unit 7

1/44

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

45 Terms

commercial bank

full service, for profit, loan interest rate higher, account interest may be higher, higher service fees, many locations, FDIC insured

wells Fargo, bank of America, capital one

credit union

non profit, account interest may be lower, loan interest rates may be lower, fewer locations, member-owned, NCUA insured, FDIC insured

apple federal, navy federal

savings & loan

home mortgage specialists, loan interest rates may be lower, account interest may be higher, fewer locations

citizen’s saving and loan

difference between NCUA & FDIC

both provide government-backed deposit account insurance. NCUA applies to federally insured credit credit unions while FICA insures bank deposits

factors of a good credit rating/score

paying bills on time, get rid of debt, monitor credit rating frequently

factors of a bad credit rating

late payments, large unpaid debt, numerous new credit cards, numerous unclosed old accounts

open-ended credit

a loan that can be taken out numerous times

credit cards

close-ended credit

a loan that can be taken out only once, specific use and time period

home mortgages

5 characteristics considered on a credit application

character, capacity, capital, conditions, collateral

character (5 characteristics)

whether or not they are responsible with their borrowing

capacity (5 characteristics)

whether or not they have enough money to be able to ever pay back the borrowed amount

capital (5 characteristics)

whether or not they have the money to show that they are serious

conditions (5 characteristics)

whether or not the money is being borrowed will go to something actually able to turn out

collateral (5 characteristics)

what can be sold (assets) if they end up not having the money to pay back

advantages of using credit

long-time rewards, convenience of a credit card, very useful in case of emergency

disadvantages of using credit

easy to overspend, interest can be very expensive, can get high bills because of poor credit score

truth in lending act

requires consumers to be fully informed of the cost of the credit

fair credit reporting act

you have the right to know what is in your file and who has seen your file

fair credit billing act

creditors must resolve billing errors within a specific amount of time

equal credit opportunity act

prevents discrimination in judgement of creditworthiness

fair debt collection practices act

designed to eliminate abusive collection practices by debt collectors

how to avoid unnecessary credit costs

maintain good credit, get rid of debt, track spending

20/10 rule

total amount borrowed should not be more than 20% of your annual income and monthly payment should not be more than 10% of your monthly income

certificate of deposit

very strict; an account that specifies an amount to be deposited and a time limit for keeping it in the bank, fixed interest rates, penalty for early withdrawal

checking account

this account links with a person’s debit card such that each swipe of the card for a purchase, the amount is automatically deducted from the balance of the account

check cashing company

because of this account a person can write a small document to another person for a good or service

money market account

must make a large deposit; must maintain a certain balance, earns a higher interest than other accounts

payday loan

a type of short-term borrowing where someone borrows a small amount of money at a very high interest rate

savings account

contents of this account are liquid; enable you to get cash quickly and transfer money into checking

mobile banking

electronic service provided by banks that allows online transactions

ATMs

electronic service provided by banks that allows convenient withdrawal and deposit

invoice

electronic service provided by banks that allows bills to be paid automatically

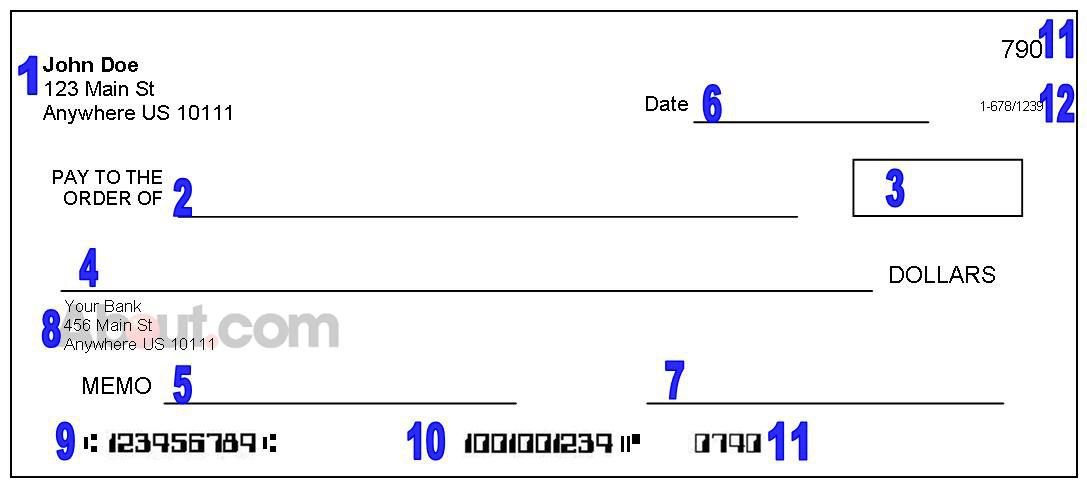

line 1: personal info of the person paying the money

line 2: name of the person receiving the money

line 3: the amount of money being paid in numbers

line 4: the amount of money being paid in words

line 5: purpose of the check

line 6: the date the check is being signed

line 7: person paying the money’s signature, approving the payment

line 8: person paying the money’s bank contact info

line 9: bank’s ABA routing number

line 10: person paying the money’s account number

line 11: the check’s number

line 12: bank’s ABA routing number again in a different format

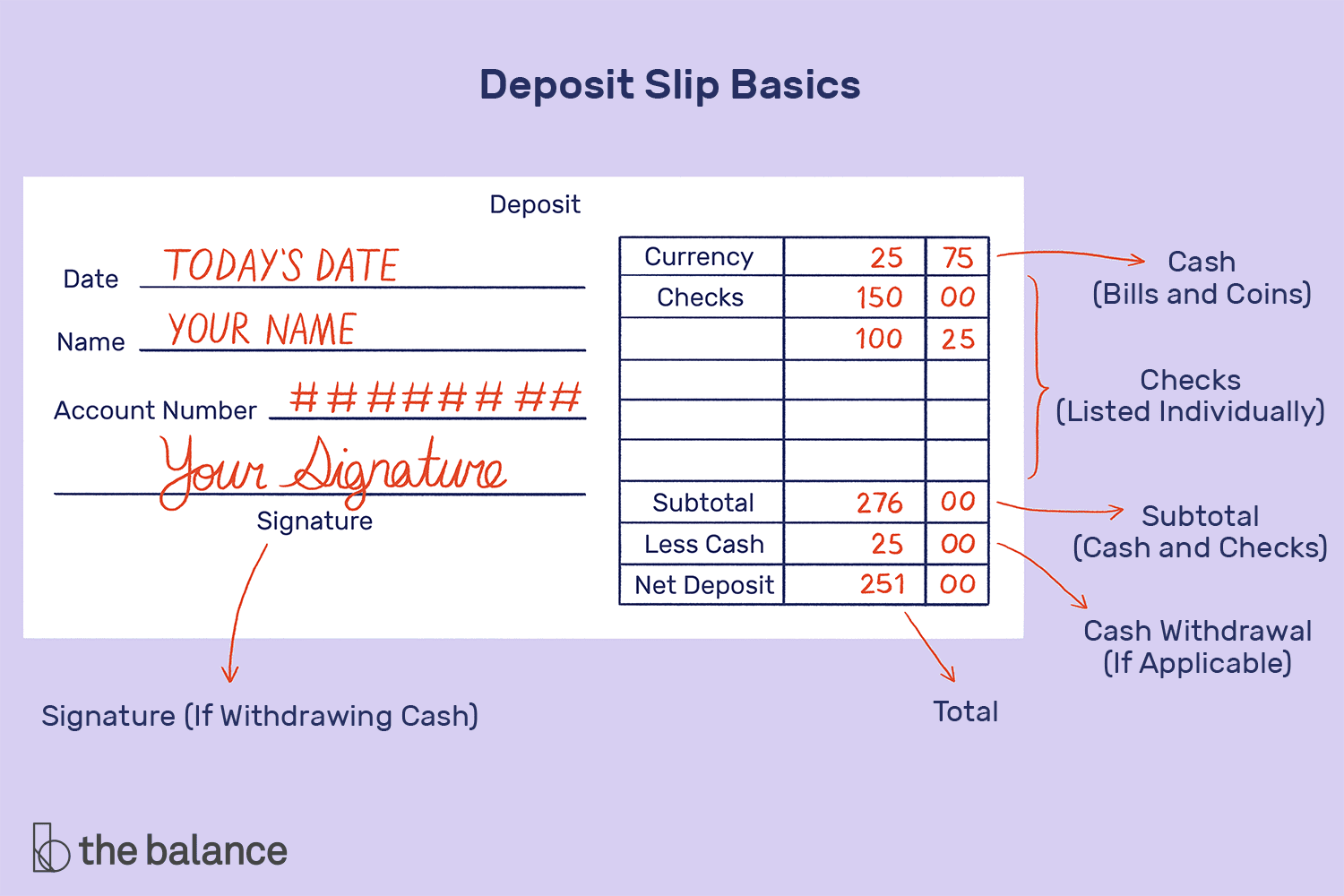

deposit slip

cash and checks are written separately, cash back is applied in ‘less cash’ section

annual percentage rate (APR)

APR is the total cost of borrowing, including interest and fees, expressed as a percentage. It helps compare loan offers and understand the true cost of credit.

automated bill pay

automated process that pays bills directly from a banking account through an electric payment system

bankruptcy

Legal process where individuals or businesses declare inability to repay debts. Assets may be liquidated to settle obligations.

cancelled check

A check that has been processed by the bank and marked as paid, typically with a stamp or hole punch to prevent reuse.

credit bureau

An agency that collects and maintains credit information on individuals and businesses, used by lenders to assess creditworthiness and make lending decisions.

credit limit

Amount of money a financial institution allows an individual to borrow or spend on a credit card or line of credit. It is based on the individual's creditworthiness.

endorsement

a signature or an equivalent stamp that authorizes payment or a transfer of funds, or other financial transaction

interest rate

"Interest rate" refers to the percentage charged by a lender on a loan

overdraft protection

An overdraft occurs when you don't have enough money in your account to cover a transaction, but the bank pays the transaction anyway

reconciliation

comparing two sets of financial records to assure consistency

stop payment request

a formal request made to a financial institution to cancel a check or payment that has not yet been processed