International economics - Chp.4

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

19 Terms

The main difference between the Heckscher–Ohlin (HO) model and the Specific Factors mode

HO:

Long-term trade

All factors(labor and capital are fully mobile) between industries

Typically 2 factors(labor and capital) and 2 goods

Specific factor model

Short run model

Only labor is mobile; capital and land are specific to particular industries and cannot move

Typically 3 factor(labor, capital, land) and 2 goods

The difference in determinant of trade between HO og specific factor model and how gaisn and loses from trade

Determinant of trade

HO: Differences in factor endowments (e.g., capital vs. labor abundance) across countries.

Specific factor model: differences in sector productivity, determined by each sector’s specific factor (e.g., capital in manufacturing, land in agriculture).

Who gains and loses from trade

HO: The abundant factor gains from trade, and the scarce factor loses (per the Stolper–Samuelson theorem).

Specific factor model: The specific factor used intensively in the export sector gains, while the specific factor in the import sector loses. Labor’s outcome is ambiguous.

Main assumptions of the Heckscher–Ohlin (HO) model,

1) Labor and capital can move freely between industries within each country. But these factors cannot move internationally- they are immobile between countries, only mobile within each country

2) Factor Intensity:

Different goods use factors in different proportions. Example: Shoes are labor-intensive, and computers are capital-intensive meaning Ls/Ks>Lc/Kc

3) Factor Abundance

Countries differ in their relative factor endowments:

Home is capital-abundant (has more capital per worker compared to another country )

Foreign is labor-abundant (has more labor per unit of capital another country capital).

4) Identical Technologies

Both countries use the same production technologies to produce goods.

5) Identical Preferences

Consumers in both countries have the same tastes and preferences for goods.

6) Free Trade in Goods

Final goods (like shoes and computers) can be traded freely between countries no tariffs, quotas, or transport costs. Meaning countries can buy and sell goods freel across border without government barriers or extra cost. Goods can move, but capital(machines), labour(workers) and land(farms) cannot move from country to country only within industries

7)Constant Returns to Scale

Each good is produced with constant returns to scale production functions.

Endowment

Means the amount of resources a country naturally has available for production

Factor endowments

How much labor, capital, and land a country has

What are other optional(often implied) assumptions

Perfect competition in all markets.

Full employment of all resources.

No factor intensity reversals

Implication (Heckscher–Ohlin Theorem)

Each country exports the good that uses its abundant factor intensively, and imports the good that uses its scarce factor intensively.

Reversal of factor intensities — what it means

Same good is labor-intensive in one country but capital-intensive in another. This happens because countries have different technologies and different relative factor prices, so firms choose the cheapest production method locally.

What is the Leontief Paradox?

The US was capital-abundant.

HO theory predicts:

→ US should export capital-intensive goods

→ and import labor-intensive goodsLeontief found the opposite:

→ US exports were labor-intensive

→ US imports were capital-intensive

What is “effective labor”?

Effective labor = number of workers × productivity.

It measures the actual productive power of a country’s labor force.

Why might Leontief’s paradox not actually be a paradox?

U.S. workers were high-skilled and very productive → the U.S. was actually skilled-labor abundant.

U.S. also had better technology.

So the U.S. exported goods using skilled labor, its real abundant factor — exactly what HO predicts.The U.S. was actually skilled-labor abundant, not just capital abundant. So exporting labor-intensive goods fits HO once you include skill + technology.

Stolper–Samuelson Theorem

1) Stopler - Samuelson Therem tells us how changes in the price of a good affect income of workers and capital owners. It is under Hecksher-Ohlin Model. Because it requires both factors(labor and capital) to be fully mobile between industries.

2) Capital- abundant country = country with more capital per worker than other country → comparative advatnage in producing capital-intensive goods.

3) Sells at a higher price PW, between autarky price of the two countries when trade

4) Since the exported good is capital- intensive:

Demand for capital increase → returns for capital owners rise

Firms demand more capital than labor → wages do not rise as fast as prices → workers real wage falls → workers lose

General Rule:

The abundant factor (the one the country has a lot of) → benefits from trad

The scarce factor (the one the country has little of) → loses from trade

Compare Hecksher-Ohlin and trade based on imperfect compteition

HO:

Explains trade through comparative advatnage that comes from relative factor abundance(labor,capital,land). It assumes perfect competition and constant return to scale. Countries export the good that uses their abundant factor intensively

Imperfect compeition:

Monopolistic competition explains trade through product differentiaten and economies of scale. It does not focus on factor abudance and does not explain trade pattern the same way. Instead it shows how trade can occur because firms produce different varieties and average costs fall as prodcution increases

Can identical countries trade - given models of imperfect and H-O models

In H-O, identical countries have no comparative advantage, so no trade would occur.

Under imperfect competition, identical countries can trade because they gain from more product varieties and lower average costs due to economies of scale.

So: No trade in H-O, but trade is possible and beneficial in the imperfect-competition model.

Compare Ricardo and Heckscher-ohlin source of comparative advantage

Ricardo(classical model)

Comparative advantage comes from differences in labor productivity

Productivity differences arise from different technologies across countries.

A country exports the good in which it has lower opportunity cost.

Hecksher-Ohlin

Comparative advantage comes from differences in factor endowments (labour, capital, land).

Countries have the same technology.

A country exports the good that uses its abundant factor intensively.

Compare implications for income distribution with model: ricardo and Hecksher-ohlin

Ricardo:

Only one factor of production: labour.

All workers gain equally when trade raises wages.

No winners and losers inside the country.

Trade benefits the country as a whole.

Heckscher–Ohlin:

Multiple factors: labour, capital (and possibly land).

Trade creates distributional conflict:

Owners of the abundant factor gain.

Owners of the scarce factor lose.

Winners and losers appear within the country.

Summary:

Ricardo → comparative advantage from technology, no internal conflict.

H-O → comparative advantage from factor abundance, winners and losers from trade.

Short coming of HO

Identical techonology -Technology differs widely between nations, affecting productivity and trade patterns. Poor countries often have lower producitivity, outdated machines or weaker infrastructure.

Factos cannor move internationally - In reality, capital and labour do move across borders (FDI, migration).

Same prefences accross countries - This is rarely true. Consumers in different countries have different tastes, which influences trade in ways the model doesn’t capture.

Perfect competition (ignores increasing returns) - oversimplified real-world conditions, where firms often have marked power.

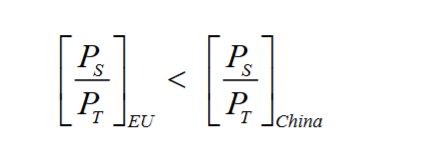

If the EU is skilled-labour abundant and China is unskilled-labour abundant, which country has the higher relative price of the skilled-labour-intensive good (Ps/Pt)?

China — because skilled labour is scarce there, so skilled-intensive goods are more expensive.