Chapter 18: Linking Interest Rates and Output Using IS-MP Analysis

1/116

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

117 Terms

lower interest rates set by the Federal Reserve means mortgages and homes loans are more

affordable

the total amount of goods and services that people want to buy across the whole economy

aggregate expenditure

AE =

C + I + G + NX

Aggregate expenditure: C is

consumption

Aggregate expenditure: I is

planned investment

Aggregate expenditure: G is

government purchases

Aggregate expenditure: NX is

net exports

occurs when the quantity of output that suppliers collectively produce is equal to the quantity of output that buyers collectively want to purchase

macroeconomic equilibrium

total produce of output = aggregate expenditure

macroeconomic equilibrium

If output exceeds aggregate expenditure, businesses will (BLANK) their production

cut back

If output is less than aggregate expenditure, businesses will (BLANK) production

ramp up

adjustment in production push the economy toward the

macroeconomic equilibrium

if people purchase less than businesses produce managers respond by (BLANK) producing

cutting back

If aggregate expenditure is greater than production for a short while managers respond by (BLANK) production

ramping up

long-run analysis, focuses on the

supply side

long-run analysis explains the economy’s

potential output

in the short run, actual output may fail to meet

potential output

Why does in the short run, actual output may fail to meet potential output?

weak aggregate expenditure

What is wrong with in the short run, actual output exceeding potential output?

not sustainable

What makes actual output exceed potential output?

strong aggregate expenditure

actual output fluctuates around

potential output

focuses on the balance between short-run demand for output and long-run supply of output

output gap

when actual output equals potential output

just right

What factors drive fluctuations in actual output deviating from potential output?

demand-side

the level of output at the point of macroeconomic equilibrium

equilibrium output

equilibrium output can differ from

potential output

Equilibrium output is when

total production of output = aggregate expenditure

describes the economy’s resting point

equilibrium output

where Goldilocks wishes the economy would rest

potential output

the nominal interest rate adjusted for inflation

real interest rate

represents the opportunity cost of spending

real interest rate

the price that determines this year’s aggregate expenditure

real interest rate

If the federal reserve increases the interest rate

increased opportunity cost of spending, people spend less

If the federal reserve decreases the interest rate

decreased opportunity cost of spending, people spend more

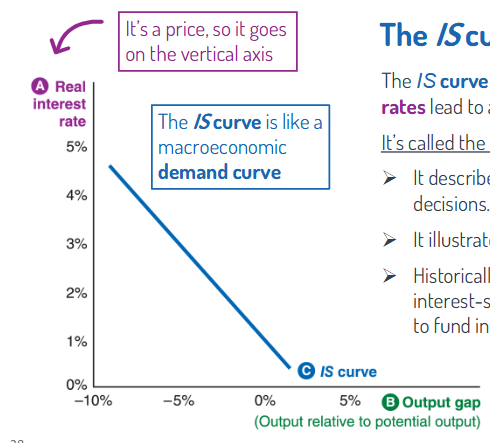

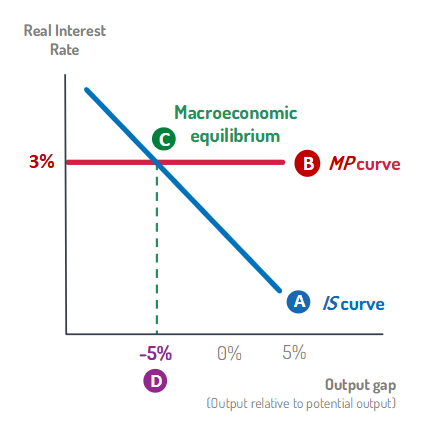

Shows how total spending and output depend on the real interest rate

IS curve

illustrates the current real interest rate

MP curve

dependent on both the federal reserve and financial markets

MP curve

lower interest rates boost

consumption, investment, government purchases, net exports

people substitute toward consumption and away from saving

lower real interest rate

lower interest rates lead to (BLANK) investment spending

more

reduce the interest payments the government must make on its debts

low interest rates

lower interest rates (BLANK) always spur government purchases. Sometimes use extra funds to pay down their existing debt instead

do not

low interest rates make the U.S. dollar cheaper, and this increases

net exports

leads foreign investors to demand fewer U.S. dollars, and U.S. investors to supply more U.S. dollars

low real interest rates

all together lower real interest rates yield higher

aggregate expenditure

lower real interest rates lead to

higher output and more positive output gap

illustrates how lower real interest rates lead to a more positive output gap

IS curve

describes investment and spending

IS curve

illustrates the interest sensitivity of output

IS curve

Draw the IS curve

y

lower real interest rates lead to

higher aggregate expenditure, output rises, more positive output gap

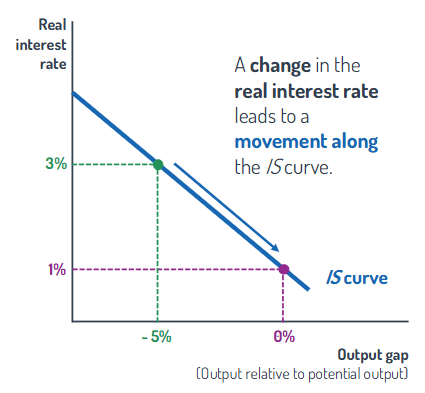

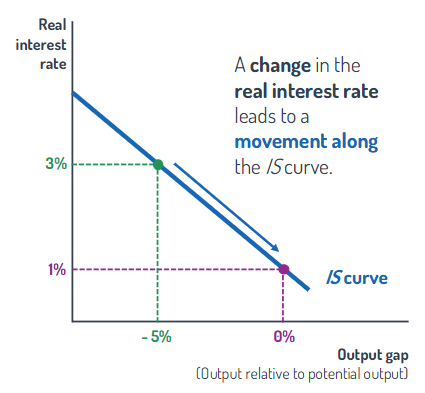

A change in the real interest rate leads to a (BLANK) the IS curve

movement along

If the real interest rate is 3% then

GDP is 5% below its potential level

If the real interest rate falls to 1% then

GDP is at its potential level

changes in other factors that change aggregate expenditure at a given interest rate cause the IS curve to

shift

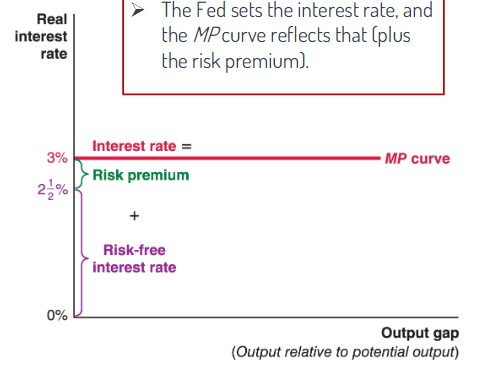

real interest rate =

risk-free real interest rate + risk premium

Is set by the federal reserve

risk-free real interest rate

the process of setting interest rates in an effort to influence economic conditions

monetary policy

The fed sets the nominal interest rate to influence the

real interest rate

Suppose inflation is 3%, and the Fed sets the nominal interest rate at 4.5%, then it’s also accurate to say it set the real interest rate at

1.5%

The Fed does (BLANK) set every interest rate in the economy?

not

The Federal Reserve effectively sets the

risk-free interest rate

the interest rate on a loan that involves no risk

risk-free interest rate

Is the reason why the interest rate you pay on your credit card, car loan, or business loan is typically higher than the risk-free interest rate set by the federal Reserve

risk premium

Why is a car loan less risky than a personal loan

bank can repossess the car

The buyers and sellers of risk meet on Wall Street to

trade risk

illustrates the current real interest rate

MP curve

MP stands for

monetary policy

MP curve shifts either because of the

Fed changing its monetary policy, changes in the risk premium

The MP curve reflects the

risk free interest rate + risk premium

Draw the MP curve

y

A higher (BLANK) signals greater risk in the banking system

TED spread

describes the output gap associated with each real interest rate

IS curve

where the IS curve and MP curve intersect

macroeconomic equilibrium

When the real interest rate is 3% then the

equilibrium output gap is -5%

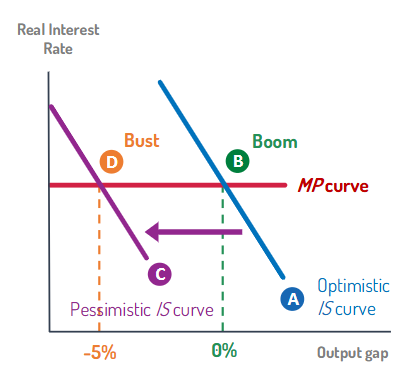

booms and busts of the business cycle reflect shifting periods of

strong and weak demand

describes spending plans when people are optimistic about their economic futures

optimistic IS curve

Optimistic IS curve leads to a boom where output is

at or above potential

When people become pessimistic about their economic futures and cutbacks occur

pessimistic IS curve

When there is a pessimistic IS curve the economic shifts to a bust and output is

less than potential output

Draw optimistic and pessimistic IS curves with an MP curve

y

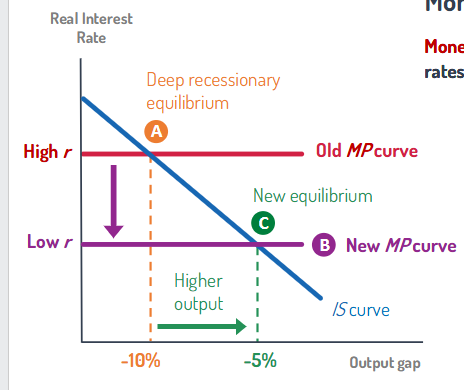

Keynes: The economy can in (BLANK) even when output is far below its potential and unemployment is widespread

macroeconomic equilibrium

Keynes: Unlikely to change form this “unhappy” spot unless the

government intervenes

Draw the shift from a deep recessionary equilibrium to a new equilibrium with higher output

y

the government’s use of spending and tax policies to influence economic outcomes

fiscal policy

Fiscal policy causes aggregate expenditure to change and shift the

IS curve

Increased government spending causes the IS curve to shift

right

When the IS curve shifts due to a change in government spending it shifts by

change in G x multiplier

A shift in the IS curve does not change the

interest rate

An increase in spending has a (BLANK) effect on aggregate expenditure

multiplied

a measure of how much GDP changes as a result of both the direct and indirect effects following from each extra dollar of spending

multiplier

An increase in spending has a multiplied effect due to (BLANK) effects throughout the economy

ripple

The IS curve shifts to reflect the new level of aggregate expenditure, accounting for both the (BLANK) of new spending and its (BLANK)

direct effect, ripple effects

IS curve: change in GDP =

change in spending x multiplier

The multiplier determines how far the IS curve

shifts

Multiplier = 2

Initial government spending = $150 billion

Generates a total of (BLANK) in additional spending

$300 billion

The state of the economy is determined by the intersections of the

IS and MP curves

spending shocks shift the

IS curve