Chapter 13: Measuring and Evaluating Financial Performance

0.0(0)

0.0(0)

Card Sorting

1/49

Last updated 11:54 PM on 12/22/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

50 Terms

1

New cards

financial statement

A(n) ________ user should be able to understand relationships, activities, and results from business operations when viewing a statement.

2

New cards

debt and stockholders’ equity

Financing for assets come from ________.

3

New cards

Horizontal (trend) analyses

_________ help financial statement users recognize important financial changes that unfold over time.

4

New cards

horizontal, vertical, and ratio

The three different types of analyses:

5

New cards

trends

They compare individual financial statement line items to ______.

6

New cards

Vertical analyses

________ show relationships between items on a financial statement. They compare the balance of one account to another.

7

New cards

Ratio analyses

________ are used to understand relationships between items on one or more financial statements. It shows a company’s performance from using their resources.

8

New cards

analysis

A(n) _________ is considered “complete” once it is successfully able to create a better understanding for those who review financial statement and its results.

9

New cards

time-series analyses

Horizontal analyses is also called __________ because of the comparison of results over time.

10

New cards

dollars or percentages

Horizontal analyses results are presented as year to year _________.

11

New cards

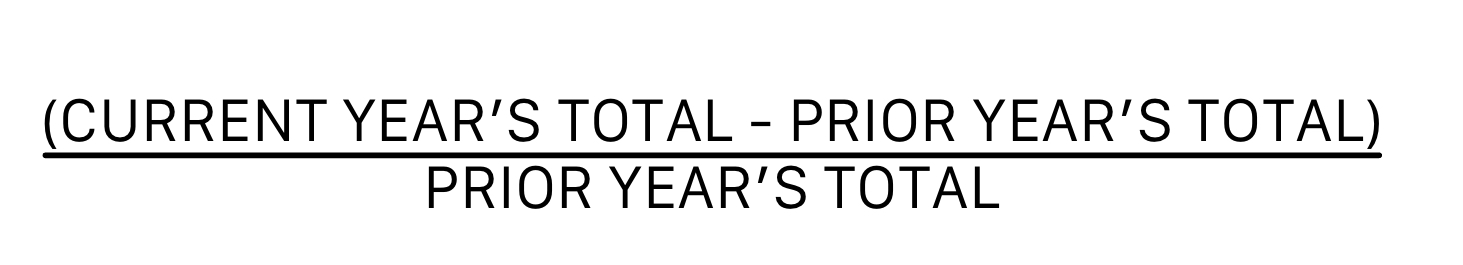

\

Equation for calculating change (%)

12

New cards

Vertical (common size) analysis

__________ focuses on relationships regarding financial statements.

13

New cards

percentages

Vertical (common size) analysis relies on __________ to translate results and relationships.

14

New cards

common size balance sheet

A(n) _________ shows the percent of total assets and each liability or stockholders’ equity as a percent of their total.

15

New cards

common size income statement

A(n) _________ gives the percentage of sales for items on the income statement.

16

New cards

common size

Ratio analyses is similar to _________ in the manner of how they both consider size in comparisons.

17

New cards

profitability, liquidity, solvency

The three categories of ratios:

18

New cards

Profitability

_________ ratios focus on a company’s net income within a current period.

19

New cards

Liquidity

_______ ratios indicate how well a company can use or sell current assets to pay the liabilities they have.

20

New cards

Solvency

________ ratios assure that a company can repay lenders and interest payments.

21

New cards

Net profit margins

_________ help when evaluating a company and shows the percentage of revenue a company generates.

22

New cards

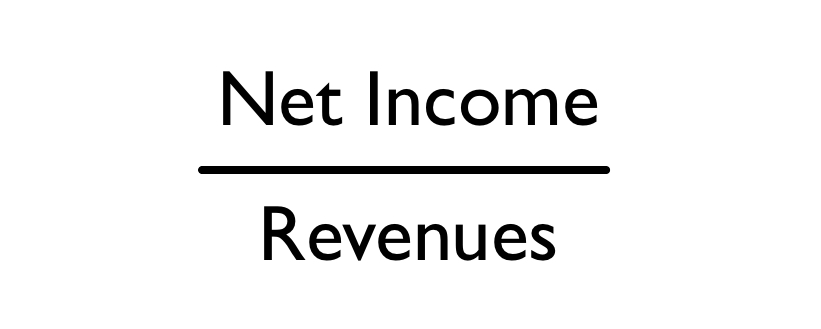

\

Equation to calculate Net Profit Margin:

23

New cards

gross profit percentage

A(n) __________ shows the overall profit made on sales.

24

New cards

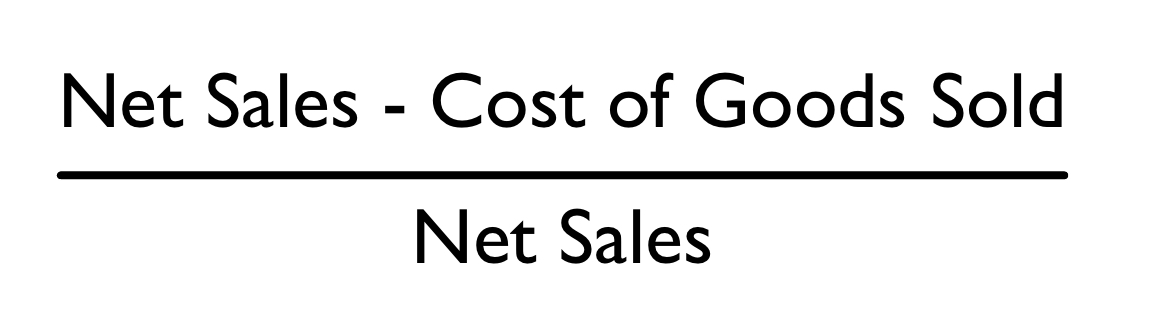

\

Equation to calculate gross profit percentage:

25

New cards

fixed asset turnover

The _______ ratio tells us the revenue earned for the amount of money a company puts into fixed assets.

26

New cards

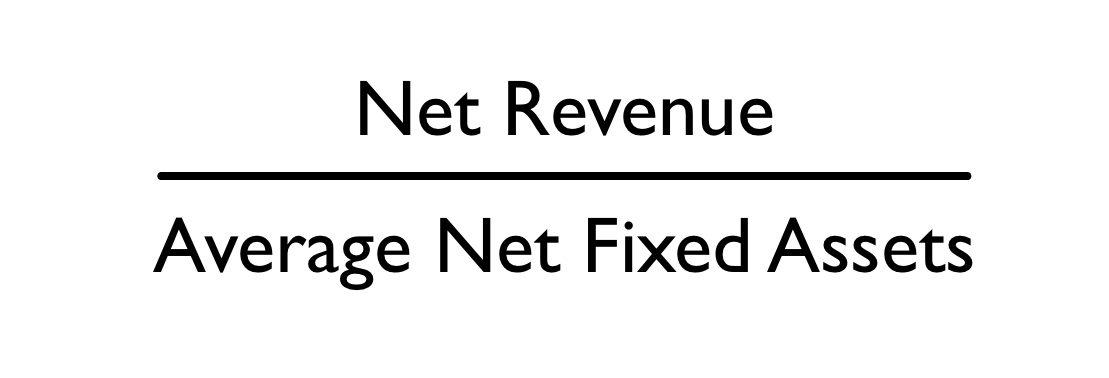

\

Equation to calculate fixed asset turnover:

27

New cards

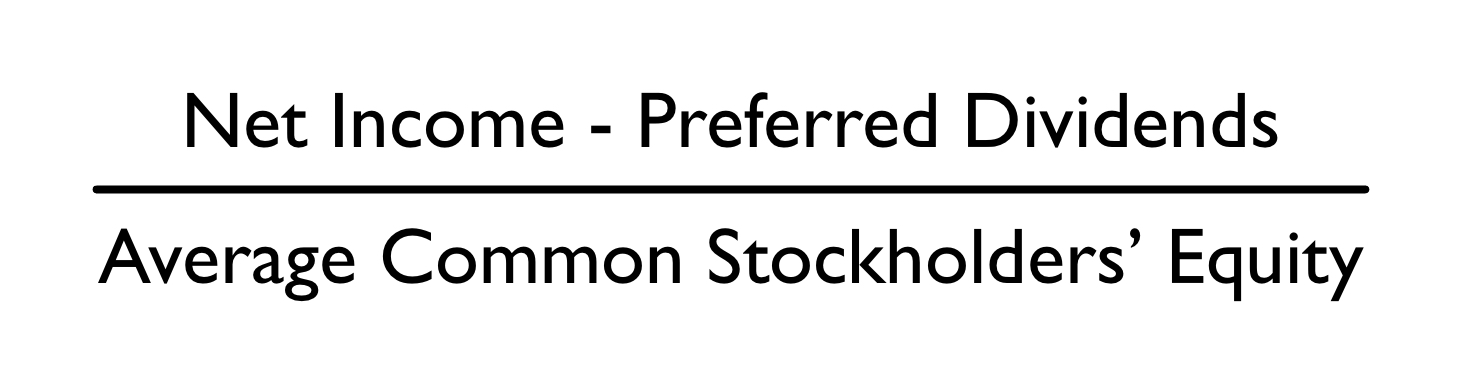

return on equity

The ________ ratio compares earned income for stockholders to the average amount of equity. It is reported as a percentage.

28

New cards

\

Equation to calculate return on equity:

29

New cards

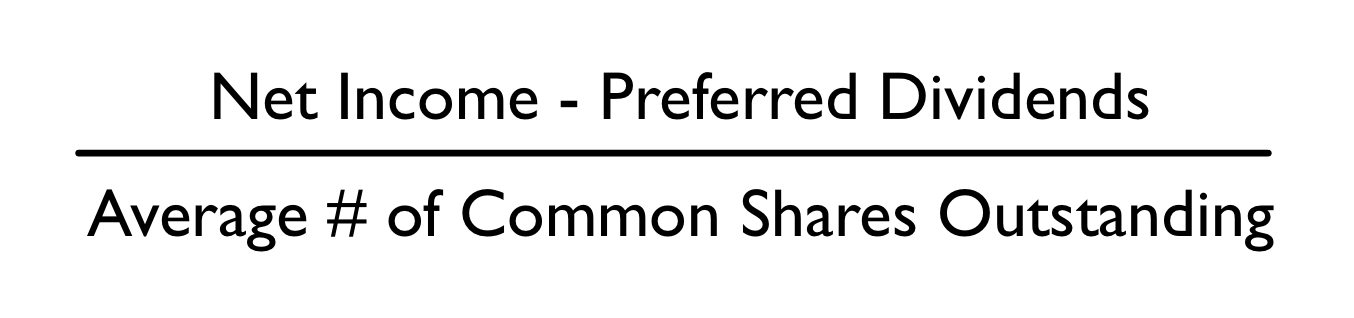

Earnings per share

________ gives the amount of earnings from outstanding shares.

30

New cards

\

Equation to calculate earnings per share:

31

New cards

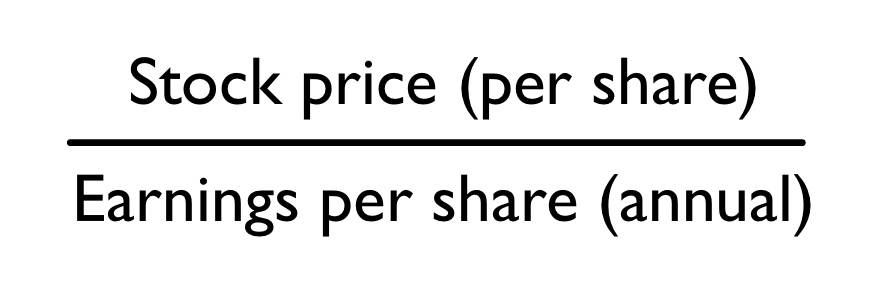

price/earning

The ________ ratio correlates the stock price to the stock’s earnings per share.

32

New cards

\

Equation to calculate price/earnings ratio:

33

New cards

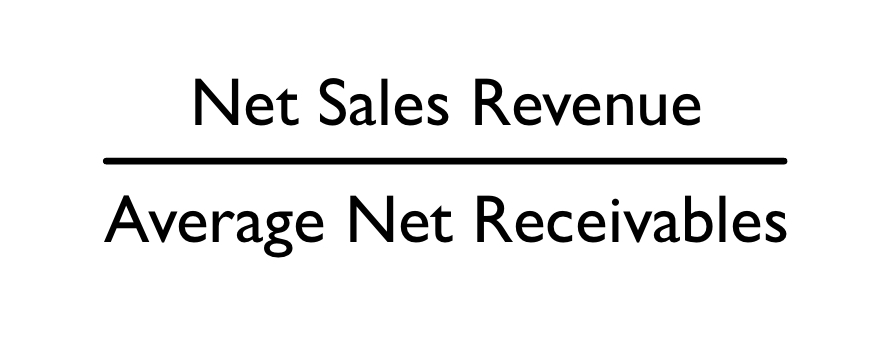

receivables turnover

The ________ ratio indicates how well a company can collect on its’ receivables.

34

New cards

\

Equation to calculate receivables turnover:

35

New cards

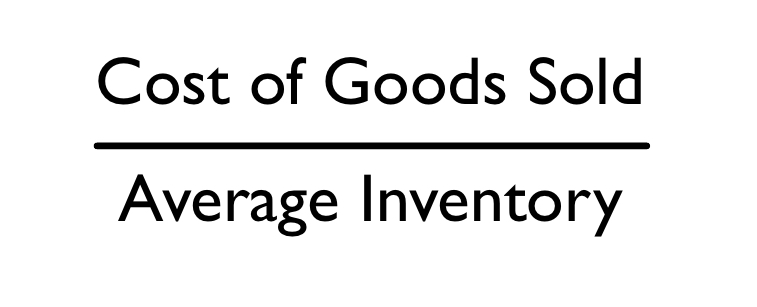

inventory turnover

The _________ ratio is the frequency of inventory being bought during the process of buying and selling items.

36

New cards

\

Equation to calculate inventory turnover:

37

New cards

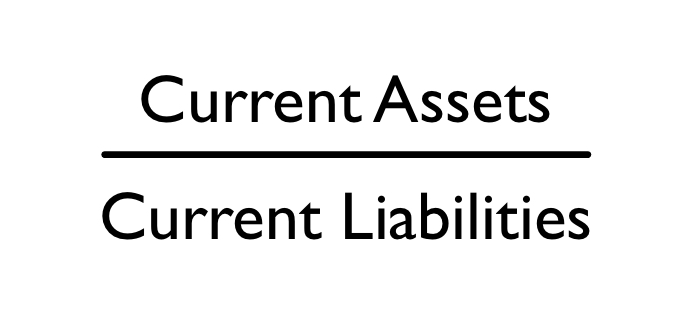

current

The ________ ratio compares current assets to current liabilities to see if those assets can pay the liabilities.

38

New cards

\

Equation to calculate current ratio:

39

New cards

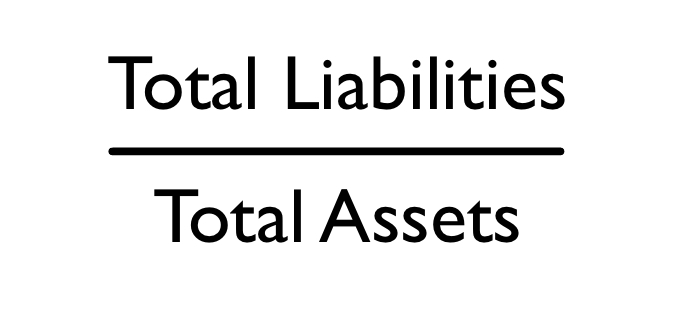

debt-to-assets

The ________ ratio is able to show how much of a company is funded by debt and financed by creditors.

40

New cards

\

Equation to calculate debt-to-asset ratio:

41

New cards

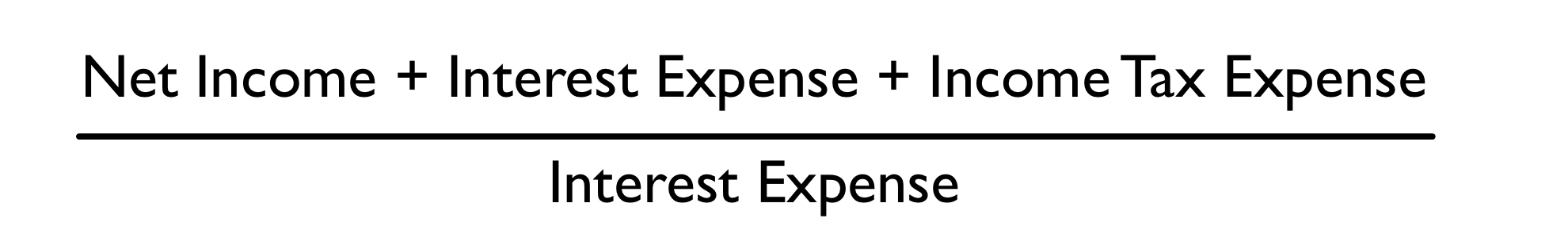

times interest earned

The ________ ratio indicates if a company’s current income can cover its debts.

42

New cards

\

Equation to calculate times interest earned:

43

New cards

how and why a company makes the decisions they do

Ratios can give us insight into ________.

44

New cards

Choice of method

_________ for certain aspects of business are different from business to business.

45

New cards

full disclosure principle

The _________ demands that all appropriate information regarding a business’s operations must be included on their financial statements.

46

New cards

going-concern assumption

The ________ lays out accounting rules.

47

New cards

continuity

The going-concern assumption is also called _________.

48

New cards

significant changes

________ are the focus of horizontal computations.

49

New cards

horizontal (trend) computations

Horizontal (trend) analyses is also called _________.

50

New cards

dollar amount and percentage

Examine and compare the ________ to ensure your final results and conclusion.