Macro Econ Exam 2

1/19

Earn XP

Description and Tags

Covers Chapters 17, 28-30, 32, of Economics 3rd edition, by Karlan & Murduch in Samuel Le's Macroeconomics class Spring Quarter 2024 Chapter Names: 17.Why Trade 28. Aggregate Expenditure 29. Aggregate Demand and Aggregate Supply 30. Fiscal Policy 32. What is Money? WEEK 5 EXAM DATE JUNE 14th.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

20 Terms

Consumption in (C)IGNX = Y (AGGREGATE EXPENDITURE)

2/3-3/4 of GDP in most countries

Accounts for much of the variation in aggregate economic activity

4 factors that affect consumption (current income (primary determinant) which affected by the mpc, wealth, expected future income, interest rate)

Marginal Propensity to Consume MPC

Amount that consumption increases when after-tax income increases by $1. Poor households have a relatively high marginal propensity to consume.

Displayed as a number between 0-1

The number equals the fractional dollar that is spent when an individual receives an additional dollar of income. (0.8 = 80% spent, 20% saved)

To calculate increase in consumption / increase in income

4 Factors of Consumption

Current Income (Positive)

Wealth (Positive)

Expected Future Income (Positive)

Interest Rate on saving and borrowing (Negative)

Wealth

Many forms ex; savings, checking accounts, stocks, (mutual) bonds, value of houses minus debt, loans

Wealth positive relationship with consumption

Smooth Consumption

Most people try to keep their spending steady even when their income rises or falls.

Interest Rate

the “price of money,” typically expressed as a percentage per dollar per unit of time; for savers, it is the price received for letting a bank use money for a specified period of time; for borrowers, it is the price of using money for a specified period of time

Higher interest encourages saving —> decrease consumption (decreases borrowing/loans) —> negative relationship between interest and consumption on a aggregate level

Investment in C(I)GNX = Y (AGGREGATE EXPENDITURE)

Changes in capital. Factors that change the benefits and cost of adding physical capital are:

Expected Profitability (positive)

Interest Rate (negative)

Business Taxes (negative)

Government Spending in CI(G)NX = Y (AGGREGATE EXPENDITURE)

Aggregates due to how much to spend based on beliefs of what the country’s citizens need, use spending as a tool of fiscal policy. In the short run Government spending is not DIRECTLY AFFECTED.

Transfer payments are NOT included in government spending but are negatively correlated with income.

Net Exports in CIG(NX) = Y (AGGREGATE EXPENDITURE)

domestic income (negatively correlated)

foreign income (positive)

exchange rates (negative)

tastes for foreign goods (negative)

trade policies (depends)

Trade Policies

Reflected in exchange rates and other variables. Case by Case.

Planned Aggregate Expenditure (PAE)

Looks at the amount of spending and production that businesses, households, and other entities are planning to make.

PAE = (a+bY) + I + G + NX

a = automatic spending

b = consumption that depends on GDP

GDP = Y = national production = total output = national expenditure = aggregate expenditure = national income

PAE = A + bY

A = autonomous expenditure (basics and others that don’t change with income)

b = MPC

Y = national income

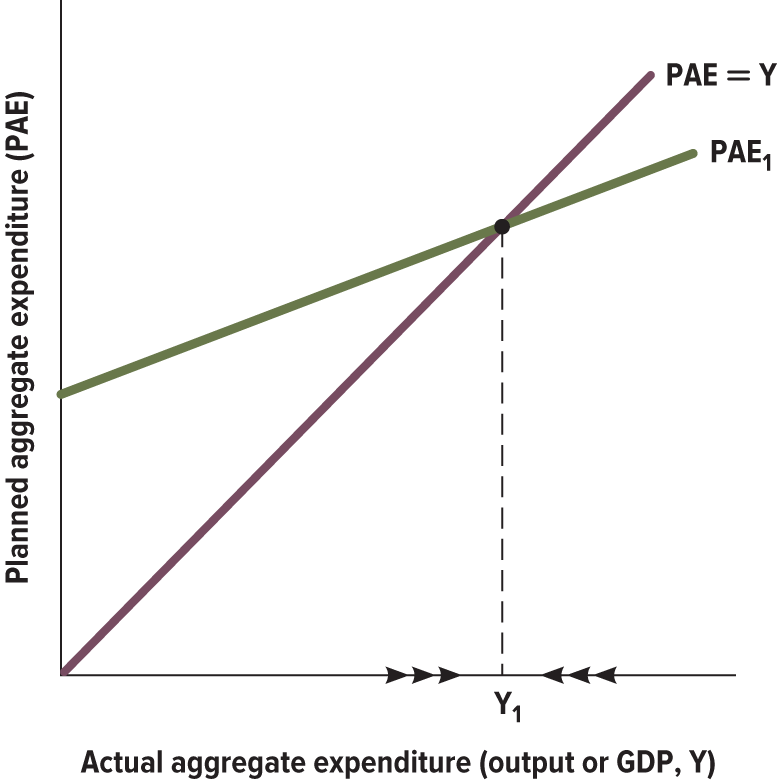

Keynesian Cross

Firms don’t always produce the most they can at a given price. They produce what they can sell at a given price.

PAE = Y is where PAE matches with GDP

PAE1 = PAE, starts 45 degrees from origin representing an aggregate supply curve.

Keynesian Equilibrium / equilibrium aggregate expenditure

Point of intersection on the Keynesian Cross

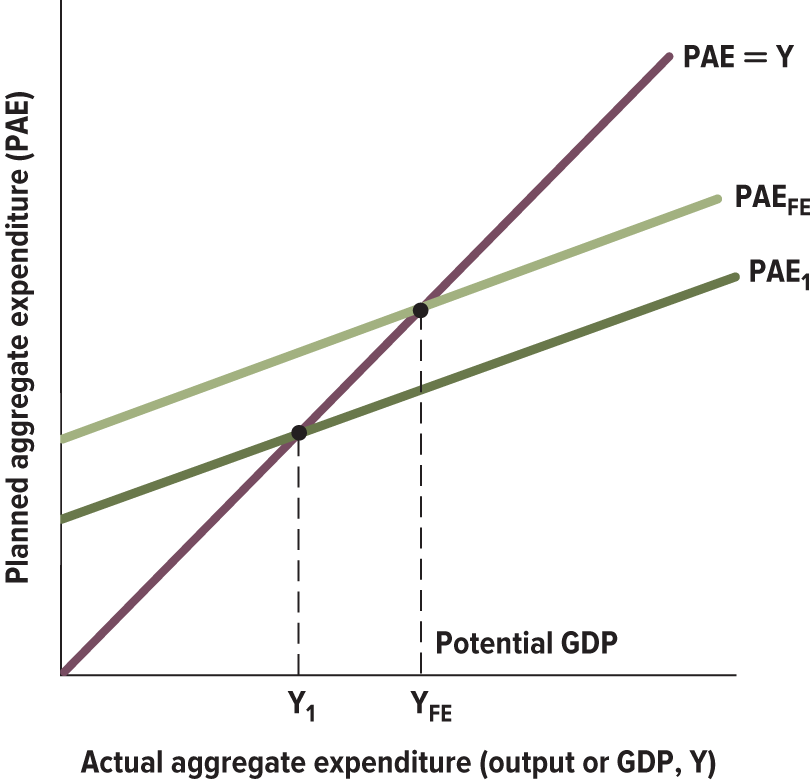

Recessionary Output Gap

Output gap when equilibrium aggregate expenditure is below the level needed for full employment (no cyclical unemployment, only frictional ~4%)

Inflationary output gap

Output gap when equilibrium aggregate expenditure is above the level needed for full employment (no cyclical unemployment, only frictional ~4%)

Multiplier effect

The increase in consumer spending that occurs when spending by one person causes others to spend more too. This effect happens due to a positive MPC

Investment (In economics)

Households set aside resources (savings) while firms borrow to invest in capital.