Chapter 4 money banking finance

1/52

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

53 Terms

Simple Loan

The lender provides the borrower with an amount of funds that must be repaid to the lender at the maturity date, along with an additional payment for the interest.

Fixed payment loan

The lender provides the borrower with an amount of funds that the borrower must repay by making the same payment, consisting of part of the principal and interest, every period (such as a month) for a set number of years

Ex: If you borrow $1000, this loan might require you to pay $126 every year for 25 years.

Coupon bond

Pays the owner of the bond a fixed interest payment (coupon payment) every year until the maturity date, when a specified final amount (face value or par value) is repaid.

Ex: A coupon bond with $1,000 face value might pay you a coupon payment of $100 per year for ten years, and then repay you the face value amount of $1,000 at the maturity date.

Coupon rate

The dollar amount of the yearly coupon payment expressed as a percentage of the face value of the bond.

The percentage of the face value that is paid semi-annually

– Coupon rate never changes. [Coupon Rate =Coupon Payment / Face

Value]

A discount bond ( also called a zero-coupon bond)

Is bought at a price below its face value (at a discount), and the face value is repaid at the maturity date.

Ex: a one-year discount bond with a face value of $1,000 might be bought for $900; in a year’s time, the owner would be repaid the face value of $1,000.

U.S. Treasury bills, U.S. savings bonds, and long-term zero-coupon bonds are examples of discount bonds.

Unlike a coupon bond, a discount bond does not make any…

… interest payments; it just pays off the face value

Simple loans and discount bonds make payments…

Simple loans and discount bonds make payments only at their maturity dates

Fixed payment loans and coupon bonds make payments…

…periodically until maturity.

Yield to Maturity

Of the several common ways of calculating interest rates, the most important is the yield to maturity, which is the interest rate that equates the present value of cash flow payments received from a debt instrument with its value today.

The percentage rate of return for a bond assuming that the investor holds the asset until its maturity date

For simple loans, the simple interest rate equals…

Simple interest rate equals maturity

To calculate the yield to maturity for a fixed-payment loan…

To calculate the yield to maturity for a fixed-payment loan, we follow the same strategy that we used for the simple loan- we equate today’s value of the loan with its present value.

Because the fixed-payment loan involves more than one cash payment…

the present value of the fixed-payment loan is calculated as the sum of the present values of all cash flow payments.

For a fixed payments loan…

… the loan value, the fixed yearly payment, and the number of years until maturity are known quantities, and only the yield to maturity is not.

Calculating yield to maturity for a coupon bond

Follow the same strategy used for the fixed-payment loan: Equate today’s value of the bond with its present value. Because coupon bonds also have more than one cash flow payment, the present value of the bond is calculated as the sum of the present values of all the coupon payments plus the present value of the final payments of the face value of the bond.

When the coupon bond is priced at its face value…

… the yield to maturity equals the coupon rate

The price of a coupon bond and the yield to maturity are…

negatively related; that is, as the yield to maturity rises, the price of the bond falls. As the yield to maturity falls, the price of the bond rises.

The yield to maturity is greater than the coupon rate when…

… the bond price is below its face value and is less than the coupon rate when the bond price is above its face value.

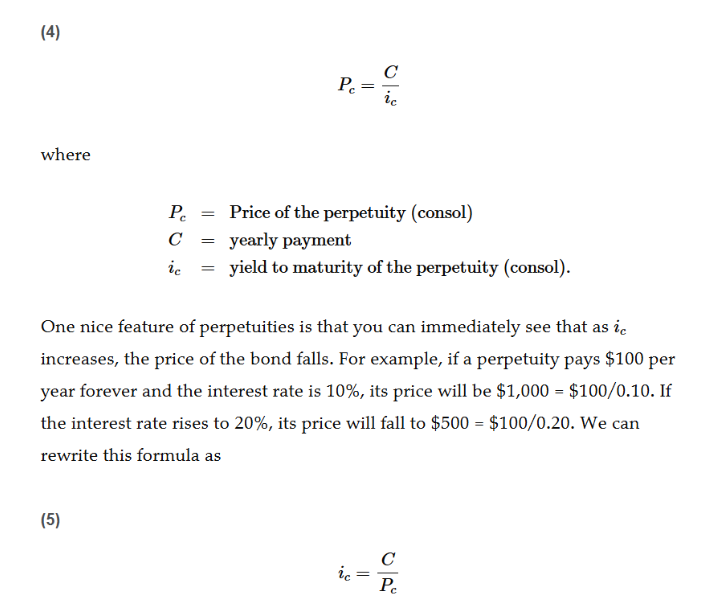

Consol/Perpetuity

A perpetual bond with no maturity date and no repayment of principal, and that makes periodic, fixed coupon payments.

Consol/Perpetuity formula

Current Yield

An approximation of the yield to maturity; equal to the yearly coupon payment divided by the price of a coupon bond.

Post settlement: (Secondary Market) it is the required rate of return

based on market rates. [Current Yield = coupon payment / current

market price]

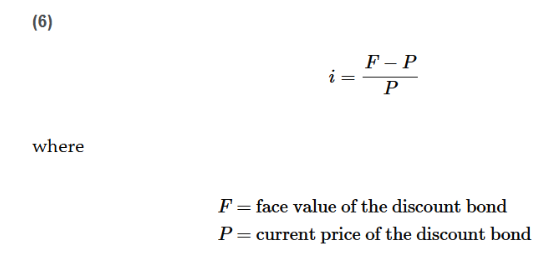

The yield to maturity calculation for a discount bond is similar to that for a simple loan.

The yield to maturity calculation for a discount bond is similar to that for a simple loan.

For any one year discount bond, the yield to maturity can be written as:

For a discount bond, the yield to maturity is…

negatively related to the current bond price.

The concept of present value tells you…

… that a dollar in the future is not as valuable to you as a dollar today because you can earn interest on a dollar you have today.

Important fact: The current bond prices and interest rates are negatively related:

When the interest rate rises, the price of the bond falls, and vice versa.

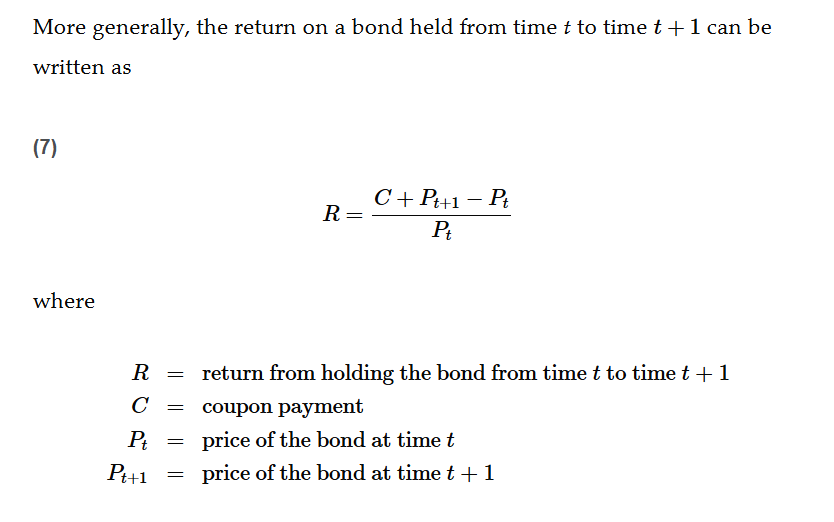

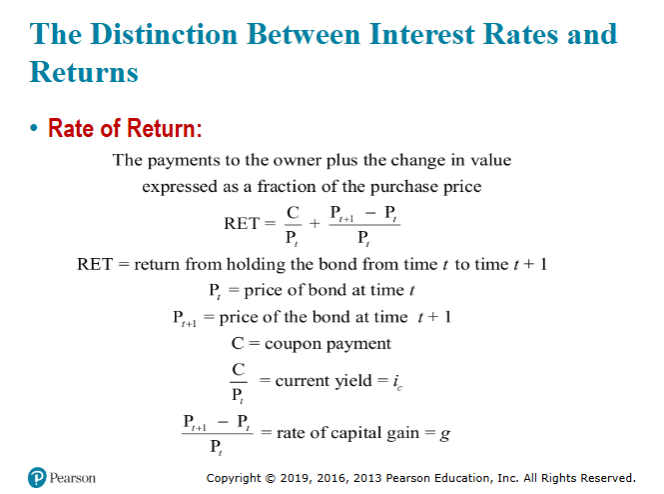

Rate of return

The payments to the owner of a security plus the change in the security’s value, expressed as a fraction of its purchase price

The rate of return equals the yield to maturity only if…

… the holding period equals the time to maturity

A rise in interest rates is associated with a fall in bond prices…

resulting in a capital loss if time to maturity is longer than the holding period.

A fall in interest rates is associated with a rise in bond price…

resulting in a capital gain if time to maturity is longer than the holding period.

Rate of return formula

The more distant a bond’s maturity…

…the greater the size of the percentage price change associated with an interest-rate change.

…the lower the rate of return that occurs as a result of an increase in the interest rate

The return on a bond will not necessarily equal the…

yield to maturity on that bond

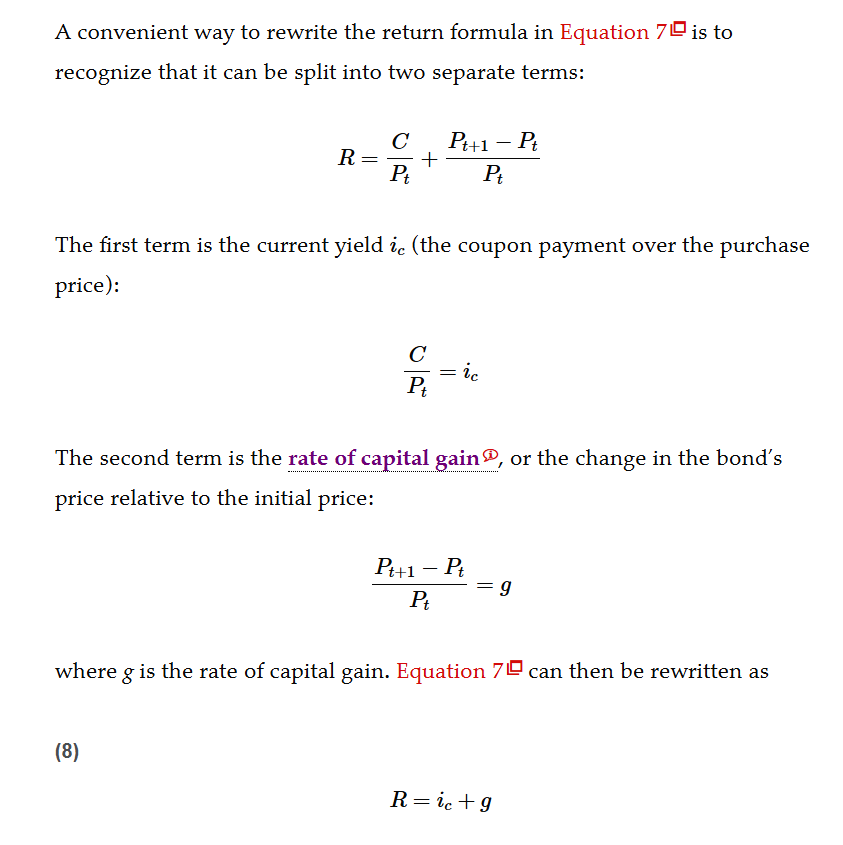

Return on a bond Formula

Return on a bond formula can be split into two parts:

Even if a bond has a substantial initial interest rate,

its return can be negative if interest rates rise.

Price and returns for long-term bonds are…

more volatile than those for shorter-term bonds

Interest Rate Risk

The possible reduction in returns associated with changes in interest rates

What types of bonds have no interest rate risk?

Bonds with a maturity term that is as short as the holding period

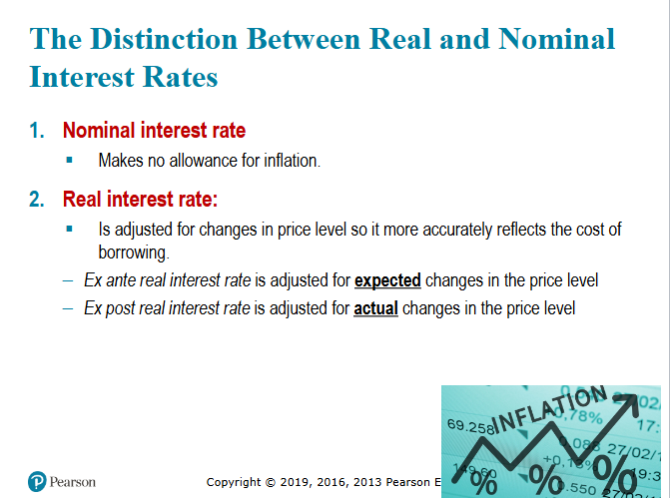

Nominal interest rate

An interest rate that does not take inflation into account

Real interest rate (ex ante real interest rate)

The interest rate adjusted for expected changes in the price level (inflation) so that it more accurately reflects the true cost of borrowing.

This interest rate is more precisely referred to as the ex ante real interest rate because it is adjusted for expected changes in the price level. The ex ante real interest rate is very important to economic decisions, and typically it is what economists mean when they make reference to the “real” interest rate.

Ex post real interest rate

The interest rate that is adjusted for actual changes in the price level, it describes how well a lender has done in real terms after the fact.

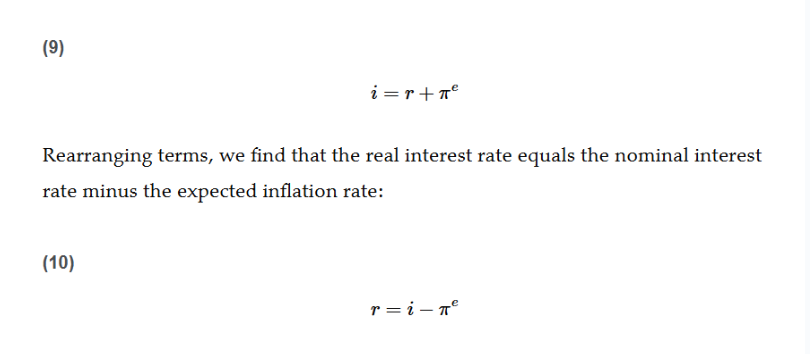

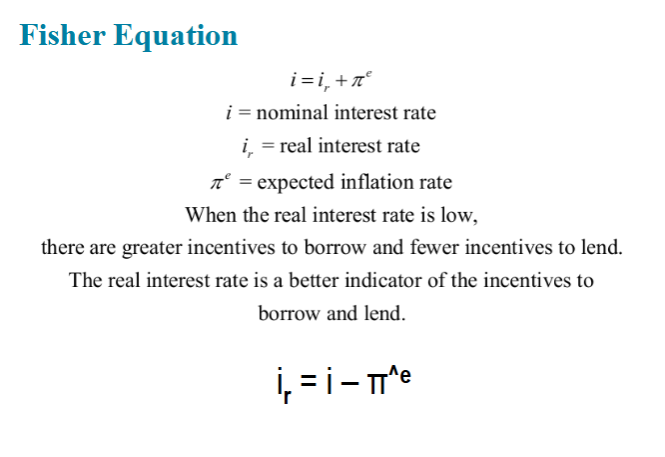

Fisher Equation

The Fisher Equation states that the nominal interest rate i equals the real interest rate r plus the expected rate of inflation π^e.

When the real interest rate is low…

there are greater incentives to borrow and fewer incentives to lend.

When inflation is subtracted from a nominal return…

we have the real return, which indicates the amount of extra goods and services that we can purchase as a result of holding the security.

The distinction between real and nominal interest rates is important because…

the real interest rate, which reflects the real cost of borrowing, is likely to be a better indicator of the incentives to borrow and lend. Nominal and real interest rates usually move together but do not always do so.

Rate of return formula sheet

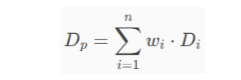

Duration

Duration measures a bond’s or fixed income portfolio’s price sensitivity to interest rate changes

Time to maturity and a bond’s coupon rate are two factors that can affect a bond’s duration

Bond portfolio duration

Slide: Distinction between real and nominal interest rates

Slide: Fisher Equation

Assuming the terms of issuance to be the same for different types of loans, the government would choose to issue an

Perpetuity, because the near-term costs to maintain a given size loan are much smaller for a perpetuity than for a similar fixed payment loan, discount bond, or coupon bond.

True or False: With a discount bond, the return on a bond is equal to the rate of capital gain.

True: A discount bond has no coupon payments so the return on the bond is equal to the rate of capital gain.

What part of the rate of return formula incorporates future changes in the price of the bond?

The rate of capital gain