AP MACROECONOMICS: UNIT 2 ECONOMIC INDICATORS AND BUSINESS CYCLE

1/70

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

71 Terms

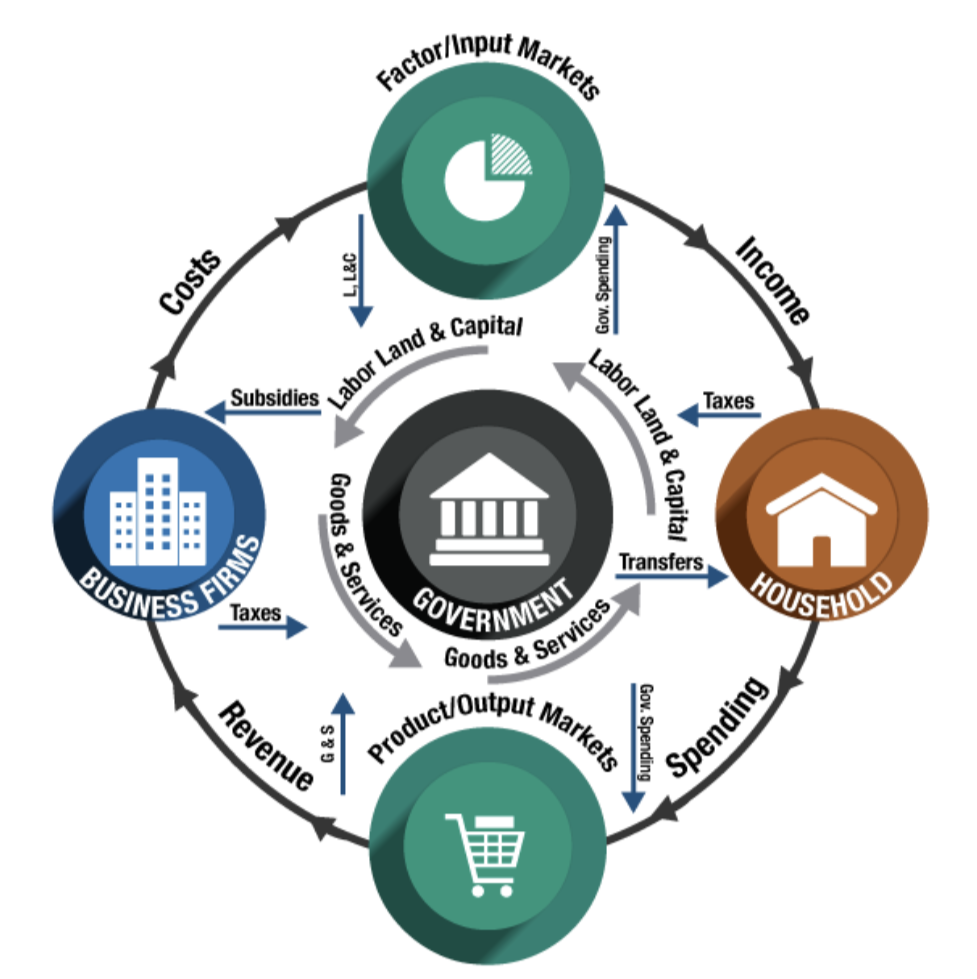

Product Markets

Where consumers purchase goods and services from businesses.

Revenue

The payment a business receives from customers for its products.

Factor Market

Where businesses purchase what they need to produce their goods and services.

Rents

Compensation paid to a property owner for land or capital in the factor market.

Wages

Compensation paid to workers/laborers in the factor market.

Interest Payments

A percentage of the amount of money borrowed that is paid for a loan.

Transfer Payment

Money granted by the government to households to influence their behavior in some way; income redistributed by the government.

Consumer Goods

Resource acquired for direct use.

Capital Goods

Resource obtained by a business from another in order to produce a consumer good or service (i.e., tools, machinery, intermediate goods).

Input and Output Markets

Gross Domestic Product

The market value of all final goods and services produced in a country in a year.

Aggregates

The total amount or value; also, to combine several distinct items into one, such as adding the market value of all goods and services together into one number.

Market Value

The amount of money for which a good or service is freely purchased.

Double Counting

Adding the same value twice, a mistake economists try hard to avoid when calculating GDP.

Intermediate Good

A product used in making a final good or service—part of a final good.

Durable Goods

A long-lasting product that will be used for three years or more, such as a car.

Nondurable Goods

A good purchased for immediate consumption, such as food.

Expenditures Approach

Counting GDP using the sum of all purchases of final goods and services by consumers, businesses, the government, and foreign customers. Summarized with the formula Y = C + I + G + Nx.

Income Approach

Counting GDP by adding all payments for the factors of production as well as business profit: wages for labor, rent for land, interest for capital loans, and taxes involved in production.

Value-Added Approach

Counting GDP by summing all incremental increases in value from raw factors of production through to final product.

National Income =

National Expenditures

Y

GDP

C

The total amount that consumers spend

I

The total amount that businesses invest in capital goods

G

Government Spending on Goods and Services

Xn

The dollar value of exports – the dollar value of imports

Net Exports

The difference in value between a country's total exports and total imports; if negative, then the country is importing more goods than it exports.

Export

A product produced for and sold to a foreign country.

Import

A product produced in and purchased from a foreign country.

Inventory

The quantity of a good that a business stores with the intent to sell.

Indicator

A measurement used to assess how well or poorly an economy is functioning; the big three are GDP, the unemployment rate, and the inflation rate.

Depreciation

A decline in the value of a good over time, often due to deterioration from use, such as the wearing out of clothing.

Per Capita

A measure divided in value for each person in a given population.

Unemployment Rate

The percentage of the total labor force without a job and looking for work.

Unemployment Rate Equation

Number of Employed Workers/Labour Force * 100%

GDP Equation

Y = C + I + G + Xn

Labour Force Participation Rate

Labor Force/Population Age 16 or older * 100%

Frictional Unemployment

Joblessness between jobs or when first entering or re-entering the job market.

Structural Unemployment

Joblessness due to fundamental changes in supply and demand within the economy, often due to technological change or international trade.

Cyclical Unemployment

Joblessness that is neither frictional nor structural and is generally considered rising and fall periodically.

Transferable Skills

Specialized abilities that can be used in diverse kinds of labor; for example, typing quickly transfers between many different office jobs.

Natural Rate of Unemployment (NRU)

The sum of frictional and structural unemployment, considered to be unemployment rate at full employment of resources for real output.

NRU

frictional employment + structural unemployment

Cyclical Unemployment Equation

the actual unemployment rate – the natural rate of unemployment

Full Unemployment

Efficient use of all land, labor, and capital, which in the real world includes the natural rate of unemployment. (Full Employment does not equal 0% Unemployment).

Discouraged Workers

A person who has not taken an action to gain employment for four weeks or more because they believe there are no available jobs for which they are qualified.

Inflation

The general rise of prices over time (negative inflation is deflation).

Inflation Rate

The percentage change in prices from year to year.

Inflation Rate Equation

Price level in Year 2 — Price level in Year 1/Price level in Year 1 × 100

Standard of Living

Consumers' ability to satisfy their wants and needs in an economy.

Disinflation

A slowing of the inflation rate; price level is still rising, just at a less rapid rate.

Nominal

Actual dollar value (not adjusted for inflation).

Consumer Price Index

Measurement of price changes in a fixed basket of goods determined to be representative of the purchases of a typical family in a United States city.

Market Basket

In a particular price index, the set of products for which the prices are tracked.

CPI

Total cost of basket in current year/Total cost of basket in base year * 100

Base Year

A given year used as the standard or marker with which to compare data for all other years in the period being analyzed.

Borrower

Person or institution that has taken out a loan; also known as a debtor.

Creditor

Person or institution that has loaned money (lender).

Interest

The price of a loan, most often expressed as a percentage of the principal, which is the amount borrowed.

Unexpected Inflation

An increase in the average price level that was not anticipated by any economic forecast.

Risk

The possibility of gain or loss accepted in investing.

Fixed Income

The same nominal income, regardless of inflation (such as when a person lives on disability payments).

Nominal GDP

The dollar value of final goods and services produced within a country, with no adjustment for inflation.

Real GDP

The dollar value of final goods and services produced within a country, with an adjustment for inflation using a base year's price level.

GDP Deflator

A price index that aggregates the price of everything produced in the economy, not just consumer goods and services, like the CPI; used to adjust nominal GDP figures to real GDP.

GDP Deflator Equation

Nominal GDP/Real GDP * 100

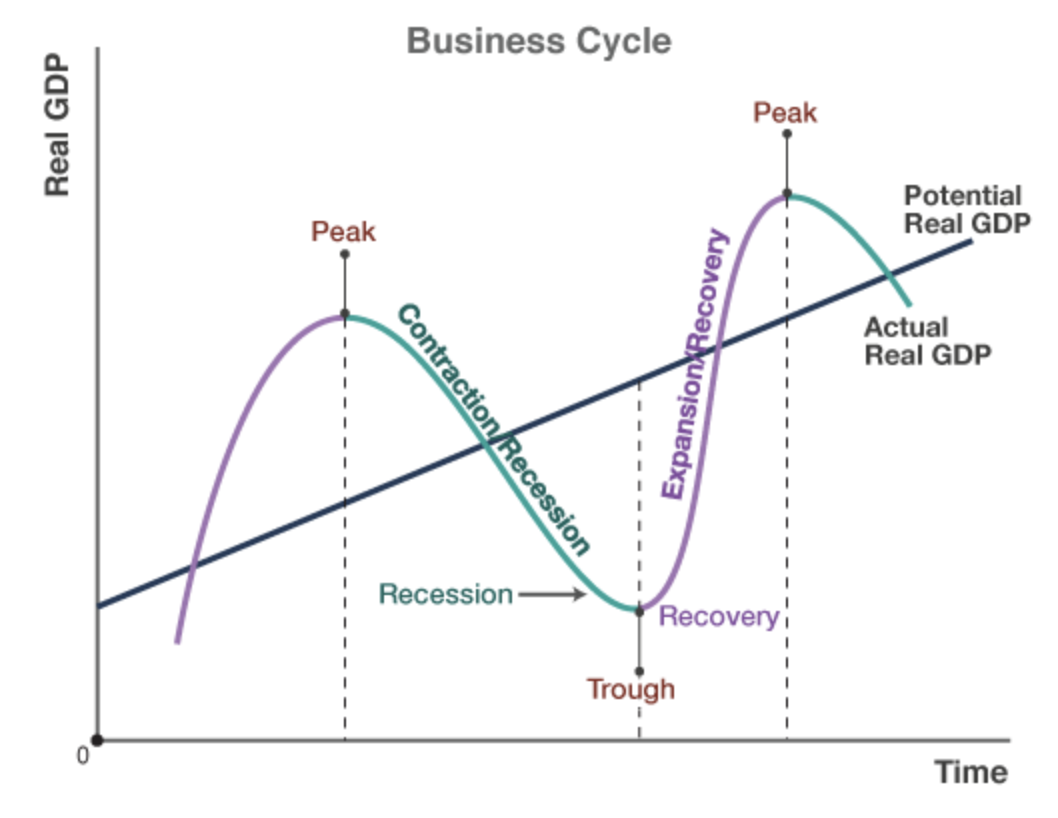

Business Cycle

An economic model showing fluctuations (changes) in aggregate output and employment because of changes in aggregate supply and/or aggregate demand.

Business Cycle Image

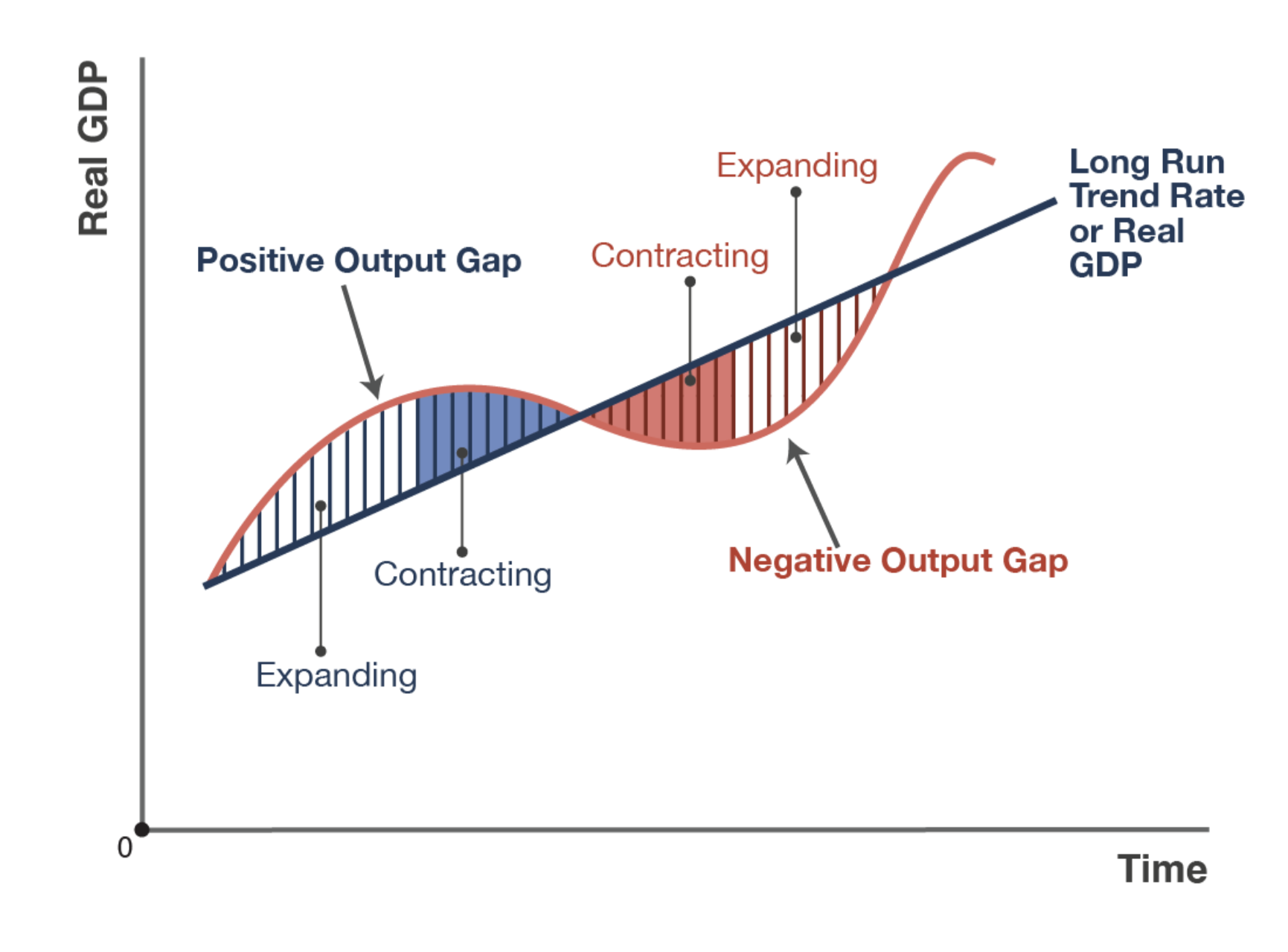

Recessionary Gap

Also known as a negative output gap, when an economy's actual output is less than its potential output, characterized most often by an increasing unemployment rate.

Inflationary Gap

Also known as a positive output gap, when an economy's real output exceeds its potential output; unsustainable activity that will push prices up.

Gaps