Chapter 7: Inventory and Cost of Goods Sold

5.0(2)Studied by 11 people

Card Sorting

1/43

Last updated 6:09 AM on 11/26/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

44 Terms

1

New cards

Merchandise inventory

________ consists of products that are already made. Merchandisers then sell these finished goods to their customers.

2

New cards

Raw materials

Work in Process

Finished Goods

Work in Process

Finished Goods

Manufacturers have three types of inventory:

3

New cards

Raw materials

________ are materials that are waiting to be processed, such as plastic, steel, and fabric. ________ are used to create the goods that are in the process of being manufactured, which results in the completed products.

4

New cards

Work in Process

________ goods are not up for sale yet, but are in the process of getting to that stage.

5

New cards

Finished

________ goods are the inventory that are completed and ready to be sold to customers.

6

New cards

Consignment inventory

________ are any products being held by a company so they do not claim ownership over the owners' product. In the case the inventory is difficult to sell, the ownership is not under them.

7

New cards

Goods in transit

________ are goods being transported to the location of the buyer, whether this is someones front door or a store getting ready to sell those items (Walmart).

8

New cards

What inventory managers must do

Ensure inventory count is meeting demand, the quality is satisfactory, and minimize costs of acquiring, transporting, and storing inventory.

9

New cards

current asset

Inventory is reported on the Balance Sheet as a ________ because it will be sold to generate cash within a year.

10

New cards

Cost of Goods Sold expense

When inventory is sold, the cost moves from the Inventory account (balance sheet) and becomes ________ (income statement).

11

New cards

\

Equation to calculate Gross Profit

12

New cards

Periodic Updating

________ is used for small businesses (mom and pop shops). It uses the Cost of Goods Sold equation.

13

New cards

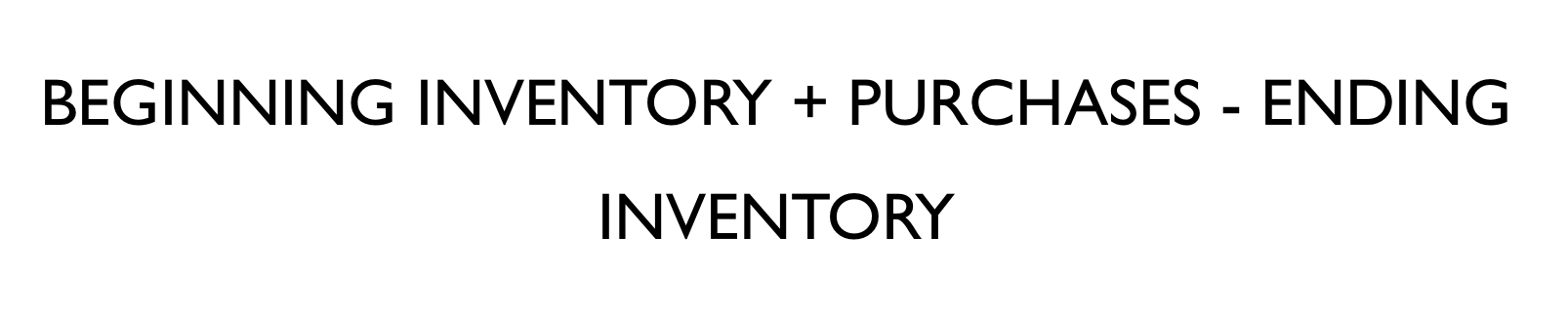

\

Cost of Goods Sold =

14

New cards

Perpetual Updating

________ is used for bigger companies (Walmart). IT uses the Ending Inventory equation.

15

New cards

\

Equation to calculate Ending Inventory

16

New cards

four inventory costing methods

The ________ tell us the value of what was sold and what should be sitting in Cost of Goods expense. They are all accepted by the GAAP.

17

New cards

Specific identification

________ individually identifies and records the cost of each item sold as Cost of Goods Sold. The cost of each item must be tracked.

18

New cards

luxury items (cars, jewelry)

The specific identification method is best used for _________.

19

New cards

Cost Flows Assumptions

The last three methods are not based on physical flow of goods, but based on ________, which are assumptions accountants make about the flow of inventory costs.

20

New cards

First in, first out (FIFO)

________ says that inventory goes out (is sold) in the order the goods are received.

21

New cards

Last in, first out (LIFO)

________ says the last goods received are the first to be sold.

22

New cards

Weighted average

________ says that the average for Cost of Goods Available for Sale is used for each good sold and for the goods that are still in inventory.

23

New cards

Cost of Goods Available for Sale/Number of Units Available for Sale

Equation to calculate Cost per unit

24

New cards

Number of units x Cost per units

Equation to calculate total cost

25

New cards

Cost of Goods Sold

Cost that goes into Inventory will not go into ________.

26

New cards

highest

The method that results in the ________ cost in Inventory will have the lowest cost in Cost of Goods Sold.

27

New cards

lowest

The method that results in the highest cost in Cost of Goods Sold will have the ________ cost in Inventory.

28

New cards

rising costs

A company will have larger inventory and smaller cost of goods because of ________.

29

New cards

falling costs

A company will have smaller inventory and larger cost of goods because of ________.

30

New cards

lower income tax

Using a method that results in lower inventory and higher cost of goods sold is beneficial because of _______.

31

New cards

financial results

A company may only switch from one method to another if it improves the accuracy of the company's ________.

32

New cards

LIFO conformity rule

The ________ says the method used for the companys income tax return must also be used for the financial statement.

33

New cards

It is replaced by similar goods and a lower cost.

The goods are outdated or damaged

The goods are outdated or damaged

The value of inventory may be lower than the cost of the inventory because.....

34

New cards

lower cost or market (LCM)/net realizable value (NRV)

As required by the GAAP, there is a rule for reporting inventory at the ________.

35

New cards

fallen below

If the inventory value has ________ its cost, it must be marked down to the lower value.

36

New cards

Market value

________ is a replacement cost.

37

New cards

Net realizable value

________ is the inventory value to be realized when sold.

38

New cards

Inventory turnover

________ is the cycle of an increasing balance when a company buys goods and a decreasing balance when a company sells goods.

39

New cards

inventory turnover analysis

To evaluate change in inventory, we use ________. An inventory turnover ratio shows how many times inventory is bought and sold.

40

New cards

bought and sold quickly

A higher inventory turnover rate indicates inventory is ________.

41

New cards

\

Equation to calculate Inventory Turnover Ratio

The higher the ratio, the better.

The higher the ratio, the better.

42

New cards

"Days to Sell"

________ focuses on the length of time it takes to sell inventory.

43

New cards

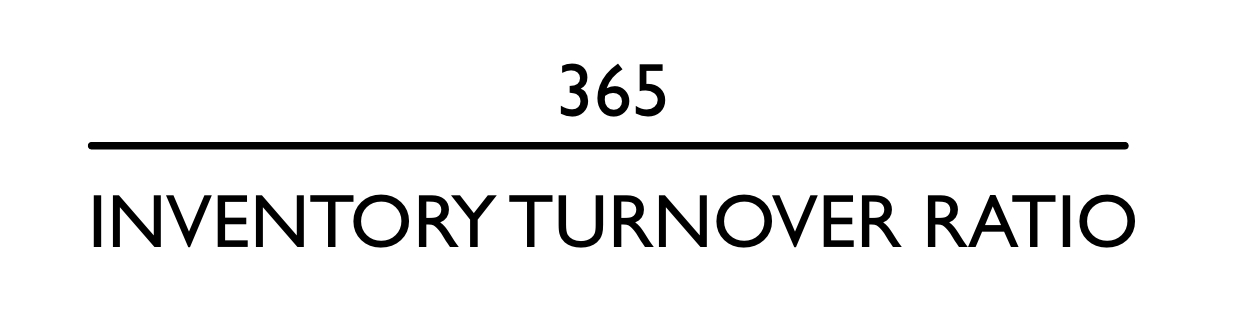

\

Equation to calculate Days to Sell:

44

New cards

longer amount of time taken to sell goods

A higher number for "days to sell" represents a(n) ________.