AP Macroeconomics Unit 3 - Test Review

1/45

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

46 Terms

Aggregate Demand is:

All the goods and services (real GDP)

that buyers are willing & able to purchase at different price

levels. The demand for everything by everyone in the US. There

is an inverse relationship between price level and Real GDP.

Why does AD slope downwards?

Real Wealth Effect

Interest Rate Effect

Exchange Rate Effect

REAL WEALTH EFFECT (REAL BALANCES EFFECT):

Changes in PL cause changes in purchasing power. Higher PL reduce purchasing power & lower PL increase purchasing power.

Ex: If you have $2,000 in your checking account but the economy is experiencing inflation, then you will likely reduce your spending because you can’t stretch you money as far.

INTEREST RATE EFFECT:

Money is exchanged for a price in the Money Market. When PL increase, lenders need to charge higher interest rates on loans to get a real rate of return. Higher interest rates discourage consumer spending & business investments.

Ex: If the interest rate to borrow money goes from 5% to 11%, consumers & businesses are less likely to take out loans to improve their home or business.

EXCHANGE RATE EFFECT:

When U.S. PL rise, foreign buyers purchase fewer U.S. goods & services &

Americans buy more foreign goods. Exports decrease & imports increase causing real GDP demanded to fall.

Ex: If price levels in the U.S. increase, Canada will no longer import as many U.S. goods.

Determinants of Aggregate Demand that can shift a curve (C+I+G+NX):

Consumption:

- Consumer wealth, income, taxes, expectations of future economy, debt, interest rates.

Investment:

- Firms' spending on capital goods, future business expectations, productivity/technology, business taxes, real interest rate changes.

Government Spending:

- Fiscal & monetary policy, war, nationalized health care, defense spending.

Net Exports:

- Exchange rates, national income vs. abroad. Exports and AD (+) relation, Imports and AD (-) relation.

How does Negative and Positve demand shocks shift the AD curve?

POSITIVE DEMAND SHOCK: Demand increases, shifting right. This is called DEMAND PULL INFLATION.

NEGATIVE DEMAND SHOCK: Demand decreases, shifting left.

What is Aggregate Supply?

Aggregate Supply is the amount of goods

and services (real GDP) that firms will

produce in an economy at different price

levels. The supply for everything by all

firms.

Two Different AS Curves and how they affect the AS:

Short-run Aggregate Supply (SRAS)

Wages and Resource Prices will not

increase as price levels increase.

Long-run Aggregate Supply (LRAS)

Wages and Resource Prices will

increase as price levels increase.

Why does SRAS slope upwards?

Sticky Wages & Input Prices: Firms spend money on factors of production like land, labor & capital. Input prices do not respond quickly to changes in price levels. Therefore wages & input prices lag behind.

HAPPENS IN INFLATIONARY GAPS

Determinants of Aggregate Supply that can shift a curve (I.R.A.P.):

INFLATIONARY EXPECTATIONS: If we experienced an increase in AD that would lead people to expect higher price levels in the future. Higher price levels mean more inflation. This will increase the cost of labor and resources therefore decreasing SRAS.

RESOURCE PRICE CHANGES: If the price of domestic or imported resources increase then the U.S. would produce less. If the price of domestic or imported resources decrease, then the U.S. would produce more.

ACTIONS OF THE GOVERNMENT: This is NOT a change to governments pending. This includes changes to taxes on producers, subsidies for domestic production, government regulation.

Ex: If EPA inspections are required to operate a farm (SRAS decreases), if there are lower corporate taxes (SRAS increases).

PRODUCTIVITY CHANGES: Anything that makes it cheaper or easier to produce.

Ex: If a computer virus destroys half of the computer in the factory (SRAS decreases).

How does Positive and Negative Supply Shock influence the Aggregate Supply Curve?

POSITIVE SUPPLY SHOCK: Short run supply increases, shifting right.

NEGATIVE SUPPLY SHOCK: Short run supply decreases, shifting left. This is called COST PUSH INFLATION & results in STAGFLATION.

LONG RUN AGGREGATE SUPPLY (LRAS):

In the long run, wages and prices go up with inflation, but real GDP doesn't change. This affects the tradeoff between inflation and unemployment. Full employment, called the natural rate of unemployment (NRU), includes structural and frictional unemployment, leaving out cyclical unemployment.

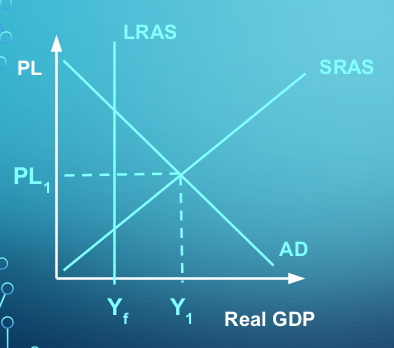

What happens in an inflationary gap?

An Inflationary Gap occurs when

the actual output/GDP is greater

than potential output/GDP. In

addition, the current unemployment

rate is less than the Natural Rate of

Unemployment (NRU).

When do short run output gaps exist?

When the actual/current output level and

potential output level differ.

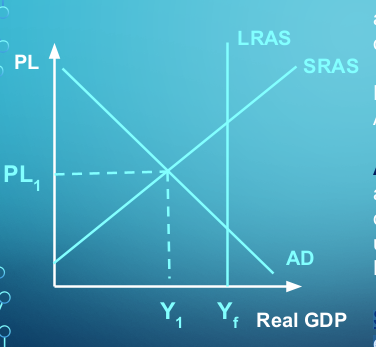

What happens in an recessionary gap?

An Recessionary Gap occurs when the

actual output/GDP is less than potential.

output/GDP. In addition, the current

unemployment rate is greater than the

Natural Rate of Unemployment (NRU).

When does STAGFLATION occur?

STAGFLATION occurs when a stagnant

economy experiences inflation. ONLY HAPPENS IN A LEFT SHIFT ON AGGREGATE SUPPLY CURVE.

Automatic stabilizers are? How do they react to a recession or inflationary gap?

Automatic stabilizers are when an economy self-adjusts in the long run without any policy action by the government.

Recession: Act as an

expansionary policy. The goal is to influence the business cycle not to go into a big trough.

Ex: Unemployment insurance and or temporary assistance.

Inflation: When an economy is experiencing inflation automatic stabilizers kick in to

act as a contractionary policy. The goal is to influence the business cycle not

to go into a big peak.

Ex: Income or corporate taxes, decrease in unemployment insurance.

Two types of fiscal policy:

Contractionary Fiscal Policy: This is the government applying the breaks to the economy. They enact laws to reduce inflation & decrease Real GDP. This is in an effort to close an inflationary gap. The way the government can implement this policy is by decreasing government spending or increasing taxes.

Expansionary Fiscal Policy: This is the government hitting the gas in the economy. They enact laws to reduce unemployment & increase Real GDP. This is in an effort to close a recessionary gap. The way this government can implement this policy is by increasing government spending or decreasing taxes.

The Multiplier Effect:

An initial change in spending will set off a spending chain that is magnified in the economy.

Ex: Bob spends $100 on shoes at Jimmy’s store. This becomes $100 of income for Jimmy. Then Jimmy takes that income and spends $100 on dinner from Diane’s restaurant. This becomes $100 of income for Diane. Then Diane takes $100 and spends it on a new purse at Rachel’s store. This becomes $100 of income for Rachel. The result of an initial $100 is spending is $300 of increased consumer spending.

Marginal Propensity to Consume:

MPC = Change in consumption/Change in income

Ex: If you receive $100 in income and spend $50

How to calculate disposable income:

Disposable Income: Gross income minus taxes.

Marginal Propensity to Save:

Change in savings/Change in income

MPC + MPS =

1.

How is spending Multiplied?

1/MPS or 1/1-MPC

How to calculate change in GDP:

Change in GDP = Multiplier x Initial Change in Spending.

As MPC falls, the _______:

The multiplier effect is less.

Tax multiplier:

MPC/1-MPC = -MPC/MPS

The tax multiplier is _____

Always 1 less than the spending multiplier.

The tax multiplier is always negative.

Non-Discretionary Fiscal Policy:

Legislation that acts to counter cyclical unemployment without explicit actions by policy makers. These are the automatic stabilizers.

When actual GDP > potential GDP (inflationary gap) the:

Government will increase taxes. Decrease in AD

When actual GDP < potential GDP (recessionary gap), the:

Government will decrease taxes. Increase AD.

Problems with Fiscal Policy:

Budget Deficit: When the government’s expenditures exceeds its revenues.

What is the accumulation of all of the budget

deficits over time.

The National Debt.

Problems with Fiscal Policy:

Problems With Timing:

Lag: Reacting, passing legislations, and planning/sending taxes before it’s too late.

Politically Motivated Policies:

Politicians may use economically inappropriate policies to get reelected.

Crowding-Out Effect:

When the government takes out many loans,

therefore, crowding out consumers or smaller private investors from taking out those loans.

Net Export Effect

International trade reduces the effectiveness of fiscal policies.

Total change in AD formula:

Total change in AD = - tax multiplier * initial change in taxes

When do you increase government spending and decrease taxes? When do you decrease government spending and increase taxes?

When you increase government spending and decrease taxes, that’s an expansionary policy. When you decrease, that’s a contractionary policy.

What is something LRAS and the PPC curve have in common?

They both represent maximum sustainable capacity.

True or False: In the long run, wages and prices are flexible to adjust automatically to full employment.

True.

What’s a consequence of flexible long-run wages?

The trade-off between inflation and unemployment and a vertical LRAS curve.

In short-run equilibrium, where can the AD-AS curves intersect?

This can happen below, above, or at the LRAS curve. Below, above, or at full employment in short-run.

How to tell if short-run equilibrium is happening? How to tell if long-

When AD and SRAS intersect. Below, above, or at full employment.

How to tell if economy is in long-run equilibrium?

If SRAS, AD and LRAS all intersect.

What gap causes nominal wages and input prices to increase, causing workers to ask for higher pay and produce less? What gap doesn’t do this?

Inflation; Recession.

What graph is the economy producing at full employment?

LRAS.

A one dollar change in autonomous expenditure leads to:

A greater-than-one-dollar change in AD for goods and services.