Chapter 9: Long-Lived Tangible and Intangible Assets

Objective 9.1: Define, classify, and explain the nature of long-lived assets.

Definition and Classification

- Long-lived assets (aka productive assets) are assets that provide benefits over a length of time (a year or more).

- They help produce goods or services sold to customers, but the asset itself will not be sold.

- There are two categories for long-lived assets:

- Tangible assets

- @@Physical assets@@, meaning you can touch them.

- Tangible assets are also known as fixed assets.

- Subject to @@depreciation@@.

- Examples include land, buildings, equipment, etc.

- Intangible assets

- @@Non-physical assets@@ that have a limited life (they need to be renewed).

- They are created through legal documents.

- Subject to @@amortization@@.

- Goodwill and trademarks have an unlimited life, so they are not amortized.

- Examples include patents, logos, trademarks, etc.

- ==Equation to calculate net book value:==

- Cost - Accumulated Depreciation = Net Book Value of Tangible Assets

- Cost - Accumulated Amortization = Net Book Value of Intangible Assets

- Examples:

- A company purchases $50,000 worth of equipment. Its accumulated depreciation is $15,000.

- Cost - Accumulated Depreciation = Net Book Value of Tangible Assets

- $50,000 - $15,000

- Net Book Value = $35,000

- A company purchases a patent for $500,000. Its accumulated amortization is $30,000.

- Cost - Accumulated Amortization = Net Book Value of Intangible Assets

- $500,000 - $30,000

- Net Book Value = $470,000

Objective 9.2: Apply the cost principle to the acquisition of long-lived assets.

Acquisition of Tangible Assets

- Tangible assets can include land improvements that can @@enhance the asset@@ and its functionality (walkways, sprinklers, roadways, fencing, etc.).

- @@Land is not depreciable@@, but the buildings on it are. If the buildings are torn down, the land still remains.

- Construction in progress relates to the construction of tangible assets such as buildings and equipment. Costs for this construction is put into the account for the asset that was built.

- The cost principle has acquisition costs like the initial purchase price and expenditures to prep assets for use.

- Every cost we incur to get the asset to our location (so it can be used for its intended purpose) should be added to the asset.

- When costs are recorded as assets it is called capitalizing the cost, which delays it’s recording as an expense.

- Capitalizing costs causes assets to increase on the balance sheet and expenses to decrease on the income statement.

- Capitalized costs for:

- Land

- Purchase cost

- Legal fees

- Survey fees

- Title search fees

- Buildings

- Purchase cost

- Construction cost

- Legal fees

- Appraisal fees

- Equipment

- Purchase cost

- Construction cost

- Transportation cost

- Sales taxes

- Installation fees

- All of these costs enhance the asset and prepare it to generate goods and services.

Basket Purchases

- A basket purchase is when assets like land, equipment, and buildings are bought together.

- Allocation for each asset is determined by the relative fair market value of each asset.

- Allocation process (color coded):

- ^^Purchase price will be given.^^

- %%Appraised value will be given.%%

- Appraised value/Initial cost = % of Value

- (% of value) x (purchase price) = @@Apportioned Cost@@

| ASSET | %%APPRAISED VALUE%% | % OF VALUE | ^^PURCHASE PRICE^^ | @@APPORTIONED COST@@ |

|---|---|---|---|---|

| Land | $ | % | $ | $ |

| Building | $ | % | $ | $ |

| Equipment | $ | % | $ | $ |

| TOTALS | $ | $ |

- Example: On March 1, a company purchased land and building for $500,000. The appraised value for the building is $425,000 and for the land the value is $275,000.

- %%Step 1%%: Add to get the total for appraised value.

- $275,000 + $425,000 = $700,000

- Step 2: Find the % of value. Divide the appraised value by the total appraised value.

- $275,000/$700,000 = 0.39 = 40%

- $425,000/$700,000 = 0.60 = 60%

- @@Step 3@@: Multiply the % of value by the purchase price of the land and building ($500,000).

- 40% x $500,000 = $200,000

- 60% x $500,000 = $300,000

- Step 4: Add up the apportioned costs to get the total of what the company paid.

- $200,000 + $300,000 = $500,000

| ASSET | APPRAISED VALUE | % OF VALUE | PURCHASE PRICE | APPORTIONED COST |

|---|---|---|---|---|

| Land | $275,000 | 40% | x $500,000 | = @@$200,000@@ |

| Building | $425,000 | 60%$$ | x $500,000 | = @@$300,000@@ |

| Total | %%$700,000%% | 100% | = $500,000 |

Maintenance Costs Incurred During Use

- Assets must be unkept for continued performance.

- @@Two types of expenditures@@:

- Ordinary repairs and maintenance

- WANTED changes.

- Small expenditures.

- Do not increase productivity.

- Do not extend the life of the asset beyond its original estimate.

- They are EXPENSED.

- Extraordinary repairs, replacements, and additions

- NEEDED changes.

- Large expenditures.

- Extends useful life.

- Increases productivity or efficiency.

- They are CAPITALIZED.

Depreciation Expense

- Depreciation is a cost allocation process that matches cost of operational assets with periods of its useful life.

- As an asset is used, it @@depreciates and creates an expense@@.

- To record depreciation, the acquisition cost of an asset moves from the balance sheet to the income statement as an expense.

- Partial year depreciation calculations: When a fixed asset is acquired during the year, depreciation is calculated for the fraction of the year the asset is owned.

- Accumulated Depreciation is the contra account for Depreciation Expense.

- Depreciation Expense:

- Normal debit balance

- On the Income statement

- Accumulated Depreciation:

- Normal credit balance

- On the Balance Sheet

- Depreciation calculations need to know the asset’s:

- Acquisition cost (including capitalized costs)

- Estimated useful life (land has an unlimited life)

- Estimated residual/salvage value (what the asset is worth if you sell it)

Objective 9.3: Apply various depreciation methods as economic benefits are used up over time.

Depreciation Methods

- There are three methods, but ACC 201 only focuses on the Straight Line Method. Material for ACC 202 goes into detail about the other two methods (you just need to know they exist).

- Straight Line Method

- The easiest and most widely used method.

- This method indicates that depreciation expense is a constant amount each year, accumulated depreciation increases by an equal amount each year, and book value decreases the same amount each year.

- ==Equation for the straight line method:==

- (Cost - Residual value) x (1/Useful life) = Depreciation Expense

- Example: A company purchases a machine for $150,000 with an estimated residual value $30,000 and a useful life of 5 years.

- Cost = $150,000

- Residual Value = $30,000

- Useful Life = 5 years

- ($150,000 - $30,000) x (1/5)

- Depreciation Expense = $24,000 per year

- Units of Production (Covered in ACC 202)

- Used if the life of an asset is generally measured in terms of units of production.

- Declining Balance (Covered in Acc 202)

- A greater depreciation expense is taken from the asset in the earlier years of its life versus its later years.

Tax Depreciation

- The least and latest rule says:

- Taxpayers want to pay the least tax that is legally permitted

- Taxpayers want to pay on the latest possible date.

Objective 9.4: Explain the effect of asset impairment on the financial statement.

Asset Impairment Losses

- @@An asset is impaired when@@:

- Its value decreases

- It can’t be recovered through future use or sale.

- Impairments represent a lower asset value than the asset’s carrying value.

- When an asset is labeled as impaired, it @@becomes a loss@@.

- A loss has a normal debit balance.

- A gain has a normal credit balance.

- @@To account for the impairment of an asset@@:

- The Accumulated Depreciation for the asset is removed.

- The asset is written down as what it is worth.

- Example: A company records an impairment loss of 7,500,000 on machinery. Their machinery originally cost 10,500,000 and has 3,000,000 in Accumulated Depreciation when its impairment was recorded.

- Step 1: Remove Accumulated Depreciation and decrease Equipment.

| Accumulated Depreciation | $3,000,000 | ||

|---|---|---|---|

| Equipment | $3,000,000 |

- Step 2: Record the Impairment Loss.

| Impairment Loss | $7,500,000 | ||

|---|---|---|---|

| Equipment | $7,500,000 |

Objective 9.5: Analyze the disposal of long-lived assets.

Disposal of Tangible Assets

- Selling assets for cash.

- @@Two adjusted journal entries are required for the disposal of an asset@@:

- Update depreciation to the date of disposal

- Record the disposal

- The journal entry would look like:

- Debit Cash

- Debit Accumulated Depreciation

- Credit Equipment

- A GAIN OR LOSS WILL BE INCLUDED IN THE ENTRY:

- Credit Gain IF the cash received is @@greater than@@ the asset’s book value.

- Debit Loss IF the cash received is @@less than@@ the asset’s book value.

- ==Equation to calculate annual depreciation:==

- (Cost - Residual value)/Years

- Example: A company sold machinery for $50,000 at the end of its 5 year of use. The machinery originally cost was $100,000, had residual value of zero, and a useful life of 10 years.

- Cost = $100,000

- Residual value (or salvage value) = $0

- Useful life = 10 years

- Fill in equation: ($100,000 - $0)/10

- Annual Depreciation = $10,000 per year

Objective 9.6: Analyze the acquisition, use, and disposal of long-lived intangible assets.

Intangible Assets

Intangible assets are non-physical assets that have a @@limited life@@ (they need to be renewed).

They are non-current assets that provide exclusive rights/privileges and help with operations.

Amortization is similar to depreciation, but it is specifically used for intangible assets. It writes off the cost of an asset over its useful or legal life.

Examples of intangible assets:

- Trademarks

- Slogans, logos, or names associated with a specific business.

- Purchased trademarks are recorded at cost.

- Examples: Apple, Nikes, McDonalds

- Copyrights

- An exclusive right granted by the federal government to protect artistic/intellectual properties.

- Amortize cost over the period benefitted.

- Examples: songs, art, literary work

- Patents

- An exclusive right granted by the federal government to sell or manufacture an invention.

- Amortize cost over the shorter of useful life or 20 years.

- Examples: Vaccines for COVID, each name has its own formula.

- Licensing Rights

- Grant limited permission to use a product or service according to specific terms and conditions.

- Example: UNLV using computer software that is made available through a campus licensing agreement.

- Technology

- Software and web development work.

- Used over a short period of time (3-7 years).

- Franchises

- Provides legally protected rights to sell products or provide services purchased by a franchisee from the franchisor.

- Examples: Starbucks, Krispy Kreme

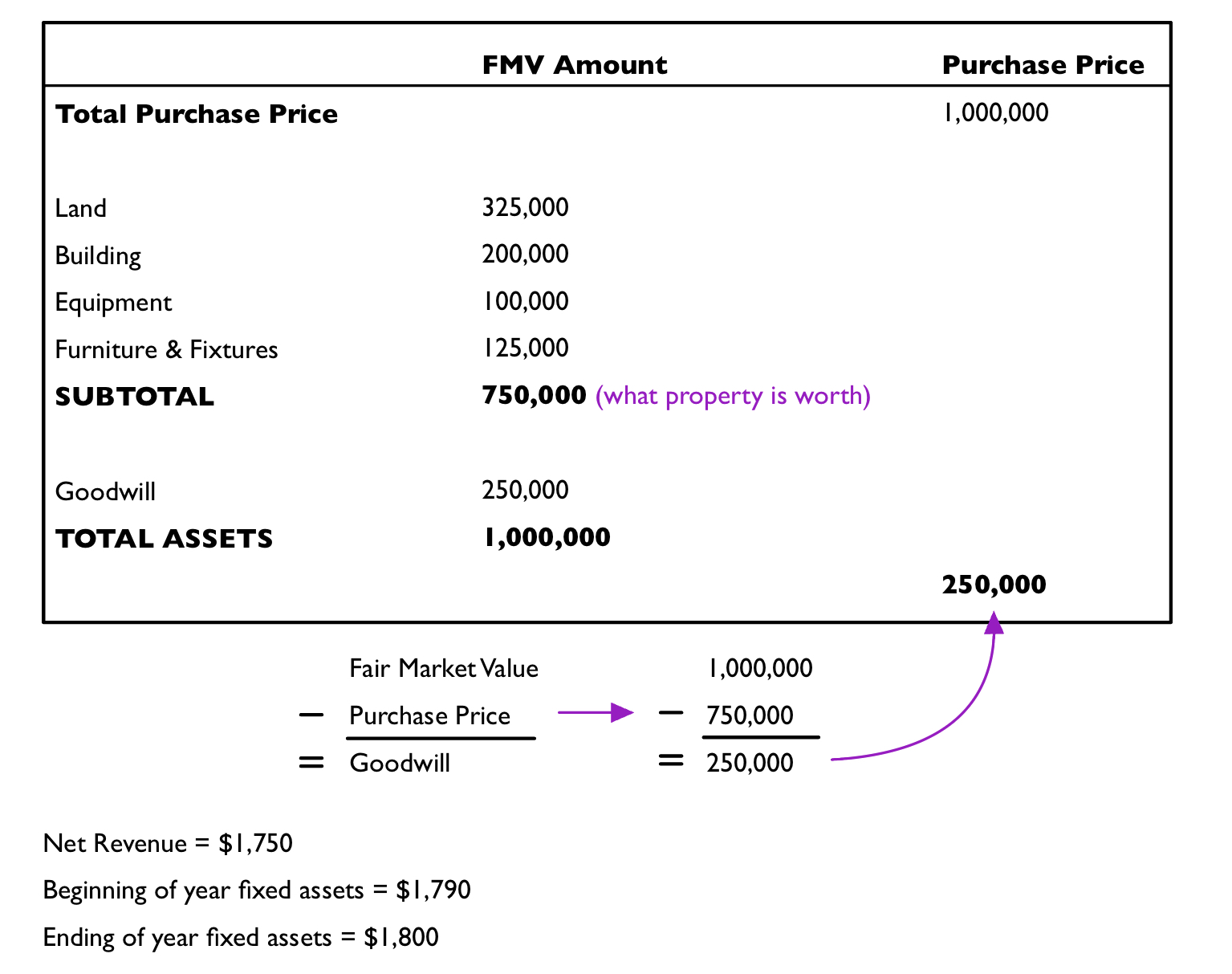

- Goodwill

- Occurs when one company buys another company.

- It is not amortized

- Only purchased goodwill is considered an intangible asset.

- ==Equation to calculate goodwill:==

- Fair market value - Purchase price = Goodwill

- Example:

Acquisition

- The cost of intangible assets are recorded as assets if they’ve been purchased.

- If the asset is self constructed, the cost is reported as research and development expenses.

Use

- Intangible assets with unlimited lives are not amortized.

- Intangible assets with limited lives are capitalized and later amortized.

Disposal

- Gains for intangible assets are the result of amounts received being greater than their book values.

- Losses for intangible assets are the result of amounts received being less than their book values.

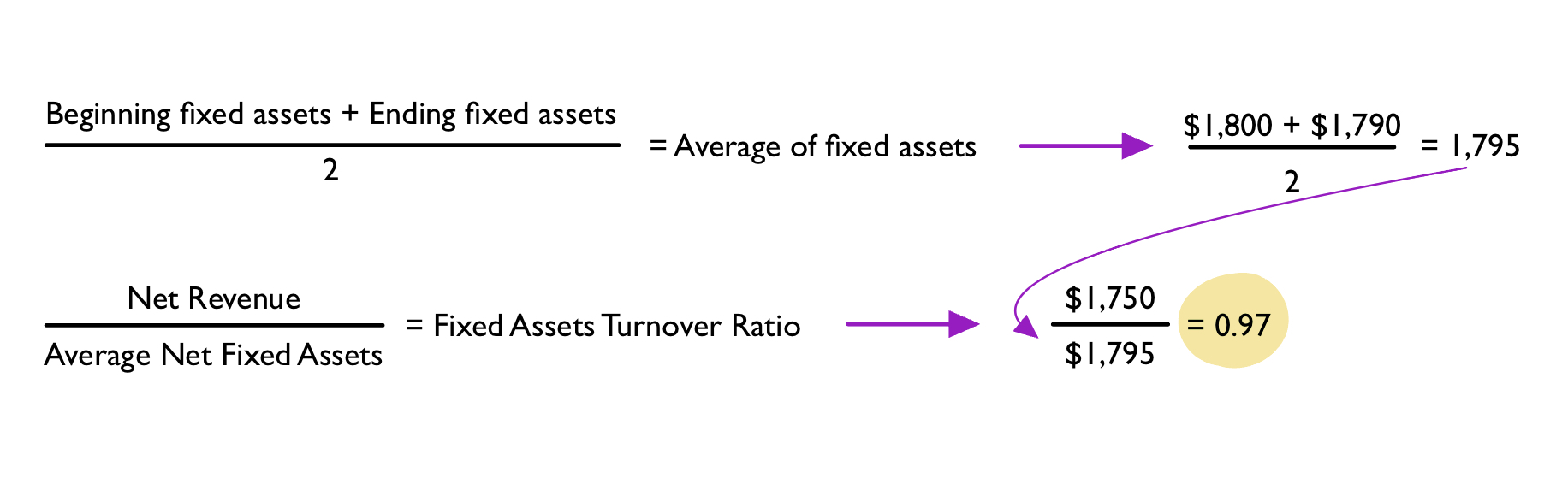

Objective 9.7: Interpret the fixed asset turnover ratio.

Fixed Asset Turnover Analysis

Used to see how well long-lived assets were used to generate revenue.

==Equation for calculating the average of fixed assets== (the denominator in the fixed asset turnover ratio equation).

- (Beginning fixed assets + Ending fixed assets)/2

==Equation to calculate the fixed asset turnover ratio:==

- (Net revenue)/(Average net fixed assets)

- A higher ratio implies great efficiency

- Example: For 2021, a company has $1,750 of revenue. End of the year assets were $1,800 and beginning of the year fixed assets were $1,950. (All of these numbers are in millions).

- Step 1: Calculate the average of fixed assets.

- Step 2: The average is used in the denominator of the fixed asset turnover ratio equation.

- Step 3: Use that equation to calculate the ratio.

Objective 9.8: Describe factors to consider when comparing companies’ long-lived assets.

Impact of Depreciation Differences

- Accelerated depreciated in early year of an asset’s useful life =

- higher depreciation expense

- lower net income

- lower book value

- Selling an asset with a low book value = gain

- Selling an asset with a high book value = loss