AP Macroeconomics Unit 6: Open Economy - International Trade and Finance

1/31

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

32 Terms

Net exports

Exports - imports

Trade surplus

Exporting > importing

Trade deficit (trade gap)

Exporting < importing

Balance of payments

A summary of the country’s international trade for a given year.

Current Account (CA)

A record of a country’s physical trading. Composes of 3 parts:

Net exports

Investment income (income from the factors of production, or WRIP)

Net transfers (money flows such as donations and remittances)

Capital and Financial Account (CFA)

Measures the purchase and sales of financial assets abroad.

Foreign Direct Investment

When a foreign company buys business in a different country.

Net capital outflow

The difference between the purchase of foreign assets by a country and the purchase of that country’s assets by a foreign country.

Financial Account Surplus

Inflow > Outflow

Financial Account Outflow

Inflow < Outflow

CA + CFA should equal this amount

0

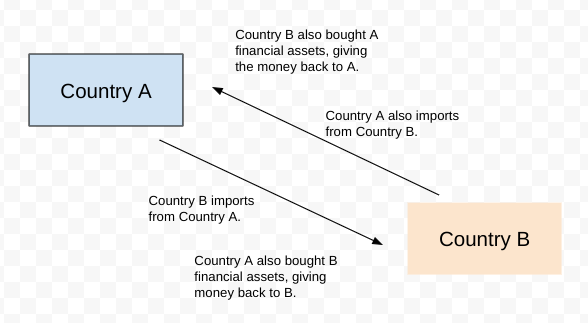

Why CA and CFA balance out

The money comes back full circle to the country, whether it be through exports, or through a foreign country buying financial assets from that country.

Exchange rate

The price of one currency relative to another.

Depreciation

The loss in value of a country’s currency when compared to another country. More of that currency is now needed to buy one unit of the foreign country’s currency. The currency “weakens.”

Appreciation

The increase in value of a country’s currency when compared to another country. Less of the currency is needed to buy one unit of the other country’s currency. The currency “strengthens.”

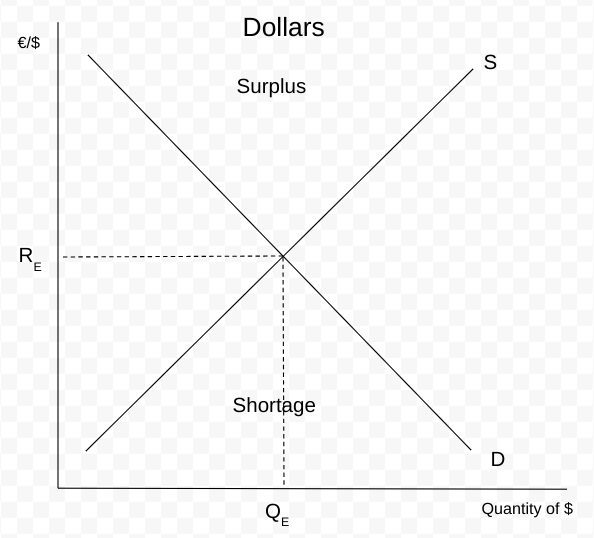

FOREX Market

A huge market conisting of every country’s currency,

FOREX Demand

Foreigners

An inverse relationship between the exchange rate and quantity demanded.

FOREX Supply

By the home country

A direct relationship between the exchange rate and quantity supplied.

If you want to buy goods from a foreign country

You must supply that country with their currency (or exchange your currency for that country’s currency using the exchange rate)

FOREX Shifters

Change in Tastes

Change in Relative Incomes

Change in Relative Price level

Change in Relative Interest Rates

Fixed exchange rate

When the government manages the country’s currency.

Floating exchange rate

Where the market determines the value of the country’s currency.

FOREX Double shifters

Changes in price levels

Changes in interest rate

Tariff

A tax on imports

Quota

A limit on the number of imports coming in

Both tariffs and quotas:

Decrease the FOREX supply of the country restricting trade since fewer trading takes place.

When currency appreciates:

US products become more expensive

Countries buy less products from the US

US net exports decrease

When currency depreciates:

US products become less expensive

Countries buy more products from the US

US net exports increase

When interest rates increase:

Foreign countries will buy more domestic assets

Citizens will want to buy less foreign assets

Capital inflow increases

Net capital outflow decreases

When net capital outflow decreases:

FOREX demand for that currency decreases

That currency’s exchange rate goes up

The currency appreciated

When interest rates decrease:

Foreign countries will buy less domestic assets

Citizens will buy more foreign assets

Capital outflow increases

Net capital outflow increases

When net capital outflow increases:

FOREX supply increases

Exchange rate decreases

The currency depreciated