AP Macro Unit 2 - Economic Indicators and the Business Cycle

0.0(0)

0.0(0)

Card Sorting

1/52

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

53 Terms

1

New cards

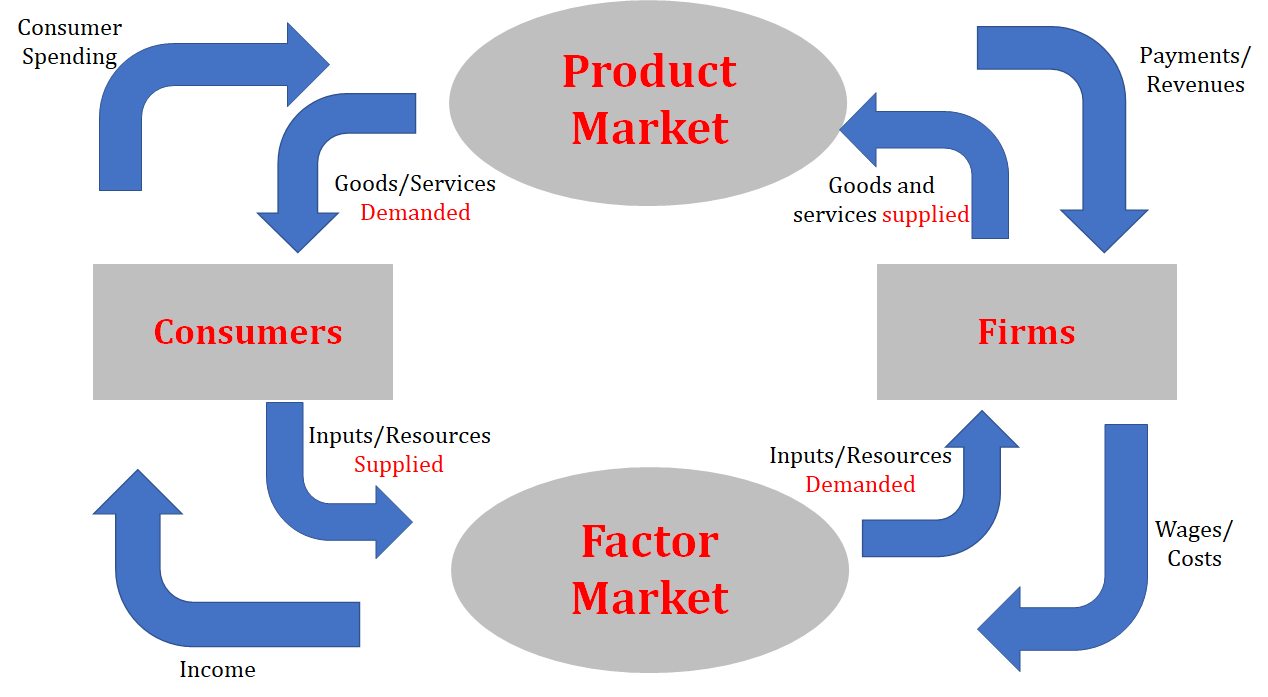

Circular Flow Diagram (definition)

* A graphical representation of how goods, services, and money flow through our economy between consumers and firms

* Based on voluntary exchange

* Based on voluntary exchange

2

New cards

Factor (Resource) Market

* Where factors of production/resources are exchanged

* Firms are demanding, consumers are supplying

* Households/Consumers supply labor, capital, and other resources for income

* Firms purchase labor, capital, land to produce goods/services for the Product Market

* Firms are demanding, consumers are supplying

* Households/Consumers supply labor, capital, and other resources for income

* Firms purchase labor, capital, land to produce goods/services for the Product Market

3

New cards

Product Market

* Where economic goods/products and services are exchanged

* Firms are supplying, consumers are demanding

* Through the sales of goods/services, firms can generate revenue and profit

* Demand is determined by households’ and businesses’ income and willingness and ability to purchase the goods/services

* Supply is determined by firms’ ability and willingness to produce and sell the goods/services at different prices

* Interaction of Supply and Demand determine prices of goods/services and the quantity of goods/services that are exchanged

* Firms are supplying, consumers are demanding

* Through the sales of goods/services, firms can generate revenue and profit

* Demand is determined by households’ and businesses’ income and willingness and ability to purchase the goods/services

* Supply is determined by firms’ ability and willingness to produce and sell the goods/services at different prices

* Interaction of Supply and Demand determine prices of goods/services and the quantity of goods/services that are exchanged

4

New cards

Voluntary Exchange

* The act of firms and consumers gathering freely in economic markets to achieve beneficial exchange to maximize their economic incentives

5

New cards

Circular Flow Diagram (diagram)

6

New cards

Consumers in the Circular Flow Diagram

* Buy goods in the economy

* Provide labor and receive wages

* Money → Product Market → Goods/Services

* Labor → Factor Market → Wages

* Provide labor and receive wages

* Money → Product Market → Goods/Services

* Labor → Factor Market → Wages

7

New cards

Consumer Spending

* When a consumer sends money to the product market by buying goods

8

New cards

Firms in the Circular Flow Diagram

* Produce in the economy

* Wages/Costs → Factor Market → Resources

* Goods/Services → Product Market → Payment

* Wages/Costs → Factor Market → Resources

* Goods/Services → Product Market → Payment

9

New cards

Gross Domestic Product (GDP)

* The dollar value of all final goods and services produced within a country’s borders in one year

* Helps economists view how productive the economy is over time

* Helps economists view how productive the economy is over time

10

New cards

How is GDP used?

* Compare ourselves with other countries

* See the impact of policy changes

* Compare growth year to year

* See the impact of policy changes

* Compare growth year to year

11

New cards

Expenditures Approach to Calculating GDP

* The sum of all aggregate (total) spending on all final goods and services within a country’s border in one year

* GDP = C + I + G + (X - N)

* C = consumption

* I = investment

* G = government spending

* X = exports

* N = imports

* GDP = C + I + G + (X - N)

* C = consumption

* I = investment

* G = government spending

* X = exports

* N = imports

12

New cards

Main Components of GDP

* Consumer Spending

* Value of any good/service purchased by a consumer

* Investment Spending

* Any spending done by businesses

* Government Spending

* Any spending done by the government

* Net Exports (Exports - Imports)

* The value of all goods/services exported from a country minus the value of all goods/services the country imported

* Value of any good/service purchased by a consumer

* Investment Spending

* Any spending done by businesses

* Government Spending

* Any spending done by the government

* Net Exports (Exports - Imports)

* The value of all goods/services exported from a country minus the value of all goods/services the country imported

13

New cards

Income Approach to Calculating GDP

* Sum of all the incomes in the economy

* Should equal the Expenditure Approach because all spending is some else’s income

* GDP = W + i + r + p

* W = wages

* i = interest payments

* r = rents

* p = corporate profits

* Should equal the Expenditure Approach because all spending is some else’s income

* GDP = W + i + r + p

* W = wages

* i = interest payments

* r = rents

* p = corporate profits

14

New cards

What is not included in GDP?

* Illegal activities - not part of the legal market and therefore not recorded

* Unpaid work - not considered a market transaction

* Transfer payments - do not represent the production of a good or service

* Intermediate goods - goods that used in the production of other goods and not intended for final consumption, and are considered part of the production process and are not a final good (which is what GDP calculates)

* Depreciation - not a new production of goods/services

* Unpaid work - not considered a market transaction

* Transfer payments - do not represent the production of a good or service

* Intermediate goods - goods that used in the production of other goods and not intended for final consumption, and are considered part of the production process and are not a final good (which is what GDP calculates)

* Depreciation - not a new production of goods/services

15

New cards

Limitations of GDP

* Acronym: PIES

* Population

* When populations are different from country to country, but the countries are producing a similar amount of a product - leads to an inaccurate picture of the standard of living (one country takes the same amount of production and distributes it to a larger population)

* Solution: GDP per capita (GDP/Population)

* Still not perfect, so many orgs use the Human Development Index for standard of living

* Inequality

* If income is not evenly distributed to all families, then it is not an accurate measure of production and economic stability

* Unequal society → less resilient market

* Environment

* GDP may not accurately measure a country’s overall health - externalities (see: AP Micro Unit 6)

* Shadow Economy

* Involves the production of items not reported and therefore not counted in GDP

* Ex. Black Market

* Population

* When populations are different from country to country, but the countries are producing a similar amount of a product - leads to an inaccurate picture of the standard of living (one country takes the same amount of production and distributes it to a larger population)

* Solution: GDP per capita (GDP/Population)

* Still not perfect, so many orgs use the Human Development Index for standard of living

* Inequality

* If income is not evenly distributed to all families, then it is not an accurate measure of production and economic stability

* Unequal society → less resilient market

* Environment

* GDP may not accurately measure a country’s overall health - externalities (see: AP Micro Unit 6)

* Shadow Economy

* Involves the production of items not reported and therefore not counted in GDP

* Ex. Black Market

16

New cards

Human Development Index

* A summary composite measure of a country’s average achievements in three basic aspects of human development: health, knowledge, and standard of living

17

New cards

Labor Force

* The total number of people who are either employed or actively seeking employment

* Must be 16+ and not in the military, institutionalized, or otherwise unable to work

* Doesn’t include individuals who are retired, in school, or not actively seeking employment

* Important economic indicator

* Insight into available employment opportunities

* Helps economists and policymakers understand the supply of labor in the economy and health of the labor market

* Can help inform policy decisions related to labor market regulation and job creation

* Must be 16+ and not in the military, institutionalized, or otherwise unable to work

* Doesn’t include individuals who are retired, in school, or not actively seeking employment

* Important economic indicator

* Insight into available employment opportunities

* Helps economists and policymakers understand the supply of labor in the economy and health of the labor market

* Can help inform policy decisions related to labor market regulation and job creation

18

New cards

Discouraged Workers

* People who are able to work but choose not to look for work

19

New cards

Labor Force Participation Rate

* Percentage of the total population that is in the labor force

* \[(Number of people in the labor force) / (Total Population)\] x 100

* Important indicator of health of the labor market and can be affected by a variety of factors (overall economic activity, availability of jobs, demographic trends)

* \[(Number of people in the labor force) / (Total Population)\] x 100

* Important indicator of health of the labor market and can be affected by a variety of factors (overall economic activity, availability of jobs, demographic trends)

20

New cards

Household Surveys

* Help economists measure the size and composition of the labor force

* Ask individuals about their employment status and job search activities

* Ask individuals about their employment status and job search activities

21

New cards

Employer Surveys

* Help economists measure the size and composition of the labor force

* Ask employers the number of workers on their payrolls and the number of job openings

* Ask employers the number of workers on their payrolls and the number of job openings

22

New cards

Unemployment Rate

* The percentage of the labor force that is not employed

* A key economic indicator to understand labor in the economy

* Not included as unemployed

* Retired individuals, criminals, etc.

* \[(Number of unemployed individuals) / (Labor Force)\] x 100

* A key economic indicator to understand labor in the economy

* Not included as unemployed

* Retired individuals, criminals, etc.

* \[(Number of unemployed individuals) / (Labor Force)\] x 100

23

New cards

Types of Unemployment

* Frictional Unemployment

* Occurs when individuals are in between jobs or are searching for their first job

* “Healthy” unemployment - regular and natural part of the economy

* Example: Student that has just graduated looking for their first job

* Structural Unemployment

* Occurs when there’s a mismatch between the skills and abilities of workers and the requirements of available jobs

* Can happen when there are changes in the economy - technological advances, shift in demand of goods/services, etc.

* Difficult to address, as it may require new training/education and require time and/or government intervention

* Example: Typewriter repairman - no longer needed in the modern day

* Seasonal Unemployment

* Jobs that are no longer needed with changing seasons

* Example: Lifeguard, agriculture, etc.

* Cyclical Unemployment

* Occurs when there is economic recession or downturn, when there is lack of demand for goods/services and firms cut down on production and hiring

* Firms may reduce production levels or go out of business, increasing the unemployed population

* “Unhealthy” unemployment - result of economic decline and difficult to reverse

* Example: Chef is fired during a recession because business is slow

* Occurs when individuals are in between jobs or are searching for their first job

* “Healthy” unemployment - regular and natural part of the economy

* Example: Student that has just graduated looking for their first job

* Structural Unemployment

* Occurs when there’s a mismatch between the skills and abilities of workers and the requirements of available jobs

* Can happen when there are changes in the economy - technological advances, shift in demand of goods/services, etc.

* Difficult to address, as it may require new training/education and require time and/or government intervention

* Example: Typewriter repairman - no longer needed in the modern day

* Seasonal Unemployment

* Jobs that are no longer needed with changing seasons

* Example: Lifeguard, agriculture, etc.

* Cyclical Unemployment

* Occurs when there is economic recession or downturn, when there is lack of demand for goods/services and firms cut down on production and hiring

* Firms may reduce production levels or go out of business, increasing the unemployed population

* “Unhealthy” unemployment - result of economic decline and difficult to reverse

* Example: Chef is fired during a recession because business is slow

24

New cards

Full Employment

* Refers to a status where there is little or no cyclical unemployment

* Frictional and Structural Unemployment will always exist

* Frictional and Structural Unemployment will always exist

25

New cards

Natural Rate of Unemployment

* Rate at which there is only frictional and structural unemployment

* Argued to be around 4-6% unemployment

* Argued to be around 4-6% unemployment

26

New cards

Inflation

* Occurs when the general level of prices in an economy is rising

* Expressed as a percentage and represents the rate at which the general price level is increasing over time

* Can affect purchasing power of money as prices for goods/services increase faster than wages/incomes

* Moderate inflation is good for the economy

* Incentivises spending because prices will be higher later

* Expressed as a percentage and represents the rate at which the general price level is increasing over time

* Can affect purchasing power of money as prices for goods/services increase faster than wages/incomes

* Moderate inflation is good for the economy

* Incentivises spending because prices will be higher later

27

New cards

Deflation

* Opposite of inflation

* Occurs when the general rate of prices in an economy is falling

* Expressed as a negative percentage and represents the rate at which the general price level is decreasing over time

* Can lead to decrease in demand and decrease in economic activity

* Occurs when the general rate of prices in an economy is falling

* Expressed as a negative percentage and represents the rate at which the general price level is decreasing over time

* Can lead to decrease in demand and decrease in economic activity

28

New cards

Disinflation

* A slower rate of inflation or slowing down of the rate at which general price level is increasing

29

New cards

Stagflation

* Where prices rise and the economy contracts

30

New cards

Price Index

* A statistical measure that reflects the changes in the general level of prices for a basket of goods and services over time

* Commonly used to measure inflation and deflation, as they provide a way to track changes in the general price level of an economy

* Commonly used to measure inflation and deflation, as they provide a way to track changes in the general price level of an economy

31

New cards

Consumer Price Index (CPI)

* A common price index

* Measures the changes in the prices of a basket of goods and services consumed by households

* Calculated by the Bureau of Labor Statistics in the US

* They collect price data for goods/services in the market basket from a sample of retailers, service providers, and other sources

* Prices collected are used to calculate the cost of the market basket at the base period, then compares that cost to the current period

* Base year is valued at 100, and all other numbers represent a percent increase or decrease

* Used to measure the changes in the cost of living over time

* Based on a market basket of goods and services that is representative of the purchases made by households

* Includes food, clothing, housing, transportation, and medical care

* Careful, might not consider substitution bias!

* Measures the changes in the prices of a basket of goods and services consumed by households

* Calculated by the Bureau of Labor Statistics in the US

* They collect price data for goods/services in the market basket from a sample of retailers, service providers, and other sources

* Prices collected are used to calculate the cost of the market basket at the base period, then compares that cost to the current period

* Base year is valued at 100, and all other numbers represent a percent increase or decrease

* Used to measure the changes in the cost of living over time

* Based on a market basket of goods and services that is representative of the purchases made by households

* Includes food, clothing, housing, transportation, and medical care

* Careful, might not consider substitution bias!

32

New cards

Substitution Bias

* Occurs when consumers switch to cheaper alternatives as the price of certain goods and services increase

33

New cards

CPI Formula

\[(Current Market Basket) / (Base Year Market Basket)\] x 100

34

New cards

Inflation Rate Formula (GDP Deflator)

\[(GDP Deflator 2 - GDP Deflator 1) / GDP Deflator 1\] x 100

35

New cards

Inflation Rate Formula (CPI)

\[(CPI2 - CPI1) / CPI1\] x 100

36

New cards

Unanticipated Inflation

* A surprise rise in general prices

* Consumers and producers were not given chance to adjust in advance

* Consumers and producers were not given chance to adjust in advance

37

New cards

Costs of Inflation

* Menu Costs

* Result from a firm having to change prices

* Example: Walmart hiring additional workers to replace all price tags on their products every week

* Shoe Leather Costs

* The cost of time and effort people end up spending to counteract the costs of inflation

* Example: Businesses may hold less cash or have to make more trips to the bank during inflation

* Loss of Purchasing Power

* Occurs because inflation causes the value of the dollar to decrease over time

* Example: Individuals who have the same wage they do the next year as the previous year cannot purchase as much with rising prices

* Wealth Redistribution

* Involves the real value of wealth being transferred from one group to another

* Inflation affects the amount of interest being repaid or earned

* Result from a firm having to change prices

* Example: Walmart hiring additional workers to replace all price tags on their products every week

* Shoe Leather Costs

* The cost of time and effort people end up spending to counteract the costs of inflation

* Example: Businesses may hold less cash or have to make more trips to the bank during inflation

* Loss of Purchasing Power

* Occurs because inflation causes the value of the dollar to decrease over time

* Example: Individuals who have the same wage they do the next year as the previous year cannot purchase as much with rising prices

* Wealth Redistribution

* Involves the real value of wealth being transferred from one group to another

* Inflation affects the amount of interest being repaid or earned

38

New cards

Individuals Helped by Inflation

* Borrowers with fixed interest rates

* Inflation can reduce the real value of the debt they owe

* Owners of assets

* Inflation can increase the nominal value of their assets

* Firms that can cut real wages

* Inflation can allow firms to reduce the nominal wages of their workers without reducing their purchasing power

* Inflation can reduce the real value of the debt they owe

* Owners of assets

* Inflation can increase the nominal value of their assets

* Firms that can cut real wages

* Inflation can allow firms to reduce the nominal wages of their workers without reducing their purchasing power

39

New cards

Individuals Hurt by Inflation

* Savers

* Inflation can erode the purchasing power of savings as the saved money loses value over time to rising prices

* Especially hurtful to those who rely on their savings for long-term financial stability (such as retirees)

* Savers can invest in assets expected to increase in value at a higher rate than inflation (real estate, stocks, certain bonds) or adjust their saving strategies to account for inflation

* Workers on fixed incomes

* Inflation can make it difficult to keep up with rising prices if income does not rise at the same rate as inflation

* Can lead to a decline in their standard of living

* Example: Those on a pension or disability benefits

* Borrowers with variable rates

* Inflation will lead lenders to increase interest rates to pay for the cost of inflation

* Inflation can erode the purchasing power of savings as the saved money loses value over time to rising prices

* Especially hurtful to those who rely on their savings for long-term financial stability (such as retirees)

* Savers can invest in assets expected to increase in value at a higher rate than inflation (real estate, stocks, certain bonds) or adjust their saving strategies to account for inflation

* Workers on fixed incomes

* Inflation can make it difficult to keep up with rising prices if income does not rise at the same rate as inflation

* Can lead to a decline in their standard of living

* Example: Those on a pension or disability benefits

* Borrowers with variable rates

* Inflation will lead lenders to increase interest rates to pay for the cost of inflation

40

New cards

Nominal GDP

* Total market value of all goods and services produced in an economy in a given year with current market prices

* Used as a measure of economic growth and is often used to compare economic performance over time

* Doesn’t account for inflation’s impact on the economy

* Used as a measure of economic growth and is often used to compare economic performance over time

* Doesn’t account for inflation’s impact on the economy

41

New cards

Real GDP

* Measure of economic growth that adjusts for the impact of inflation

* Calculated by adjusting nominal GDP for the effects of inflation using a base year as a reference point

* Allows for more accurate comparison of economic performance over time as it accounts for changes in purchasing power of money

* Calculated by adjusting nominal GDP for the effects of inflation using a base year as a reference point

* Allows for more accurate comparison of economic performance over time as it accounts for changes in purchasing power of money

42

New cards

Nominal GDP Equation

* Multiply the amount of each good produced by the price of that particular year

43

New cards

Real GDP Equation

* Multiply the amount of each good produced by base year prices

44

New cards

GDP Deflator

* Used to measure the effects of inflation by deflating nominal GDP

* It compares the nominal and real GDP of a country in a year

* When nominal GDP = real GDP, the GDP deflator is 100

* It compares the nominal and real GDP of a country in a year

* When nominal GDP = real GDP, the GDP deflator is 100

45

New cards

GDP Deflator Equation

* (Nominal GDP / Real GDP) x 100

46

New cards

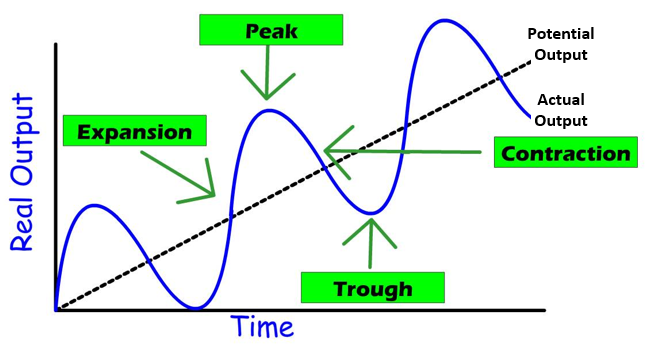

The Business Cycle (definition + chart)

* The cyclical pattern of expansion and recession of the economy over time

* Expansion and Peak = Expansionary Phase

* Contraction and Trough = Contractionary Period

* Expansion and Peak = Expansionary Phase

* Contraction and Trough = Contractionary Period

47

New cards

Actual Output on the Business Cycle

* The squiggle line

* Shows the short run economic growth

* Shows the short run economic growth

48

New cards

Potential Output on the Business Cycle

* The straight line

* Shows the long run economic growth

* Shows the long run economic growth

49

New cards

Actual Output = Potential Output

* Economy is experiencing full employment and is reaching its goals of promoting economic growth, preventing unemployment, and limiting inflation

50

New cards

Expansionary Phase of the Business Cycle

* The economy is growing in the short run

* Unemployment is typically low

* Inflation is rising

* AKA Inflationary Gap because of the positive gap between actual output and potential output

* Unemployment is typically low

* Inflation is rising

* AKA Inflationary Gap because of the positive gap between actual output and potential output

51

New cards

Contractionary Period of the Business Cycle

* The economy is shrinking in the short run

* Unemployment is high

* Inflation is low

* Unemployment is high

* Inflation is low

52

New cards

Economic Recession

* A period of two straight fiscal quarters (6 months) of negative GDP growth

* Can develop into a depression

* Can develop into a depression

53

New cards

Economic Depression

* A particularly severe and long recession that occurs for years