Ap Macro Unit 4

1/24

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

25 Terms

Which of the following is the best example of the crowding out effect?

Deficit spending results in high interest rates that decrease private investment

Which of the following is true for the money market graph?

There is an inverse relationship between the nominal interest rate and the quantity of money demanded

Fractional reserve banking means that banks are required to

keep part of their demand deposits at reserves

When an economy is at full employment an expansionary monetary policy will lead to

lower interest rates and more investment

If the federal reserve raises the discount rate, how are interest rates and real GDP affected

Interest rates = increase

Real GDP = decrease

To eliminate an inflationary gap, the Federal Reserve might

Sell bonds on the open market

The federal reserve can increase the money supply by

buying bonds on the open market

If on receiving a checking deposit of $500 a bank’s excess reserves increased by $400, the required reserve must be:

20%

Assume the required reserve ratio is .2. If a bank initially has no Excess reserves and $100,000 cash is deposited in the bank, the maximum amount by which this bank may increase its loans is

$80,000

If required reserves is 10% and that bank receives a new demand deposit of $300. Which of the following will most likely occur in the bank’s balance sheet?

Liabilities: Increase by $300

Required Reserves: Increase by $30

The Federal Reserve can change the US money supply by changing

Discount rate

Open market operations refer to which of the following activities?

The buying and selling of government securities by the Federal Reserve

An open market purchase of bonds by the Fed will most likely change the money supply, the interest rate, and the unemployment rate in which of the following ways??

Money Supply: Increase

Interest Rate: Decrease

Unemployment Rate: Decrease

The federal funds rate is the interest rate that

Banks charge one another for short-term loans

If the Fed institutes a policy to reduce inflation, which of the following is most likely to increase?

Interest rates

If the supply for loanable funds increases, what will happen to real interest rates and investment?

Real Interest Rates: decrease

Investment: Increase

Which of the following is true regarding the balance sheet of a commercial bank?

Demand deposits are considered a liability

A decrease in the supply of money will cause which of the following?

An increase in nominal interest rates

Which of the following is the best example of fractional reserve banking?

A bank lends out $5000 of its excess reserves

The required reserve ration is 10% and the central bank sells $2 million in bonds to banks. If banks loan out all their excess reserves and there are no leakages, what will happen to the money supply?

It will decrease by $20 million

Suppose that all banks hold no Excess reserves and the reserve requirement is 20%. If Paula deposits $200 she earned for babysitting in the bank, what is the maximum increase in the total money supply?

$800

Which of the following is true regarding the central bank’s use of open market operations?

Interest Rates will decrease when the central bank buys bonds

In country z the required reserve ratio is 10 percent. Assume that the central bank sells $50 million in government securities on the open market.

A. Calculate each of the following

i. The total change in reserves in the banking system

ii. The maximum possible change in the money supply

i. $50 million

ii. 10 x $50 = $500 million

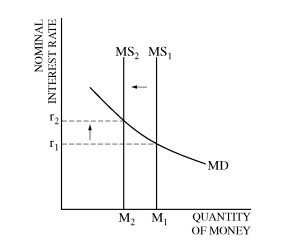

B. Using a correctly labeled graph of the money market. Show the impact of the central bank’s bond sale on the nominal interest rate.

Look at image

C. What is the impact of the central bank's bond sale on the equilibrium price level in the short run?

D. As a result of the price level change in part C. are people with fixed incomes better off, worse off, or unaffected. Explain.

C. Equilibrium price will fall

D. People with fixed incomes will be better off. Lower prices raise real income or increase the purchasing power of fixed income