Chapter 8 - Consumption, Saving, Investment, and the Multiplier

0.0(0)

0.0(0)

New

Card Sorting

1/38

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

39 Terms

1

New cards

Disposable income (DI)

The income a consumer has left over to spend or save once they have paid out net taxes

2

New cards

Net taxes

Taxes paid - Transfers received

3

New cards

Consumption and saving schedules

Tables that show the direct relationships between disposable income and consumption and saving

4

New cards

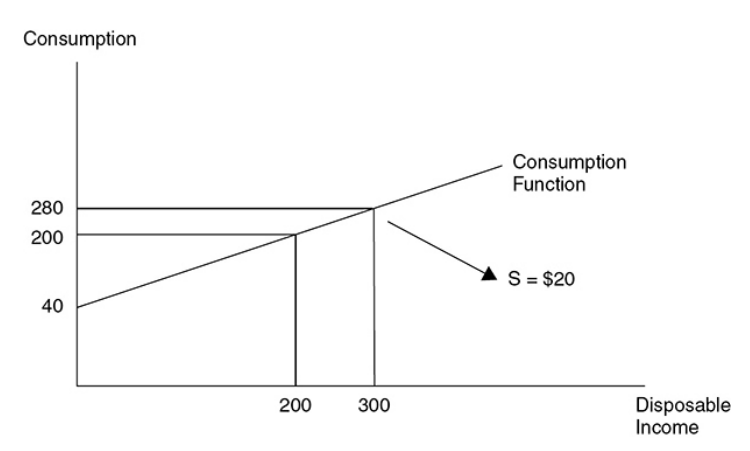

Consumption function

A linear relationship showing how increases in disposable income cause increases in consumption

5

New cards

Autonomous consumption

The amount of consumption that occurs no matter the level of disposable income

6

New cards

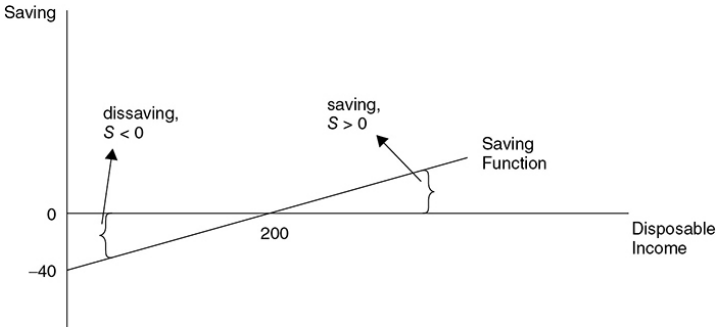

Dissaving

Another way of saying that saving is less than zero. Can occur at low levels of disposable income when the consumer must liquidate assets or borrow to maintain consumption.

7

New cards

Saving function

A linear relationship showing how increases in disposable income cause increases in saving

8

New cards

Autonomous saving

The amount of saving that occurs no matter the level of disposable income

9

New cards

Marginal propensity to consume (MPC)

The change in consumption caused by a change in disposable income, or the slope of the consumption function

10

New cards

Marginal propensity to save (MPS)

The change in saving caused by a change in disposable income, or the slope of the saving function

11

New cards

what causes a change in disposable income

causes a movement along the consumption and savings functions.

12

New cards

Determinants of consumption and saving

Factors that shift the consumption and saving functions in the opposite direction

* wealth

* expectations

* household debt

* wealth

* expectations

* household debt

13

New cards

Wealth

When the value of accumulated wealth increases, consumption functions shift upward, and the saving function shifts downward, because households can sell stock or other assets to consume more goods at their current level of disposable income

14

New cards

Expectations

Uncertainty or a low expectation about future income usually prompts a household to decrease consumption and increase saving. An expectation of a higher future price level spurs higher consumption right now and less saving.

15

New cards

Household debt

Households can increase consumption with borrowing, or debt. However, as households accumulate more and more debt, they need to use more and more disposable income to pay off the debt and thus **decrease consumption**.

16

New cards

Taxes and transfers

* If the government increases taxes, households see both consumption and saving decrease

* an increase in government transfer payments increases both consumption and saving functions.

* an increase in government transfer payments increases both consumption and saving functions.

17

New cards

upward shift in consumption

at all levels of disposable income, consumption is greater

* If consumption is greater at all levels of disposable income, saving must be lower and vice versa.

* If consumption is greater at all levels of disposable income, saving must be lower and vice versa.

18

New cards

in tax and transfers, when the consumption function shifts upward, the saving function shifts downward.

the saving function shifts downward.

19

New cards

in tax and transfers, when the consumption function shifts downward

the saving function shifts upward.

20

New cards

when taxes increase or transfers decrease

both consumption and saving functions shift downward.

21

New cards

when taxes decrease or transfers increase

both consumption and saving functions shift upward.

22

New cards

Decision to invest

This decision is based on marginal benefits and marginal costs. A firm invests in projects as long as r ≥ i.

23

New cards

The marginal cost of the investment

The real rate of interest (i), or the cost of borrowing

24

New cards

Expected real rate of return (r)

The rate of real profit the firm anticipates receiving on investment expenditures

25

New cards

Real rate of interest (i)

The cost of borrowing to fund an investment. This can be thought of as the marginal cost of an investment project.

26

New cards

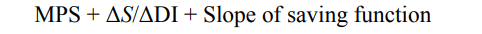

Investment demand

The inverse relationship between the real interest rate and the cumulative dollars invested

27

New cards

Investment demand curve

Shows the inverse relationship between the interest rate and the cumulative dollars invested

28

New cards

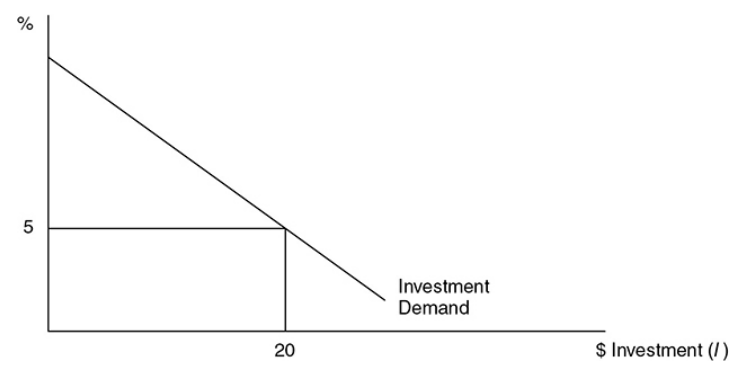

Autonomous investment

The level of investment determined by investment demand. It is constant at all levels of GDP

29

New cards

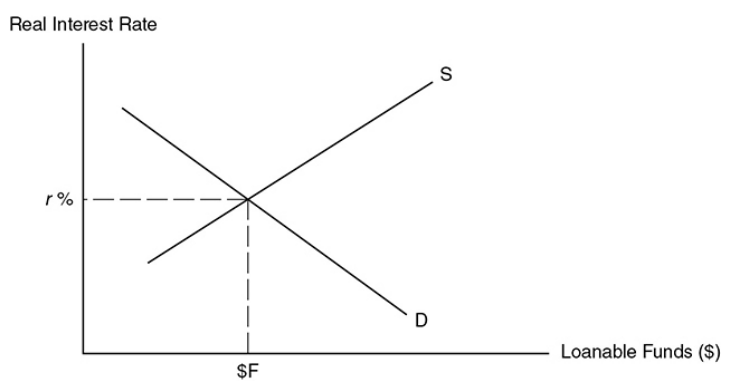

Market for loanable funds

The market for dollars that are available to be borrowed for investment projects

30

New cards

Demand for loanable funds

The negative relationship between the real interest rate and the dollars invested and borrowed by firms and by the government

31

New cards

Supply of loanable funds

The positive relationship between the dollars saved and the real interest rate

32

New cards

Private saving

Saving conducted by households and equal to the difference between disposable income and consumption

33

New cards

supply of loanable funds source

saving and lending

34

New cards

demand of loanable funds source

investment and borrowing

35

New cards

Multiplier effect

Describes how a change in any component of aggregate expenditures creates a larger change in GDP

36

New cards

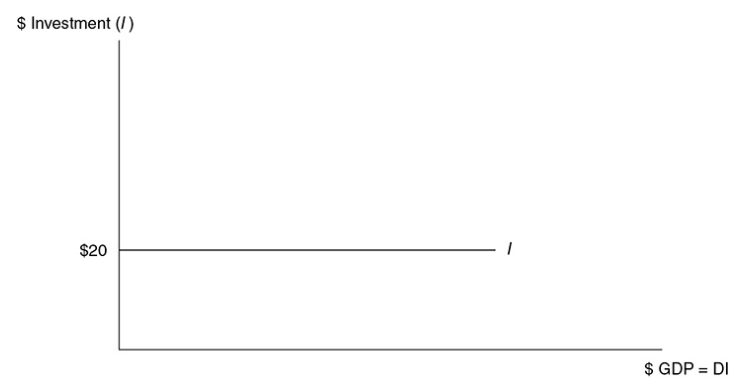

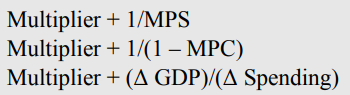

spending multiplier

37

New cards

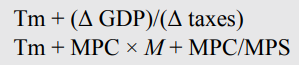

Tax multiplier

The magnitude of the effect that a change in taxes has on real GDP

38

New cards

why is the mpc bigger than the tax multiplier

The spending multiplier begins to work as soon as there is a change in autonomous spendin, but the tax multiplier must first go through a person’s consumption function as disposable income.

39

New cards

Balanced-budget multiplier

When a change in government spending is offset by a change in lump-sum taxes, real GDP changes by the amount of the change in G; the balanced-budget multiplier is thus equal to 1