Chapter 9: Long-Lived Tangible and Intangible Assets

0.0(0)

Card Sorting

1/62

Last updated 10:35 PM on 1/5/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

63 Terms

1

New cards

Long lived assets

________ are assets that provide benefits over a length of time (a year or more). They help provide goods or services, but the asset will not be sold.

2

New cards

productive assets

Long lived assets can also be called ________.

3

New cards

tangible assets and intangibles assets

The two categories for long-lived assets are ________.

4

New cards

fixed assets

Tangible assets, also known as ________, are physical assets that are subject to depreciation (land, buildings, equipment).

5

New cards

Intangible assets

________ are non-physical assets that have a limited life. They are created through legal documents and are subject to amortization (patents, logos, trademarks, slogans).

6

New cards

Goodwill and trademarks

________ have an unlimited life and are NOT amortized.

7

New cards

\

Equation for Net Book Value (TANGIBLE)

8

New cards

\

Equation for Net Book Value (INTANGIBLE)

9

New cards

land improvements

Tangible assets can include ________ that can enhance the asset and its functionality (walkways, sprinklers, roadways, fencing, etc).

10

New cards

Land

________ is not depreciable.

11

New cards

Construction in progress

_________ relates to the construction of tangible assets such as buildings and equipment.

12

New cards

cost principle

The ________ has acquisition costs like the initial purchase to prep assets for use (transportation, construction, etc).

13

New cards

capitalizing the cost

When costs are recorded as assets it is called ________, which delays it's recording as an expense.

14

New cards

increase; decrease

Capitalizing costs causes assets to ________ on the balance sheet and expenses to ________ on the income statement.

15

New cards

Purchase cost

Legal fees

Survey fees

Title search fees

Legal fees

Survey fees

Title search fees

The capitalized costs for land:

16

New cards

Purchase cost

Construction cost

Legal fees

Appraisal fees

Construction cost

Legal fees

Appraisal fees

The capitalized costs for buildings:

17

New cards

Purchase cost

Construction cost

Transportation cost

Sales taxes

Installation fees

Construction cost

Transportation cost

Sales taxes

Installation fees

The capitalized costs for Equipment:

18

New cards

basket purchase

A(n) ________ is when assets like land, equipment, and buildings are bought together.

19

New cards

Allocation

________ for each asset is determined by the relative fair market value of each asset.

20

New cards

Ordinary repairs and maintenance.

Extraordinary repairs, replacements, and additions.

Extraordinary repairs, replacements, and additions.

The two types of expenditures:

21

New cards

WANTED

Ordinary repairs and maintenance are ________ changes and small expenditures, which are expensed on the income statement. They don't extend the life of the asset.

22

New cards

NEEDED

Extraordinary repairs, replacements, and additions are ________ changes and are large expenditures. The asset's productivity is increased. They are capitalized.

23

New cards

cost allocation

Depreciation is a ________ process that matches cost of operational assets with periods of its useful life.

24

New cards

balance sheet; income statement

To record depreciation, the acquisition cost of an asset moves from the ________ to the ________ as an expense.

25

New cards

Debit

Income statement

Income statement

What is the normal balance of Depreciation Expense and what financial statement is it on?

26

New cards

Credit

Balance sheet

Balance sheet

What is the normal balance of Accumulated Depreciation and what financial statement is it on?

27

New cards

Depreciation calculations

The acquisition cost (including capitalized cost), estimated useful life, and the estimated residual (aka salvage) value (what the asset is worth if you sell it is all information you need to know to do:

28

New cards

Straight Line Method

The easiest and most widely used method. It indicates that depreciation expense is a constant amount each year, accumulated depreciation increases by an equal amount each year, and book value decreases the same amount each year.

29

New cards

\

Equation for Depreciation Expense (Straight Line Method)

30

New cards

Units of Production

________ is used if the life of an asset is generally measured in terms of units of production.

31

New cards

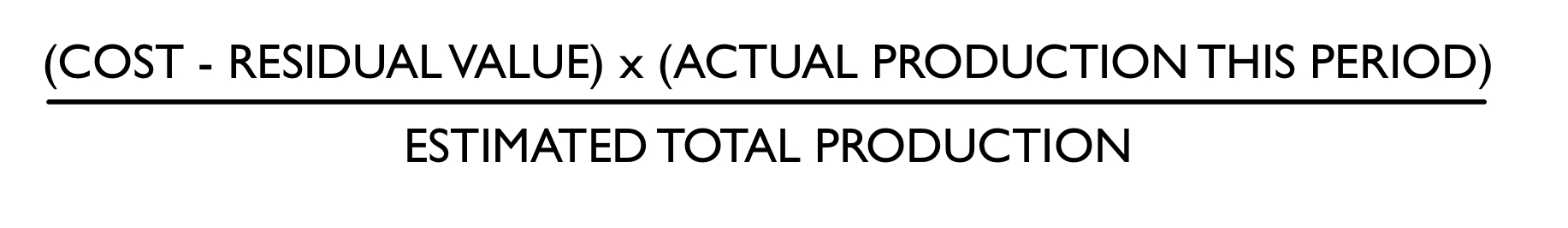

\

Equation for Depreciation Expense (Units of Production Method)

32

New cards

Declining Balance

A greater depreciation expense is taken from the asset in the earlier years of its life versus its later years.

33

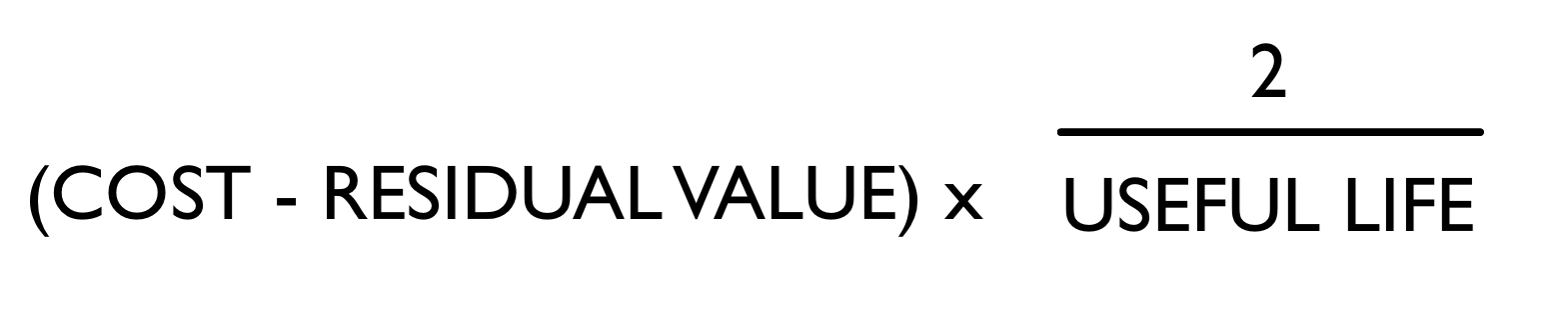

New cards

\

Equation for Depreciation Expense (Declining Balance Method)

34

New cards

least and latest

The ________ says taxpayers want to pay the least tax that is legally permitted and want to pay on the latest possible date.

35

New cards

Its value decreases and it can't be recovered.

An asset is impaired when:

36

New cards

Impairments

________ represent a lower asset value than the assets carrying value.

37

New cards

gain

A(n) ________ has a normal credit balance.

38

New cards

loss

A(n) ________ has a normal debit balance.

39

New cards

1. Update depreciation to the date of disposal.

2. Record the disposal.

2. Record the disposal.

Two adjusted journal entries are required for the disposal of an asset to.....

40

New cards

Debit Cash

Debit Accumulated Depreciation

Credit Equipment

Credit Gain on Disposal

Debit Accumulated Depreciation

Credit Equipment

Credit Gain on Disposal

Journal entry if there is a gain on disposal:

41

New cards

Debit Cash

Debit Loss on Disposal

Debit Accumulated Depreciation

Credit Equipment

Debit Loss on Disposal

Debit Accumulated Depreciation

Credit Equipment

Journal entry if there is a gain on disposal:

42

New cards

Debit Loss

There is ________ IF cash received is less than asset's book value.

43

New cards

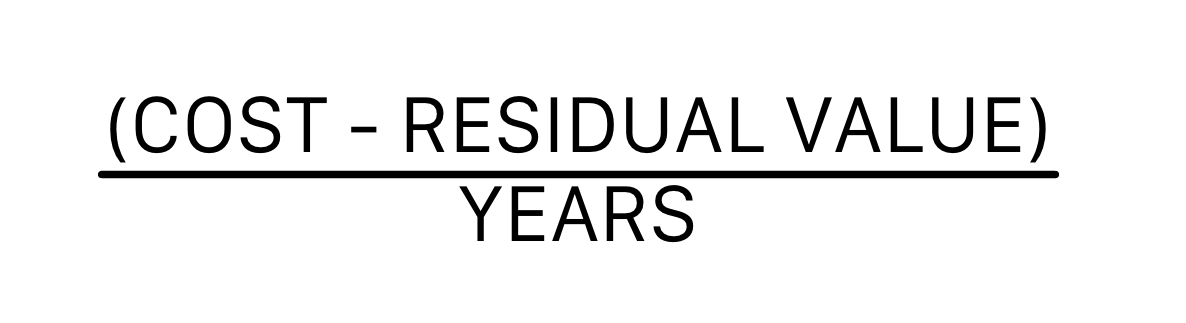

\

Equation for annual Depreciation:

44

New cards

Amortization

________ is similar to depreciation, but it is specifically used for intangible assets. It writes off the cost of an asset over its useful or legal life.

45

New cards

Trademarks

Slogans, logos, or names associated with a specific business.

46

New cards

Copyrights

An exclusive right granted by the federal government to protect properties.

47

New cards

Patents

An exclusive right granted by the federal government to sell or manufacture an invention.

48

New cards

Licensing Rights

Grant limited permission to use a product or service according to specific terms and conditions.

49

New cards

Technology Assets

Software and web development work.

50

New cards

Franchises

Provides legally protected rights to sell products or provide services purchased by a franchise from the franchisor.

51

New cards

Goodwill

Occurs when one company buys another company. It is not amortized. Purchased ________ is considered an intangible asset.

52

New cards

\

Equation for Goodwill:

53

New cards

purchased

The cost of intangible assets are recorded as assets if they've been ________.

54

New cards

research and development expenses

If the asset is self constructed, the cost is reported as ________.

55

New cards

amortized

Intangible assets with unlimited lives are not ________. Intangible assets with limited lives are capitalized and later ________.

56

New cards

Depreciation

________ is a cost allocation process that matches cost of operational assets with periods of its useful life.

57

New cards

Credit Gain

There is ________ IF the cash received is greater than the assets book value.

58

New cards

greater

Gains for intangible assets are the result of amounts received being ________ than their book values.

59

New cards

less

Losses for intangible assets are the result of amounts received being ________ than their book values.

60

New cards

Fixed asset turnover analysis

_________ is used to see how well long lived assets were used to generate revenue.

61

New cards

\

Equation for calculating the average of fixed assets:

62

New cards

\

Equation for the fixed asset turnover ratio:

63

New cards

great efficiency

A higher fixed asset turnover ratio implies ________.