Ap Macroeconomics Unit 4 Study Guide

1/24

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

25 Terms

what is the relationship between interest rate and interest sensitive spending

inverse relationship

liquidity

the ease with which an asset can be converted to a medium of exchange

bonds

loans or IOUs that represent debt that the govt., business, or individual must repay to the lender

stocks

represent ownership of a corporation and the stockholder is often entitled to a portion of the profit paid out as dividends

what is the relationship between bond prices and interest rate

inversely related

formula for real interest rates

real ir = nominal ir- expected inflation

formula for nominal interest rates

nominal ir= real ir - expected inflation

commodity money

something that preforms the function of money and has intrinsic value

fiat money

something that serves as money but has no other value/uses

what are the 3 functions of money

medium of exchange

measure of value

store of value

M0 money (monetary base)

currency in circulation

bank reserves

M1 money

currency in circulation

demand deposits in the bank (checking account and savings account)

M2 money

M1 money

certificates of deposit

money market funds

fractional reserve banking

when the bank holds a portion of deposits to cover potential withdraws and then loans the rest out

formula for money multiplier

1/reserve requirement

when the FED gives money to commercial banks do they have to keep required reserves

no, they do not have to keep any reserves they can loan it all out

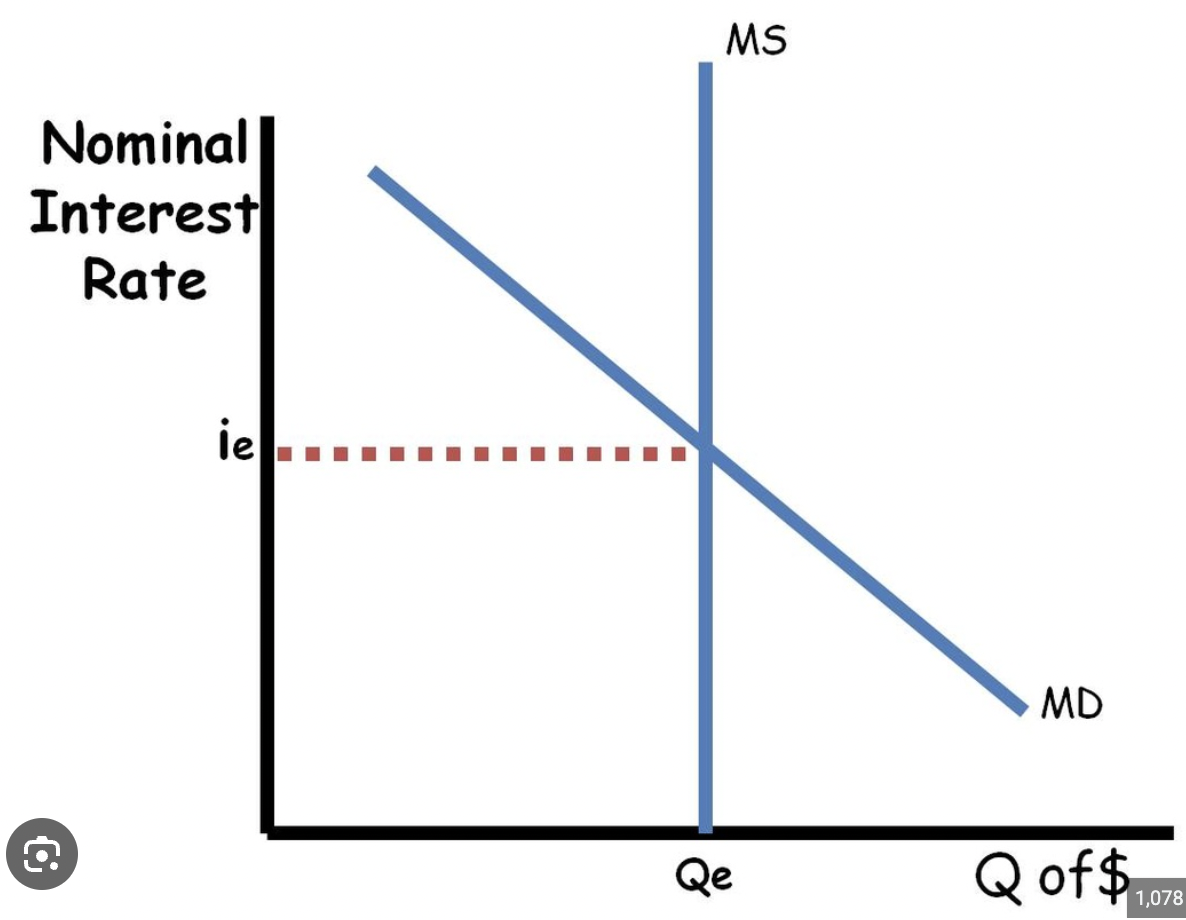

relationship between interest rate and quantity of money demanded

inverse relationship

money market graph

money demand shifters

changes in price level

change in income

change in technology

what monetary policy does the FED use to adjust money supply in limited reserves

reserve requirement ratio

amount commercial banks need to keep in reserves

discount rate

interest rate the FED charges commercial bank

inverse relationship between MS and DR

open market operations

buying and selling bonds

buy big, sell small

federal funds rate

the interest rate that banks charge one another for one day loans of reserve

monetary policy the FED uses to adjust monetary supply in ample reserves

Administered rates like interest on reserves

the interest rate that the FED pays commercial banks to hold reserves

IOR and MS have an inverse relationship

increase IOR to slow economy

decrease IOR to boost economy

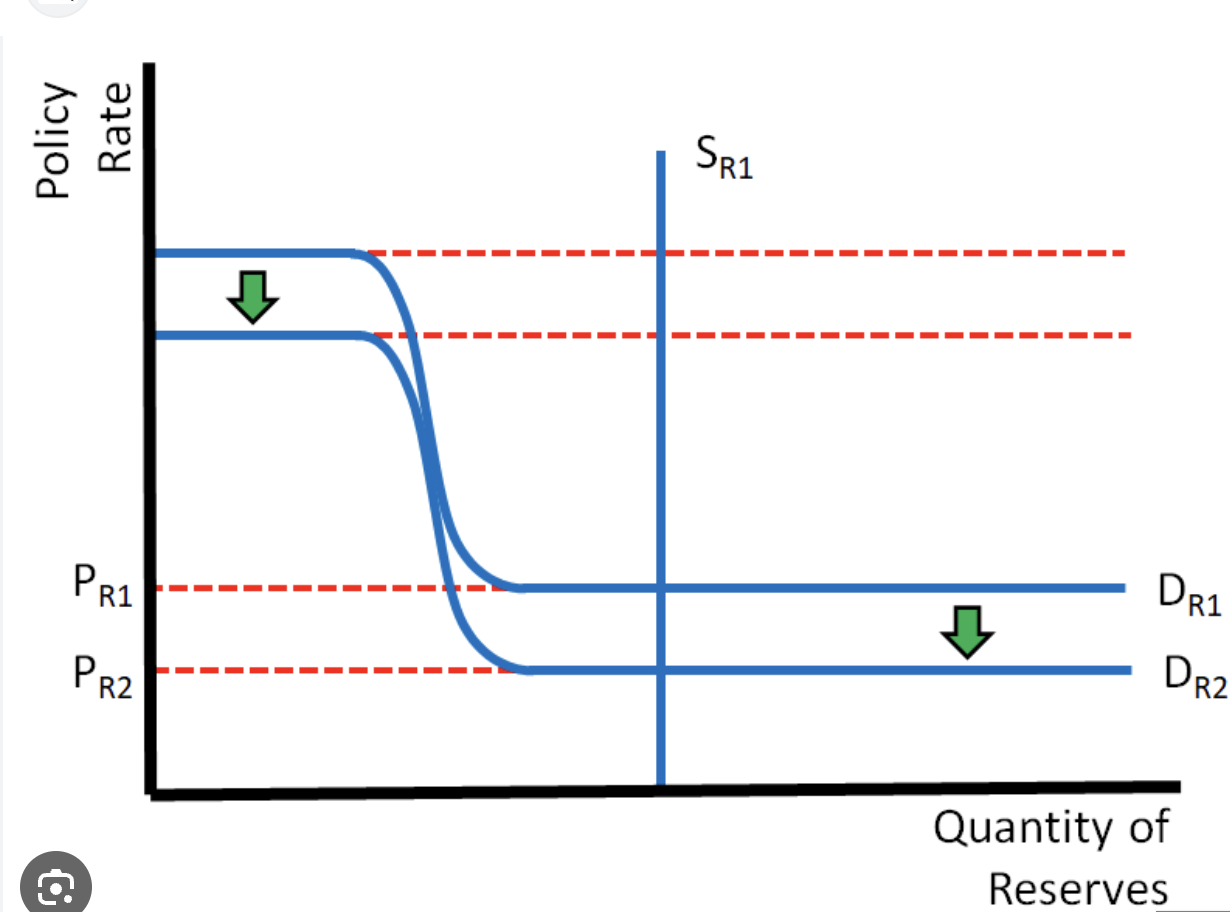

reserve market model

top line

represents the discount rate

bottom line

represents IOR

middle section

represents federal funds rate

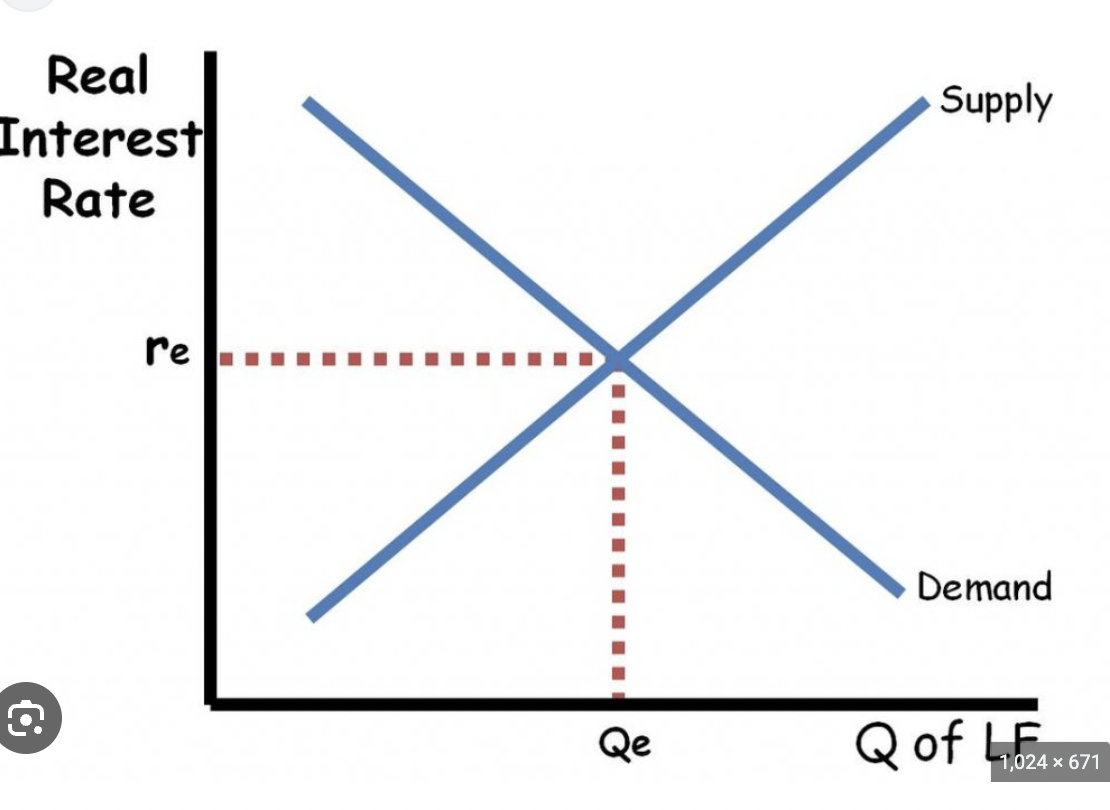

loanable funds market

supply (lenders)

shifts by change in inflow/outflow

demand (borrows)

shifts by change in borrowing