Assets,PPE,Inventory

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

27 Terms

Asset

A present economic resource owned and controlle dby an entity as a result of a past event

Is it an asset

Is it a present economic resource representing a Eright( economic right) - right to use a object, is it your intellectual property, right to receive chash, goods , or a service

Does it have potential to bring Eb (economic benefit) - generate cash , reduce expenses

Ctrl by the enetity - Does the entity have the power to dictate the use of the item and receive its benefits

Past event- The event that gave rise to the businesses control (transaction etc)

Recognition criteria (to be recognized on the SOFP)

No Existence uncertainty

Probability of flow of economic benefits is not low

No measurement unceratinty - can easily determine the value

Life of an asset

Asset definition

Recognition criteria

Initial measurement

Subsequent measurement

Disposal

Intitail measurement includes

All costs incurred to get the asset to the condition where it can be used and generate revenue

When is asset recorded on SOFP

The day the entity takes control of the asset

Subsequent measurement

Updating of an assets value over time in financial records at the end of eeach reporting period

Carrying amount

Value of an asset at each reporting date

Purpose of subsequent measurement

Make sure fianncial staement accurately portary the value of a business

Helps investors and decision-makers understand a comapny’s real financial position

Subsequent costs

Amounts spent on ana asset after acquition

Subsequent costs

Capitalised (added to carrying amount) if they will probably give rise to additional economic benefits and theyre not day-to-day servicing costs- Rennovations + additions

Expensed if : day to day servicing cost - Repairs and maintenance

What happens when an assets at the end of its life

Expensed on SOCI as:

Amoritization

Depreciation

Cost of sales

Impairment-

Impairment

Asset losses more value than what was expected from normal use

Accounting principle

Asset can’t be measured at a value bigger than its actual value to the business

3 steps for identifying impairment

Look if it has signs for impairment

If yes , calc recoverable amount (higher of its fair value-cost to sell and value in use)

If RA < CA (current carrying amount) impair the asset to CA-RA on SOFP & SOCI (Expense)

CA of PPE

Initial cost-depreciation-impairment

Journal entries for impairment

Dr Impairment loss(P/L) - expense

Cr Asset impairment (-A)

Derecognition

The process for when assest is sold or scrapped and subsequently removed from the busiensses accounting records

PPE

Tangible items that are 1held for use in the production or supply of goods and services, for 2rental to others, or for 3administrative purposes; and (b) are expected to be used for more than one period.

Subsequent measurement of PPE

Cost model : The asset’s depreciated over the useful lifetime of the asset

Depreciation + impairment expense on P/L

Depreciation

•All items of PPE that have a limited useful life are depreciated

•Depreciation reflects the consumption of economic benefits implicit in the asset i.e. the cost of using the asset

•Depreciation commences (starts) when as asset is ready for use

Straight line depreciation

Consistent annual charge

annual deprecciation= cost-residual value(amount business will get if they sell asset at end of its life - costs to sell it , in today’s terms) /useful life(yrs)

Inventory

Assets: (a) held for sale in the ordinary course of business; or (b) in the process of production for sale; or (c) in the form of materials or supplies to be consumed in the production process or in the rendering of services.

**must meet asset definition

Inventory initial measurment

Cost - cost of getting inventory to present location + condition for sale (costs attributable to their acquisition or manufacture)

Net reallisable value of inventory

Estimated selling price-Estimated costs to sell

Inventory summary

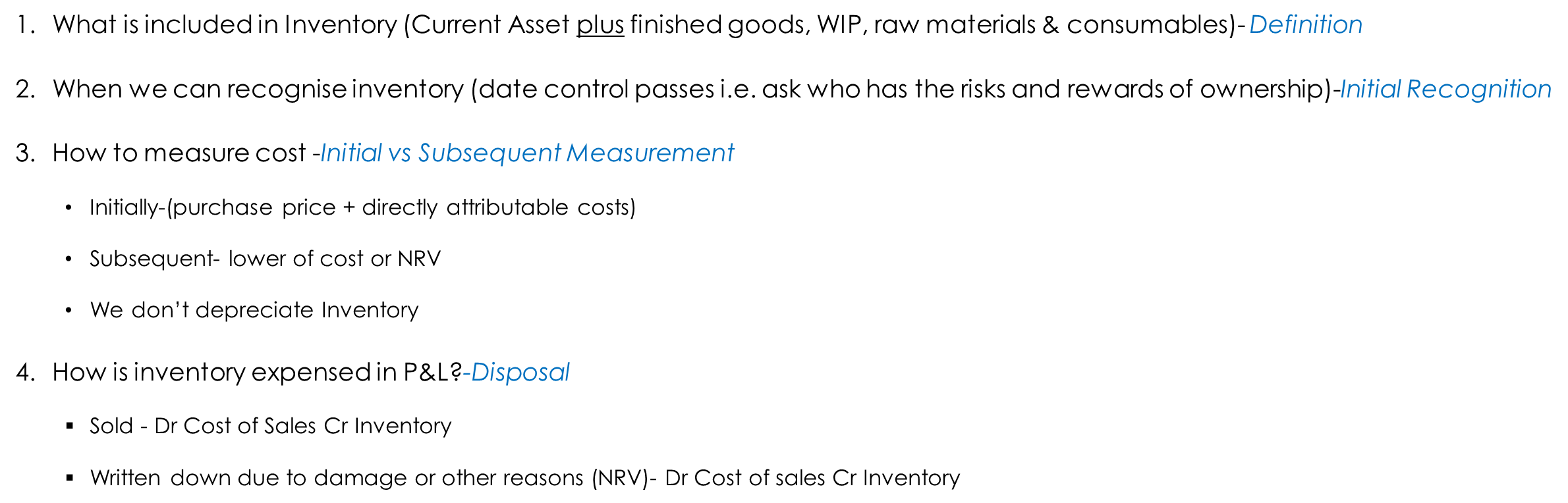

1.What is included in Inventory (Current Asset plus finished goods, WIP, raw materials & consumables)- Definition

2.When we can recognise inventory (date control passes i.e. ask who has the risks and rewards of ownership)-Initial Recognition

3.How to measure cost -Initial vs Subsequent Measurement

•Initially-(purchase price + directly attributable costs)

•Subsequent- lower of cost or NRV

•We don’t depreciate Inventory

4.How is inventory expensed in P&L?-Disposal

§Sold - Dr Cost of Sales Cr Inventory

§Written down due to damage or other reasons (NRV)- Dr Cost of sales Cr Inventory