Oligopoly

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

27 Terms

Characteristics of Oligopoly

Most markets are imperfectly competitive

Most imperfectly competitive industries operate in an oligopoly market structure

E.g., Banks, insurance companies, department stores, supermarkets, petrol retailers, sport stores etc.

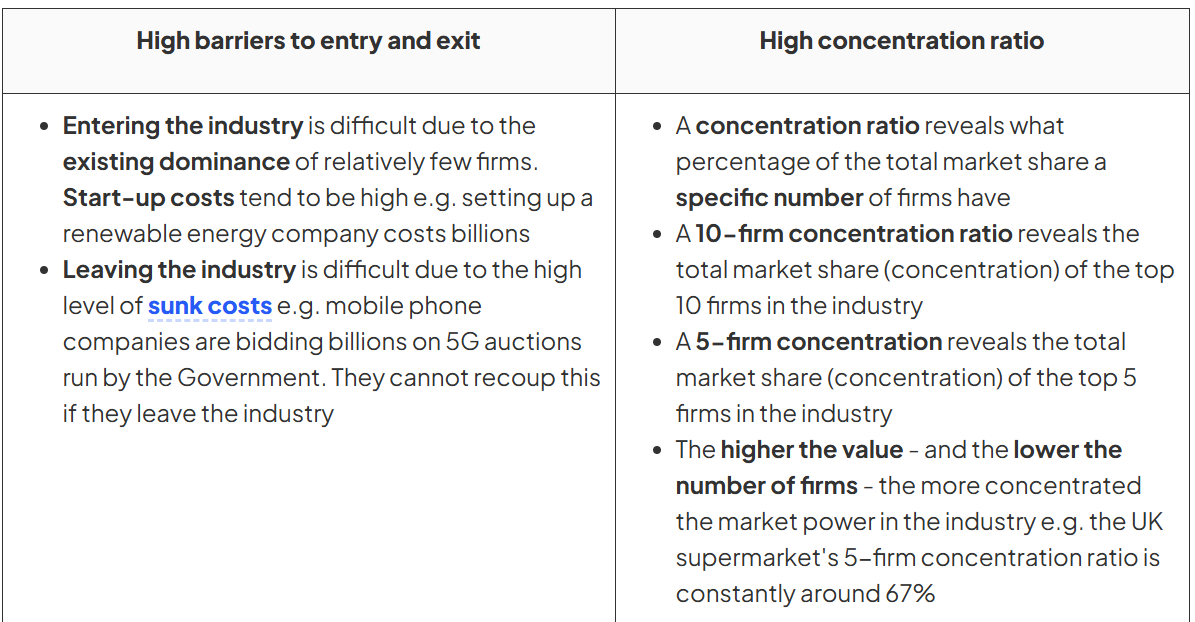

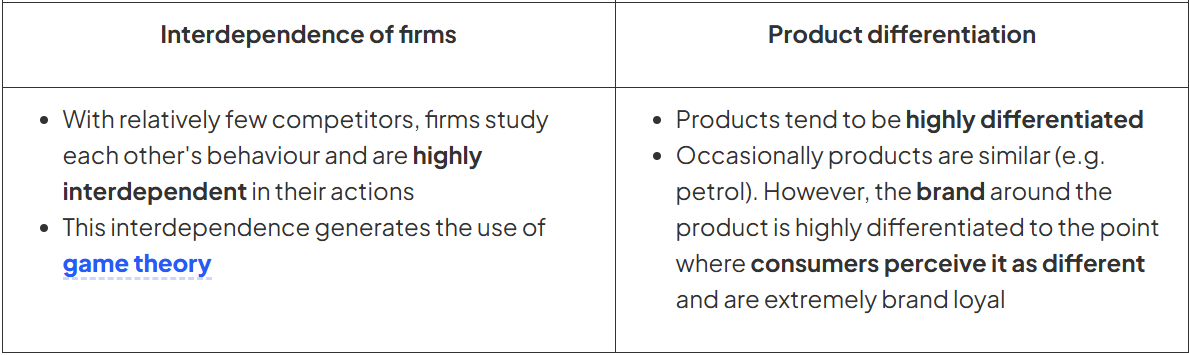

Characteristics of an oligopoly market

Characteristics of an oligopoly market

Calculation of Concentration Ratios

The most commonly used concentration ratios in the UK are the five-firm, ten-firm, and twenty-firm concentration ratios

A five-firm concentration ratio of around 60% is considered to be an oligopoly

A one-firm concentration ratio of 100% would be a pure monopoly

The UK Competition and Markets Authority (CMA) defines a monopoly as a firm with more than 25% market share

It prevents mergers or acquisitions from taking place which would give one firm more than 25% market share

Reasons for collusive and non-collusive behaviour

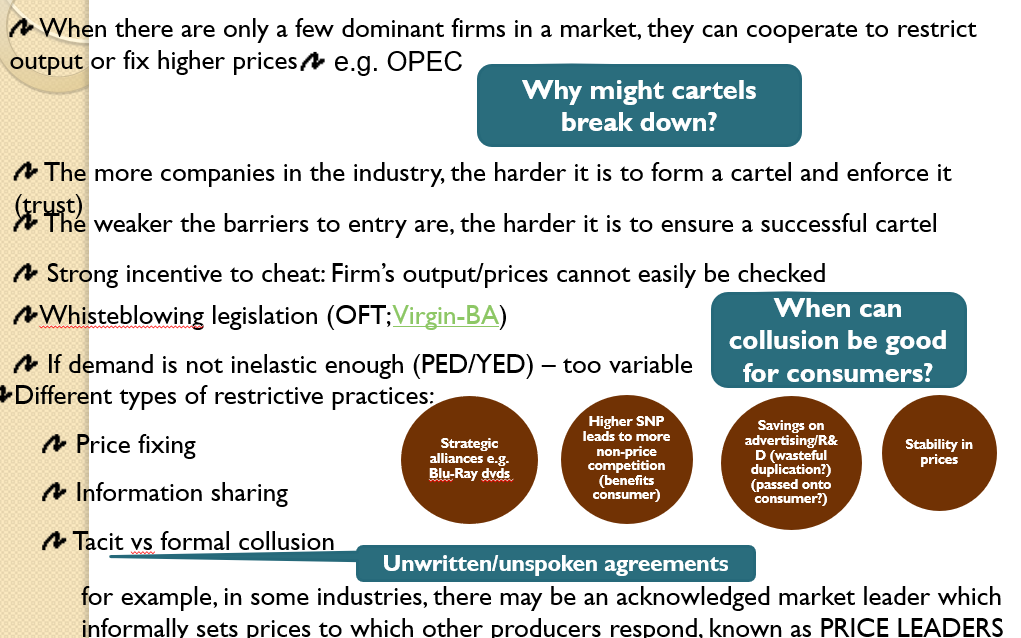

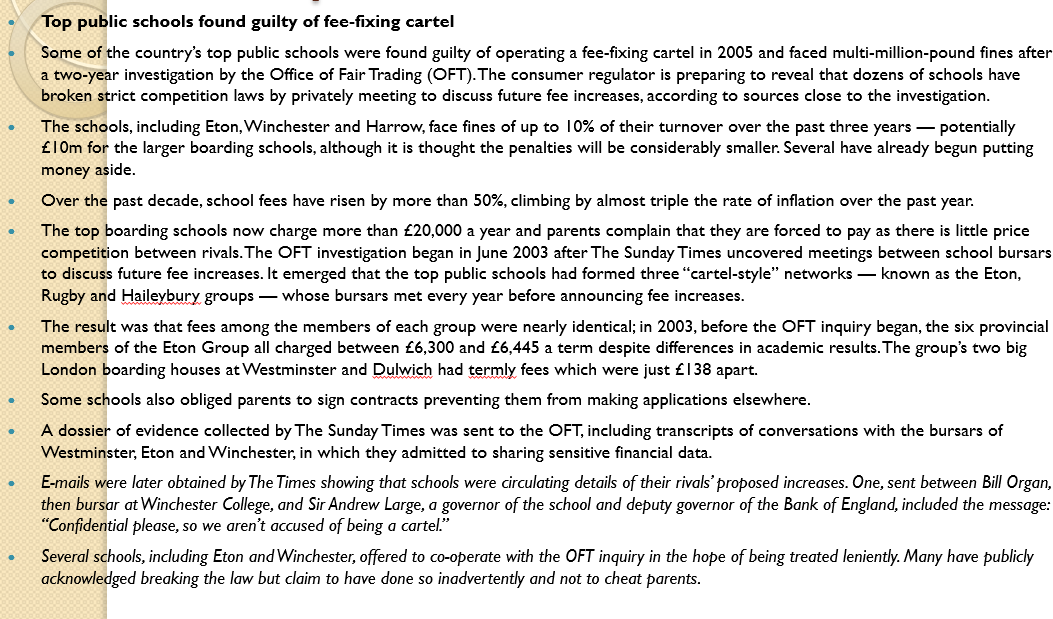

Collusive behaviour in oligopolies occurs when firms cooperate to fix prices and restrict output

They cease to compete as vigorously as they can

Non collusive behaviour in oligopolies occurs when firms actively compete to maintain/increase market share

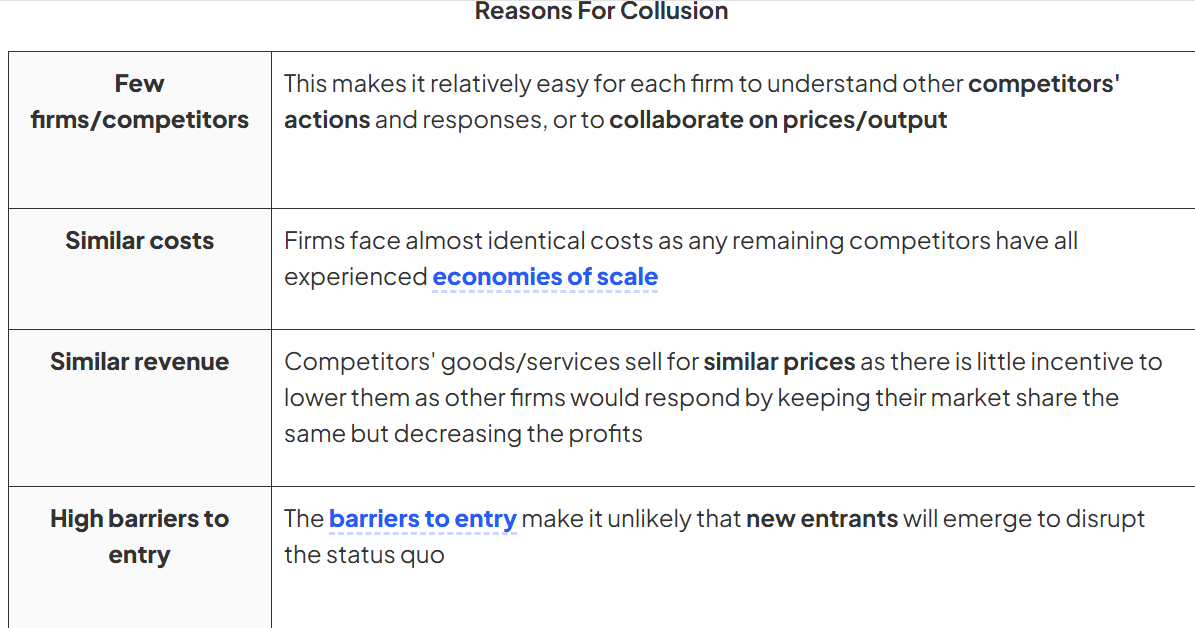

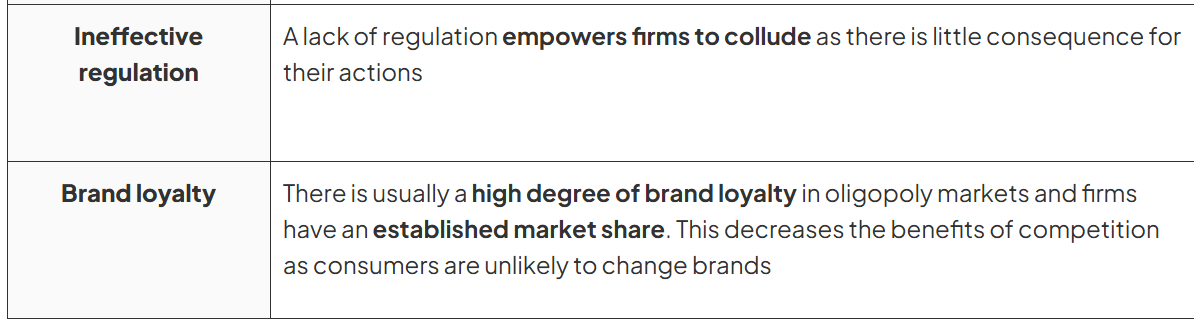

Reasons for collusion

Reasons for collusion

Types of collusion

Collusion can be overt or tacit

The net effect of collusion is that a group of firms end up acting like a monopoly in the market

Overt collusion

Overt collusion occurs when firms explicitly agree to limit competition or raise prices (price fixing)

A cartel is the most restrictive form of collusion and is illegal in most countries

The consequences of overt collusion include:

Higher prices for consumers

Less output in the market

Poor quality products and/or customer service

Less investment in innovation

How overt collusion often happens

Overt collusion often happens in the following ways

Price fixing

Setting output quotas which limit supply and naturally results in price increases

Agreements to block new firms from entering the industry

Agreements to pay suppliers the same price thereby driving down prices in the supply chain (monopsony power)

When does tacit collusion occur:

Tacit collusion occurs when firms avoid formal agreements but closely monitor each other's behaviour usually following the lead of the largest firm in the industry

The most common form of tacit collusion is price leadership or price matching

This occurs when firms monitor the price of the largest firm in the industry and then adjust their prices to match

It is difficult for regulators to prove that collusion has occurred

It provides similar benefits to firms as overt collusion, but perhaps not to the same degree

It has similar consequences for consumers as overt collusion, but perhaps not to the same degree

What is game theory

Game theory is a mathematical framework which is used by firms to ensure optimal decisions are made in a strategic setting where there is a high level of interdependence (such as in oligopoly markets)

What are the three elements of game theory

Any game has three elements

The players - (firms)

The strategies available to the players

The payoffs (outcomes) that each player receives for each combination of strategies

Game theory - It was first illustrated using a simple model called The Prisoners Dilemma

Two criminals are caught after a train robbery (Carol and Doug)

The prosecutor does not have much evidence

The criminals are guilty but have agreed with each other that they will deny all involvement

The prosector wants one (or both) to confess

The strategies and payoffs available to the prisoners are presented in a payoff matrix

Diagram analysis - game theory

If Carol and Doug stick to their plan and deny involvement, they each get 3 years jail time

If Doug confesses and indicates Carol's involvement, then Doug gets a lenient sentence of 1 year and Carol gets 10 years

If Carol confesses and indicates Doug's involvement, then Carol gets a lenient sentence of 1 year and Doug gets 10 years

There is a strong incentive to collude as it will yield the most beneficial outcome for Carol and Doug (3 years each)

Fearing the worst, both players decide to confess and receive 5 years each

This outcome is called the dominant strategy as it carries the least risk

How do firms use game theory

Firms typically use game theory in the following situations:

When making decisions to raise or lower prices

When making decisions about new advertising and branding initiatives

When making decisions about investment in product innovation

When making decisions on product bundling e.g. combined phone and broadband package

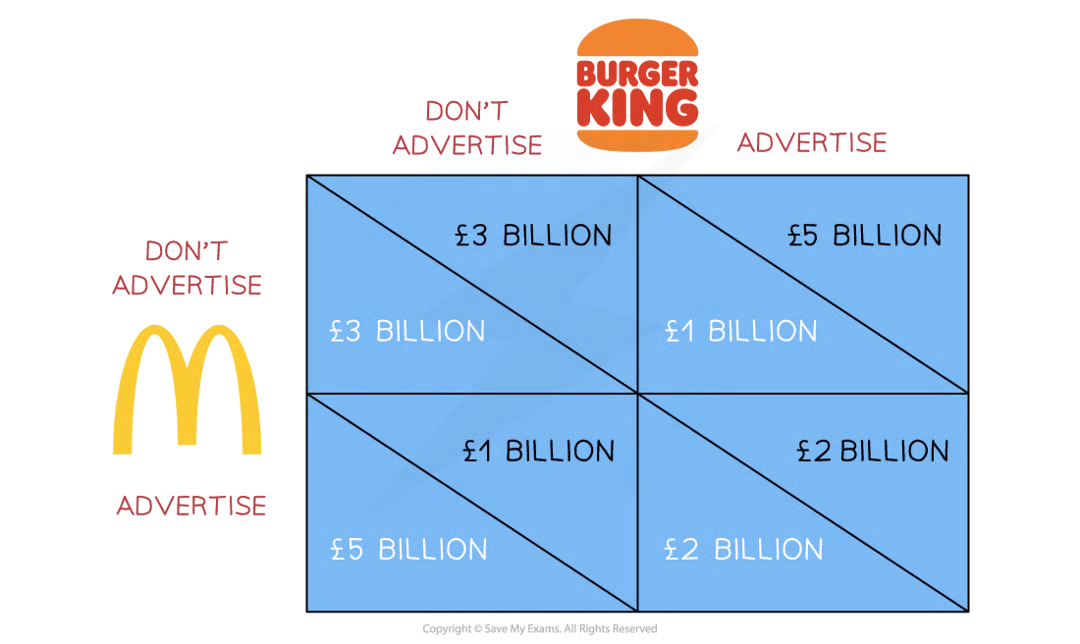

payoff matrix representing the strategic options available to Burger King and McDonald's when making advertising decisions

The £ payoffs represent the likely profits for each combination of choices selected

Diagram analysis

If Burger King and McDonald's collude and agree not to advertise (top left), they can each enjoy £3 bn. in profits

There is a strong incentive to collude

If Burger King advertises and McDonald's does not, then Burger King's profits are £5 bn. and McDonald's are £1 bn.

If McDonald's advertises and Burger King does not, then McDonald's profits are £5 bn. and Burger King's are £1 bn.

Both firms decide to advertise and receive £2 bn. of profits each

This outcome is called the dominant strategy as it carries the least risk

The risk of collusion is that one player will cheat and by doing so, get ahead

Price competition

Price wars: occur when competitors repeatedly lower prices to undercut each other in an attempt to gain or increase market share. This often occurs when there is a lower level of non-price competition and where firms find it difficult to collude (either formal or tacit)

Predatory pricing: this is the practice of lowering prices when a new competitor joins the industry in order to drive them out. Prices are often lowered to a point below the cost of production. Once they have left the market, prices are raised again. This pricing strategy is usually illegal as it is anticompetitive

Limit pricing: occurs when firms set a limit on how high the price will go in the industry. A lower price reduces profit and disincentivize other firms from joining the industry. The greater the barriers to entry the higher the limit price is likely to be as firms are already disincentivized

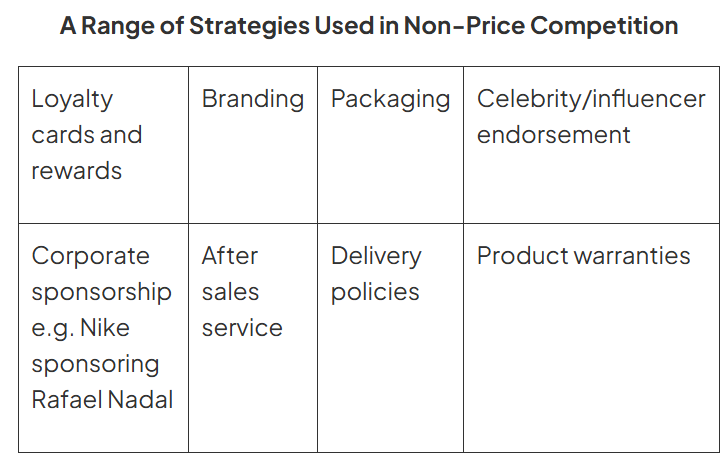

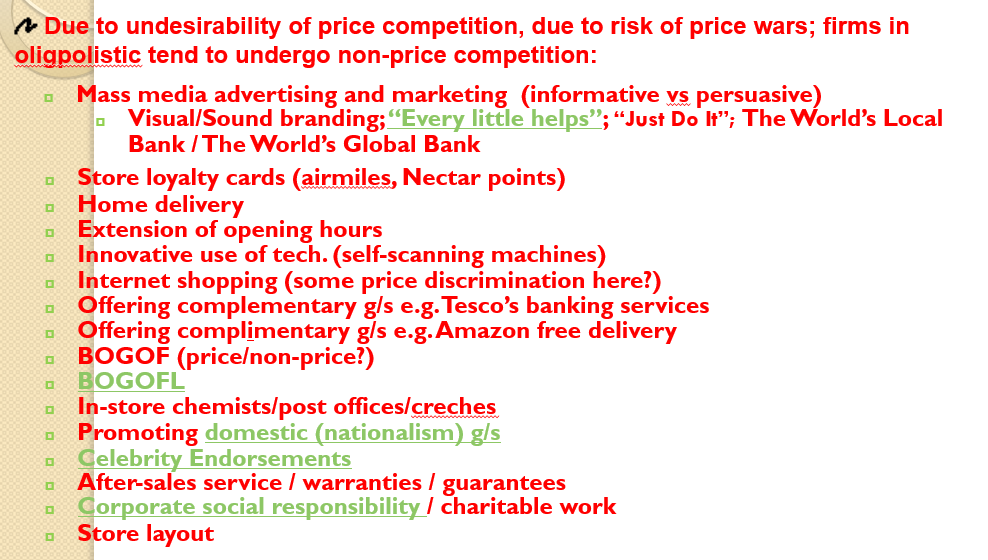

Types of Non-price Competition

Firms engage in a wide range of non-price competition strategies

The aim is to increase product differentiation, develop or increase brand loyalty, and to increase market share

Cartels

Examples of collusion

Game theory

Price wars

◦Price wars occur when a firm lowers price in order to increase market share. Other firms will react to losing market share by lowering price too. This will continue as firms seek to regain lost market share. The consumer will benefit from lower prices but the oligopolists will lose out as overall revenues will fall

Predatory pricing

◦Predatory pricing occurs when a firm attempts to force competition out of the market by setting low prices. This might be below average cost in the short run and is likely to see increased output as demand is higher

Limit pricing

◦Limit-pricing occurs when a firm operates below the profit maximising output of MC = MR. The firm will still make a profit but potential entrants will be deterred from entering the market as lower price means that entry is not profitable

Non-price competition

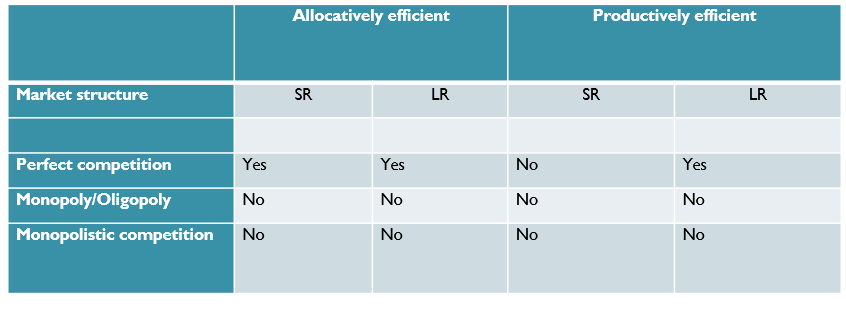

Efficiency summary

Chain 1: Allocative Efficiency in the Short Run (Yes)

In perfect competition, firms are price takers, meaning the market price is determined solely by supply and demand. Firms produce where marginal cost = price, which is also equal to marginal benefit to consumers. This condition ensures allocative efficiency, as resources are allocated to produce the exact quantity consumers want at that price.

Chain 2: Allocative Efficiency in the Long Run (Yes)

In the long run, abnormal profits attract new firms due to free entry and exit. This increases supply and drives price down until P = MC again. As a result, allocative efficiency is maintained in the long run because consumer preferences continue to dictate output levels.

Chain 3: Productive Efficiency in the Short Run (No)

In the short run, firms may earn abnormal profits or losses and therefore may not produce at the minimum point of the average cost curve. This means firms are not productively efficient in the short run, as they are not minimising costs.

Chain 4: Productive Efficiency in the Long Run (Yes)

In the long run, competition forces inefficient firms to exit the market. Surviving firms produce at minimum average cost, achieving productive efficiency. Any firm not minimising costs would be driven out by more efficient competitors.

Chain 5: Overall Efficiency Outcome

Perfect competition is the benchmark market structure because it achieves both allocative and productive efficiency in the long run. This explains why economists often view it as socially optimal, despite its limited realism in real-world markets.

2. Monopoly / Oligopoly – 5 Chains of Reasoning Chain 1: Allocative Inefficiency in the Short Run

Monopolies and oligopolies are price makers, allowing them to restrict output and raise price. They produce where marginal revenue = MC, not where P = MC. Since price exceeds marginal cost, consumer welfare is reduced, causing allocative inefficiency.

Chain 2: Allocative Inefficiency in the Long Run

High barriers to entry prevent new firms from entering the market. As a result, firms can sustain prices above marginal cost in the long run, meaning allocative inefficiency persists over time.

Chain 3: Productive Inefficiency in the Short Run

Due to limited competitive pressure, firms may experience X-inefficiency, where costs rise due to poor management or lack of incentives to minimise costs. This leads to productive inefficiency in the short run.

Chain 4: Productive Inefficiency in the Long Run

Even in the long run, monopolies and oligopolies may not be forced to reduce costs, as rivals cannot enter the market easily. Therefore, firms may continue producing above minimum average cost, remaining productively inefficient.

Chain 5: Exception and Evaluation

While generally inefficient, oligopolies may reinvest abnormal profits into research and development, potentially improving dynamic efficiency. However, this does not guarantee allocative or productive efficiency, which is why the table correctly identifies “No” across all categories.

3. Monopolistic Competition – 5 Chains of Reasoning Chain 1: Allocative Inefficiency in the Short Run

Firms sell differentiated products and therefore face downward-sloping demand curves. They set output where MR = MC, meaning P > MC. As price exceeds marginal cost, consumer preferences are not fully satisfied, causing allocative inefficiency.

Chain 2: Allocative Inefficiency in the Long Run

In the long run, new firms enter due to low barriers to entry, shifting demand curves left until firms earn normal profit. However, P still exceeds MC, meaning allocative inefficiency persists even in long-run equilibrium.

Chain 3: Productive Inefficiency in the Short Run

Firms do not produce at the minimum of the average cost curve in the short run, as differentiated products reduce pressure to minimise costs. This results in productive inefficiency.

Chain 4: Productive Inefficiency in the Long Run

Even in the long run, firms operate with excess capacity, producing at an output level below minimum average cost. This confirms long-run productive inefficiency.

Chain 5: Trade-Off Between Efficiency and Choice

Although monopolistic competition is inefficient in both allocative and productive terms, it provides greater consumer choice and product variety. This represents a trade-off between static efficiency and consumer satisfaction, which is why economists do not view it as entirely undesirable.