unit 3 economics

1/40

Earn XP

Description and Tags

12th grade ap microeconomics

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

41 Terms

explicit cost

a cost that involves spending money

implicit cost

- opportunity cost

- cost of resources already owned by the firm that could have been put to some other use

accounting profit

total revenue - explicit cost

economic profit

total revenue - (explicit + implicit costs)

economic profit

- anything above normal profit

- called normal profit if the profit equals zero

normal profit

minimum level of profit needed for a company to remain competitive in the market and cover their explicit and implicit costs

economic cost

always lower because they add the accounting cost/opportunity cost

short run production

- some cost(s) is/are fixed (ex: more workers but no more resources)

- change in variable costs shifts market supply

- changes in fixed costs will not change firm or market output or pricing (only shifts ATC upwards)

- no entry or exit of new firms or tech

- firm is constrained in regard to what production decisions it can make

long run production

- all costs are variable (ex: company can have infinite number of resources)

- market supply shifts with firm entry/exit

- tech can be developed to improve production

- firm chooses from all possible production techniques

law of diminishing marginal product/returns

- only exist in the short run

- averages aren't a good reflection bc it doesn't tell the whole story

- ex: too many workers in the short run will diminish productivity

law of diminishing marginal product/returns stages

- increasing marginal returns

- diminishing returns: begins where MC is minimized (bc next unit of output will be produced at a higher cost) and MP is maximized

- negative returns: begins where MP = 0

law of diminish marginal product/returns relationships

- MP & MC: inverse

- AP & AC = inverse

- highest point of AP = MP

- lowest point of AC = MC

total variable cost (TVC)

costs that can change over time and depend on production

total fixed cost (TFC)

- costs that cannot change in the short run

- not related to the amount of production

- found between TVC and TC

total costs (explicit & implicit costs)

total variable cost + total fixed cost

average fixed cost (AFC)

TFC/Q

average variable cost (AVC)

TVC/Q

average total cost (ATC)

AFC + AVC

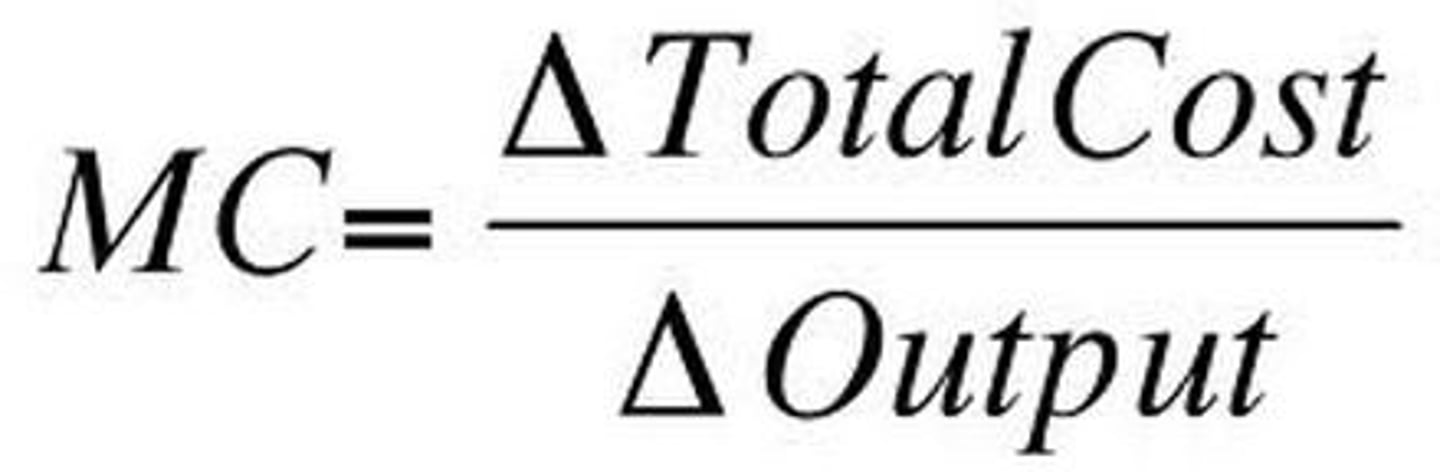

marginal cost (MC)

additional cost to produce one additional output

AVC and ATC

distance between the curves must shrink as the company produces more output

lump sum taxes

- one time tax that only impact the firm's fixed costs

- quantity will not change

- ATC will shift upwards

lump sum subsidies

- one time payment that only impact the firm's fixed costs

- quantity will not change

- ATC will shift downward

per unit tax

- taxes charged to each unit that only impact the firm's variable costs

- quantity will change

- ATC, MC, & AVC will shift upward

per unit subsidies

- payments provided for each unit that only impact the firm's variable costs

- quantity will change

- ATC, MC, & AVC will shift downward

economies of scale

- LRATC decreases as output increases

- long run concept

constant returns to scale

- LRATC is constant as output increases

- minimum efficient scale occurs at lowest point in LRATC

- long run concept

diseconomies of scale

- LRATC increases as output increases

- long run concept

LRATC

long run average total costs increase as firms exhaust all forms of production methods and resources become scarce

profit maximization rule

MR = MC

shut down rule

- firms should shut down when they cannot cover any portion of their variable expense/ the price falls below the minimum AVC

- occurs in the short run

- AVC is above MRDARP

perfect competition

- price is determined by the market

- many firms (each being a price taker)

- identical products

- easy entry and exit

- long run: returns to normal profits

price takers

- they take the price they are given and can't change the price

- no market power

market power

ability to set one's own prices

short run (perfect competition)

- profits and loss

- marginal revenue looks like a horizontal line

long run (perfect competition)

- profits always return to normal profit/ zero economic profit

- no profits or loss

- minimum point of ATC hits MR

- lump sum tax increases fixed costs -> ATC increase -> firms exit

- per unit tax increases variable costs -> ATC & MC increase -> firms exit

productive efficiency

- production = lowest ATC

- perfectively competitive firms will always return to this point in the long run

allocative efficiency

- price = MC

- no deadweight loss

- quantity of output produced achieves the greatest level of total welfare possible

market

- sets the price

- consists of many different ranges of elasticities

firm

- takes price from market

- costs do not change when there is entry/exit

- faces a perfectly elastic demand

- too small to take advantage of economies of scale

- in long run, will produce at productively efficient and allocatively efficient point

marginal cost changes

only when variable costs changes

marginal product = 0

total product is maximized bc the change in total product is 0