3.8 Investment Appraisal

1/6

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

7 Terms

Investment Appraisal

Refers to a series of quantitative techniques designed to assist businesses in judging the desirability of investing in particular projects

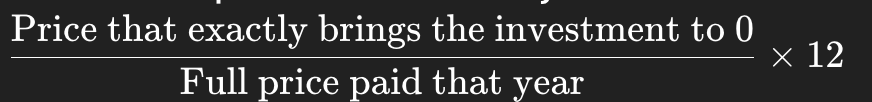

Payback Period equation for below one year

subtract each net cash flow from each year from the initial capital cost

Use equation attached

Advantages of Payback Period

Quick and easy to calculate

Effect: Business can make decisions quicker, higher productivity

Disadvantages of Payback Period

Only assesses the investment through how fast the company receives its investment back

Effect: Investment may not contribute to goals such as improving brand image/awareness/loyalty. Could also encourage short-term thinking (depends on link)

Does not consider the profits the investment will ultimately make

Effect: Ignoring the opportunity for better cash flows in the future is an opportunity cost.

Does not take into account the timing of any income received

Effect (?): Can not judge which investment yields higher profits in the beginning

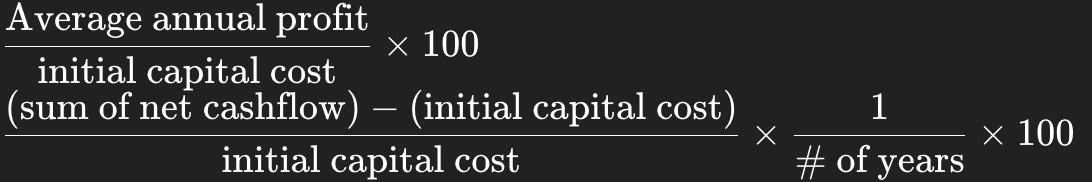

Average rate of Return Calculation

See attached file

Advantages of Average Rate of Return (ARR)

Considers the level of profits earned from an investment as it uses all cash flows

Effect: Ensures the business chooses the most profitable investment

Easy comparison with investments such as loans/other investments from banks

Disadvantages of Average Rate of Return (ARR)

Does not take into account the timing of any income received

Effect: could negatively impact the liquidity position of the business