Consumer Education Final

0.0(0)

Card Sorting

1/142

There's no tags or description

Looks like no tags are added yet.

Last updated 7:30 PM on 7/25/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

143 Terms

1

New cards

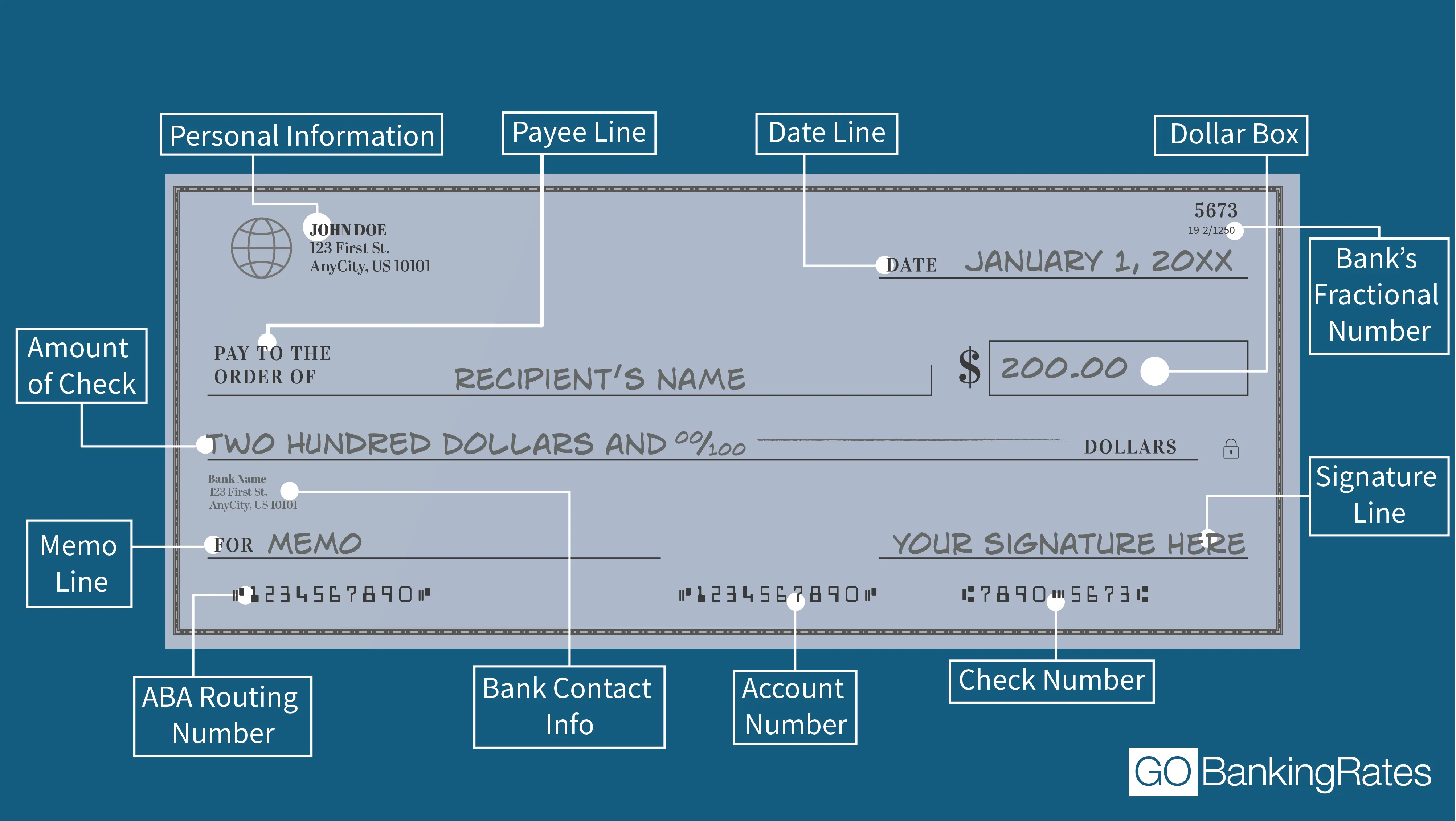

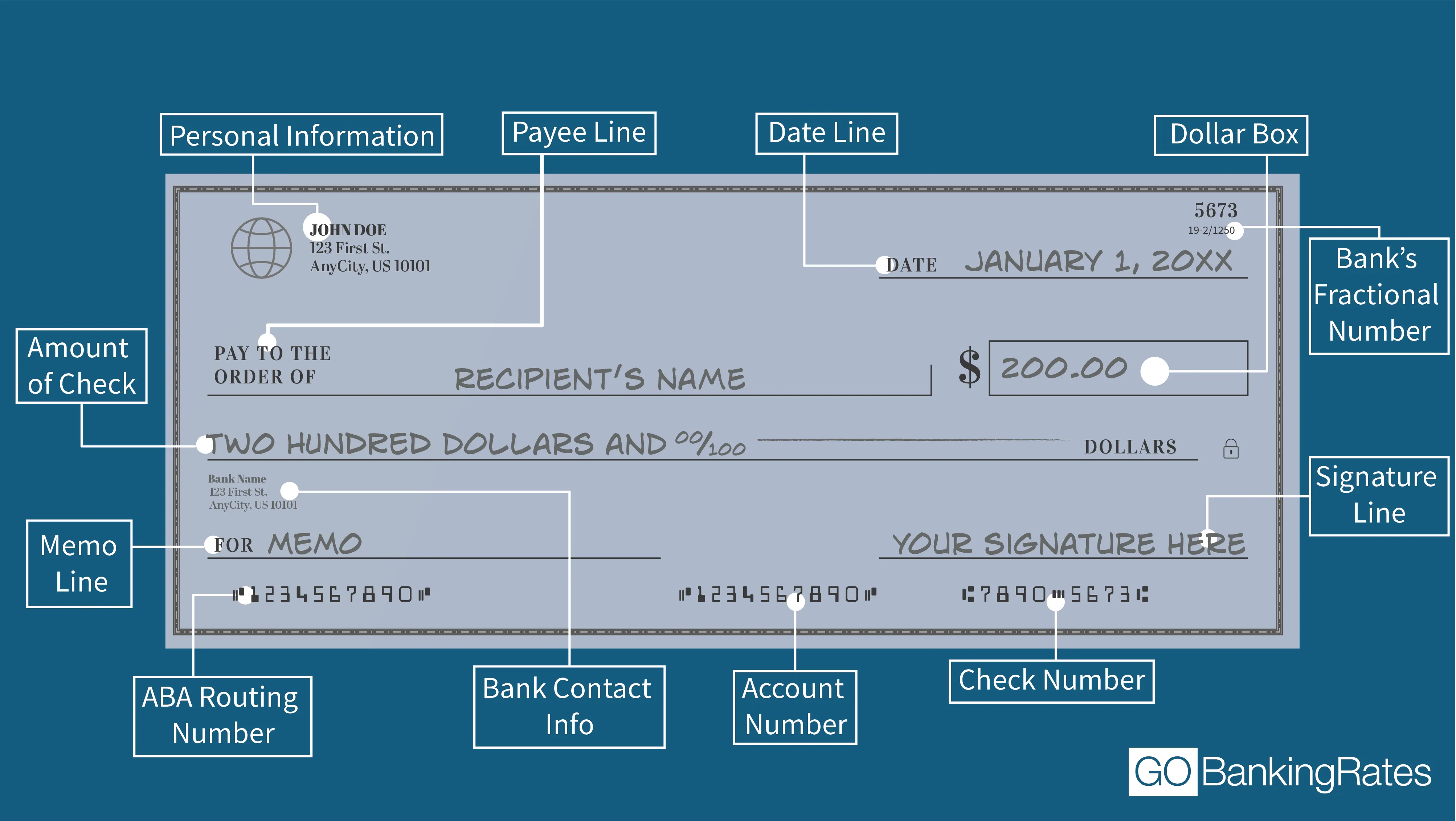

Pay to the order of:

Payee Line

2

New cards

Bottom Left #

Bank’s ABA Routing #

3

New cards

Bottom Center #

Account #

4

New cards

Standard Deposit Insurance

Safety and Protection

5

New cards

Cash check for customers issued in that bank, cashing fee for non-member

Convenient and Free Check Cashing

6

New cards

Businesses allow for automated bill pay

Convenient and Free Bill Pay

7

New cards

Avoiding carrying large sums of money

Debit Card Convenience

8

New cards

Automatically tracked on bank accounts

Budgeting Tools

9

New cards

Lower fees and better interest rates on savings accounts and loans

Credit Union

10

New cards

Mobile apps and online technology tend to be more advanced; more branches and ATM’s nationally

Local and Federal Bank

11

New cards

Shows you all the deposits and withdrawals from your account

ctement

12

New cards

Shows you terms and conditions of account such as fee structure and minimum requirements

Checking Agreement

13

New cards

Bank branch, ATM, direct deposit from employer, electronic transfer, mobile app, 3rd party payment

Accessing Account

14

New cards

Making a withdrawal when there is not enough money in account to pay for it

Overdraft fees

15

New cards

Printed record of balance in a bank account and amount paid of withdrawn from last 30 days

Bank Statement

16

New cards

Account that doesn’t have enough money to cover transactions

NSF or balanced checks

17

New cards

Hourly rate, most common for part-time jobs

Wages

18

New cards

Monthly/Annual amount you receive regardless of time worked; professional positions

Salary

19

New cards

Some or all income based on productivity % of every sale you make

Commision

20

New cards

Direct payment below minimum wage and make minimum wage if employer need to make up difference

Tips

21

New cards

Verifies identity and employment authorization of individual hired for employment (employee)

I-9

22

New cards

Determines how much should be withheld from your paycheck for federal income taxes; tax situation (employee)

W-4

23

New cards

Determines whether someone pays additional taxes or receives a tax refund; annual wages and taxes withheld (1/31; by employer)

W-2

24

New cards

Reports non-employee compensation, pay from independent contractor; taxes not withheld (1/31)

1099 NEC

25

New cards

Used by taxpayers to file annual income tax return by online, professional, or paper (IRS form; refund=overpaid, 4/15)

1040

26

New cards

Wages before taxes and other deductions

Gross Pay

27

New cards

Wages after taxes and other deductions

Net Pay

28

New cards

Federal Law that requires an employer to withhold taxes from wages they pay their employees; funds go toward social security and Medicare

FICA

29

New cards

Amounts withheld from your wage/salary involuntarily for federal, state, and FICA taxes (IL- 4.95%)

Withholdings

30

New cards

Individuals who depend on you for financial support; set amount of money claimed as deduction per dependent

Dependents

31

New cards

You deduct a flat-dollar amount, less effort, reduces taxable income, saves you more than itemizing single, head of house, married

Standard Deduction

32

New cards

You report each qualified deduction, complete schedule A forms, reduce taxable income, could save you more than standard deduction mortgage interest, charitable donations, medical expenses, state and local tax.

Itemize Deduction

33

New cards

Earns less than $12,950, Unearned less than $1,150, gross income larger of $1,150 or income +$400

Dependent

34

New cards

Earned income of more than $12,950

Non-dependent

35

New cards

Net earnings from self-employment were more than $1,400, IRA’s cannot be exceeded taxable compensation, max $6,000/yr for tax year

File for taxes

36

New cards

Top three cost categories

Housing, Taxes, Transportation

37

New cards

Benefit profit or value of something that must be given up to acquire/achieve something else. Trading off something for another

Opportunity Cost

38

New cards

Process of planning how to get the most of your income

Money Management

39

New cards

Money spent by consumers on things other than necessary things like food, clothing, fuel

Discretionary Spending

40

New cards

50% goes to Fixed Expenses (mortgage/rent, utilities, insurance, etc), 20% to Savings (financial goals), and 30% to Fun (entertainment, hobbies, travel, etc.)

Budgeting Rules of Thumb

41

New cards

Plan for spending and investing you money to meet your needs and wants (meet short and long term goals)

\

* Identify current income spending

* Set goals and budgeting

* Track spending and make adjustments

\

* Identify current income spending

* Set goals and budgeting

* Track spending and make adjustments

Budgeting Process

42

New cards

Occurs when income exceeds expenditures

Budget Surplus

43

New cards

Occurs when expenses exceed revenue

Budget Deficit

44

New cards

A contract between the insurance company and the insured that states the exact terms of policy

Policy

45

New cards

The risk covered and amount of money paid for losses under an insurance policy

Coverage

46

New cards

Person who owns the insurance policy

Policy-holder

47

New cards

Money paid to purchase the policy

Premium

48

New cards

* Event occurs resulting in loss

* Policy holder makes a claim to insurance organization

* Insurance organization determines if event is covered by policy

* Policy holder pays deductible

* Remaining money is payed by co-insurance (if applicable)

* Policy holder makes a claim to insurance organization

* Insurance organization determines if event is covered by policy

* Policy holder pays deductible

* Remaining money is payed by co-insurance (if applicable)

Insurance Process

49

New cards

Formal request to insurance company asking for payment when policy holder has an accident, illness, injury

Claim

50

New cards

out of pocket money paid by policy holder before insurance will cover remaining cost

Deductible

51

New cards

Chance of loss from an event that cannot be controlled

Risk

52

New cards

* Individual (long term care, property, liability)

* Employer (health, disability, life insurance)

* Federal (catastrophes)

* Employer (health, disability, life insurance)

* Federal (catastrophes)

Source of Insurance

53

New cards

Average percentage of cost paid by insurer each year

Actuarial Value Paid

54

New cards

Provided by employer or federally (doctors visits, hospital bills, procedures, etc.)

* Bronze (60%)

* Silver (70%)

* Gold (80%)

* Platinum (90%)

* Bronze (60%)

* Silver (70%)

* Gold (80%)

* Platinum (90%)

Health Insurance

55

New cards

Only in-network care, primary doctor, and low cost

HMO and EPO

56

New cards

No referral, out of network, more expensive

PPO

57

New cards

Payment for liability and property insurance on a vehicle

Automobile Insurance

58

New cards

Payment to cover liability losses and damages/ loss of home structure and its contents

Homeowners Insurance

59

New cards

Payment for damage/loss of property in rental unit in addition to liability losses

Renters Insurance

60

New cards

Payment to replace earnings during times when workers cannot work due to illness/injury

Disability Insurance

61

New cards

Payment for extended nursing care when they cannot live independently

Long-term Insurance

62

New cards

Money received when insured person dies

Beneficiary

63

New cards

Amount of loan $

Principal

64

New cards

Cost of borrowing

Interest

65

New cards

How long to pay back in months/years

Loan Term

66

New cards

Cost you pay each year to borrow money, including fees, expressed as a percentage

APR (Annual Percentage Rate)

67

New cards

Changes and is based on the prime rate or index rate

Variable Rate

68

New cards

Remains the same for the length of the loan

Fixed Rate

69

New cards

Used to finance specific purchases for an amount of time (regular payments/same total)

Installment Loans

70

New cards

Open line of credit that can any purchases as long as you are under the credit limit (vary/based on size)

Revolving Credit

71

New cards

Debt that can used as collateral and repossessed if borrower doesn’t make payments (low interest/less risky)

Secured Debt

72

New cards

Interest isn’t charged if balance is paid in full

* 20-30 days

* N/A if you have a balance

* 20-30 days

* N/A if you have a balance

Grace Period

73

New cards

Money that will be charged minimally if you carry balance

Minimum Finance Charge

74

New cards

A numeric score that uses credit history to asses creditworthiness

Credit Score

75

New cards

% charged on the amount you owe

Interest Rate

76

New cards

Amount owed on an existing lone of credit

Balance

77

New cards

List of your credit usage history

Credit Report

78

New cards

Minimum amount owed each month to keep credit in good standing

Minimum Monthly Payment

79

New cards

Fair Issac Corporation

FICO

80

New cards

Payment history, amount owed, length of credit history, new credit, types of credit used

Credit Ties

81

New cards

Insurance rates, Employment, Public Utility Services, Housing

Credit History Affects

82

New cards

Consumer, Credit Account Information, Public Record Information, Inquiry Information

Credit Report Categories

83

New cards

Organizations that collect credit information on individual consumers (Equifax, TransUnion, Experian)

Credit Bureaus

84

New cards

Crime in which someone wrongfully obtains and uses another person’s personal data in some way that involves fraud or deception typically for economic gain

Identity Theft

85

New cards

SSN used to open new utility, cell phone, credit card accounts, etc.

New Account Fraud

86

New cards

Using account numbers like credit card numbers to extract funds from bank account

Account Takeover Fraud

87

New cards

Commits crime under another name, fake ID with victim’s information but imposter picture

Criminal Identity Theft

88

New cards

Using another person’s name/insurance to obtain medical services and goods, effects medical record

Medical Identity Theft

89

New cards

Using business name to obtain credit and billing clients for products and services

Business/Commercial Theft

90

New cards

Living and functioning as victim on purpose; running from the law, evading child support, mentally ill

Identity Cloning

91

New cards

Looking through old bills, financial statements, etc to get name, address, account number, bank name, etc.

Trash

92

New cards

Stealing mail is how criminals take advantage of credit card offers, open account information, and going on a spree

Mail

93

New cards

E-mails with phony finance institutions or friends asking for money. Cyber criminals deceive consumers with opening these e-mails.

Phishing

94

New cards

Thieves manipulate credit card processes and ATM’s with device that captures account information

Skimming

95

New cards

Paper-thin, card sized shim with microchip and flash storage in card slot, unseen to get data off credit and EMV

Shimmer

96

New cards

Stealing purses, pit-pocketing in crowed places, stealing personal records

Straight Theft

97

New cards

Spam calls to get information to fill out financial applications, address form, or paperwork to replace drivers license

Conning

98

New cards

“verifying” your identity when changing your address by giving credit/debit information to charge you to test new address, diverts mail and gains aspects

Address Minipulation

99

New cards

Two-factor authentication against phishing, credential exploitation, and other attempts to takeover your accounts

* Password

* Proof

* Access

* Password

* Proof

* Access

2FA

100

New cards

* File an initial fraud alert

* Initiate a credit freeze

* File and identity theft report

* Contact credit bureaus and businesses

* Place an extended fraud alert

* Initiate a credit freeze

* File and identity theft report

* Contact credit bureaus and businesses

* Place an extended fraud alert

When identity is stolen