3.6 government intervention

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

Explain the role of the competition and markets authority (CMA)

The CMA is the UK's primary competition and consumer authority. It is an independent department with responsibility for carrying out investigations into mergers, markets and the regulated industries and enforcing competition and consumer law

impact of merger regulation

Choice

Avoids the build up of monopolies which may reduce range of choice

Price

Regulation prevents exploitation of consumers by powerful firms (closer to allocative efficiency)

Costs

Greater competition provides a stronger incentives to keep x-inefficiencies to a minimum

Innovation

Greater competition provides a stronger incentive for firms to innovate (dynamic efficiency)

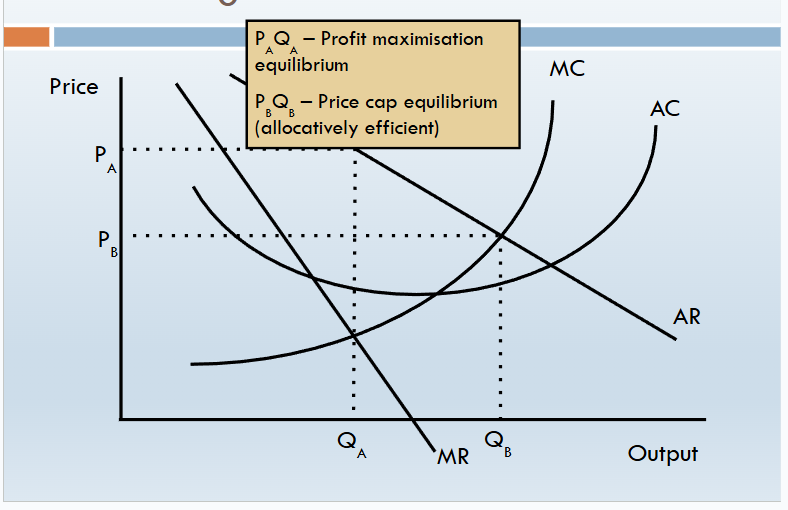

price regulation to control monopolies

Monopolies raise price and restrict output compared to competitive markets – as a result they are allocatively inefficient

Allocative efficiency can be created by setting a maximum price where P=MC

Examples:

Train fares – some routes have been regulated this way

Water

RPI - X

Allow prices to increase at the rate of RPI but subtract an amount reflecting the efficiency gains that the regulator believes can be achieved by the firm

RPI + K

Takes the RPI and allows the addition of ‘K’ which is the additional capital spending a firm has agreed with the regulator is necessary

Water industry is regulated using RPI – X + K

price cap

arguments for price capping

Prevents powerful monopolies from exploiting consumers via high prices

Cuts in price of necessity items increases affordability for consumers (particularly poorer households)

i.e. it increases allocative efficiency

Price caps create an incentive for firms to lower costs in order to increase profits (especially RPI-X)

arguments against price capping

Price capping distorts the price mechanism – could create supply issues in the long run

Regulators may lack accurate information for setting price caps

Capping prices reduces profits which could lead to reduced investment (dynamic inefficiency)

Under-investment could harm long run infrastructure

profit regulation

Set a maximum level of profit that can be earned

Typically this is done by taking the operating costs and adding a rate of return on capital employed

Used extensively in the US to control electricity and water companies

evaluate profit regulation

Regulators need to have a good understanding of costs and rates of return in the industry

The monopolist has more information than the regulator (asymmetric information) – it may attempt to present to regulators that costs are higher than they are

It creates little incentive to minimise costs

If they cover costs and earn a profit on capital employed it creates no gain to the monopolist to reduce costs as they are covered by the consumer

profit cap

quality standards

Where quality is an issue government can set quality standards to be met

In the UK the Post Office has a legal obligation to provide a daily letter delivery service to rural areas, despite the fact that it is a loss making activity

A company making decisions purely on profit maximising grounds would not provide the service

Electricity companies may be required to have enough capacity to prevent blackouts occurring

quality standards

Monopolies will try to resist or water down any quality requirements

Regulators need to ensure that standards are not set so high as to be too restrictive to businesses

Regulators need to have understanding of the industry to impose meaningful quality standards

performance targets

Similar in principle to quality standards

Governments may set targets for price, product quality or choice

Used in the UK for rail travel

Train companies given targets for the percentage of trains that arrive on time

problems with performance targets

Monopolists may find ways round meeting performance targets without actually making improvements

E.g. train companies could change timetables to appear that journeys are completed on time, even if journey times have not changed

explain the term regulatory capture and why may it undermine the governments efforts to control dominant firms in an industry

Regulatory capture is a form of government failure. It happens when a government agency operates in favour of producers rather than consumers.

how regulatory capture undermines government efforts to control dominant firms in an industry

Regulatory capture undermines government efforts to manage dominant firms by turning regulatory bodies into protectors rather than monitors. This results in the following issues:

Creation of Entry Barriers: Captured agencies often create strict licensing, permits, and compliance standards that protect incumbent firms from competition. These regulations raise the costs for new competitors, allowing dominant firms to maintain their market power.

deregulation to promote contestability

Removing government controls in order to promote competition and improve efficiency through lower costs

Fewer constraints on business should allow more flexibility and remove costly bureaucracy

Can lead to problem of private firms focussing only on profitable sections of the industry

E.g. rural bus routes disappearing after deregulation in 1980s