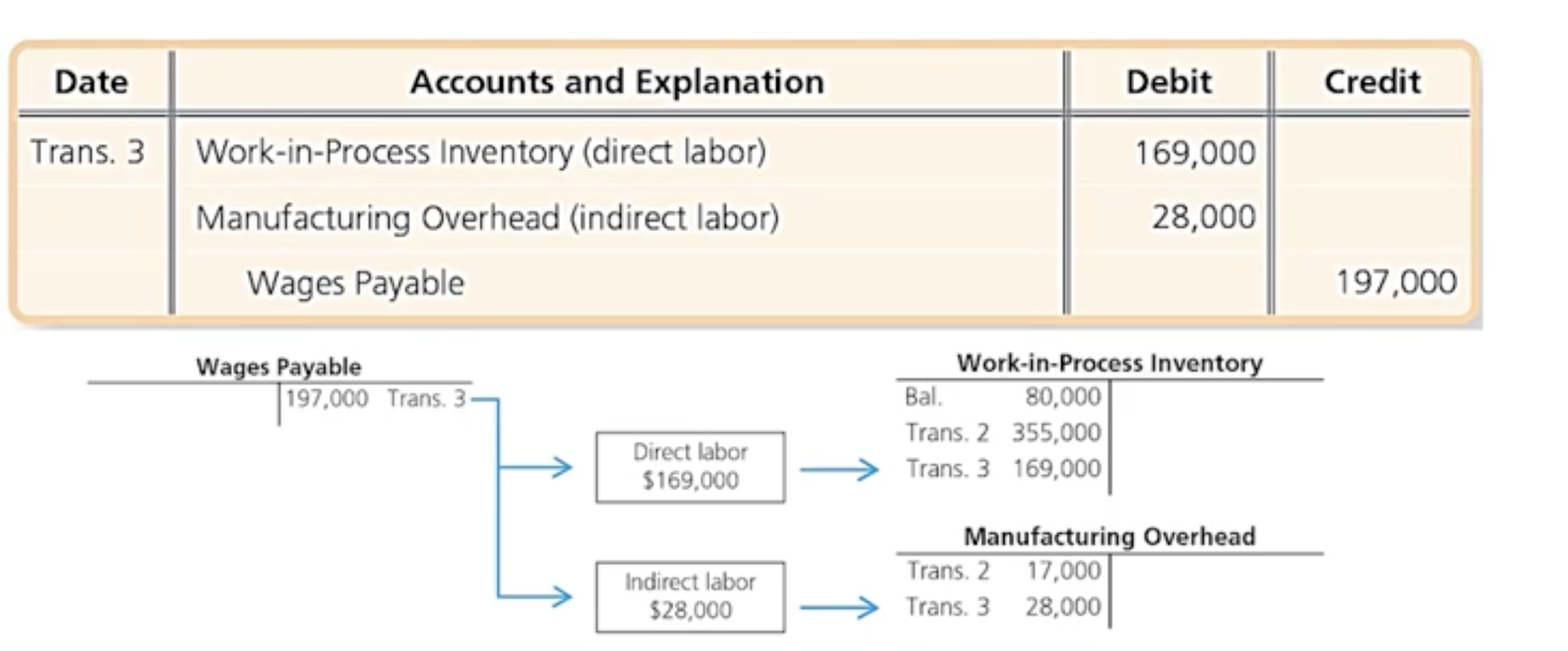

How do materials and labor costs flow through the job order costing system:

Match the example to journal

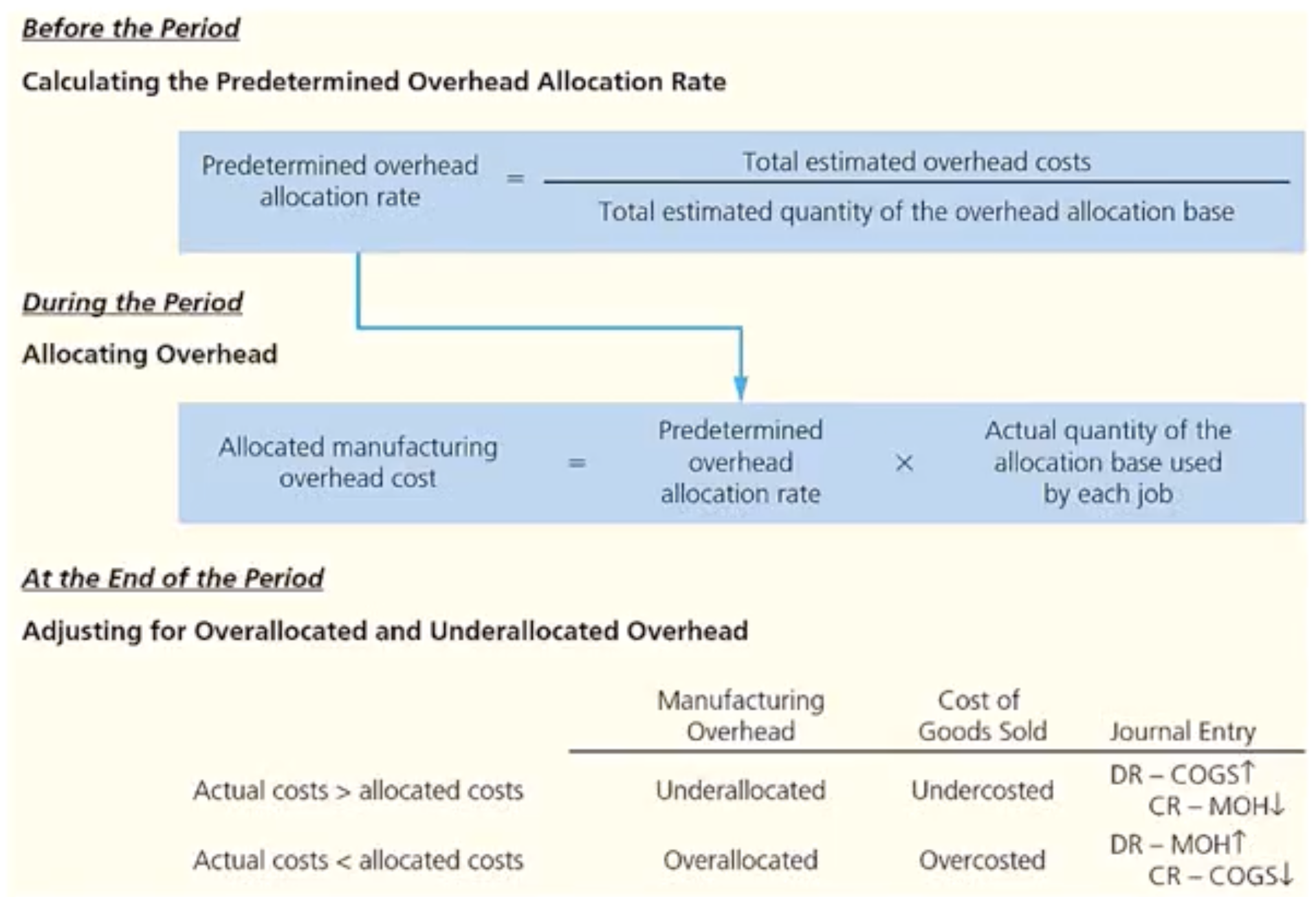

How do overhead costs flow through the job order costing system: 3 step process for all allocating overhead costs to specific jobs

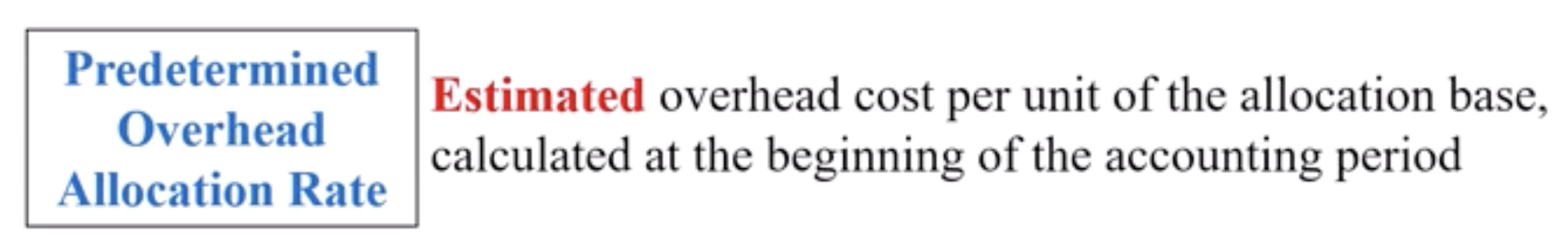

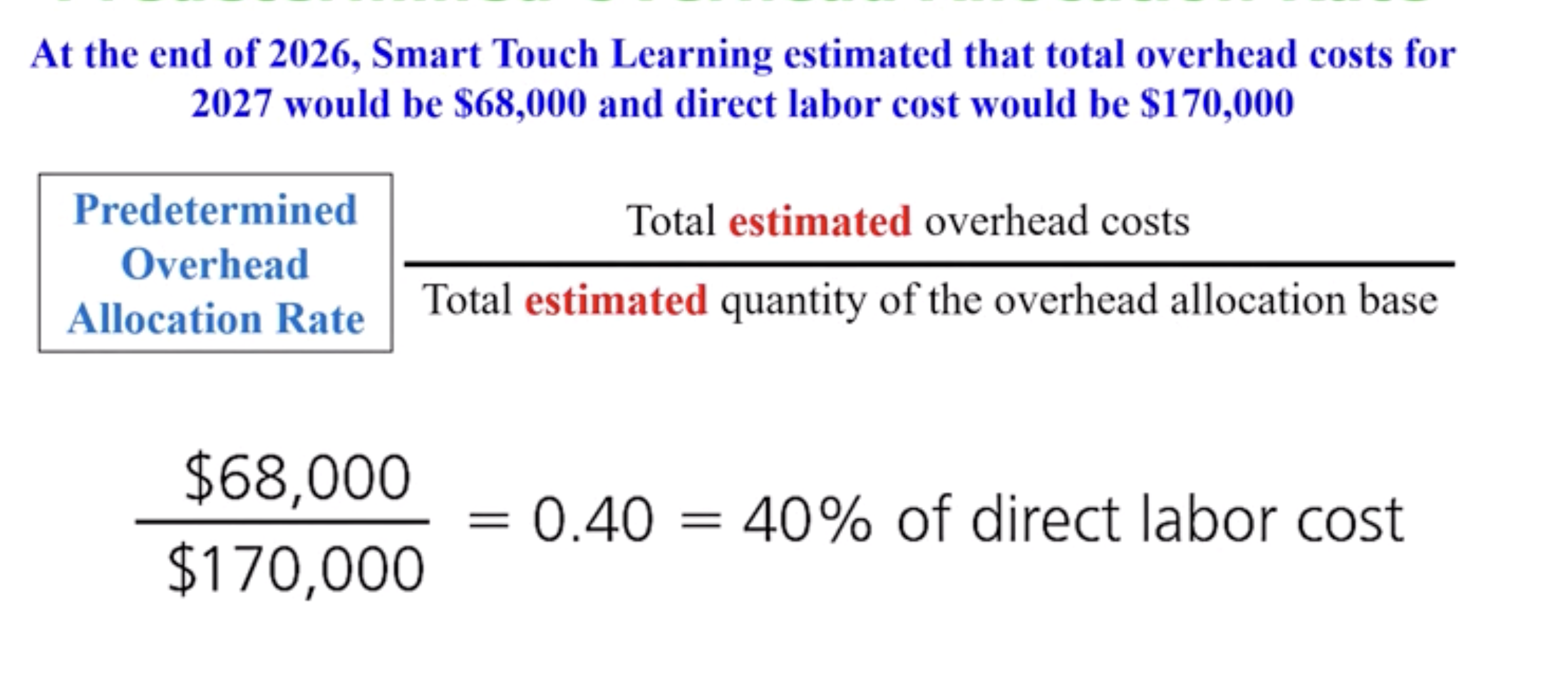

How do overhead costs flow through the job order costing system: Step 1. Calculating the predetermined overhead allocation rate before the period begins

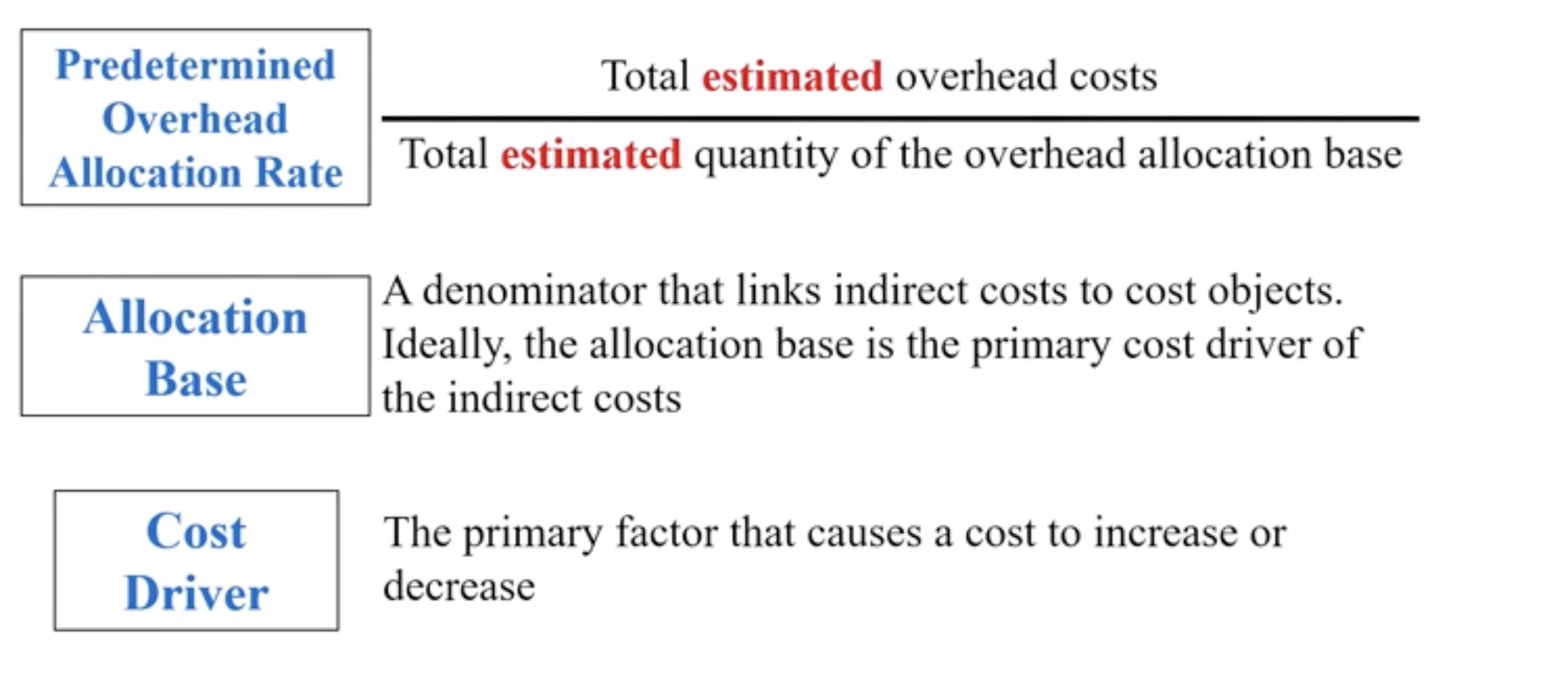

How do overhead costs flow through the job order costing system: Step 2. Allocating overhead during the period example

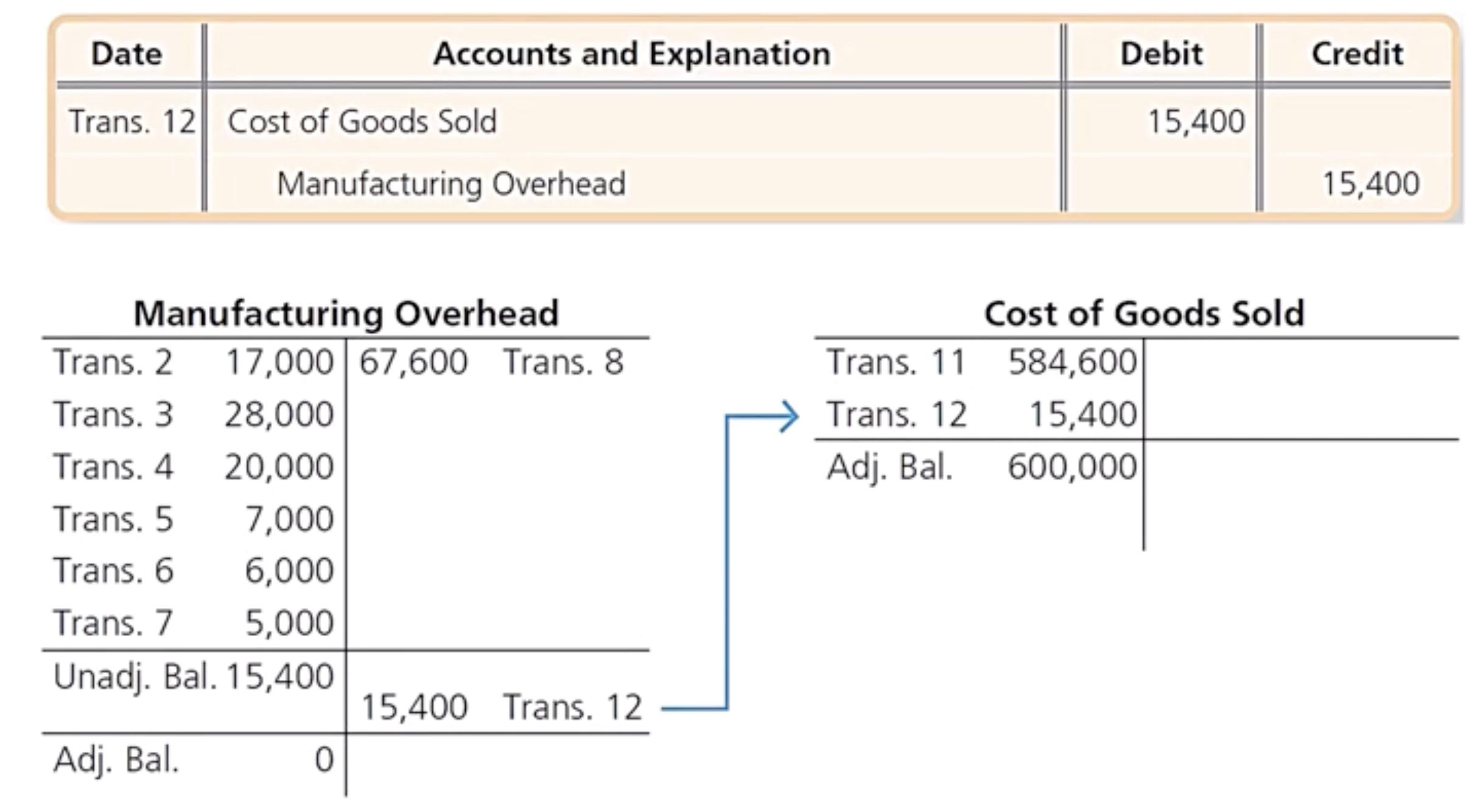

How do overhead costs flow through the job order costing system: Step 3. Adjusting overhead at the end of the period example

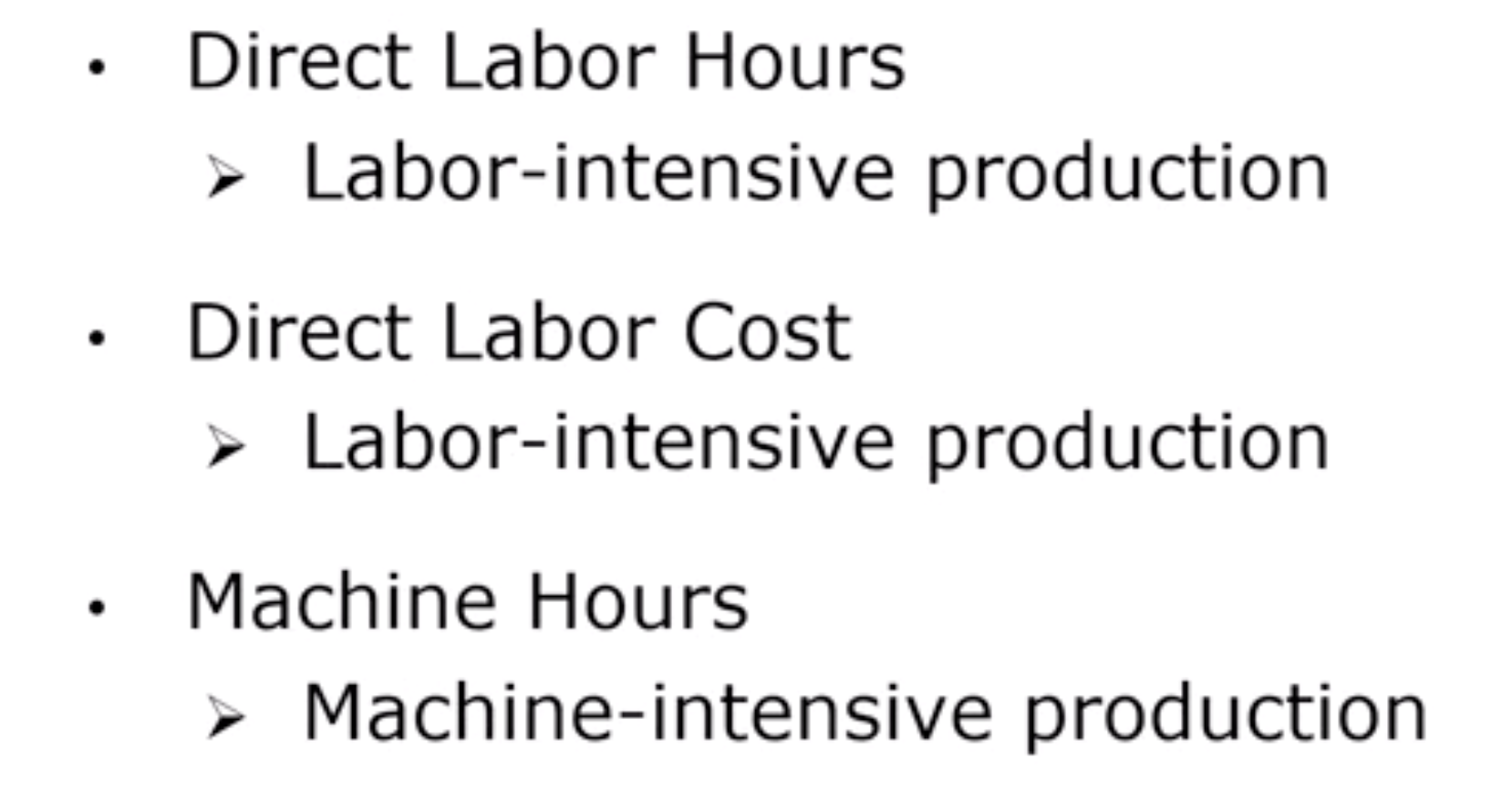

How do overhead costs flow through the job order costing system: Traditional cost driver

How do overhead costs flow through the job order costing system: Step 1. Calculating the predetermined overhead allocation rate before the period begins example

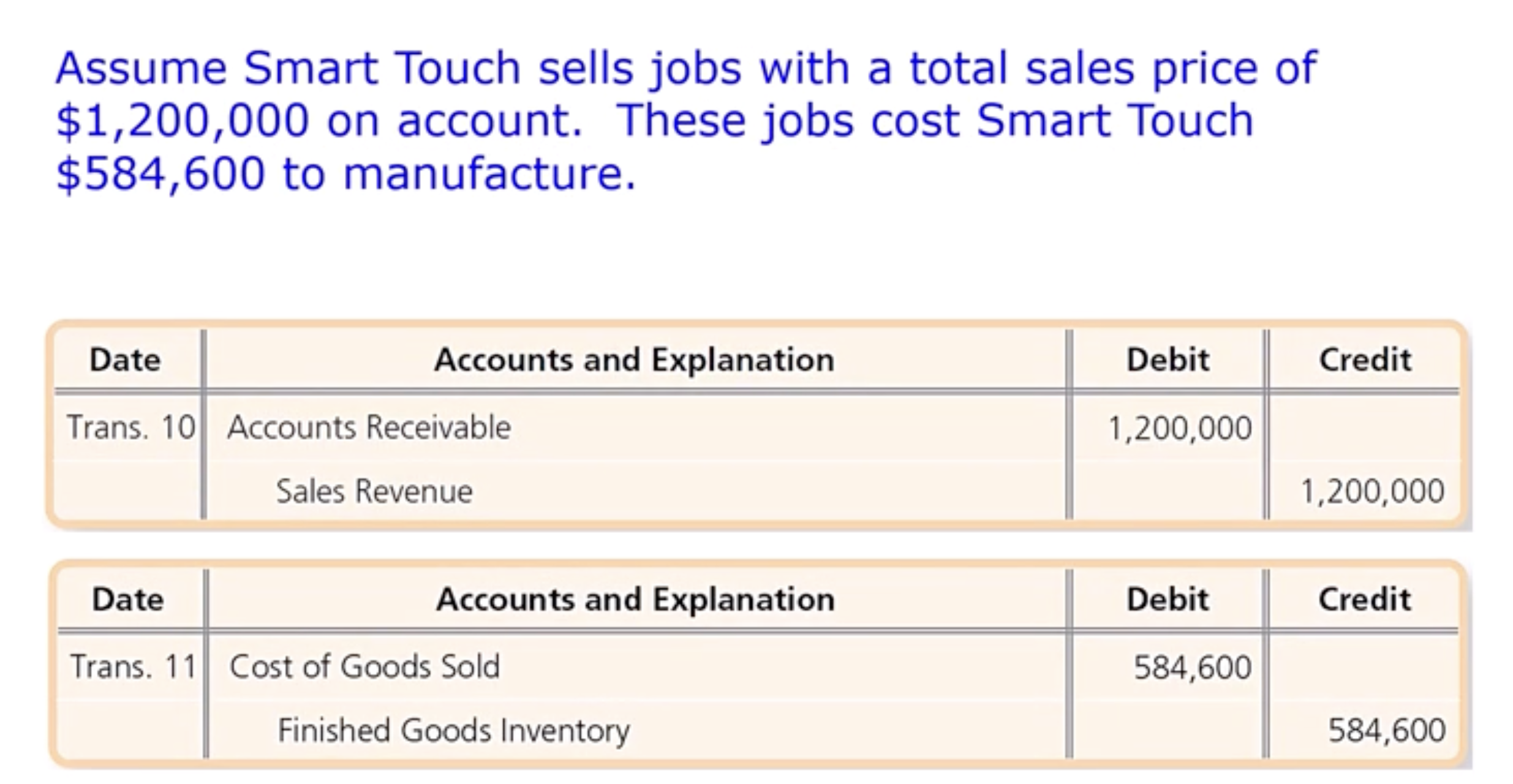

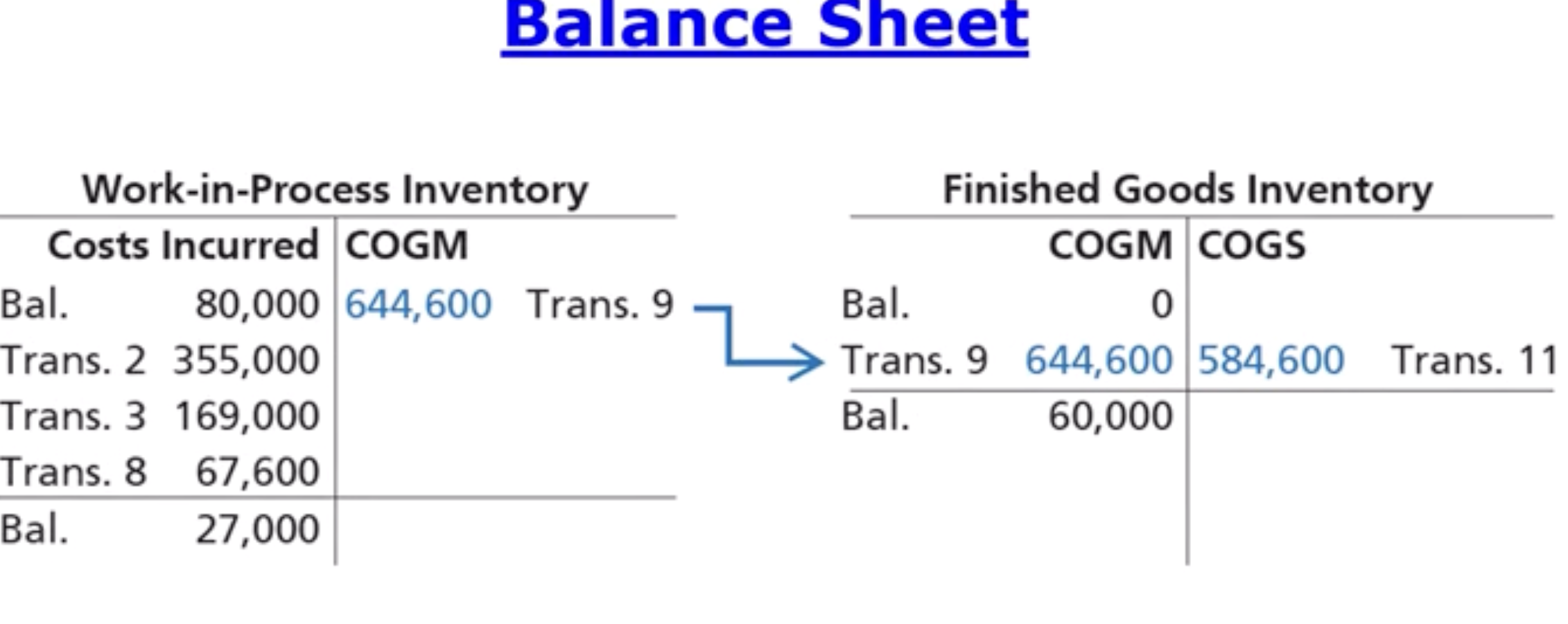

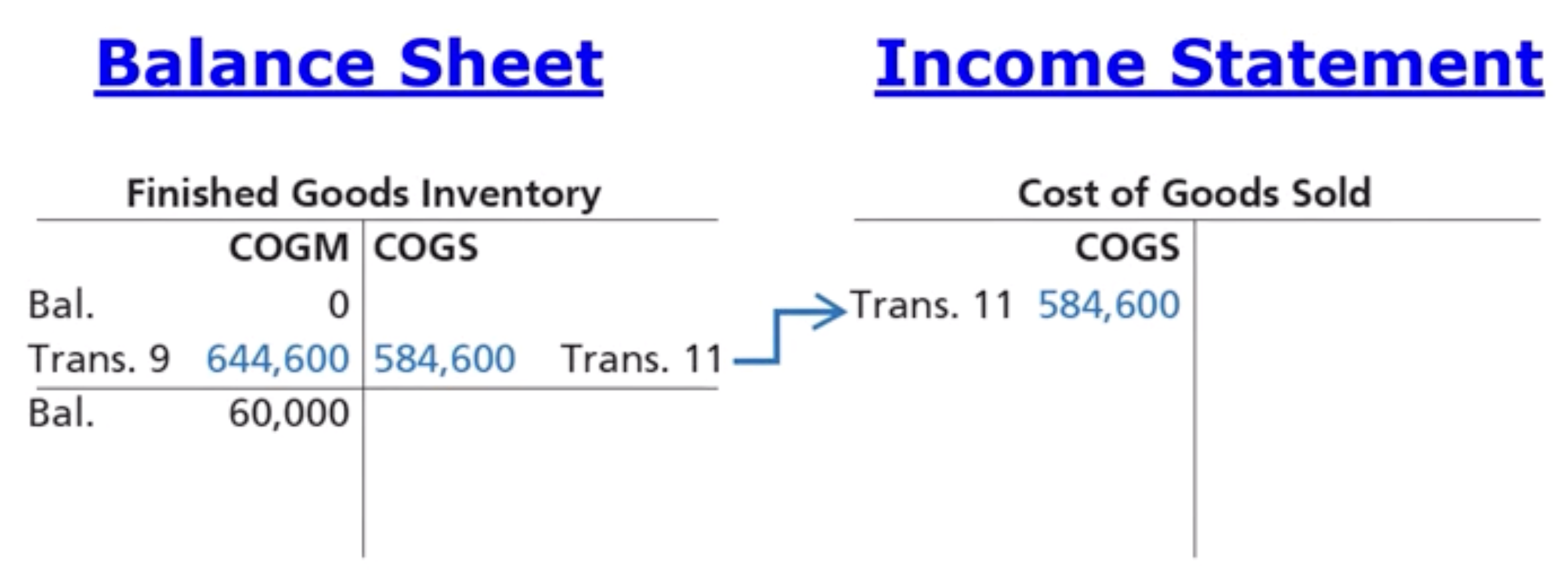

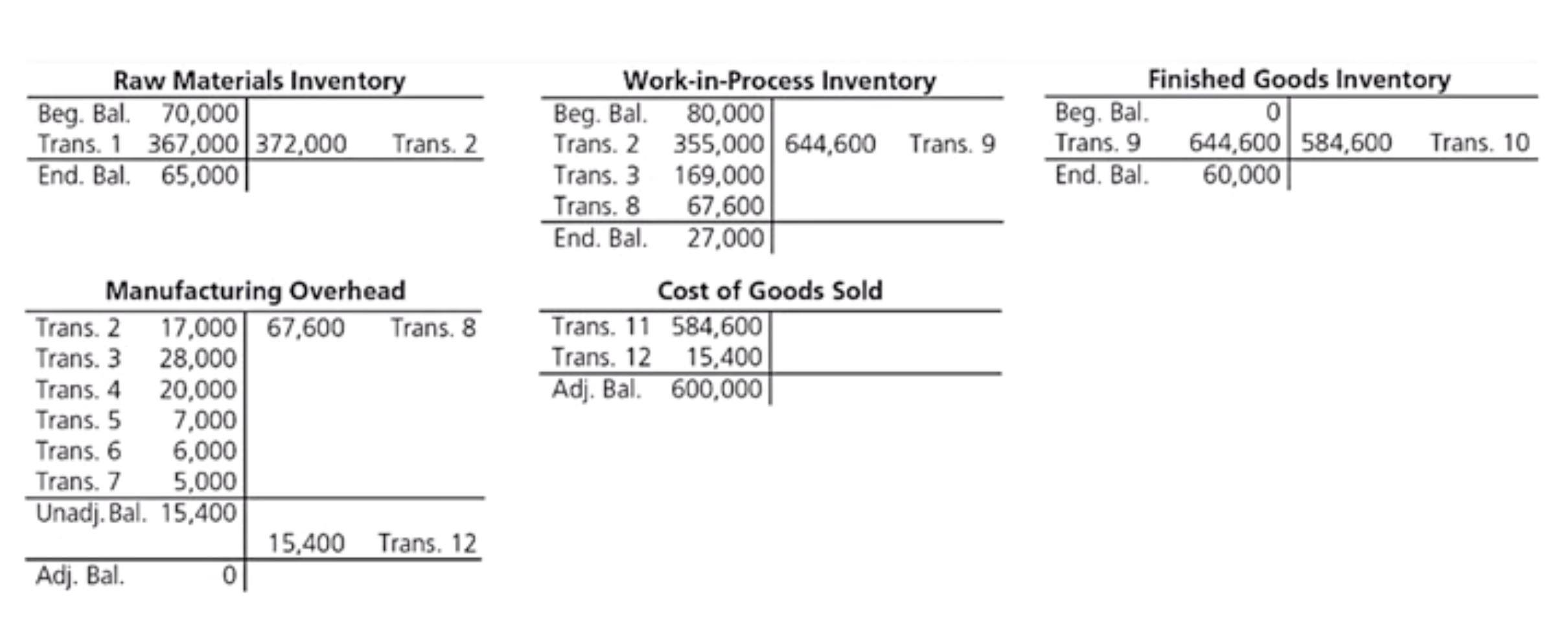

What happens when products are completed and sold: Transferring costs to costs of good sold ex (Step. 4 kinda)

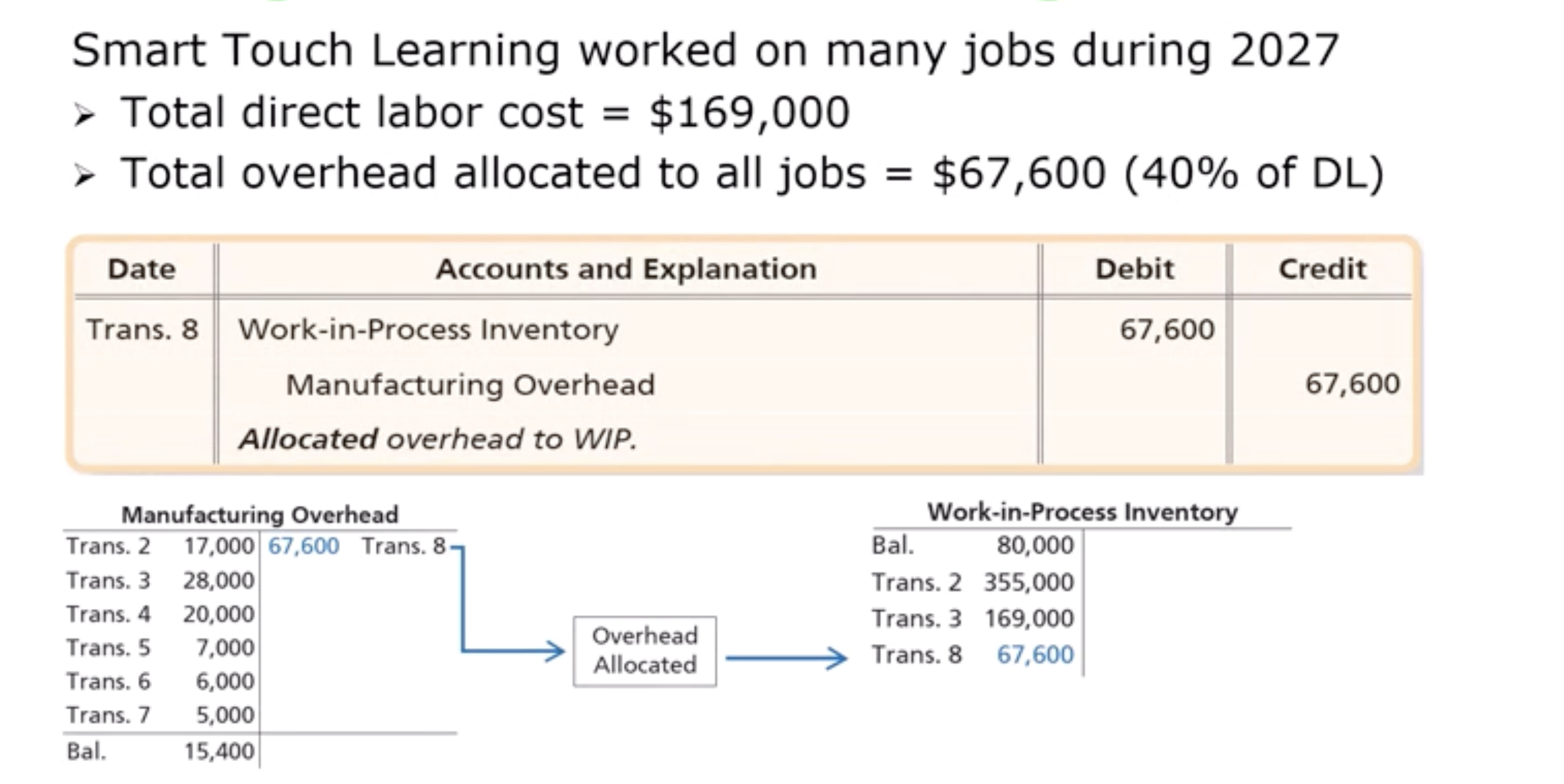

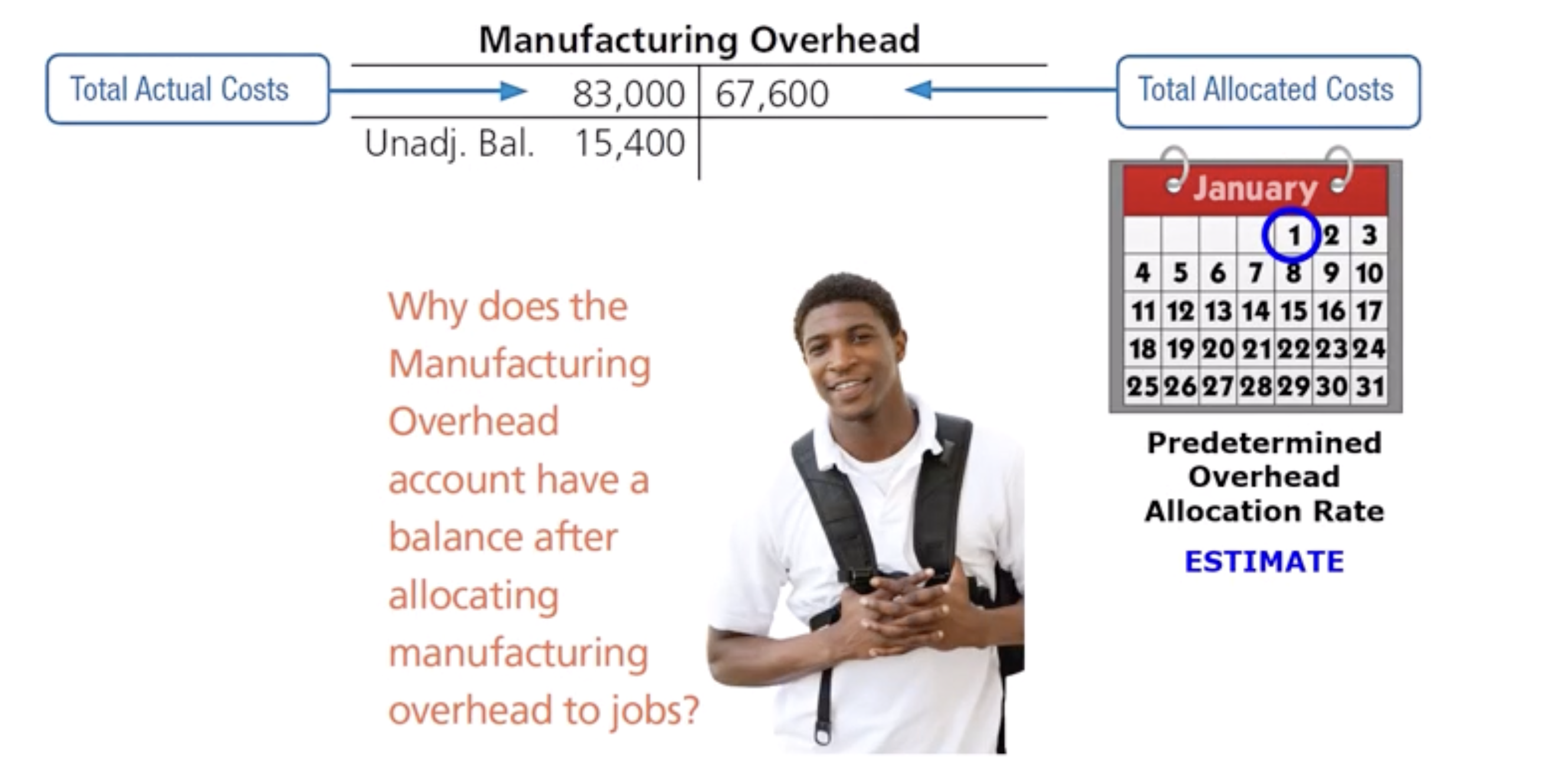

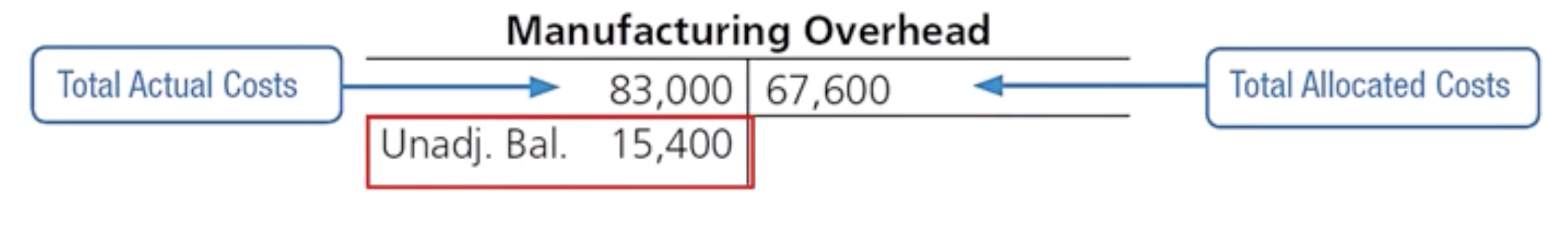

How is the manufacturing overhead account adjusted: Manufacturing overhead

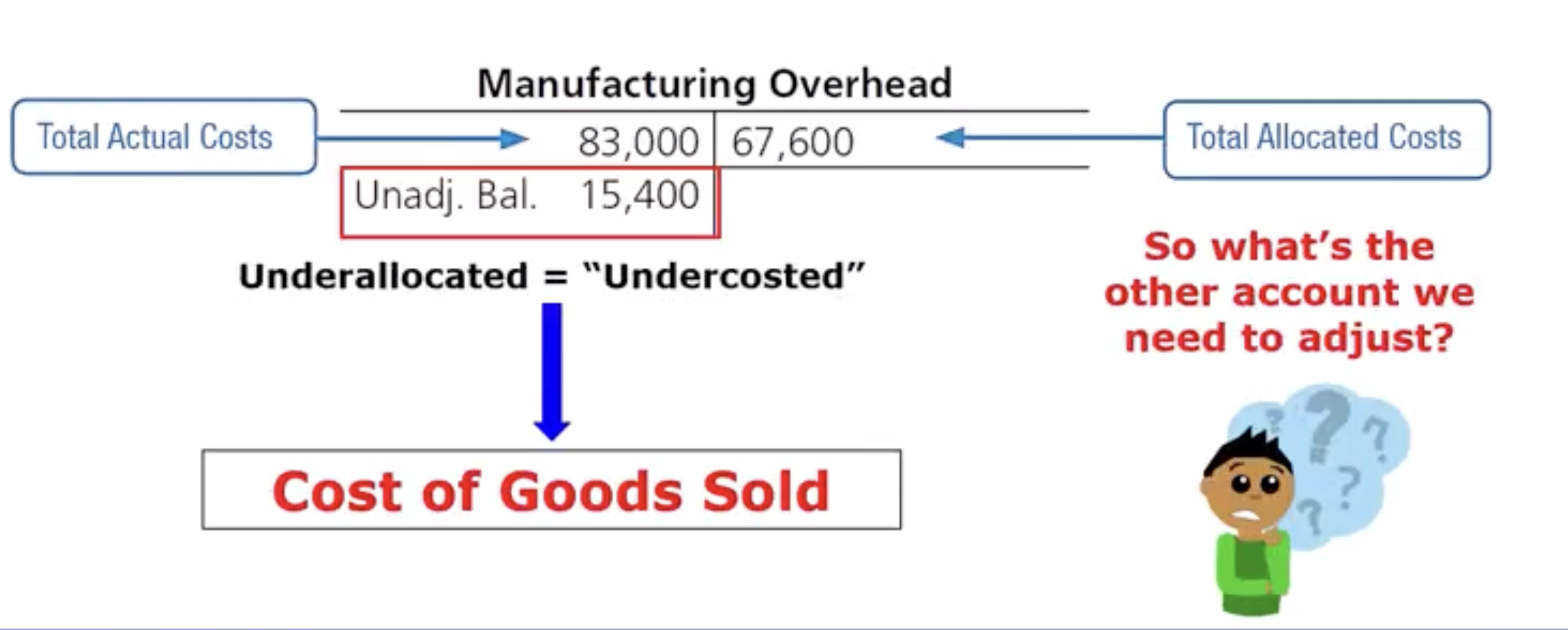

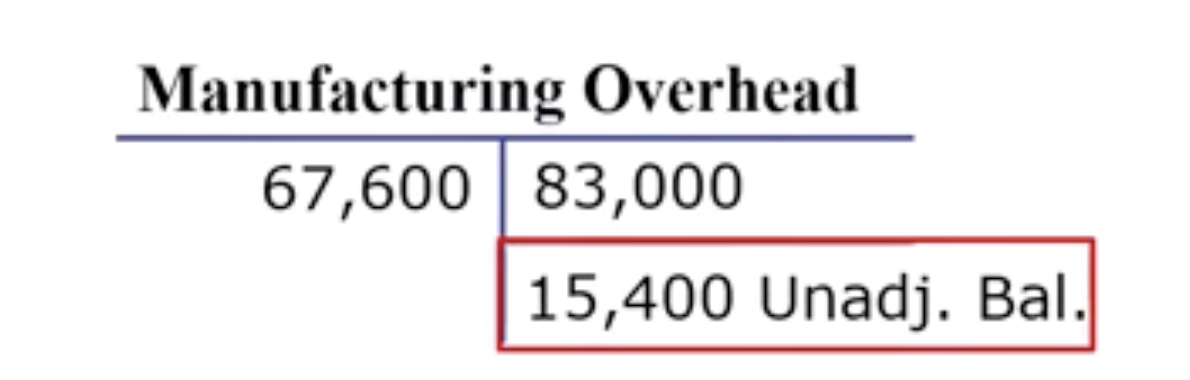

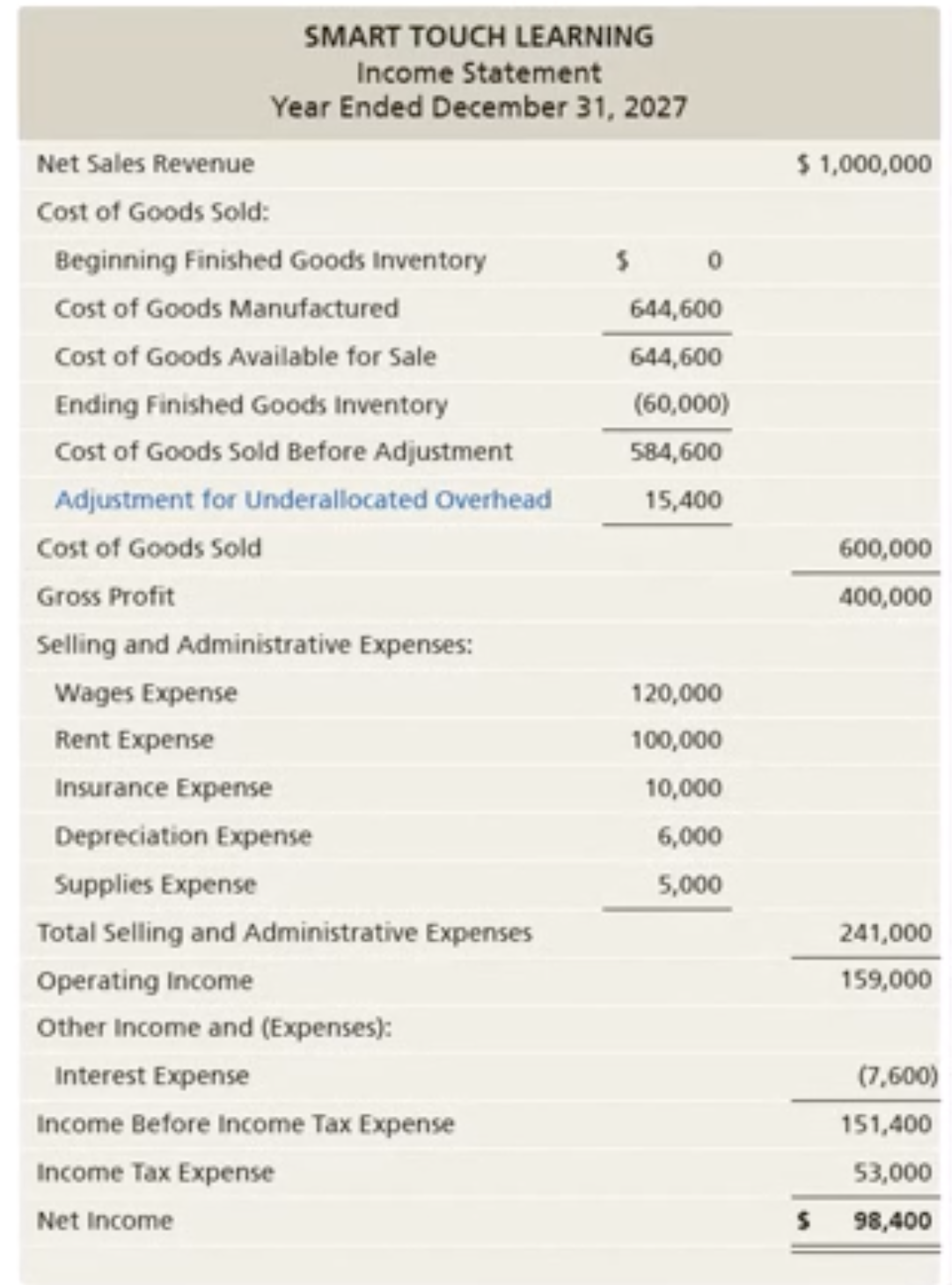

How is the manufacturing overhead account adjusted: Underallocated overhead

Occurs when the actual manufacturing overhead costs are more than allocated manufacturing overhead costs

How is the manufacturing overhead account adjusted: Overallocated overhead

Occurs when the actual manufacturing overhead costs are less than allocated manufacturing overhead costs

How is the manufacturing overhead account adjusted: Summary of Before the period, during the period, and at the end of the period

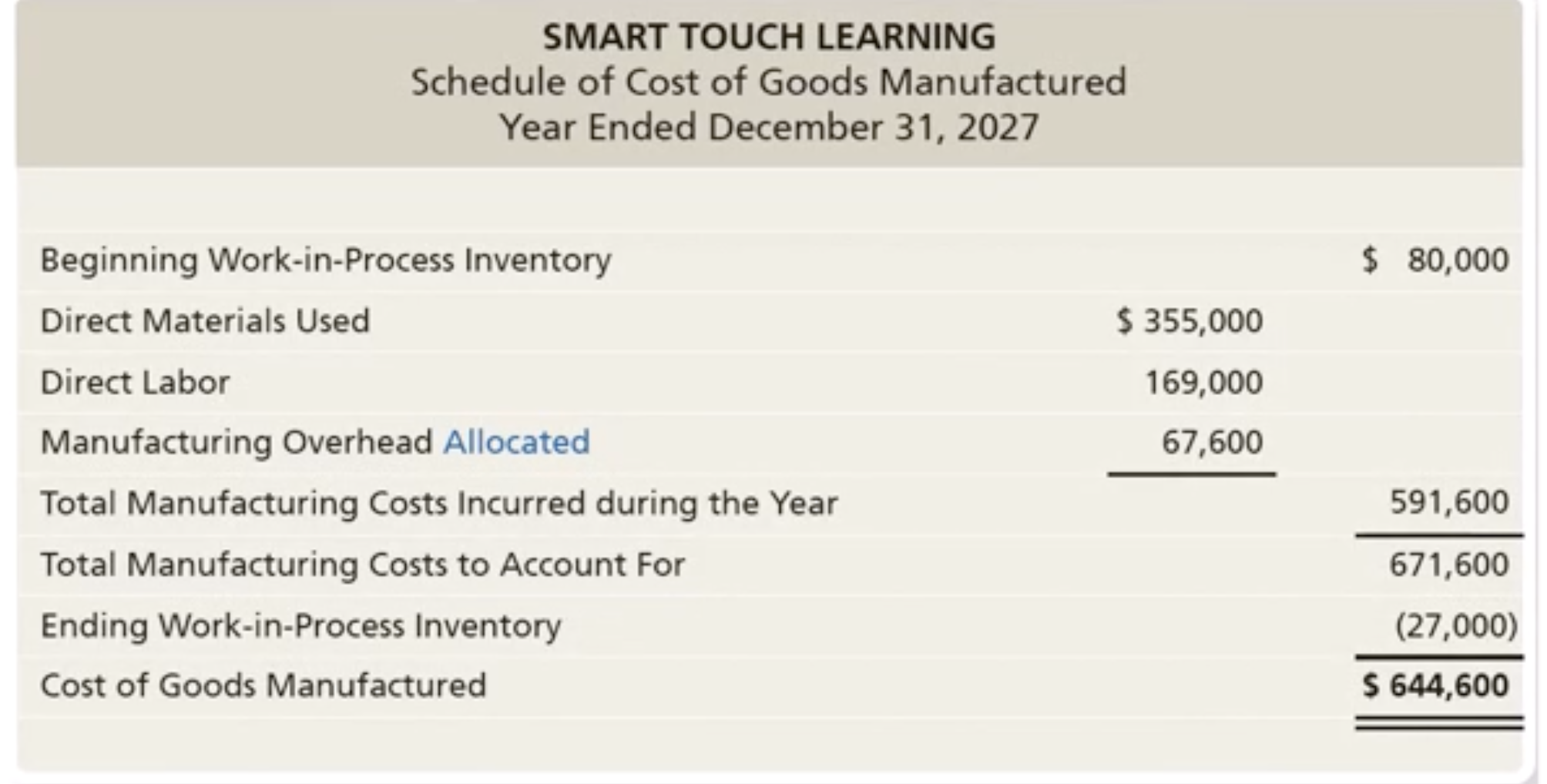

How are Cost of Goods manufactured and cost of goods sold calculated

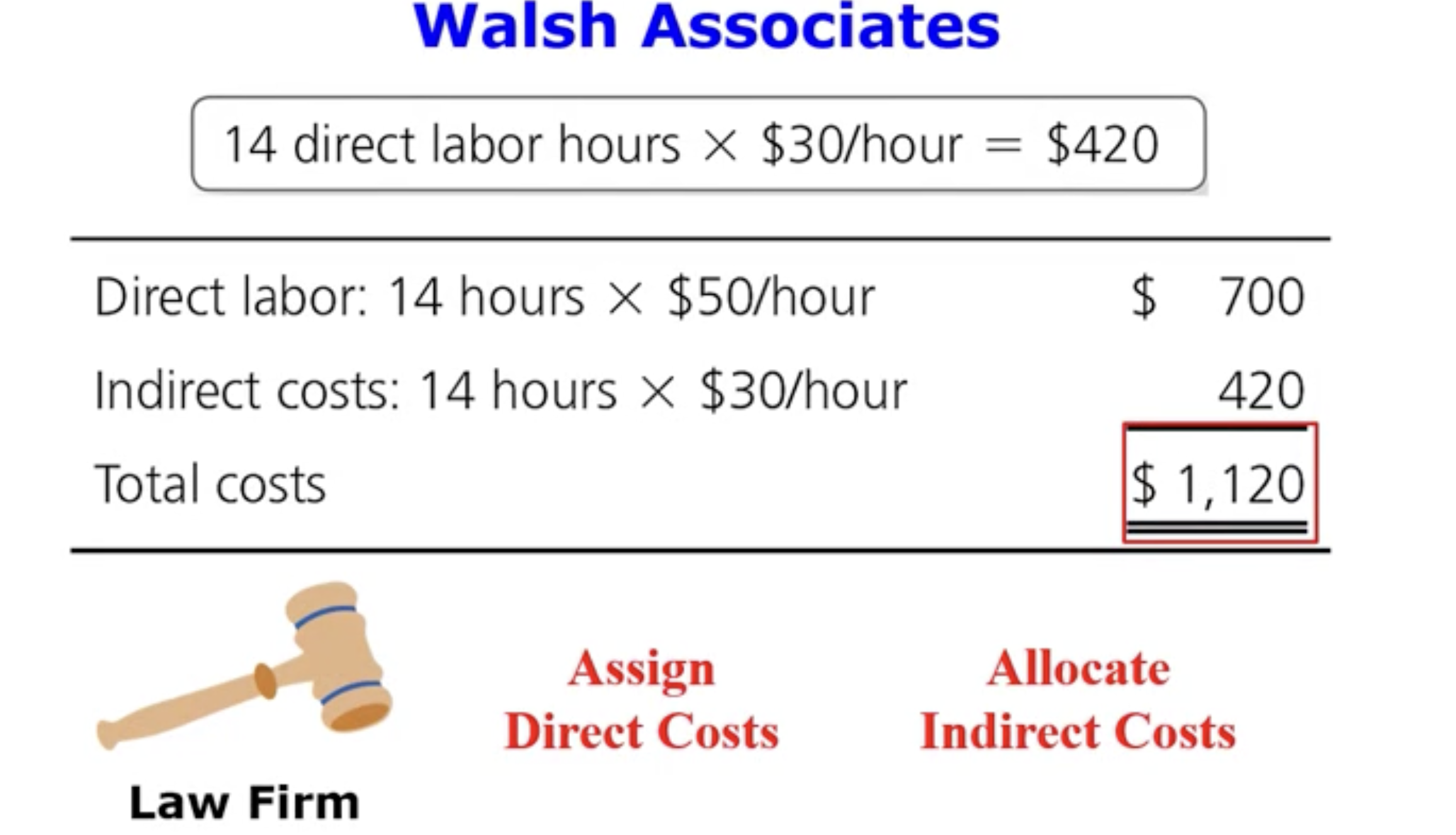

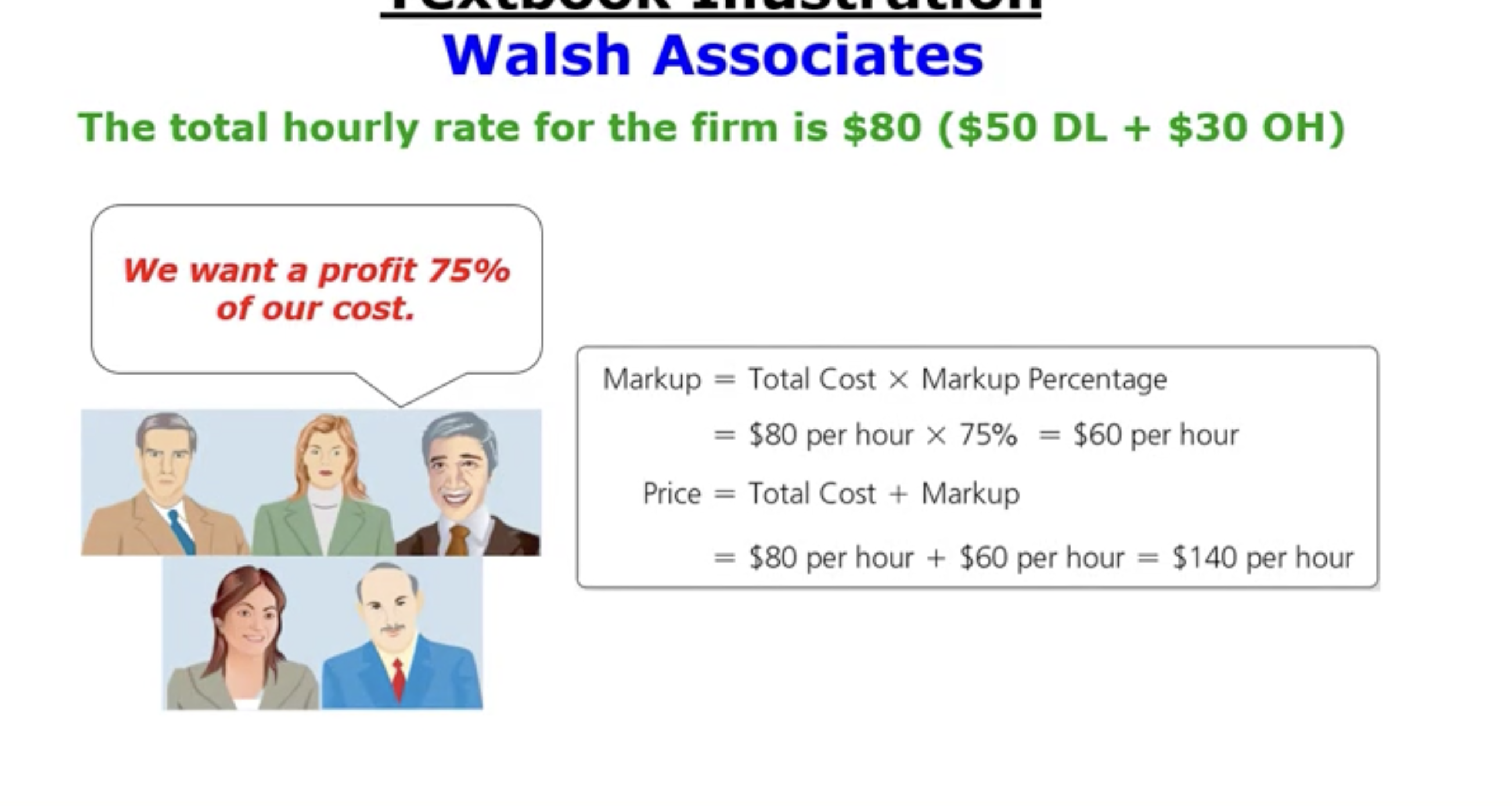

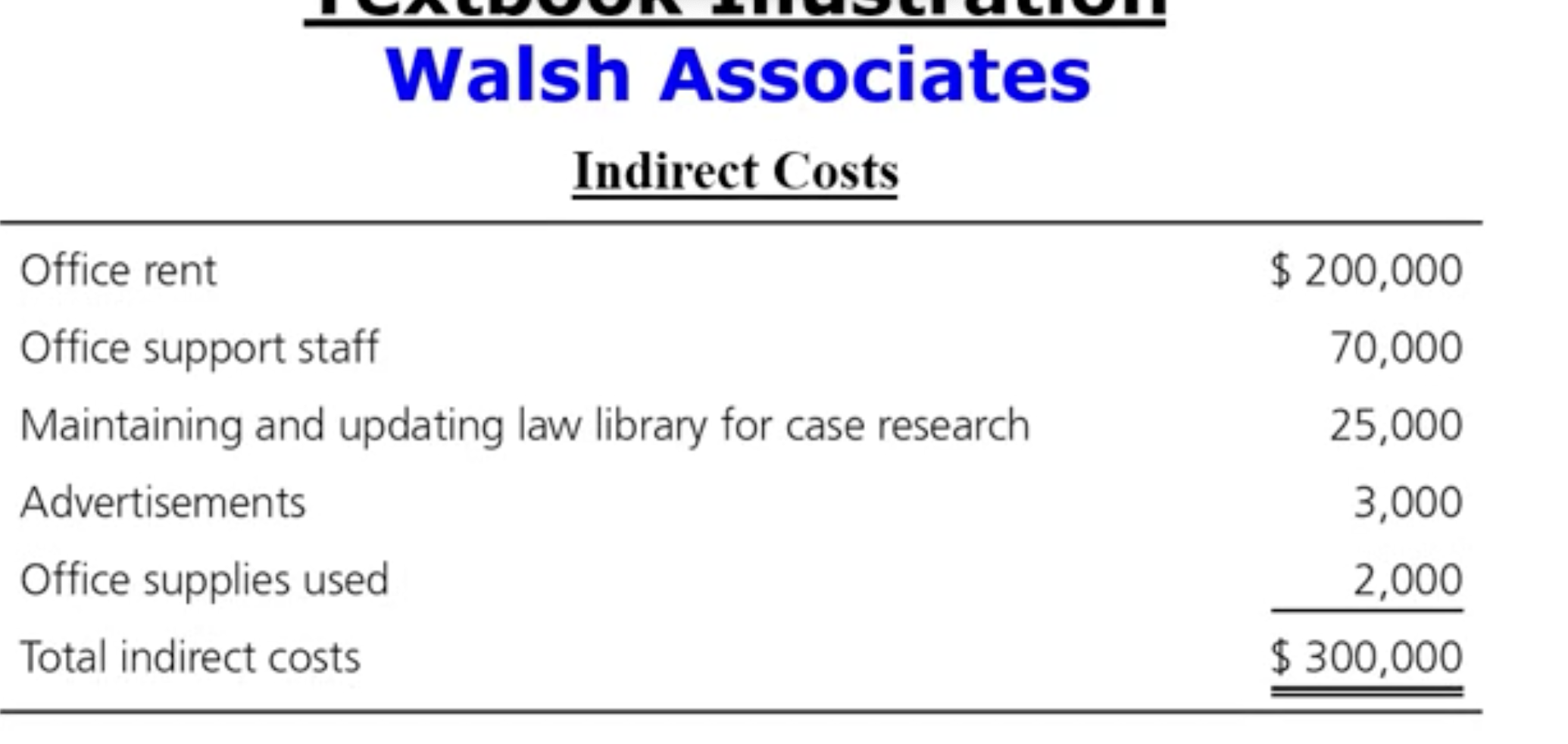

How do service companies use a job order costing system: Walsh associates- Most significant cost & indrect costs

Direct labor

How do service companies use a job order costing system: Hourly rate to the employer

How do service companies use a job order costing system: Allocation base

Direct labor hours

How do service companies use a job order costing system: Direct and Indirect hrs = Total costs