Chapter 8: Receivables, Bad Debt Expense, and Interest Revenue

4.7(3)

Card Sorting

1/49

Last updated 7:46 AM on 11/29/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

50 Terms

1

New cards

It encourages the customer to buy more goods or services, so revenue goes up.

An advantage of extending credit is:

2

New cards

Increase in wage costs, bad debt expense, and delays receipt of cash

Disadvantages to extending credit includes:

3

New cards

Increase is wage costs

________ is caused by having to hire more employees to see if someone is credit worthy, see how much money people owe, and to collect from customers.

4

New cards

Bad debt costs

________ is due to the fact that sometimes people don't pay what they owe.

5

New cards

Delays receipt of cash

________ means cash may be received in 30-60 days.

6

New cards

bad debt

When accounts receivables aren't fully paid off, it results in ________.

7

New cards

"net realizable value"

Accounts Receivable is recorded at the value that is expected to be collected, aka ________.

8

New cards

expense recognition principle (matching)

You must record Sales Revenue and Bad Debt Expense in the same period of the sale. This is called ________.

9

New cards

allowance method

A(n) ________ is estimating bad debts that may not be collected and adjusting these estimations later.

10

New cards

Allowance for Doubtful Accounts

________ is a contra account to Accounts Receivable and has a normal credit balance.

11

New cards

written off

When an account can not be collected, the account must be ________.

12

New cards

Income Statement

Write offs DO NOT appear on the ________.

13

New cards

Debit Allowance for Doubtful Accounts

Credit Accounts Receivable

Credit Accounts Receivable

Journal entry for write offs:

14

New cards

\

Net Receivable Value =

15

New cards

Debit Accounts Receivable

Credit Sales Revenue

Credit Sales Revenue

Journal entry to record sales on account:

16

New cards

Debit Bad Debt Expense

Credit Allowance for Doubtful Accounts

Credit Allowance for Doubtful Accounts

Journal entry to record estimate for bad debts:

17

New cards

Percentage of Credit Sales Method

Aging of Accounts Receivable

Aging of Accounts Receivable

The two methods to calculate the estimate of bad debt:

18

New cards

Percentage of Credit Sales Method

________ is also known as the Income Statement Account. It estimates Bad Debt Expense for the period, but is not precise.

19

New cards

\

Equation for estimating bad debt expense (% of Credit Sales Method):

20

New cards

Aging of Accounts Receivable

________ is also known as the Balance Sheet Method. It estimates the ending balance in the Allowance for Doubtful Accounts. It is more accurate.

21

New cards

The steps for the Aging of Accounts Receivable

Prepare an aged listing of accounts receivable.

Estimate the bad debt loss percentages for each category.

Compute the total estimated bad debts.

Estimate the bad debt loss percentages for each category.

Compute the total estimated bad debts.

22

New cards

Revising estimates

________ is when a company revises their bad debt estimates for the current period.

23

New cards

Accounts recovery

________ is reviving written off accounts.

24

New cards

recovery

There are always 2 journal entries for a ________.

25

New cards

Debit Accounts Receivable

Credit Allowance for Doubtful Accounts

Credit Allowance for Doubtful Accounts

Journal entry for reversing the write off (first recovery entry):

26

New cards

Debit Cash

Credit Accounts Receivable

Credit Accounts Receivable

Journal entry for the collection of the account (second recovery entry):

27

New cards

notes receivable

A ________ is reported when a promissory note is used for a transaction. It has a stronger legal claim.

28

New cards

charge interest

Notes receivables ________ from the date they are created to when they are due.

29

New cards

maturity date

The day the Notes Receivable is due is called the ________.

30

New cards

Loaning money.

Receiving extended payment.

Switching from Accounts Receivable to Notes Receivable.

Receiving extended payment.

Switching from Accounts Receivable to Notes Receivable.

A company may use a Notes Receivable for:

31

New cards

\

Equation for calculating interest =

32

New cards

Principal

The amount of the Note Receivable.

33

New cards

Interest Rate

The interest percentage charged on the note.

34

New cards

Time Period

The amount of time covered in the interest.

35

New cards

Debit Notes Receivable

Credit Cash

Credit Cash

Journal entry for establishing a Note Receivable:

36

New cards

Debit Interest Receivable

Credit Interest Revenue

Credit Interest Revenue

Journal entry for accruing interest earned but not received (use interest formula):

37

New cards

Debit Cash

Credit Interest Receivable

Credit Interest Revenue

Credit Interest Receivable

Credit Interest Revenue

Journal entry for recording interest payments received (adjusting journal):

38

New cards

Debit Cash

Credit Note Receivable

Credit Note Receivable

Journal entry for the principal payments received:

39

New cards

receivables turnover analysis

A(n) ________ helps see the effectiveness of a companys credit- granting and collection activity.

40

New cards

increase

Selling goods or services make the receivables balance ________.

41

New cards

decrease

Collecting the money from customers makes the receivables balance _______.

42

New cards

Receivables turnover

________ is the constant selling and collecting cycle.

43

New cards

receivables turnover ratio

The ________ indicates how many times the cycle is repeated during the accounting period.

44

New cards

A higher ratio means a faster collection of receivables.

Low ratios mean companies give their customers too long of a period to pay.

Low ratios mean companies give their customers too long of a period to pay.

Higher vs lower receivables turnover ratio

45

New cards

Days to collect

________ is the number of days to collect receivables. A higher ratio means it takes more days to collect. We want a low ratio.

46

New cards

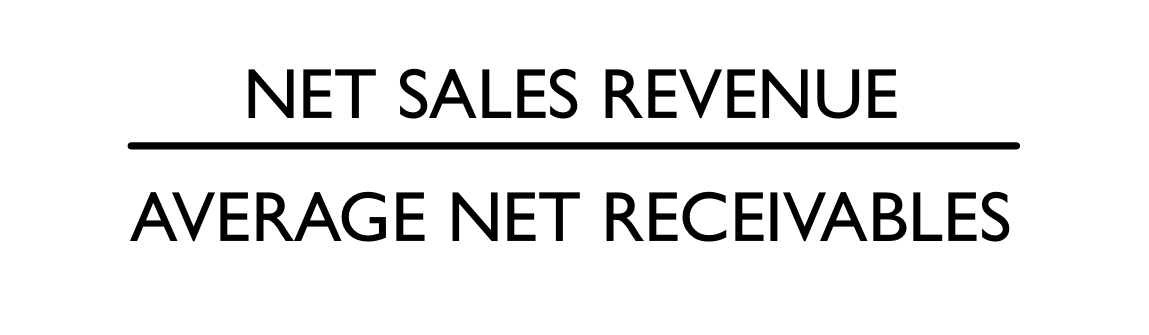

\

Equation for Receivable Turnover Ratio:

Receivable Turnover Ratio =

Receivable Turnover Ratio =

47

New cards

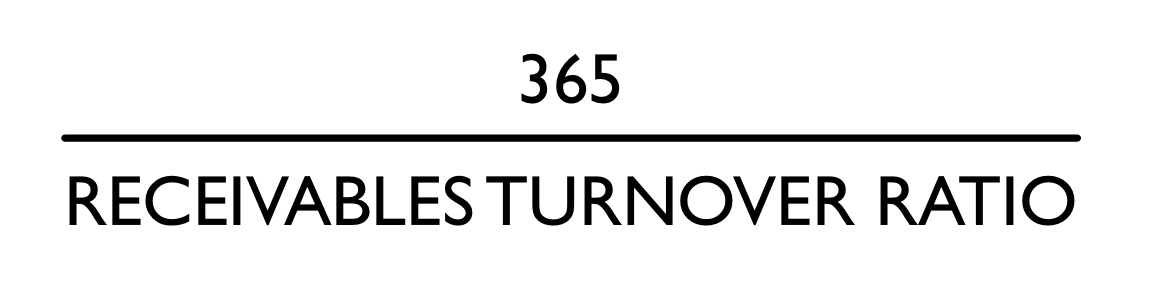

365/Receivables Turnover Ratio

Equation for Days to Collect:

Days to Collect =

Days to Collect =

48

New cards

Credit cards

________ speed up cash collection and make it less likely to receive bad checks from customers.

49

New cards

Credit terms

________ is an agreement between the buyer and seller about the timings and payment to be made for the goods bought on credit.

50

New cards

factor

A ________ is when you sell outstanding accounts to a different company. By doing so, your company is paid for the receivables it sells to the factors. A factoring fee must be considered.