Adjustments, Financial Statements, & the Quality of Earnings

1/12

Earn XP

Description and Tags

Financial Accounting and Reporting: Chapter 4

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

13 Terms

Steps for Creating Financial Statements during the Accounting Period

Analyze business transactions

Record transactions using journal entries

Aggregate journal entries.

Steps for Creating Financial Statements at the end of the Accounting Period

Prepare the (unadjusted) trial balance

Make adjusting entries (record & post)

Prepare financial statements

Close temporary accounts

What is the purpose of a trial balance?

To prepare an unadjusted trial balance at the end of the accounting period.

‘Regular’ Journal Entries

Entries recorded in the normal course of daily business transactions, which may or may not involve cash, revenue, or expenses.

Adjusted Journal Entry (AJE)

Entries recorded at the end of the accounting period that never involve cash and always involve revenue or expenses.

Necessity of Adjusted Journal Entry (AJE)

Timing differences between Revenues being earned vs receipt of cash

Timing differences between Expenses being incurred vs exchange of cash

Expenses that are difficult or inefficient to recognize on a daily basis (ie depreciation expense)

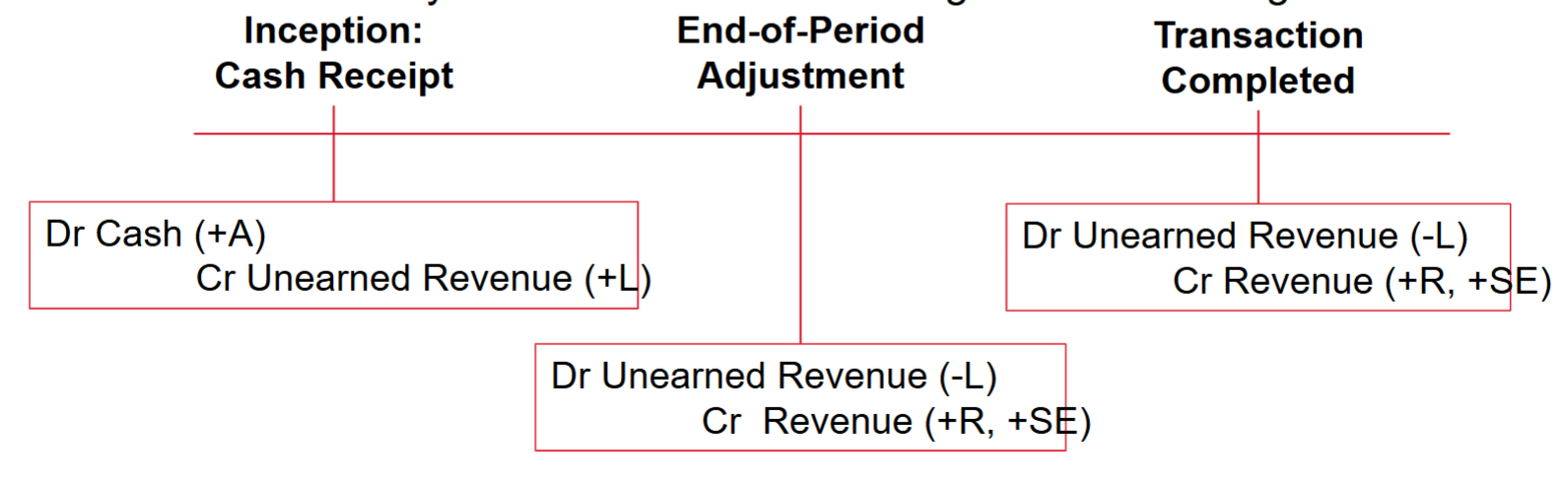

Deferred Revenue

Revenue recorded after cash receipt, where a liability is reduced to recognize revenue earned.

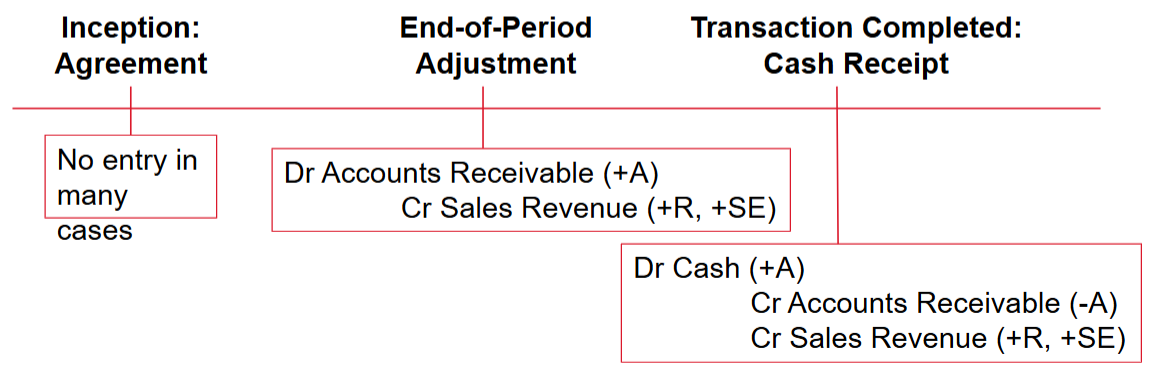

Accrued Revenue

Revenue is recognized before cash is received, and a receivable is increased.

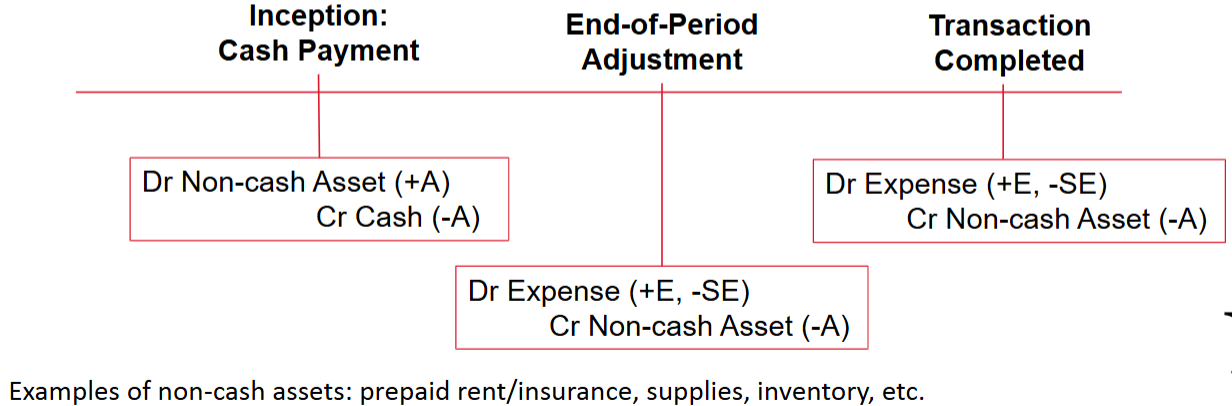

Deferred Expense

Expenses recorded after cash payment, where an asset balance is reduced to recognize the expense incurred.

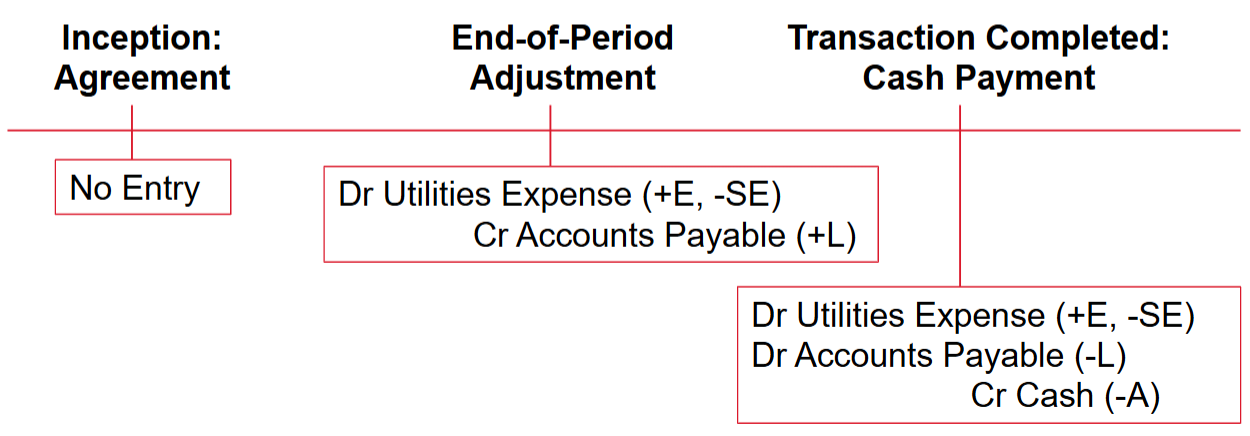

Accrued Expense

Expenses incurred before cash payment, leading to an increase in payable.

Purpose of the Balance Sheet

A snapshot of a company’s resources and sources at a given date with permanent accounts.

Balance Sheet accounts are permanent accounts

Purpose of the Income Statement

Provides a report of performance over a period, requiring account balances to be reset at zero each period.

Income Statement accounts are temporary accounts

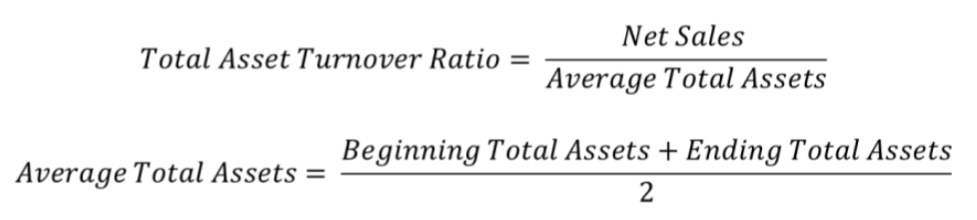

Total Asset Turnover Ratio

A measure of how efficiently a company uses its assets to generate sales.