GMU ECON 104 Macroeconomics Final Exam

1/77

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

78 Terms

The Quantity Theory of Money

MV = PQ A classical monetarist's view that explains how changes in the money supply (M) will affect the price level (P) and/or real output (Q) assuming the velocity of money (V) is fixed in the short run.

Monetary Theory of Inflation

The greater the rate of growth in money, the greater the rate of inflation. You Increase M, you Increase P. Q is not affected.

Nominals

Nominals are rates "as stated", without accounting for factors such as inflation, fees, compound interest, etc. Nominals affect Nominals.

Reals

Reals are rates that have been accounted for all the factors, and are the actual rates. Reals affect Reals.

The real or natural rate of interest

Bohm Bawerk, interest is the price of time or productivity of capital.

Irving Fisher's Quantity Theory of Money

MV=PQ. A tautological identity (true in all circumstances)

Keynes: M & V move in opposite directions

Friedman (Correct): M& V move in the SAME direction

Income Quantity Theory of Money

MV=PQ

Cambridge Cash Balance Quantity Theory of Money

M=KPQ, Where K is 1/velocity, allows us to make a distinction between actual and desired cash holdings

Say's Law

Keynes incorrectly argues that Say's Law meant he believed Supply creates its own demand. Say's Law actually states EFFECTIVE DEMAND COMES FROM PRIOR SUPPLY

Disproportionality Problems

Recessions are caused by a disproportionate, excessive production of inferior goods. (Say's argument against mercantilists incorrect belief that recessions are caused by general overproduction)

Classical Macro Theory

- Believed in Price Flexibility as a Policy GOAL

- Believed Interest as a price of time

- Quantity theory of money

- Nominals affect nominals, reals affect reals,

- Nominal rates minus expectations equal real interest rate

- Say's Law

Included in GNP and GDP statistics

the value of consumer goods and services transactions

NOT included in GNP and GDP statistics

- Leisure time (People consume leisure instead of work),

- non-market non-cash intermediated transactions (all the goods and services that add up into making the final product), - environmental quality

Unemployment Rate

The percentage of labor force out of work but LOOKING FOR WORK.

Both Unemployment and Employment rates can logically increase and decrease together, it is possible for Unemployment rate to be increasing and Employment rate to also be increasing.

Employment Rate

The percentage of the total population aged 16 or over that is employed.

It is possible for the employment rate and unemployment rate to raise or lower simultaneously together.

How is it possible for unemployment and employment rate to both be increasing?

Suppose: There is a population of 200 million.

Of that, 100 million is in the labor force. 90 million are working, 10 million are looking for work. Employment rate is 90/200, so 45%. Unemployment is 10/100, so 10%.

Now suppose 20 million enter the labor force.

Suppose 10 million of them found jobs. 90+10=100. 100/200 = 50% Employment Rate.

10 million of them are looking for work. 10+10 = 20/120 = 16%.

Unemployment rate rose 6% While Employment rate rose 5%.

Natural Rate of Unemployment

the unemployment rate that arises from the effects of frictional plus structural unemployment

A healthy labor market should have zero unemployment.

FALSE. Zero unemployment does not equal full employment.

Why is some unemployment GOOD?

1. Eliminating unemployment would mean no one could quit their jobs (slavery). Employees quit when they are not happy with their jobs, and forces employers to respect employees.

2. An employers right to fire an employee is highly desirable. They want productive workers.

3. Consumers have the right to spend their money where they want to. They shift the demand from one industry to another. If people want hula hoops and not frisbees, frisbees are going to face unemployment.

4. Technology. When Ford made the assembly line, buggy makers went out of business. Buggy makers then go find jobs within Ford.

5. Jobs are not an end, but a means to an end. You never want job maximization, but rather wealth maximization from that job. (You can create millions of jobs if you plowed every field with plastic spoons. But we don't want that.)

Frictional Unemployment

Arises from a mismatch of information between unemployed people and people who want to hire them. They can't find each other. (Ads can reduce this)

Structural Unemployment

Unemployed workers don't have required skills to be hired in the labor market. Ain't gonna hire truck drivers for a shortage of nurses. How to reduce? Educate people

Cyclical Unemployment

unemployment that rises during economic downturns and falls when the economy improves. Because economy is shrinking, downward spiral of ppl getting laid off. Cumulative rot.

The Federal Reserve

the central banking system of the United States. Tries to regulate money and credit. The purpose of the fed was to form an elastic currency.

Two Track Banking System

National banks and state chartered banks. US. has a dual track regulatory system.

Fractional Reserve System

system requiring financial institutions (banks) to set aside a fraction of their deposits in the form of reserves.

Board of Governers of the federal reserve system

Seven presidential appointees. They serve 14 year terms, the most powerful person is the chairman, who serves a 4 year renewable term. They have monetary levers to control money and credit in the system.

Federal Open Market Committee

the 12 member group that determines the purchase and sale policies of the Federal Reserve Banks in the market for U.S. government securities (open market operations). Of the 12, 7 are from the board of Governers. The other 5 are presidents from district banks.

The General Directive

Issued by the Board of Governers (BoG) where they instruct the open market committee to buy or sell assets. Whenever the fed buys assets, it creates more cash balances (they buy govt debt. and treasuries with newly created money.) They're in Group 1. They inject money each time they buy. Opposite happens when they sell. Each time they buy, causes inflation, each time they sell, causes deflation.

Discount Rate

The Federal Reserve is the "banker's bank" or the "bank of last resort." When banks need to borrow money, they can go to other banks. When those banks don't have money to loan, the banks then go to the "Discount Window" where they borrow from the fed reserve. The interest rate the federal reserve charges is called the Discount Rate.

Overnight Loan

refers to when a bank needs to borrow money from another bank because at the end of the day the bank does not have the required reserve ratio

Reserve Requirement

the percentage of deposits that banking institutions must hold in reserve, set by the BoG and Fed. When raised, banks have to scramble to get cash to put in the vault. When lowered, banks make more loans with the extra money in the vault.

Federal Funds Rate

the interest rate at which banks make overnight loans to one another

Liquidity

the ease with which an asset can be converted into cash

liquidity problems

Problems that arise when organizations cannot easily convert assets to cash. Cash is considered the most liquid asset—that is, the most widely accepted with a value understood by all.

Defensive Operations

BoG wants to keep the status quo, they maintain the interest rate at the discount window

Aggressive Operations

The BoG wants to change the discount rate.

Insolvency

a financial state that occurs if liabilities are greater than assets

money multiplier formula

amount of new money that will be created with each demand deposit, calculated as

1 + d/c

--------

d/c + RR

where d/c is the deposit to currency ratio and RR is the reserve requirement.

Money Supply Equation

money multiplier eq *(multiplied by) monetary base = money supply

The Invisible Hand (micro)

The guiding force behind self-interested, maximizing behavior by individuals

The Law of Demand (micro)

An inverse relationship between the relative price of the good and the quantity of that good demanded.

Equality Exchange (micro, mercantilism)

Trade occurs between things of equal value. Could not explain why voluntary exchange occurs, because equal values in trade benefits no one.

Which was a mistake by the Classical School of thought? (micro)

Infinite regress in value.

What determines law of supply? (micro)

The opportunity cost of the next unit.

Capital Account (micro)

Tabulated by the Federal Reserve, US treasury and IRS.

Rent Controls cause housing surpluses? (micro)

FALSE. Rent controls cause housing SHORTAGES.

Rational Ignorance (micro)

the state of being uninformed about politics because of the cost in time and energy

3 Consequences of Maximum Rent Controls (micro)

1. Housing Shortages

2. Landlord picks and choosing who lives in their housing since everyone pays the same price, causing discrimination to those with children and favoritism to older folks

3. Landlords start charging tenants for parking or other amenities to make up the difference for what has been lost in paying the rent control.

Can the price of shoes affect the demand for shoes? (micro)

No. The demand for shoes affects the price, not the other way around. Price is a reflection of consumer values and their ability to obtain it given the quantity available in a world of scarcity. A change in the price of shoes can only affect the QUANTITY demanded, only a shift in consumer values will shift the demand.

Tarriffs

a tax on imports and exports. Can reduce consumer welfare.

A repressed inflation actually magnifies inflation.

TRUE

Real Interest Rate

Nominal market rate - expected rate of inflation = real/natural interest rate

What can influence velocity of circulation?

- Level of money in intermediated transactions

- Expected changes in the value of money

- political and economic instability

- expected yields in safe, but slightly less liquid assets (T-Bills, etc)

Do budgetary deficits cause inflation?

Not necessarily. If the government runs a deficit, that does not mean there will be inflation. Gov can get money from taxes or borrowing. If they create new money, then there will be inflation.

Gibson's paradox

Nominal Interest Rates are positively correlated with expected inflation.

Federal Market Operations -> Buy Assets

Bank reserves go up, Interest rates go down, Agg. Demand goes up, Inflation

Federal Market Operations -> Sell assets

Bank reserves go down, interest rates go up, agg. demand goes down, deflation

Raise the Discount Rate

Bank reserves go down, interest rates go up, agg demand goes down. deflation

Lower the Discount Rate

Bank reserves go up, interest rates go down, agg. demand goes up, inflation

Lower Reserve Requirements

Bank reserves go up, interest rates go down, agg. demand goes up, inflation

Raise reserve requirements

Bank reserves go down, interest rates go up, agg. demand goes down, deflation

Keynes Theory

1. Economy is stuck in underemployment equillibrium.

2. People are hoarding money on a mass scale

3. Producers and Consumers completely lack expectations

4. the price system is broken in capital, labor, and commodity markets

5. Economy is entirely demand driven. Supply is irrelevant to demand, Scrap Say's Law

Keynes was wrong about all of this.

Keynes' Consumption Function

C=a+b(yd) where C is consumption function, a is autonomous consumption, b is marginal propensity to consume, and Yd is real disposable income.

Liquidity Trap

A situation in a severe recession in which the Fed's injection of additional reserves into the banking system has little or no additional positive impact on lending, borrowing, investment, or aggregate demand.

White House Wage Rate Conferences

President Hoover's 1929 effort to prevent wages and prices from falling, disastrous, raises wages, huge unemployment rate increase as a result

Smoot-Hawley Tariff

One of Herbert Hoover's earliest efforts to protect the nation's farmers following the onset of the Great Depression. Tariff raised rates to an all-time high.

Instead, destroyed farming industry. Foreign gov. retaliated with similarly high tariffs. Farmers in the US were feeding the world after the war, and now couldn't pay high tariffs. Farmers real income drops 70%, US largest crop exports dropped 20% that day, and 23% drop in stocks. Farmers start taking money out of their banks, which leads to a domino effect of bank failures. Freeze of international trade, countries saw US. banks failing and took their money out. Banks went on bank holidays and Fed Reserve did not allow banks to borrow from bother banks to avoid responsibility for the bank failures. Government then paid farmers to stop producing by mistaking the cause as overproduction. Great Depression Economic Downward Spiral.

standstill agreement

A contract between the target firm and the potential acquirer specifying that the acquirer will not purchase additional shares of the target firm for a specified period of time in exchange for a fee paid by the target firm

Interregnum Crisis

Roosevelt's uncertainty in removing the gold standard drops deposit to currency ratio 27 percent. Money supply drops 9.4 percent. 4k banks failed. Hoover asks the BoG to issue clearing house scrip, IOU from one bank to another. Wait till the depositors put their money back in and pay each other back. But the idea is rejected, as it would have been acknowledging the failure of the federal reserve.

Hoover writes a letter to Roosevelt telling him to clarify what is meant by gold standard, as banks are failing.

Roosevelt allegedly ignores this or did not get this letter.

Friedman's rebuttal to the Consumption Function

Yd is not correct. Consumers don't make spending decisions based on what is their hands but what they expect to have. They have expectations about the money they will have in time.

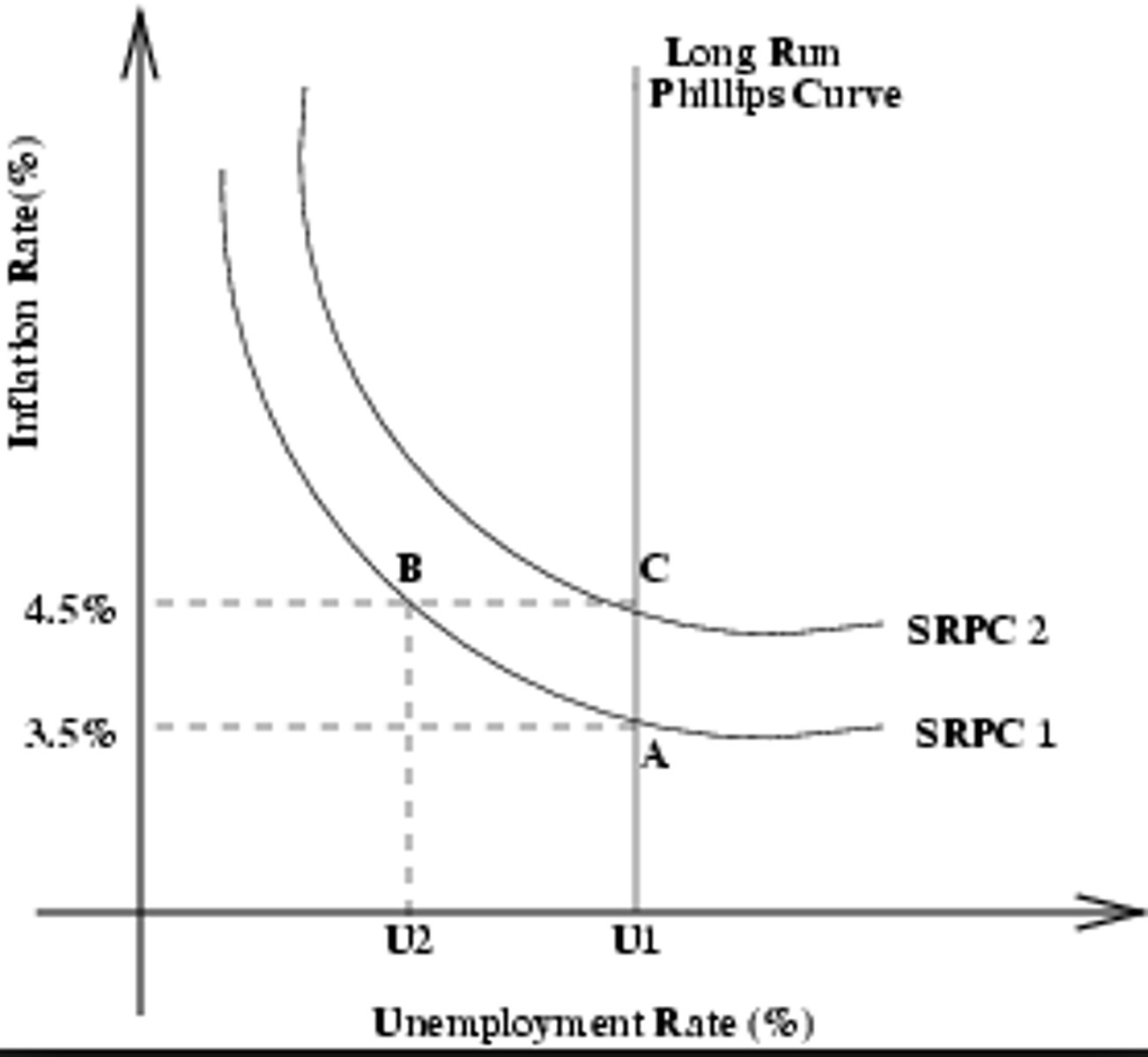

Phillips Curve

Efficient Capital Market

1. Trading occurs continously

2. Prices are flexible

3. Assets traded in financial markets can easily be resold in future when prices fully and instantly reflect all available relevant information.

Robert Lucas Random Shocks and Business Cycles

1. Random distortions are shocking the economy in terms of supply and demand

2. All markets are clearing in general equilibrium

3. Adjustment cost from moving from 1 equilibrium to another

4. Have a problem between distinguishing between nominal price level affects from real supply and demand

Lucas "Surprise" Supply Equation

Yt - Ytn = a(Pt - Pt*) + e

where

Yt is actual change in real output,

Ytn is Long Run Trend Rate

Pt is actual inflation rate

Pt* is actual expected inflation rate

E is random shock

Policies are predictable. Only way to trick is to random shock, which isn't stable.

High Tax in Customs

Leads to more smuggling. Governments raise tax on foreign trade but often earn less because of this.

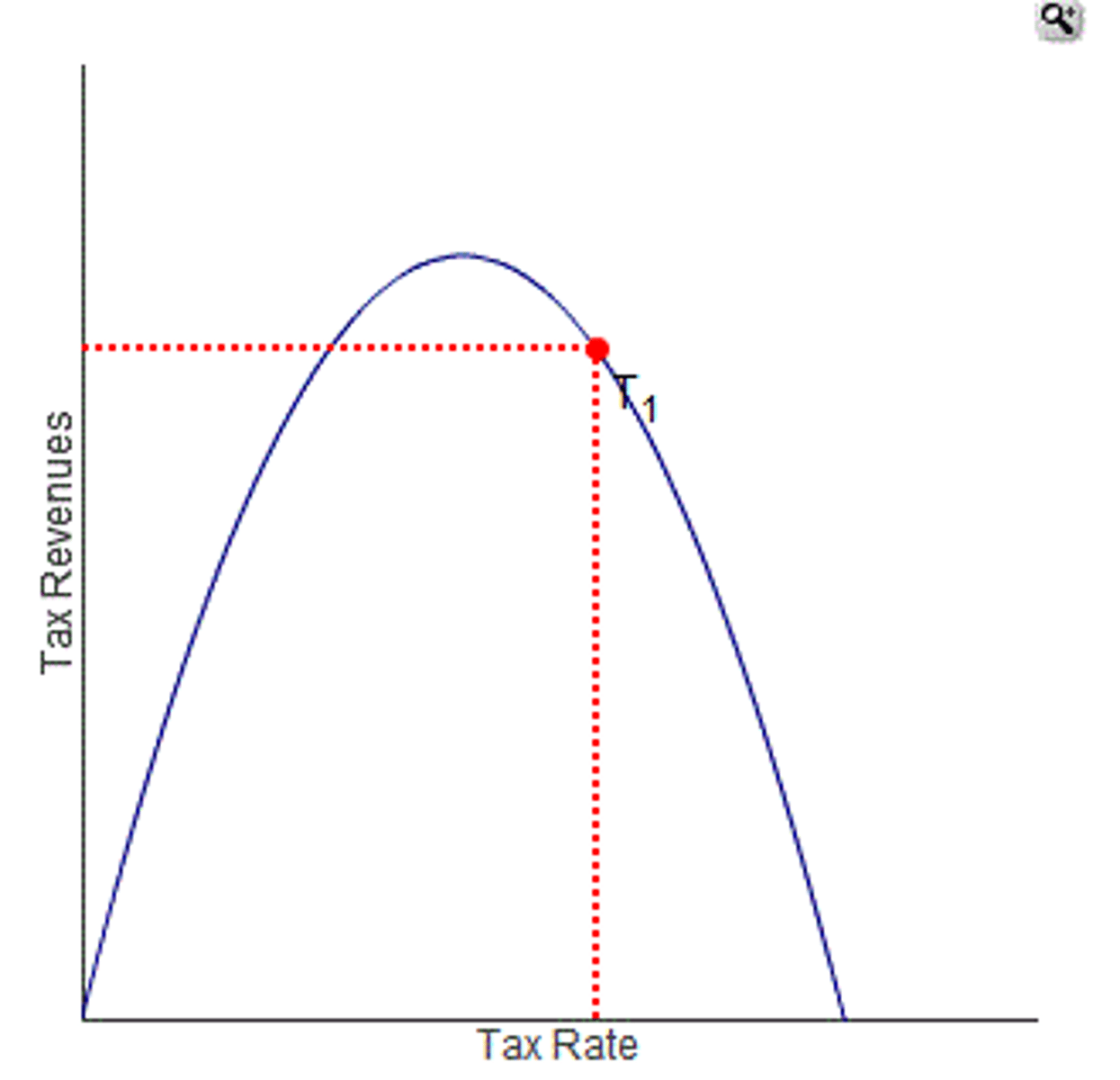

Arthur Laffer's Curve

Government might collect more taxes if they lessen the tax rate, to a certain degree.

Reason's For backwards bend of laffer curve

1. Leisure and all other goods trade-off. People forego leisure for all other goods. At high marginal rates, people are going to consumer much more leisure, since the money they make working more hours will be taken by the gov.

2. Entrepreneurial Risk-Taking: Risk and Rate of return move together. If high taxes, no one is going to take risks, like drilling for oil, and therefore no one will invest in riskier techn that the economy may profit off of.

3. Tax loopholes and shelters: There are ways to get out of paying high rates. Like behaving how politicians want you to. Incomprehensible tax code creates a bsuiness for those to help decipher taxes for those who can afford it.

4. Unerground economy. accounts for 20% of GDP.

Hauser's Law

in the US, ratio of tax revenue to GDP is insensitive to federal tax rates

applied to Laffer curve, it would plateau

Production Possibilities Frontier

a graph that shows the combinations of output that the economy can possibly produce given the available factors of production and the available production technology