Mcgraw Hill Accounting Chapter 1 & 2

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

29 Terms

Assets vs Liabilities

https://gyazo.com/8095d76f90415857aeaf5368e07a4688

Source Document

Identifies and describes transactions and is the basis for entering an event into the accounting system.

Account

Record within an accounting system in which increases and decreases are entered and stored in a specific asset, liability, equity, revenue, or expense.

General ledge/Ledger

Collection of all accounts with their activity and balances that exist in a business

Asset Accounts

Accounts relating to Assets, examples; Buildings, Equipment, Cash,

Cash Account

All increases and decreases in cash are recorded in the Account. Includes funds that a bank accepts for deposits. Ex; coins, checks, money orders, and checking account balances

Accounts Receivable

(IS AN ASSET) held by a seller and are promises of payment from customers to sellers.

Note Receivable / Promissory Note

Promise of another entity to pay a specific sum of money on a specified future date. Considered an asset.

Notes Payable

long-term liabilities that indicate the money a company owes its financiers

Prepaid Accounts

Assets that represent prepayments of future expenses and are increased with a debit (ex prepaid insurance, prepaid rent, and prepaid services) Unexpired portions are treated as assets, expired portions are transferred to expenses category

Supplies Account

Supplies are assets until they are used. When they are used up their costs are reported as expenses

Supplies Asset Account

Unused supplies

Equipment Accounts

Equipment is an asset. Its cost is allocated time to expense, called depreciation.

Buildings Accounts

Buildings such as stores, offices, warehouses, and factories are assets

Land

The cost of land (buildings located on the land is separately recorded in building accounts)

Liability Accounts

Obligations to transfer assets or provide products or services to others

Accounts Payable

Refer to obligations owed by the business and are classified as a liability

Debtors

Individuals or organizations that owe money

Creditors

Individuals or organizations entitled to receive payments

Liabilities

Claims against the assets of a business, claims are made by creditors

Assets

Things of value owned by a business (land, unused equipment, buildings)

Expenses

Cost of doing business (labor, used equipment, wages)

Equity

Owner's claim on a company's assets.

Equity = (Common Stock - Divdens) + (Revenues - Expenses)

Chart of Accounts

List of all ledger accounts which exist in a business and includes an identification number assigned to each account

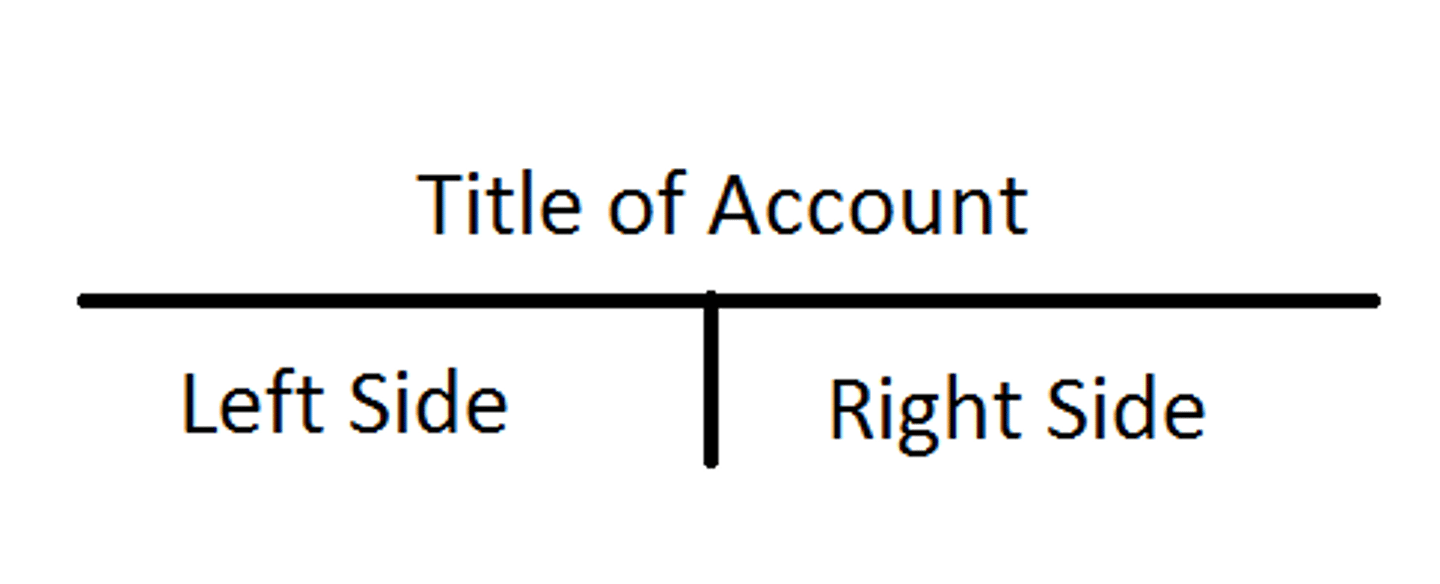

T- Account

Represents a ledger account and is a tool used to understand the effects of one or more transactions.

Journal

Book of original entry that includes a chronological record of all transactions that have occurred within a business during a period that occurred

Trial balance

List of each account and its balance at any given time is used to verify that debits = credits

Journalizing

Process of recording transactions in a journal

Posting

Process of transferring journal entry information to the ledger